Previous Session Recap

Trading volume at PSX floor dropped by 79.84 million shares or 40.44% on DoD basis, whereas the benchmark KSE100 index opened at 40,455.44, posted a day high of 40,603.16 and a day low of 40,094.29 points during last trading session while session suspended at 40,243.46 points with net change of -212.18 points and net trading volume of 85.81 million shares. Daily trading volume of KSE100 listed companies also dropped by 53.57 million shares or 38.43% on DoD basis.

Foreign Investors remained in net selling positions of 7.81 million shares and value of Foreign Inflow dropped by 0.53 million US Dollars. Categorically, Foreign Individuals remained in net long positions of 0.13 million shares and Foreign Corporate and Overseas Pakistani Investors remained in net selling positions of 1.38 and 6.57 million shares respectively. While on the other side Local Individuals, Banks, Brokers and Insurance Companies remained in net long positions of 7.61, 2.09, 0.4 and 1.06 million shares but Local Companies, NBFCs and Mutual Fund remained in net selling positions of 1.80, 0.004 and 2.25 million shares respectively.

Analytical Review

Asian shares hover around three-week highs on Chinese support measures

Asian shares reversed earlier losses on Monday and moved back toward a three-week top as Chinese efforts to cushion the blow from a coronavirus outbreak cheered investors, although Japanese stocks faltered amid growing recession risks. Trading is expected to be light as U.S. stocks and bond markets will be shut on Monday for a public holiday. MSCI’s broadest index of Asia-Pacific shares outside Japan was a tad firmer at 557.30, not far from last week’s peak of 558.30, which was the highest since late January. The gains were helped largely by Chinese shares with the blue-chip index adding 0.4% after the country’s central bank lowered one of its key interest rates and injected more liquidity into the system.

Revenue from oil, gas products rises by 44pc

The government is estimated to have collected almost 43.7 per cent higher revenue on key oil and gas products during the first half of this fiscal year than the same period last year despite over 10pc drop in domestic production and 20pc fall in imports, it emerged on Sunday. Data released by the finance ministry puts the total revenue collection from seven important oil and gas products at Rs205bn in six months (July-December 2019) compared to Rs151bn of the same period in 2018, showing about 35pc increase. In addition, energy ministry officials put another Rs160bn collection as General Sales Tax (GST) on oil products in the first half of the current fiscal year compared to Rs103bn of the same period last year, showing an increase of over 55pc.

Cracking down on profiteers

It is good that the government has finally acknowledged the economic stress that Pakistani households are enduring. It has sprung into action at last. It is another matter if these actions seem desperate, ad hoc attempts at salvaging whatever little public goodwill that the PTI is left with. Will the Captain’s strategy succeed in providing the poor with relief, punishing market manipulators and arresting the inflation spiral? People express doubts about the last two of the three elements of the official strategy.

Pakistan may import insecticides from India to fight locust attack

As trade with India is under suspension for more than seven months, Pakistan is considering a one-time exemption for import of insecticides from India to fight ongoing locust attack on its agriculture. This will be one of the key items on the agenda of the federal cabinet called to meet on Feb 18 to also deliberate on gas pricing and power bills to comply with requirements of the International Monetary Fund (IMF) for disbursement of next tranche of $450 million. The meeting to be presided over by Prime Minister Imran Khan on Tuesday will have a comprehensive presentation for engagement of party parliamentarians in the Ehsaas programme by the special adviser to the PM on social protection and poverty alleviation.

ICCI foresees huge opportunity after Pak-Turkey FTA

President Islamabad Chamber of Commerce and Industry (ICCI) Muhammad Ahmed Waheed on Sunday observed huge trade opportunities after signing of Free Trade Agreement (FTA) between Pakistan and Turkey would also help balancing the trade volume between the two sides. After finalising the FTA between the two countries, bilateral trade could increase from existing $800 million to $5 billion, which would also help decreasing the country’s trade and foreign account deficit, Muhammad Ahmed Waheed told APP here. After the recent official visit of Turkish President RecepTayyip Erdogan to Pakistan, he hoped that both of the countries evolved consensus for finalizing the FTA, which would start a new era of growing trade and economic relations between the two countries.

Asian shares reversed earlier losses on Monday and moved back toward a three-week top as Chinese efforts to cushion the blow from a coronavirus outbreak cheered investors, although Japanese stocks faltered amid growing recession risks. Trading is expected to be light as U.S. stocks and bond markets will be shut on Monday for a public holiday. MSCI’s broadest index of Asia-Pacific shares outside Japan was a tad firmer at 557.30, not far from last week’s peak of 558.30, which was the highest since late January. The gains were helped largely by Chinese shares with the blue-chip index adding 0.4% after the country’s central bank lowered one of its key interest rates and injected more liquidity into the system.

The government is estimated to have collected almost 43.7 per cent higher revenue on key oil and gas products during the first half of this fiscal year than the same period last year despite over 10pc drop in domestic production and 20pc fall in imports, it emerged on Sunday. Data released by the finance ministry puts the total revenue collection from seven important oil and gas products at Rs205bn in six months (July-December 2019) compared to Rs151bn of the same period in 2018, showing about 35pc increase. In addition, energy ministry officials put another Rs160bn collection as General Sales Tax (GST) on oil products in the first half of the current fiscal year compared to Rs103bn of the same period last year, showing an increase of over 55pc.

It is good that the government has finally acknowledged the economic stress that Pakistani households are enduring. It has sprung into action at last. It is another matter if these actions seem desperate, ad hoc attempts at salvaging whatever little public goodwill that the PTI is left with. Will the Captain’s strategy succeed in providing the poor with relief, punishing market manipulators and arresting the inflation spiral? People express doubts about the last two of the three elements of the official strategy.

As trade with India is under suspension for more than seven months, Pakistan is considering a one-time exemption for import of insecticides from India to fight ongoing locust attack on its agriculture. This will be one of the key items on the agenda of the federal cabinet called to meet on Feb 18 to also deliberate on gas pricing and power bills to comply with requirements of the International Monetary Fund (IMF) for disbursement of next tranche of $450 million. The meeting to be presided over by Prime Minister Imran Khan on Tuesday will have a comprehensive presentation for engagement of party parliamentarians in the Ehsaas programme by the special adviser to the PM on social protection and poverty alleviation.

President Islamabad Chamber of Commerce and Industry (ICCI) Muhammad Ahmed Waheed on Sunday observed huge trade opportunities after signing of Free Trade Agreement (FTA) between Pakistan and Turkey would also help balancing the trade volume between the two sides. After finalising the FTA between the two countries, bilateral trade could increase from existing $800 million to $5 billion, which would also help decreasing the country’s trade and foreign account deficit, Muhammad Ahmed Waheed told APP here. After the recent official visit of Turkish President RecepTayyip Erdogan to Pakistan, he hoped that both of the countries evolved consensus for finalizing the FTA, which would start a new era of growing trade and economic relations between the two countries.

Market is expected to remain volatile during current trading session.

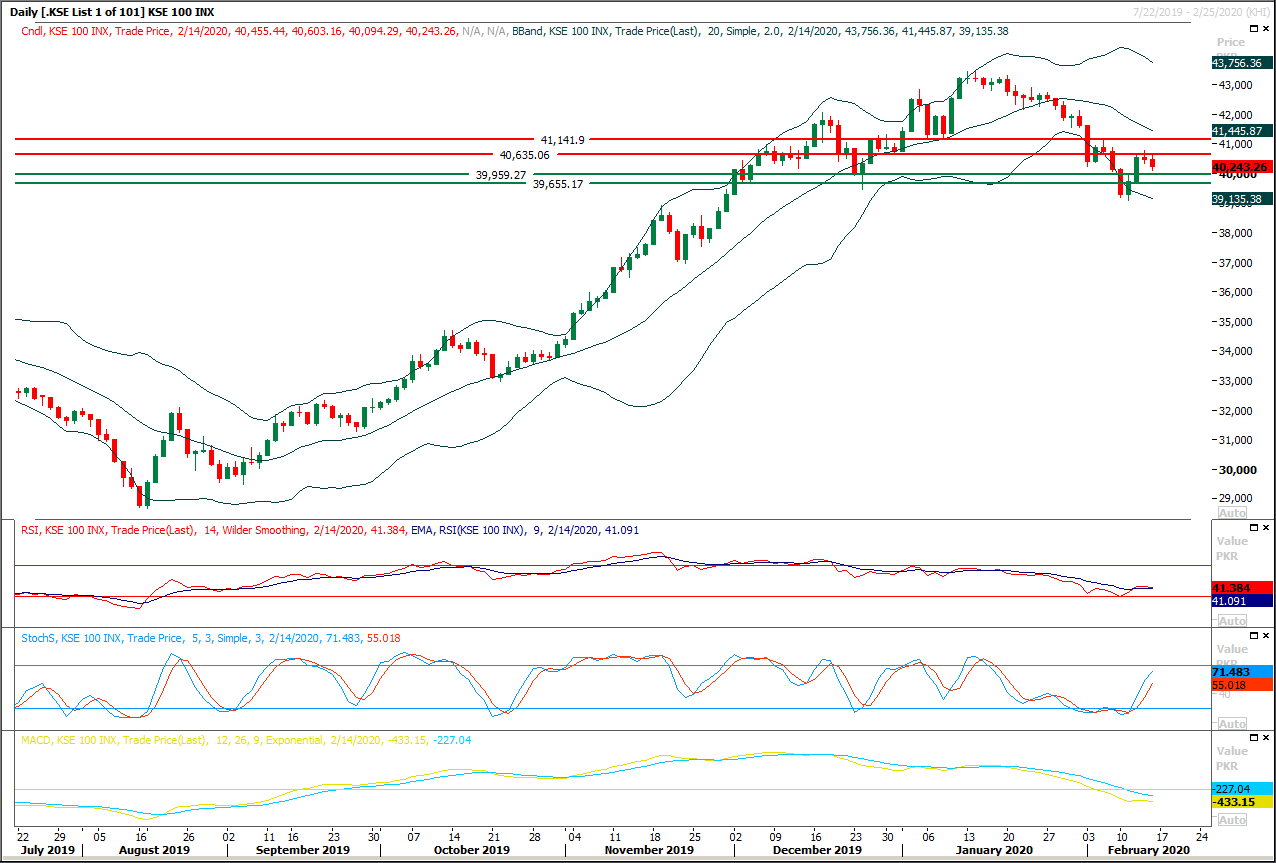

Technical Analysis

The Benchmark KSE100 index have faced a strong resistance at 40,800 points during last trading session and had bounced back after getting resistance from that level. It's expected that index would face intraday pressure again today from same region in case of bullish pull back but some kind of bearish volatility could be witnessed and chances of formation of an evening star would increased if index would slide below 40,000 points. It's recommended to adopt swing trading with strict stop loss on both sides. Index have initial supportive regions ahead at 40,000 points and breakout below said regions would call for 39,900 and 39,700 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.