Previous Session Recap

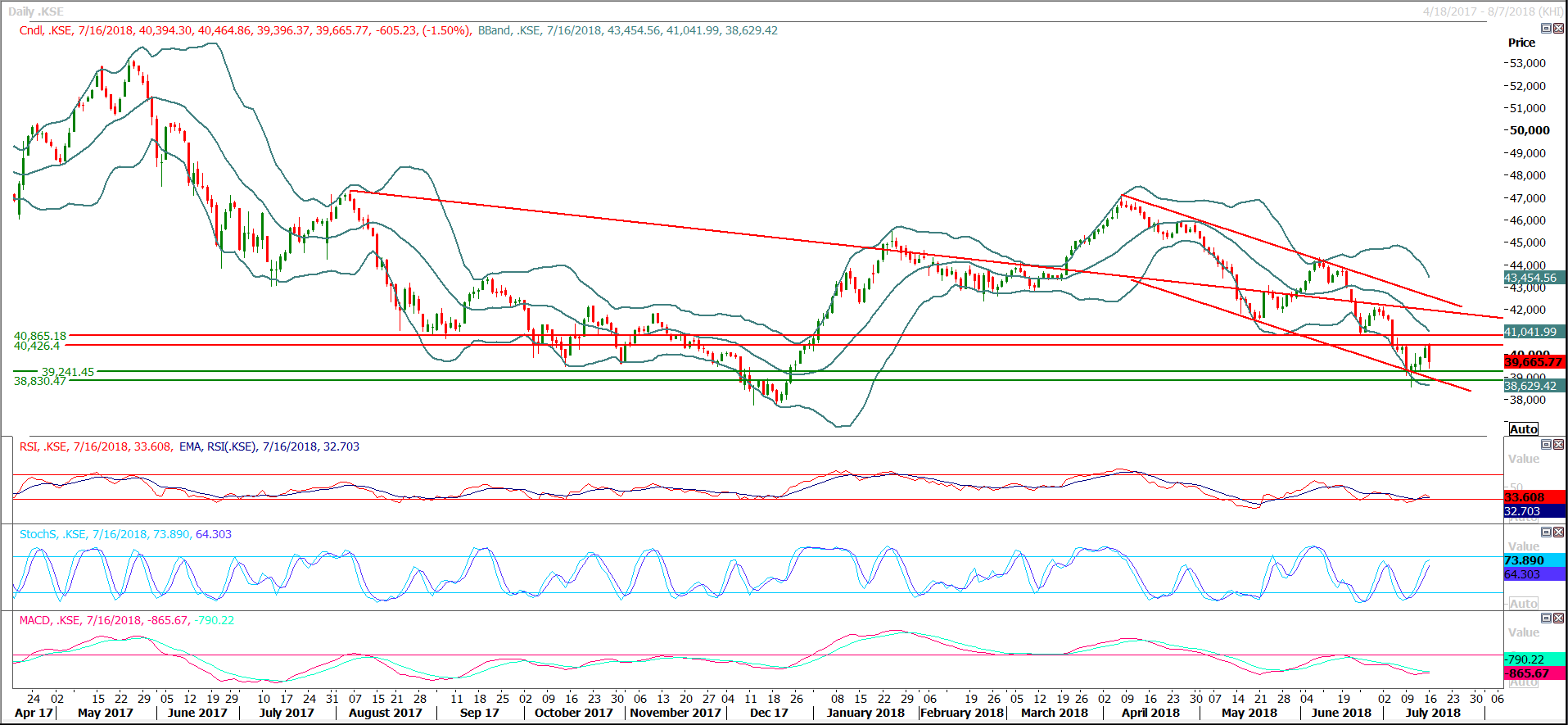

Trading volume at PSX floor increased by 22.73 million shares or 18.22% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 40,394.30, posted a day high of 40,461.94 and a day low of 39,396.37 during last trading session. The session suspended at 39,665.77 with net change of -605.23 and net trading volume of 93.22 million shares. Daily trading volume of KSE100 listed companies increased by 6.04 million shares or 6.92% on DoD basis.

Foreign Investors remained in net selling position of 16.85 million shares and net value of Foreign Inflow dropped by 9.67 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.04 million shares but Foreign Corporate and Overseas Pakistani investors remained in net selling positions of 16.53 and 0.37 million shares. While on the other side Local Individuals, Local Companies, Banks, NBFCs and Insurance Companies remained in net buying positions of 20.94, 7.13, 0.33, 0.01 and 4.57 million shares but Mutual Fund and Brokers remained in net selling positions of 4.07 and 14.27 million shares respectively.

Analytical Review

Asia stocks sag after oil slides, dollar steady before Fed speech

Asian stocks sagged on Tuesday, weighed by a sharp decline in crude oil prices as Libyan ports reopened, while the dollar steadied ahead of Federal Reserve Chairman Jerome Powell’s first congressional testimony. Overnight on Wall Street, the Dow edged up 0.2 percent but the S&P 500 lost 0.1 percent as energy shares were hit by the drop in oil that offset a jump in financials. [.N] MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.5 pct lower following two sessions of gains. Chinese shares extended losses after dropping the previous day on soft economic data. The Shanghai Composite Index fell 0.7 percent and Hong Kong’s Hang Seng dropped 0.9 percent. Australian stocks fell 0.4 percent and South Korea’s KOSPI lost 0.2 percent. Japan’s Nikkei bucked the trend and rose 0.5 percent.

Calamities caused Rs20b losses in recent past: Shamshad

Caretaker Minister for Finance, Revenue and Economic Affairs Dr Shamshad Akhtar said on Monday that the National Disaster Risk Management Fund will be a first concrete step towards making Pakistan resilient against natural disasters and climate change impacts. She expressed these views at the launching ceremony of the NDRMF. She said that Pakistan has suffered over Rs20 billion losses over the last few years, affecting more than 30 million people. She stressed the need for setting up a sustainable financing system to fund risk reduction and mitigation activities in the country. Dr Akhtar assured the full commitment of the government to support the NDRMF and the provision of additional resources to strengthen the fund's operations to comply with international and national commitments.

Funds release linked to AGPR pre-audit

The Ministry of Finance on Monday has unveiled the strategy to release the funds during current fiscal year directing the departments to make all the payments through pre-audit of Accountant General of Pakistan Revenues (AGPR). The ministry of finance has directed the ministries and departments to restrict the current and development expenditures at the level of 20 percent each for the first and second quarter and the level of 30 percent each for the third and fourth quarter of current financial year. However, funds required for payment of salaries and pensions would be released at 25 percent of budget of each year. Meanwhile, the cases relating to unavoidable, international and domestic contractual/obligatory payments beyond the above limits will be considered on cases to case basis and relaxation, if required, would be allowed by the Finance Secretary. “Cases in respect of current expenditure for releases exceeding Rs50 million may be referred to Budget Wing for ways and means clearance after completion of all procedural and codal requirements,” the office memorandum stated.

Waste-to-energy power plant approved

The National Electric Power Regulatory Authority (Nepra) has approved the grant of power generation licence to Lahore Xingzhong Renewable Energy Company Limited for setting up 40 MW municipal waste based power plant in Punjab. The company will set up Pakistan's first waste-to-energy plant with 40-megawatt production capacity in Lakhodair, Lahore district. It will deploy a state-of-the-art incineration-type generation facility and the most suitable waste-to-energy technology, said a spokesman for the Nepra. The project will deploy state of the art incineration type generation facility and the most suitable waste to energy technology. It is relevant to highlight that the project will reduce 2000 tonnes/day of the city's municipal solid waste to generate electricity to address the municipality's waste and energy needs of the country.

CDWP defers 17 projects' approval until next govt

The Central Development Working Party (CDWP) has deferred 17 projects for the approval of the next elected government as the interim government was not mandated to approve new projects or projects with extended scope of work or cost escalation. The CDWP under interim government have no authority to approve new projects and has only the mandate to grant extension to the ongoing project, consider PC-II or revised PC-I with no cost escalation or increase in scope of work, official sources told The Nation here Monday. Out of the total 18 development projects, as well as concept clearance cases, presented to the CDWP, only a revised PC-II for the capacity building of Azad Jammu and Kashmir Power Development Organization worth Rs47.775 million was approved.

Asian stocks sagged on Tuesday, weighed by a sharp decline in crude oil prices as Libyan ports reopened, while the dollar steadied ahead of Federal Reserve Chairman Jerome Powell’s first congressional testimony. Overnight on Wall Street, the Dow edged up 0.2 percent but the S&P 500 lost 0.1 percent as energy shares were hit by the drop in oil that offset a jump in financials. [.N] MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.5 pct lower following two sessions of gains. Chinese shares extended losses after dropping the previous day on soft economic data. The Shanghai Composite Index fell 0.7 percent and Hong Kong’s Hang Seng dropped 0.9 percent. Australian stocks fell 0.4 percent and South Korea’s KOSPI lost 0.2 percent. Japan’s Nikkei bucked the trend and rose 0.5 percent.

Caretaker Minister for Finance, Revenue and Economic Affairs Dr Shamshad Akhtar said on Monday that the National Disaster Risk Management Fund will be a first concrete step towards making Pakistan resilient against natural disasters and climate change impacts. She expressed these views at the launching ceremony of the NDRMF. She said that Pakistan has suffered over Rs20 billion losses over the last few years, affecting more than 30 million people. She stressed the need for setting up a sustainable financing system to fund risk reduction and mitigation activities in the country. Dr Akhtar assured the full commitment of the government to support the NDRMF and the provision of additional resources to strengthen the fund's operations to comply with international and national commitments.

The Ministry of Finance on Monday has unveiled the strategy to release the funds during current fiscal year directing the departments to make all the payments through pre-audit of Accountant General of Pakistan Revenues (AGPR). The ministry of finance has directed the ministries and departments to restrict the current and development expenditures at the level of 20 percent each for the first and second quarter and the level of 30 percent each for the third and fourth quarter of current financial year. However, funds required for payment of salaries and pensions would be released at 25 percent of budget of each year. Meanwhile, the cases relating to unavoidable, international and domestic contractual/obligatory payments beyond the above limits will be considered on cases to case basis and relaxation, if required, would be allowed by the Finance Secretary. “Cases in respect of current expenditure for releases exceeding Rs50 million may be referred to Budget Wing for ways and means clearance after completion of all procedural and codal requirements,” the office memorandum stated.

The National Electric Power Regulatory Authority (Nepra) has approved the grant of power generation licence to Lahore Xingzhong Renewable Energy Company Limited for setting up 40 MW municipal waste based power plant in Punjab. The company will set up Pakistan's first waste-to-energy plant with 40-megawatt production capacity in Lakhodair, Lahore district. It will deploy a state-of-the-art incineration-type generation facility and the most suitable waste-to-energy technology, said a spokesman for the Nepra. The project will deploy state of the art incineration type generation facility and the most suitable waste to energy technology. It is relevant to highlight that the project will reduce 2000 tonnes/day of the city's municipal solid waste to generate electricity to address the municipality's waste and energy needs of the country.

The Central Development Working Party (CDWP) has deferred 17 projects for the approval of the next elected government as the interim government was not mandated to approve new projects or projects with extended scope of work or cost escalation. The CDWP under interim government have no authority to approve new projects and has only the mandate to grant extension to the ongoing project, consider PC-II or revised PC-I with no cost escalation or increase in scope of work, official sources told The Nation here Monday. Out of the total 18 development projects, as well as concept clearance cases, presented to the CDWP, only a revised PC-II for the capacity building of Azad Jammu and Kashmir Power Development Organization worth Rs47.775 million was approved.

Market is expected to remain volatile therefore it's recommended to stay cautious while trading today.

Technical Analysis

The Benchmark KSE100 Index has bounced back after completing its 50% correction of last bearish rally and had created a bearish engulfing pattern on daily chart during last trading session, but sometimes these type of clear indications/formations create a decisive move therefore its recommended to stay cautious while trading during current trading session because index have supportive regions ahead at 39,200 and 38,800 points where index could find some ground against bearish pressure. If index would succeed in sliding below 38,800 points then a further slide of 1000-1400 points could be witnessed in coming days. As of now it’s recommended to swing between 40,500 and 38,800 points until breakout of either side.

Index is moving in a bearish trend channel and supportive trend line of said channel is going to provide support against the bearish momentum which was created during last trading session. Intraday momentum shows some strength therefore it’s expected that index would try to pull back after a dip on intraday basis. MLCF, SNGP, PAEL and ISL would try to strike back after a dip during current trading session. .

Index is moving in a bearish trend channel and supportive trend line of said channel is going to provide support against the bearish momentum which was created during last trading session. Intraday momentum shows some strength therefore it’s expected that index would try to pull back after a dip on intraday basis. MLCF, SNGP, PAEL and ISL would try to strike back after a dip during current trading session. .

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.