Previous Session Recap

Trading volume at PSX floor increased by 87.08 million shares or 32.17% on DoD basis, whereas the benchmark KSE100 index opened at 40,916.59, posted a day high of 41,669.04 and a day low of 40,916.59 points during last trading session while session suspended at 41,644.88 points with net change of 728.29 points and net trading volume of 222.33 million shares. Daily trading volume of KSE100 listed companies increased by 41.98 million shares or 23.28% on DoD basis.

Foreign Investors remained in net selling positions of 0.41 million shares but value of Foreign Inflow dropped by 2.13 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.14 and 3.33 million shares but Foreign Corporate remained in net selling positions of 3.88 million shares. While on the other side Local Individuals, Mutual Fund and Insurance Companies remained in net buying positions of 16.31, 3.26 and 6.45 million shares but Local Companies, Banks, NBFCs and Brokers remained in net selling positions of 11.41, 13.16, 0.002 and 0.79 million shares respectively.

Analytical Review

Asian stocks ride Wall Street momentum to eight-month peak, pound slips

Asian shares rose to their highest in eight months on Tuesday, as trade deal optimism and Wall Street’s streak to all-time highs supported sentiment, while familiar fears of a hard Brexit knocked the pound. The mood carried MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS up 0.4% to its highest since April. Japan's Nikkei .N225 hit its firmest in more than year and Hong Kong's Hang Seng .HSI rose half a percent. Australia’s S&P/ASX 200 eked a tiny extension to Monday’s big gains. Though bond markets, currencies and commodities were more circumspect, and futures trade pointed to softness in Europe and the United States after a bumper Monday.

Rs800bn of circular debt stock to be shifted to public debt

Estimating power sector losses rising by four per cent since the financial year 2016 to 29pc, the Asian Development Bank (ADB) and the government have agreed to raise about Rs469 billion revenues through consumer tariff during the current fiscal year and shift about Rs800bn of the circular debt stock to public debt in three years. This is part of the Energy Sector Reforms and Financial Sustainability Programme under which the Manila-based lending agency disbursed $300million loan to Pakistan last week for 25 years including five years of grace period at 2pc interest rate. “The plan will include (i) using the sales proceeds of some generation assets (ii) divesting power subsector transmission and distribution of SOEs (iii) rolling tariff subsidies preferably into a social assistance programme targeting the poorest households and (iv) converting portions of Power Holding Private Limited debt stock into public debt,” Adviser to the PM on Finance and Revenue Dr Abdul Hafeez Shaikh wrote to the ADB president.

ADB stresses diversification to boost exports

Pakistan is required to undertake structural reforms to improve its exports for attaining a sustainable economic growth rate of above 3.8 per cent, suggests a new study released by the Asian Development Bank on Monday.The study — Why Pakistan’s Economic Growth Continues to be Balance of Payments Constrained — says this requires an upgrade in the country’s international specialisation profile. “A more diversified economy results in more diverse exports, and this is required to acquire the wider set of productive capabilities that is needed to export goods with a higher level of sophistication,” it noted. The first steps towards export diversification could be to identify causes of lost export value in important industries like glass and stone, mineral products, plastics and chemicals; and explore options for moving into new export products that require productive capabilities similar to those used for existing Pakistani exports, but have a higher level of sophistication within the product space.

Car import policy & economic growth of Pakistan

Pakistan is among the group of 40 countries in the world that produce automobiles. Its booming population of 180 million and 9th largest labor force has a huge potential to grow and achieve economic prosperity with right and focused policies for its economy. Auto industry is referred to as “industry of industries” in the developed world. The auto industry of many regional countries has played a pivotal role in transforming those countries into economic tigers. It is common to face difficulties when you are in the market to buy an imported car in Pakistan. Japanese used vehicle exporting is a grey market international trade involving the export of used cars and other vehicles from Japan to other markets around the world since the 1980s.

Fertilizers import reduces 25pc

The fertilizers manufactured imports into the country during first four months of current financial year decreased by 25.60 percent as compared the imports of the corresponding period of last year. During the period from Jul-October, 2019, about 889,395 metric tons of fertilizers worth $320.149 million imported to fulfill the domestic requirements as compared the imports of 995,549 metric tons valuing $430.323 million of same period last year, according the data of Pakistan Bureau of Statistics. Meanwhile, the imports of agriculture machinery and implements into the country during the period under review reduced by 25.07 percent as compared the corresponding period of last year as agriculture machinery and other implements worth $34.732 million imported as compared the imports of $46.342 million of same period of last year.

Asian shares rose to their highest in eight months on Tuesday, as trade deal optimism and Wall Street’s streak to all-time highs supported sentiment, while familiar fears of a hard Brexit knocked the pound. The mood carried MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS up 0.4% to its highest since April. Japan's Nikkei .N225 hit its firmest in more than year and Hong Kong's Hang Seng .HSI rose half a percent. Australia’s S&P/ASX 200 eked a tiny extension to Monday’s big gains. Though bond markets, currencies and commodities were more circumspect, and futures trade pointed to softness in Europe and the United States after a bumper Monday.

Estimating power sector losses rising by four per cent since the financial year 2016 to 29pc, the Asian Development Bank (ADB) and the government have agreed to raise about Rs469 billion revenues through consumer tariff during the current fiscal year and shift about Rs800bn of the circular debt stock to public debt in three years. This is part of the Energy Sector Reforms and Financial Sustainability Programme under which the Manila-based lending agency disbursed $300million loan to Pakistan last week for 25 years including five years of grace period at 2pc interest rate. “The plan will include (i) using the sales proceeds of some generation assets (ii) divesting power subsector transmission and distribution of SOEs (iii) rolling tariff subsidies preferably into a social assistance programme targeting the poorest households and (iv) converting portions of Power Holding Private Limited debt stock into public debt,” Adviser to the PM on Finance and Revenue Dr Abdul Hafeez Shaikh wrote to the ADB president.

Pakistan is required to undertake structural reforms to improve its exports for attaining a sustainable economic growth rate of above 3.8 per cent, suggests a new study released by the Asian Development Bank on Monday.The study — Why Pakistan’s Economic Growth Continues to be Balance of Payments Constrained — says this requires an upgrade in the country’s international specialisation profile. “A more diversified economy results in more diverse exports, and this is required to acquire the wider set of productive capabilities that is needed to export goods with a higher level of sophistication,” it noted. The first steps towards export diversification could be to identify causes of lost export value in important industries like glass and stone, mineral products, plastics and chemicals; and explore options for moving into new export products that require productive capabilities similar to those used for existing Pakistani exports, but have a higher level of sophistication within the product space.

Pakistan is among the group of 40 countries in the world that produce automobiles. Its booming population of 180 million and 9th largest labor force has a huge potential to grow and achieve economic prosperity with right and focused policies for its economy. Auto industry is referred to as “industry of industries” in the developed world. The auto industry of many regional countries has played a pivotal role in transforming those countries into economic tigers. It is common to face difficulties when you are in the market to buy an imported car in Pakistan. Japanese used vehicle exporting is a grey market international trade involving the export of used cars and other vehicles from Japan to other markets around the world since the 1980s.

The fertilizers manufactured imports into the country during first four months of current financial year decreased by 25.60 percent as compared the imports of the corresponding period of last year. During the period from Jul-October, 2019, about 889,395 metric tons of fertilizers worth $320.149 million imported to fulfill the domestic requirements as compared the imports of 995,549 metric tons valuing $430.323 million of same period last year, according the data of Pakistan Bureau of Statistics. Meanwhile, the imports of agriculture machinery and implements into the country during the period under review reduced by 25.07 percent as compared the corresponding period of last year as agriculture machinery and other implements worth $34.732 million imported as compared the imports of $46.342 million of same period of last year.

Market is expected to remain volatile during current trading session.

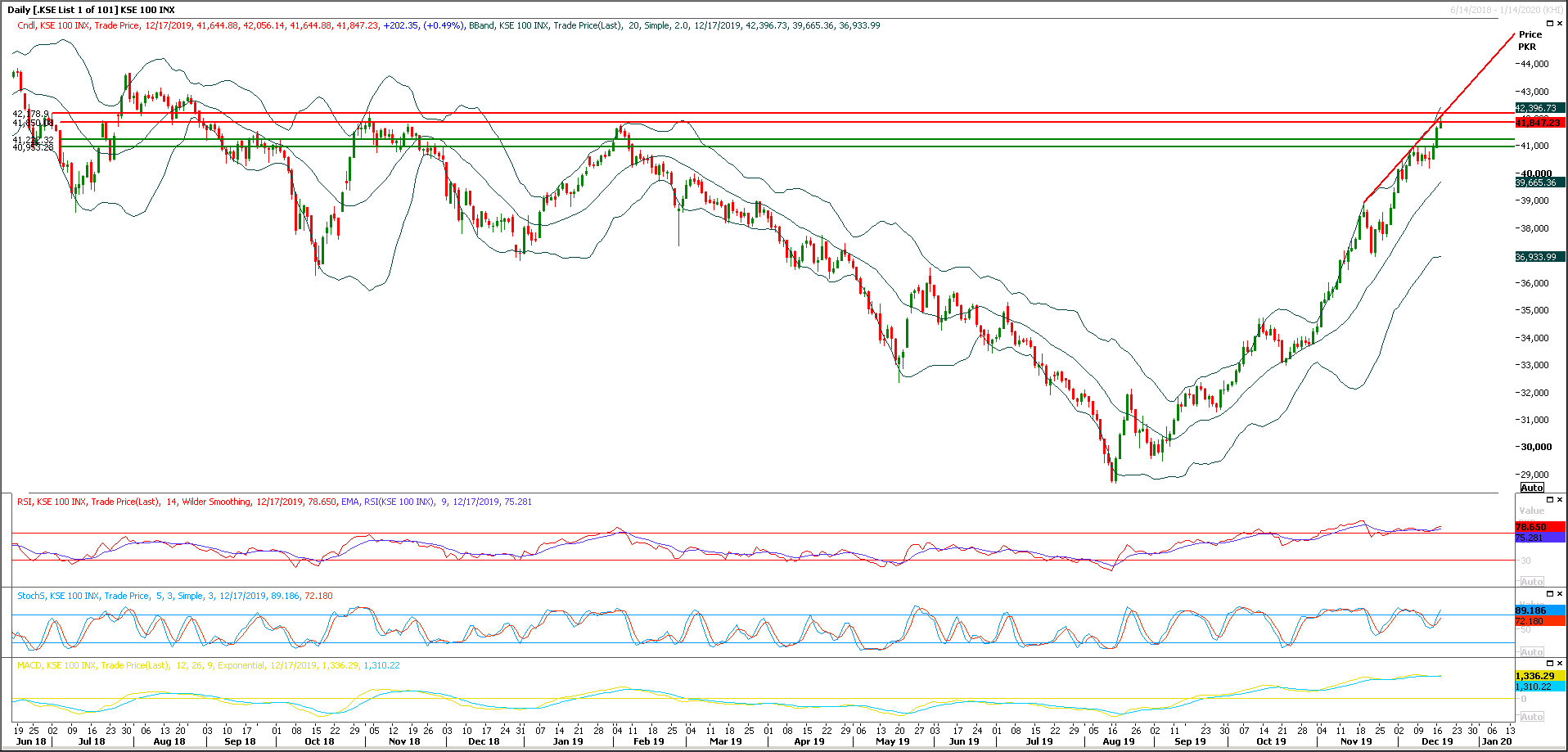

Technical Analysis

The Benchmark KSE100 have succeeded in maintaining above its major region during last trading session. As of now index would face resisatnce at 42,200 points in coming days if it would not succeed in maintaining above a rising trend line. Daily momentum indicator are trying to generate bullish crossovers but all this depends on today's closing. It's recommended to stay cautious in case of any bearish pressure even on intraday basis.

While on flip side index would remain bullish until it would slide beow 40,800 points on daily closing basis. on breakout below that region Index would enter in bearish zone.

While on flip side index would remain bullish until it would slide beow 40,800 points on daily closing basis. on breakout below that region Index would enter in bearish zone.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.