Previous Session Recap

Trading volume at PSX floor increased by 14.27 million shares or 16.94% on DOD basis whereas the Benchmark KSE100 index opened at 38,084.20, posted a day high of 38,597.68 and day low of 38.011.63 during last trading session while session suspended at 38,585.66 points with net change of 574.03 points and net trading volume of 65.90 million shares. Daily trading volume of KSE100 listed companies increased by 8.18 million shares or 14.17% on DOD basis.

Foreign Investors remained in net selling positions of 6.19 million shares and net value of Foreign Inflow dropped by 2.56 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net selling positions of 6.11 and 0.13 million shares but Foreign Individuals investors remained in net buying positions of 0.05 million shares. While on the other side Local Individuals, NBFCs, Mutual Fund and Insurance Companies remained in net buying positions of 3.24, 0.19, 2.74 and 2.64 million shares respectively but Local Companies, Banks and Brokers remained in net selling positions of 0.78, 1.82 and 0.25 million shares.

Analytical Review

Asian shares hobbled by mounting risks to global growth

Asian share markets began the week on a cautious note after soft economic data from China and Europe added to evidence of cooling global growth and reinforced anxiety over the broadening impact of international trade frictions. MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.1 percent in early Monday trade, led by losses in China and Hong Kong. The CSI 300 of Shanghai and Shenzhen share index dropped 0.9 percent Other markets showed some resilience. Japan’s Nikkei was up 0.5 percent while U.S. stock futures ticked up 0.2 percent. Taiwan also gained 0.3 percent.

ECC meets to fix market price of urea

Economic Coordination Committee (ECC) of the Cabinet will meet today (Monday) to fix the market price of the imported urea. The ECC is likely to allow Rs50 per bag subsidy in the price of urea, said official source to The Nation. The ECC, which will meet with Federal Minister for Finance, Revenue and Economic Affairs Asad Umar in chair, will also discuss the availability of urea, its demand and the prospects of future import. The imported price of the urea is Rs1730 per bag and if the ECC allowed Rs 50 per bag subsidy on the imported urea, it will reduce its market price to Rs1680 per bag.

Karachi’s Green Line project to be completed by June 2019

Federal Minister for Communications Murad Saeed has informed the National Assembly that the Green Line Bus Rapid Transit System, Karachi is set to be completed before July 2019. Saeed told the House that deadline for completion of the project is 30th June, 2019, but he avoided to take a categorical stance whether the project would meet its deadline for completion or not.

Saudi oil facility to ease pressure on rupee: SBP governor

The pressure on rupee will ease as soon as dollars start flowing in and the Saudi oil facility of $3 billion becomes available, according to the governor of State Bank of Pakistan (SBP), Tariq Bajwa. “The exchange rate has recently been under immense pressure because of the country’s dwindling foreign exchange reserves, which fell to just above $7bn on Dec 7 despite receipt of $1bn cash deposit from Saudi Arabia. Riyadh has since transferred $1bn more and is expected to deposit another $1bn next month as part of its assistance package for Pakistan,” he said on Sunday.

Sufficient LPG stock available: LPGDA

Liquefied Petroleum Gas Distributors Association (LPGDA) Chairman Irfan Khokhar has categorically said that the country has sufficient LPG stock to ensure smooth supply in peak winter season, but urged the government to take action against the ‘mafia’ involved in creating artificial shortages by black-marketing the commodity.

Asian share markets began the week on a cautious note after soft economic data from China and Europe added to evidence of cooling global growth and reinforced anxiety over the broadening impact of international trade frictions. MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.1 percent in early Monday trade, led by losses in China and Hong Kong. The CSI 300 of Shanghai and Shenzhen share index dropped 0.9 percent Other markets showed some resilience. Japan’s Nikkei was up 0.5 percent while U.S. stock futures ticked up 0.2 percent. Taiwan also gained 0.3 percent.

Economic Coordination Committee (ECC) of the Cabinet will meet today (Monday) to fix the market price of the imported urea. The ECC is likely to allow Rs50 per bag subsidy in the price of urea, said official source to The Nation. The ECC, which will meet with Federal Minister for Finance, Revenue and Economic Affairs Asad Umar in chair, will also discuss the availability of urea, its demand and the prospects of future import. The imported price of the urea is Rs1730 per bag and if the ECC allowed Rs 50 per bag subsidy on the imported urea, it will reduce its market price to Rs1680 per bag.

Federal Minister for Communications Murad Saeed has informed the National Assembly that the Green Line Bus Rapid Transit System, Karachi is set to be completed before July 2019. Saeed told the House that deadline for completion of the project is 30th June, 2019, but he avoided to take a categorical stance whether the project would meet its deadline for completion or not.

The pressure on rupee will ease as soon as dollars start flowing in and the Saudi oil facility of $3 billion becomes available, according to the governor of State Bank of Pakistan (SBP), Tariq Bajwa. “The exchange rate has recently been under immense pressure because of the country’s dwindling foreign exchange reserves, which fell to just above $7bn on Dec 7 despite receipt of $1bn cash deposit from Saudi Arabia. Riyadh has since transferred $1bn more and is expected to deposit another $1bn next month as part of its assistance package for Pakistan,” he said on Sunday.

Liquefied Petroleum Gas Distributors Association (LPGDA) Chairman Irfan Khokhar has categorically said that the country has sufficient LPG stock to ensure smooth supply in peak winter season, but urged the government to take action against the ‘mafia’ involved in creating artificial shortages by black-marketing the commodity.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

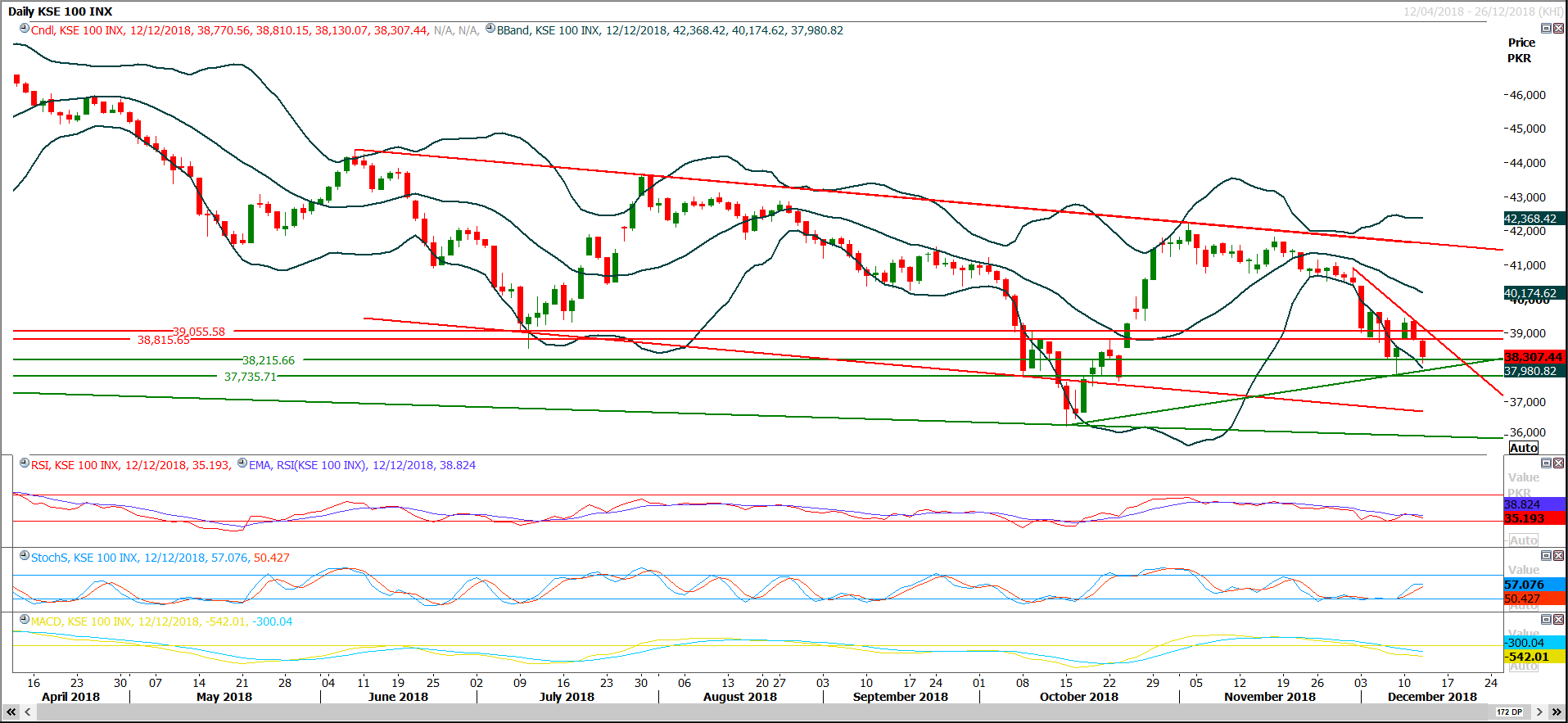

Technical Analysis

The Benchmark KSE100 Index is being capped by a descending trend line on daily chart therefore it needs to open with a positive gap above 38,600 points to maintain its bullish momentum on intraday basis. It’ expected that index would try to target 38,815 points on intraday basis and if it would succeed in penetration above that region then it would face a major resistance at 39,055 points, It’s recommended to start profit taking before these both regions respectively from intraday trades. As market seems bullish therefore it’s not recommended to initiate short positions at this level and instead of that its recommended to start buying on dip with profit targets at nearest resistant regions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.