Previous Session Recap

Trading volume at PSX floor increased by 69.53 million shares or 100.5% on DoD basis, whereas the benchmark KSE100 index opened at 32,914.92, posted a day high of 33,093.79 and a day low of 32,604.64 points during last trading session while session suspended at 32,972.02 points with net change of 13.67 points and net trading volume of 119.5 million shares. Daily trading volume of KSE100 listed companies increased by 67.27 million shares or 128.79% on DoD basis.

Foreign Investors remained in net selling positions of 52.02 million shares and net value of Foreign Inflow dropped by 0.11 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net selling positions of 0.83 and 51.28 million shares respectively. While on the other side Local Individuals, Banks, NBFCs, Brokers and Insurance Companies remained in net buying positions of 34.1, 2.23, 0.66, 47.67 and 0.23 million shares respectively, but Local Companies and Mutual Funds remained in net selling positions of 8.4 and 23.85 million shares.

Analytical Review

Asia shares subdued, dollar benefits as sterling suffers

Asian shares drifted off on Wednesday as anxious investors awaited more earnings reports from corporate America, while the dollar held firm in the wake of robust U.S. retail data and a Brexit-driven dive in the pound. Oil prices also nursed losses on hints U.S. tensions with Iran could be easing and as data showed stockpiles fell by less than expected last week. Not helping the mood was Tuesday’s threat from U.S. President Donald Trump to put tariffs on another $325 billion of Chinese goods, amid market nervousness over when face-to-face trade negotiations will resume. The fallout of the year-long trade dispute was apparent in data from Singapore, where exports sank by the most in six years in June led by a steep drop in electronics. In stock markets trade was generally muted with MSCI’s broadest index of Asia-Pacific shares outside Japan off 0.3%. Japan’s Nikkei eased 0.5% and South Korea 1%, while Chinese blue chips dipped into the red.

SBP increases policy rate to 13.25pc

The State Bank of Pakistan on Tuesday decided to raise the policy rate by 100bps to 13.25 percent with effect from 17th July, 2019. The announcement was made by State Bank governor Baqir Reza at the bank headquarters in Karachi, who said the decision taken by the Monetary Policy Committee (MPC) took into account upside inflationary pressures from exchange rate depreciation since the last MPC meeting on 20th May 2019 and the likely increase in near term inflation from the one-off impact of recent adjustments in utility prices and other measures in the FY20 budget. The decision also takes into account downside inflation pressures from softening demand indicators. Taking these factors into consideration, the MPC expects average inflation of 11 – 12 percent in FY20, higher than previously projected. Nevertheless, inflation is expected to fall considerably in FY21 as the one-off effect of some of the causes of the recent rise in inflation diminishes.

Govt to issue short term bonds, Sukuks to build reserves

The government has decided to issue short term bonds and Sukuks to raise resources from the international market to build foreign exchange reserves of the country. The federal cabinet has allowed ministry of finance to initiate Medium-Term Notes (MTN) programme covering both Eurobonds and Sukuk. “The federal cabinet has decided to constitute legal team to review the process of issuing Eurobonds and Sukuk,” said an official of the ministry of finance. He further said that size of the bonds has not decided yet, as the government would review the market situation first. The federal government in annual budget for current fiscal year 2019-20 had projected to generate Rs450 billion (around $2.8 billion) for the Sukuk bonds.

Industry for increasing prices of fertiliser

Representatives of fertilizer industry on Tuesday raised their concerns regarding the proposed amendments in the Gas Infrastructure Development Cess (GIDC) Act, 2015 and its implementation. They asked for increasing the prices of fertiliser due to proposed amendments in GIDC Act 2015. The hike of 62 percent in feed gas and 31 percent in fuel gas price to fertilizer industry was made effective from July 1, 2019 by the government. This substantial increase in gas price has had a 12 percent incremental effect on urea prices as gas is the main raw material of urea. In rupees, the increase in urea price is Rs 210 per bag. To keep urea prices at affordable level, the fertilizer companies agreed to absorb Rs100 per bag on account of envisaged impact of GIDC settlement of 50 percent, but kept waiting for the formal announcement from the government.

New FBR chairman being considered

Clouds of uncertainty gathered around the Federal Board of Revenue (FBR) as talk continues to swirl in the capital that its chairman, Shabbar Zaidi, could be replaced in the coming days. Zaidi himself could be moved up the heirarchy, either to the position of Minister of State for Revenue that fell vacant after its former occupant, Hammad Azhar, was elevated to full minister status and given the Economic Affairs Division, or to the position of Special Advisor to the Prime Minister on Revenue. When contacted, the chairman was tight lipped but when asked again he said, “I don’t want to comment, Prime Minister Imran Khan will decide.” Zaidi was appointed to the position on May 10 by the premier.

Asian shares drifted off on Wednesday as anxious investors awaited more earnings reports from corporate America, while the dollar held firm in the wake of robust U.S. retail data and a Brexit-driven dive in the pound. Oil prices also nursed losses on hints U.S. tensions with Iran could be easing and as data showed stockpiles fell by less than expected last week. Not helping the mood was Tuesday’s threat from U.S. President Donald Trump to put tariffs on another $325 billion of Chinese goods, amid market nervousness over when face-to-face trade negotiations will resume. The fallout of the year-long trade dispute was apparent in data from Singapore, where exports sank by the most in six years in June led by a steep drop in electronics. In stock markets trade was generally muted with MSCI’s broadest index of Asia-Pacific shares outside Japan off 0.3%. Japan’s Nikkei eased 0.5% and South Korea 1%, while Chinese blue chips dipped into the red.

The State Bank of Pakistan on Tuesday decided to raise the policy rate by 100bps to 13.25 percent with effect from 17th July, 2019. The announcement was made by State Bank governor Baqir Reza at the bank headquarters in Karachi, who said the decision taken by the Monetary Policy Committee (MPC) took into account upside inflationary pressures from exchange rate depreciation since the last MPC meeting on 20th May 2019 and the likely increase in near term inflation from the one-off impact of recent adjustments in utility prices and other measures in the FY20 budget. The decision also takes into account downside inflation pressures from softening demand indicators. Taking these factors into consideration, the MPC expects average inflation of 11 – 12 percent in FY20, higher than previously projected. Nevertheless, inflation is expected to fall considerably in FY21 as the one-off effect of some of the causes of the recent rise in inflation diminishes.

The government has decided to issue short term bonds and Sukuks to raise resources from the international market to build foreign exchange reserves of the country. The federal cabinet has allowed ministry of finance to initiate Medium-Term Notes (MTN) programme covering both Eurobonds and Sukuk. “The federal cabinet has decided to constitute legal team to review the process of issuing Eurobonds and Sukuk,” said an official of the ministry of finance. He further said that size of the bonds has not decided yet, as the government would review the market situation first. The federal government in annual budget for current fiscal year 2019-20 had projected to generate Rs450 billion (around $2.8 billion) for the Sukuk bonds.

Representatives of fertilizer industry on Tuesday raised their concerns regarding the proposed amendments in the Gas Infrastructure Development Cess (GIDC) Act, 2015 and its implementation. They asked for increasing the prices of fertiliser due to proposed amendments in GIDC Act 2015. The hike of 62 percent in feed gas and 31 percent in fuel gas price to fertilizer industry was made effective from July 1, 2019 by the government. This substantial increase in gas price has had a 12 percent incremental effect on urea prices as gas is the main raw material of urea. In rupees, the increase in urea price is Rs 210 per bag. To keep urea prices at affordable level, the fertilizer companies agreed to absorb Rs100 per bag on account of envisaged impact of GIDC settlement of 50 percent, but kept waiting for the formal announcement from the government.

Clouds of uncertainty gathered around the Federal Board of Revenue (FBR) as talk continues to swirl in the capital that its chairman, Shabbar Zaidi, could be replaced in the coming days. Zaidi himself could be moved up the heirarchy, either to the position of Minister of State for Revenue that fell vacant after its former occupant, Hammad Azhar, was elevated to full minister status and given the Economic Affairs Division, or to the position of Special Advisor to the Prime Minister on Revenue. When contacted, the chairman was tight lipped but when asked again he said, “I don’t want to comment, Prime Minister Imran Khan will decide.” Zaidi was appointed to the position on May 10 by the premier.

Market is expected to remain volatile during current trading session.

Technical Analysis

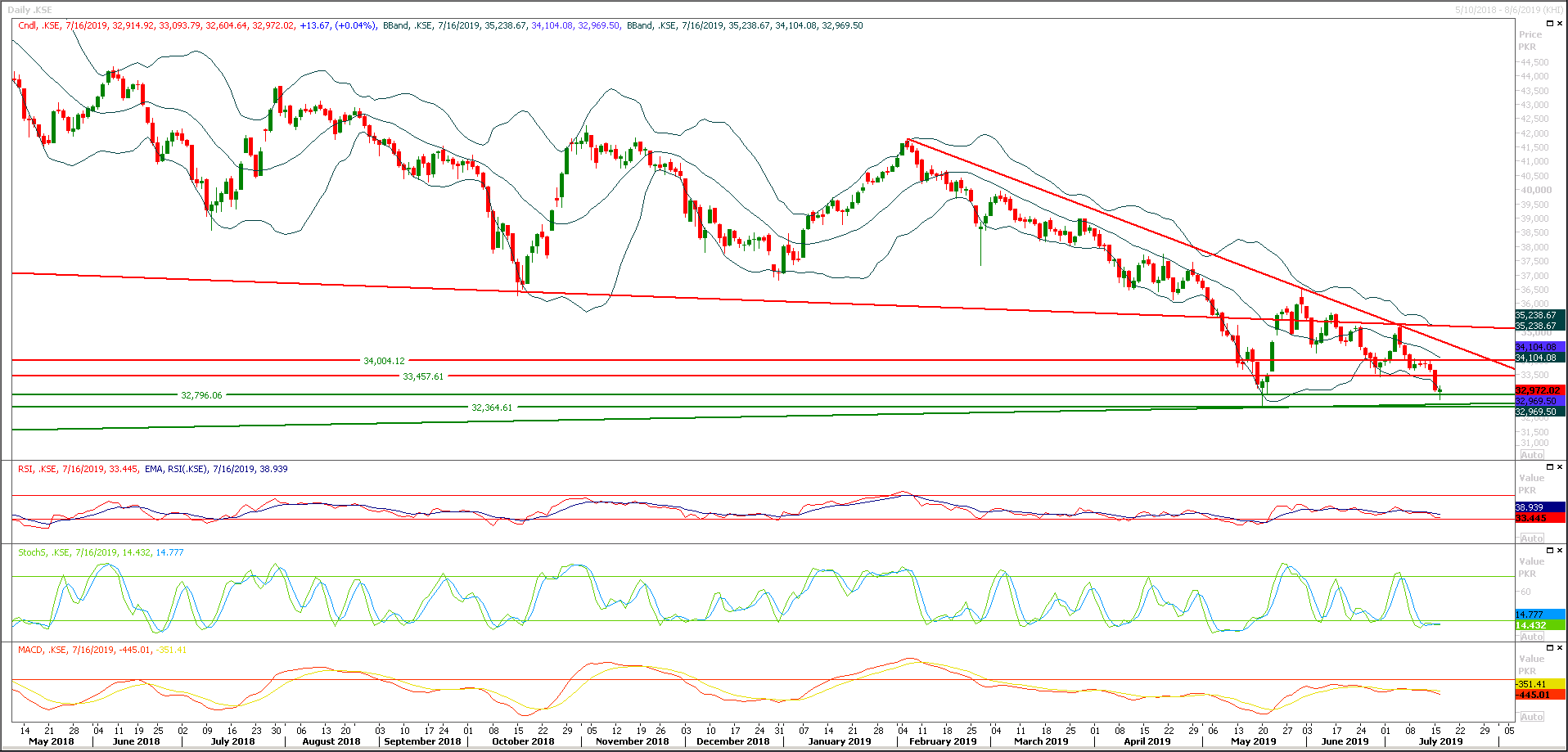

The Benchmark KSE100 Index have formatted a hammer on daily chart after getting support from 32,600 points and chances of occurrence of a morning star have become evident if index would succeed in penetration above 33,450 points till day end today. But its recommended to stay cautious because daily momentum indicators are still in bearish mode and there are still chances of formation of a cheat pattern either by last trading session's hammer or if index would succeed in formatting a morning star. It's recommended to post trailing stop loss on long positions until index succeed in closing above at least 34,000 points. During current trading session index would face resistances at 33,450 and 34,000 points while on flip side supportive regions are standing at 32,600 and 32,400 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.