Previous Session Recap

Trading volume at PSX floor increased by 30.4 million shares or 23.3% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 442358.99, posted a day high of 43142.59 and a day low of 42324.27 during last trading session. The session suspended at 42939.68 with net change of 592.19 and net trading volume of 73.61 million shares. Daily trading volume of KSE100 listed companies increased by 17.85 million shares or 32.03% on DoD basis.

Foreign Investors remained in net buying position of 3.82 million shares and net value of Foreign Inflow increased by 5.97 million US Dollars. Categorically, Foreign Individuals remained in net selling postion of 0.11 million shares but Foreign Corporate and Overseas Pakistanis remained in net buying postions of 3.52 and 0.41 million shares. While on the other side Local Individuals, Banks and Mutual Funds remained in net buying postions of 081, 0.23 and 3.72 million shares respectively but Local Companies, NBFCs, Brokers and Insurance Companies remained in net selling postions of 5.41, 0.14, 5.17 and 1.43 million shares respectively.

Analytical Review

Asian stocks stepped back from a record high on Wednesday as the region’s resource shares were dented by falling oil and commodity prices while digital currencies tumbled on worries about tighter regulations. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dropped 0.1 percent from its record high as resource shares declined after oil and other commodities succumbed to profit-taking after recent gains. Japan's Nikkei .N225 fell 0.7 percent from its 26-year peak hit the previous day. Wall Street paused its rally, led by a 1.2 percent fall in energy stocks .SPNY as well as weakness in General Electric (GE.N). The U.S. conglomerate raised the prospect of breaking itself up and announced more than $11 billion in charges from its long-term care insurance portfolio and new U.S. tax laws.

Foreign direct investment (FDI) fell 2.8 per cent to $1.38 billion in the first half of 2017-18, although inflows from China rose 2.4 times, the State Bank of Pakistan reported on Tuesday. Data showed the pattern of inflows significantly changed recently. China now dominates FDI with a share of more than two-thirds in total investments. Beijing emerged first as the largest trading partner of Islamabad and now it has become the top foreign investor. Inflows from countries other than China have come down drastically over the same period. FDI from China was $969 million during the six months, which constituted 70pc of total inflows. In the same period of the preceding fiscal year, investment from China amounted to $393m and constituted 27.6pc of total inflows.

Saying that the federal government is transgressing the powers of the Council of Common Interests (CCI), the Sindh government has asked the centre to “rescind unilateral changes” to the energy policy that are affecting the development of domestic sources of power generation. “Any policy decision by the Cabinet Committee on Energy (CCoE) on electricity is a clear transgression and infringement into the domain of the CCI,” wrote Sindh Chief Minister Murad Ali Shah to Prime Minister Shahid Khaqan Abbasi. He added that unilateral and arbitrary decisions by the CCoE had created an alarming situation that was adversely affecting provincial interests.

Pakistan will start paying up to Rs4 billion annually on loans obtained under China-Pakistan Economic Corridor (CPEC) in next few years, Senate standing committee on commerce and textiles was told on Tuesday. The committee, which met under the chair of Senator Shibli Faraz, sought details of loans which will be payable in future. The officials of Ministry of Commerce told the members of meeting that new trade policy is in the making, in which service policy and investment and tariff issues are also included. Officials said that the free trade agreement (FTA) with China is being considered again. The Ministry of Commerce officials said that the FTA with China will be revised.

Punjab Provincial Development Working Party (PDWP), in its 45th meeting of current financial year 2017-18, approved three development schemes of irrigation sector at an estimated cost of Rs 3617.472 million. Punjab Planning and Development (P&D) Chairman chaired the meeting, which was attended by all members of P&D Board, provincial secretary concerned, P&D Assistant Chief Coordination-II Hafiz Muhammad Iqbal and other representatives of the departments concerned, according to P&D spokesman here Tuesday.

Its recommended to practice caution as market is expected to remain volatile.

Technical Analysis

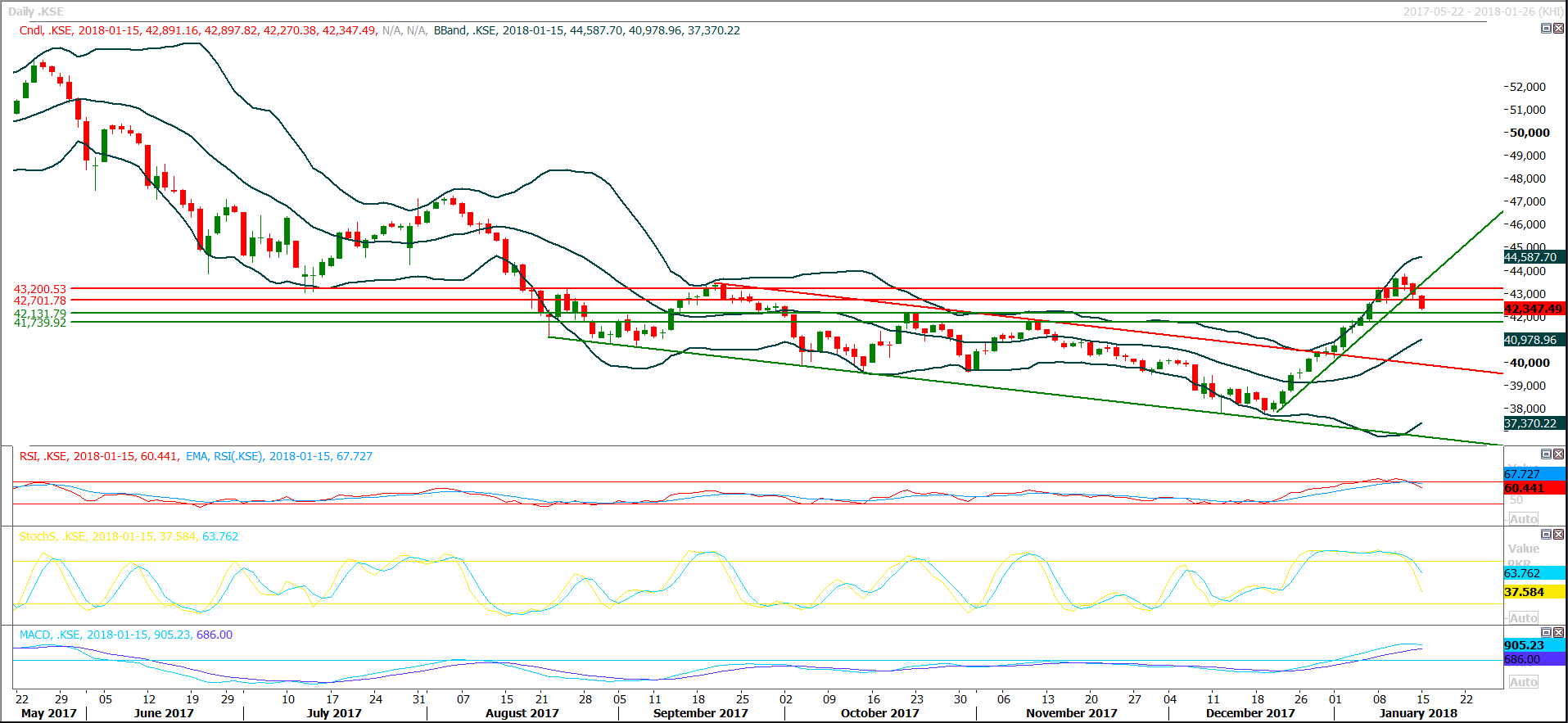

The Benchmark KSE100 Index have generated a bullish engulfing of daily chart after posting a double bottom, but as of right now its standing at a critical level as it have 61.8% correction level of its last bearish rally which started from 43824.02 and ended up at 42270.38 ahead at 43247 which woul try to react as a strong resistance. Its also capped by two major resistant regions at 43219 and 43760. Daily MAORSI have tried to pull back during last trading session but stochastic is still in bearish mode which would also impact current bullish sentiment. Its recommened to sell on strength with strict stop loss of 43760 during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.