Previous Session Recap

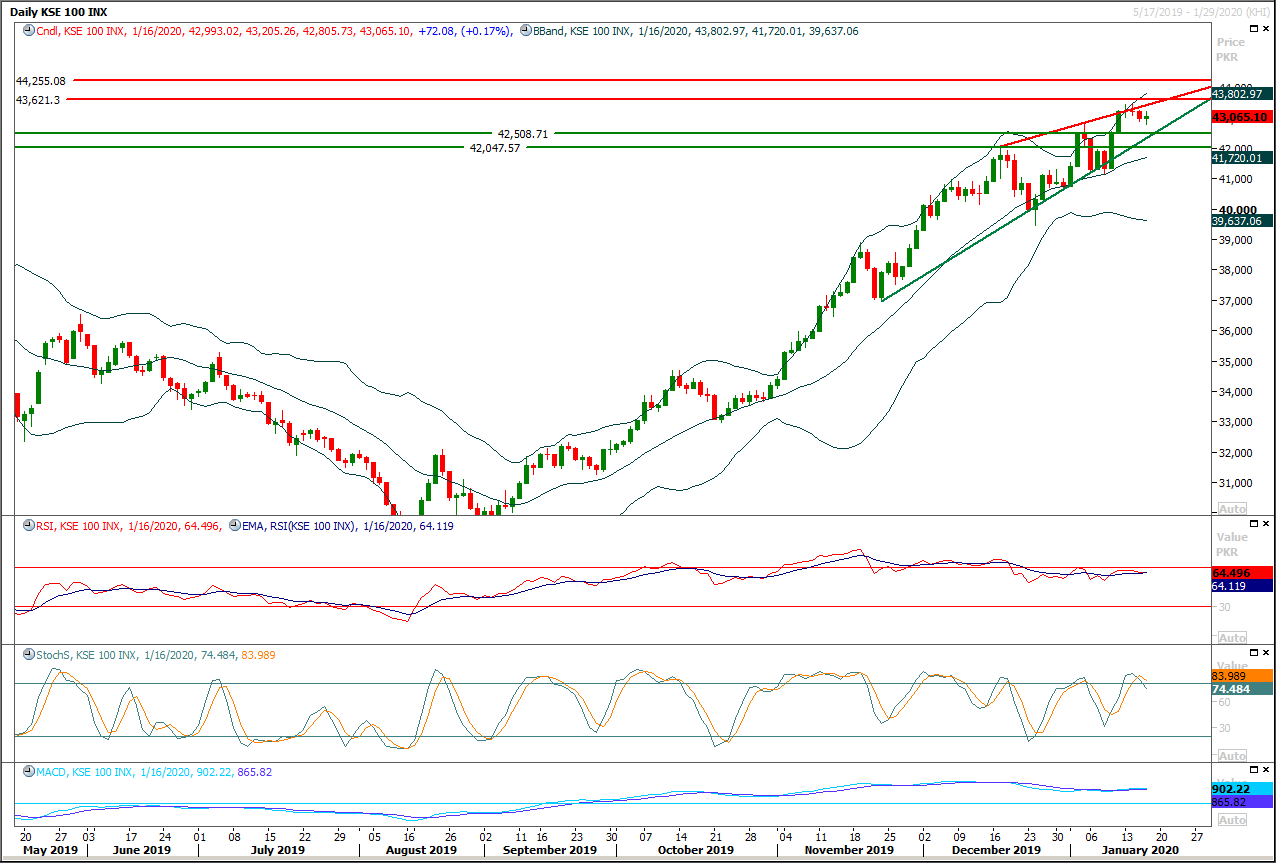

Trading volume at PSX floor increased by 58.61 million shares or 34.22% on DoD basis, whereas the benchmark KSE100 index opened at 43015.81, posted a day high of 43,205.26 and a day low of 42,805.73 points during last trading session while session suspended at 43,065.10 points with net change of 72.07 points and net trading volume of 152.13 million shares. Daily trading volume of KSE100 listed companies increased by 32.18 million shares or 26.83% on DoD basis.

Foreign Investors remained in net selling positions of 14.58 million shares and value of Foreign Inflow dropped by 1.30 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistanis Investor remained in net selling positions of 0.005, 12.27 and 2.30 million shares. While on the other side Local Companies, NBFCS and Brokers remained in net buying positions of 15.46, 0.16 and 48.25 million shares but Local Individuals, Banks, Mutual Fund and Insurance Companies remained in net selling positions of 35.23, 7.61, 3.90 and 2.02 million shares respectively.

Analytical Review

Asian shares firm after Wall Street records; China GDP awaited

Asian shares inched higher on Friday after global stock indexes and Wall Street posted more records, with strong corporate earnings and upbeat U.S. economic data adding to optimism after China and the U.S. signed a partial trade deal. But investors will be closely watching key Chinese economic data for clues on whether a marked slowdown in the world’s second-largest economy is starting to bottom out. China is expected to post its weakest annual growth rate in 29 years — 6.1% — due to anemic domestic demand and the damaging trade war with the United States. Data in the last few months have pointed to an improvement in Chinese manufacturing and business confidence as trade tensions eased, but analysts are not sure if the gains can be sustained and Beijing is widely expected to roll out more stimulus measures. Fourth-quarter and 2019 gross domestic product (GDP) data and December factory output, retail sales and fixed-asset investment numbers are due at 0200 GMT.

Six-month foreign direct investment jumps 68.3pc

The inflows of foreign direct investment (FDI) jumped 68.3 per cent to $1.34 billion during the first half of the current fiscal year compared to $796.8 million in the same period last year. The major chunk of these investments was concentrated in the telecommunication, power and electrical machinery sectors with China and Norway emerging as the top investors. The SBP figures showed surprise addition of Malta which invested $111.1m during the July-December period of 2019-20. The jump in the cumulative FDI numbers came following a one-off payment made by the telecommunication companies — Telenor, Warid and Zong — for licence renewal. On the flipside, data for December 2019 showed total foreign investment bottom-line outflow of $198.3m. Although the FDI increased by 52.6pc to $487m in the month and $684m outflow in the debt securities – bonds, T-bills and PIBs — closed the total investment account in negative.

Govt striving to boost industrial capacity: Asad

The government is focused on boosting Pakistan’s industrial capacity through joint ventures in priority areas, relocation of labour-intensive export-led industry, SMEs collaboration and enhancement of vocational training capacity, Federal Minister for Planning, Development and Special Initiatives Asad Umar said on Thursday. The minister was talking to a delegation of Rawalpindi Chamber of Commerce and Industry (RCCI) — led by its president Saboor Malik — which called on him in his office. The minister highlighted that only in December, the government spent Rs75 billion out of the Rs97bn on development schemes in the country under the Public Sector Development Projects (PSDP). “The PTI government is determined to establish four special economic zones (SEZs) in all provinces,” he said.

Unutilised water flow into sea causes $29bn yearly loss to economy: Irsa

Pakistan is facing about $29 billion in economic losses every year on account of unutilised flow of river waters into the sea due to limited water storage capacity. “We and our coming generations would die of hunger if we do not build dams,” Rao Irshad Ali Khan, Member Punjab of the Indus River System Authority (Irsa), told the Senate Standing Committee on Water Resources on Tuesday. The meeting was presided over by Senator Mohammad Yousuf Badini. The committee ordered completion of the process to award by June the contract for establishment of the telemetry system for accurate reporting of water flows and immediate appointment of Irsa’s member from Balochistan. At the outset, the senators expressed displeasure over the absence of Minister for Water Resources Faisal Vawda from the meeting. Mr Badini said it was unfortunate that the “Faisal Vawda bootwala” had enough time to appear in talk shows and make mockery of state institutions with show of boots but did not attend committee meetings about his ministry.

LCCI, FPCCI to work jointly for promotion of economic activities

The Lahore Chamber of Commerce (LCCI) & Industry and Federation of Pakistan Chambers of Commerce & Industry (FPCCI) have decided to work jointly for promotion of trade and economic activities in the country. The decision was made during the visit of FPCCI President Mian Anjum Nisar to the LCCI on Thursday. LCCI President Irfan Iqbal Sheikh, Senior Vice President Ali Hussam Asghar, Vice President Mian Zahid Jawaid Ahmad also spoke on the occasion while former office-bearers Shahid Hassan Sheikh, Muhammad Ali Mian, Sohail Lashari, Amjad Ali Jawa, Nasir Hameed Khan, Faheem-ur-Rehman Saigal and Executive Committee members were also present. Current economic scenario and challenges being faced by the trade and industry came under discussion.

Asian shares inched higher on Friday after global stock indexes and Wall Street posted more records, with strong corporate earnings and upbeat U.S. economic data adding to optimism after China and the U.S. signed a partial trade deal. But investors will be closely watching key Chinese economic data for clues on whether a marked slowdown in the world’s second-largest economy is starting to bottom out. China is expected to post its weakest annual growth rate in 29 years — 6.1% — due to anemic domestic demand and the damaging trade war with the United States. Data in the last few months have pointed to an improvement in Chinese manufacturing and business confidence as trade tensions eased, but analysts are not sure if the gains can be sustained and Beijing is widely expected to roll out more stimulus measures. Fourth-quarter and 2019 gross domestic product (GDP) data and December factory output, retail sales and fixed-asset investment numbers are due at 0200 GMT.

The inflows of foreign direct investment (FDI) jumped 68.3 per cent to $1.34 billion during the first half of the current fiscal year compared to $796.8 million in the same period last year. The major chunk of these investments was concentrated in the telecommunication, power and electrical machinery sectors with China and Norway emerging as the top investors. The SBP figures showed surprise addition of Malta which invested $111.1m during the July-December period of 2019-20. The jump in the cumulative FDI numbers came following a one-off payment made by the telecommunication companies — Telenor, Warid and Zong — for licence renewal. On the flipside, data for December 2019 showed total foreign investment bottom-line outflow of $198.3m. Although the FDI increased by 52.6pc to $487m in the month and $684m outflow in the debt securities – bonds, T-bills and PIBs — closed the total investment account in negative.

The government is focused on boosting Pakistan’s industrial capacity through joint ventures in priority areas, relocation of labour-intensive export-led industry, SMEs collaboration and enhancement of vocational training capacity, Federal Minister for Planning, Development and Special Initiatives Asad Umar said on Thursday. The minister was talking to a delegation of Rawalpindi Chamber of Commerce and Industry (RCCI) — led by its president Saboor Malik — which called on him in his office. The minister highlighted that only in December, the government spent Rs75 billion out of the Rs97bn on development schemes in the country under the Public Sector Development Projects (PSDP). “The PTI government is determined to establish four special economic zones (SEZs) in all provinces,” he said.

Pakistan is facing about $29 billion in economic losses every year on account of unutilised flow of river waters into the sea due to limited water storage capacity. “We and our coming generations would die of hunger if we do not build dams,” Rao Irshad Ali Khan, Member Punjab of the Indus River System Authority (Irsa), told the Senate Standing Committee on Water Resources on Tuesday. The meeting was presided over by Senator Mohammad Yousuf Badini. The committee ordered completion of the process to award by June the contract for establishment of the telemetry system for accurate reporting of water flows and immediate appointment of Irsa’s member from Balochistan. At the outset, the senators expressed displeasure over the absence of Minister for Water Resources Faisal Vawda from the meeting. Mr Badini said it was unfortunate that the “Faisal Vawda bootwala” had enough time to appear in talk shows and make mockery of state institutions with show of boots but did not attend committee meetings about his ministry.

The Lahore Chamber of Commerce (LCCI) & Industry and Federation of Pakistan Chambers of Commerce & Industry (FPCCI) have decided to work jointly for promotion of trade and economic activities in the country. The decision was made during the visit of FPCCI President Mian Anjum Nisar to the LCCI on Thursday. LCCI President Irfan Iqbal Sheikh, Senior Vice President Ali Hussam Asghar, Vice President Mian Zahid Jawaid Ahmad also spoke on the occasion while former office-bearers Shahid Hassan Sheikh, Muhammad Ali Mian, Sohail Lashari, Amjad Ali Jawa, Nasir Hameed Khan, Faheem-ur-Rehman Saigal and Executive Committee members were also present. Current economic scenario and challenges being faced by the trade and industry came under discussion.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index had tried to recover after getting support from supportive trend line of its rising wedge and now daily momentum indicators have also succeed in generating bearish crossovers but its recommended to wait for today's closing because today's closing would set market trend on weekly chart as well therefore it's better to wait for a confirmation call before initiating new positions. Index is currently facing rejection from its correction levels of bearish rally and to penetrate above these levels it need massive volumes meanwhile major resistant regions are standing ahead at t 43,620 and 43,860 points and it would not enter into bullish zone until it would close on daily or basis above these regions. while today's closing below 42,500 points would add further pressure on index and it would try to push index further downward till 42,300 and then 41,800 points. wait and see could be better option until a clear breakout took place on either side.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.