Previous Session Recap

Trading volume at PSX floor dropped by 130.58 million shares or 57.19% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,467.22, posted a day high of 42,579.81 and a day low of 42,198.84 during last trading session. The session suspended at 42,301.20 with net change of -158.33 and net trading volume of 39.63 million shares. Daily trading volume of KSE100 listed companies dropped by 71.71 million shares or 64.41% on DoD basis.

Foreign Investors remained in net selling position of 2.79 million shares and net value of Foreign Inflow dropped by 2.21 million US Dollars. Categorically, Foreign Individual and Corporate Investors remained in net selling positions of 0.01 and 6.61 million shares but Overseas Pakistanis remained in net buying positions of 3.83 million shares. While on the other side Local Individuals, Companies, NBFCs, Mutual Funds and Brokers remained in net selling positions of 2.37, 2.55, 0.13, 3.34 and 2.79 million shares respectively but Local Banks and Insurance Companies remained in net buying positions of 1.81 and 10.79 million shares respectively.

Analytical Review

Asian shares steady; euro hampered by Italian political risk

Asian shares held steady on Thursday, while the euro struggled near five-month lows set a day earlier following a report that Italian populist parties trying to form a coalition could ask the European Central Bank to forgive 250 billion euros of debt. In equity markets, MSCI’s broadest index of Asia-Pacific shares outside Japan was little changed, while Japan’s Nikkei gained 0.4 percent and South Korea’s KOSPI rose 0.4 percent. Worries about political risks had jolted Italian markets and pressured the euro following reports that Italy’s anti-establishment 5-Star Movement and anti-immigrant League may ask the European Central Bank to forgive 250 billion euros of debt as the parties worked to draft a coalition program. The two populist parties have held six days of talks aimed at putting together a coalition government and ending 10 weeks of stalemate following an inconclusive election on March 4. The common currency edged up 0.l percent to $1.1814 in early Asian trade, after having set a five-month low of $1.1763 on Wednesday. Italian stocks tumbled 2.3 percent while Italy’s10-year bond yield jumped nearly 19 basis points to 2.13 percent.

Major items short at USC outlets as Ramazan starts

As Ramazan starts several outlets of the Utility Stores Cooperation are facing shortage of major eatables and other daily used items including sugar, flour and pulses, as the suppliers, including multinational companies, have halted supply due to non-payment by the government. Presently, there is no availability of sugar and different variety of pulses while flour supply is also short at outlets of Mozang Road, AG Office, Shadman, Multan Road and Gulshan-e-Ravi. The USC outlet branch manager Fayyaz Taj, situated in Mozang area of Lahore, stated that several items of different multinational companies like Colgate and Unilever are not available for sale in the branch including detergent powder, toothpaste, bath soap, dish washing soap, Lipton and Supreme teas and shampoos etc.

Incentives to IT sector paying dividends: Anusha

Federal Minister for Information Technology Anusha Rehman Khan said Pakistan has entered in the era of digitization through revolution and not through an evolution. Chairing the 39th meeting of the Board of Directors of Pakistan Software Export Board (PSEB) here Wednesday, she said that a lot more work needs to be done to keep up pace with technology including amendments in rules of business, framework and laws to take full benefits of what technology for development and growth. Anusha said that 'The Digital Pakistan' policy gives a framework and would be presented to the cabinet for its approval. Due to strenuous efforts of the incumbent government and particularly Ministry of IT and PSEB Board, Pakistan's IT sector has developed exponentially through the incentives and facilitation granted to the IT and ITeS sector and announced by the prime minister last week including cash reward on IT/ ITeS exports, extension of tax holiday on IT/ ITeS exports till 2025.

Pakistan to export rice, sugar to Nigeria

Pakistan has started implementing agreement to export 3000 metric tons rice to Nigeria while 5000 metric tons sugar will also be exported to Nigeria. According to Commerce Ministry, government has issued tenders for exporting 3000 metric tons irri-6 rice. These exports will prove wholesome for next crop and incentives will be given to farmers to cultivate next crop of rice in a better way. Pakistan has surplus rice. Government has also issued tenders for supply of 5000 metric tons sugar to Nigeria. These tenders have been issued by TCP authorities. The export of sugar to Nigeria will enable sugar mills owners to pay price of sugarcane to the cultivators forthwith besides clearing their outstanding dues.

PSEs debt, liabilities swell to Rs1.2tr

The collective debt and liabilities of Public Sector Entities have swelled to Rs1.2 trillion at the end of March this year amid government's failure to bring reforms or privatizing these PSEs. The debt and liabilities of PSEs have gone up by over 24 percent on annual basis, as it recorded at Rs964 billion in March last year. Liabilities alone have swelled to Rs200 billion in March 2018, according to the data of State Bank of Pakistan. Debt of the PSEs has increased to Rs996.4 billion at the end of March 2018 as compared to Rs765 billion a year ago, showing an increase of 30.2 percent. The debt is increasing at rapid pace as ailing PSEs could not meet its expenses due to their heavy losses. The government has failed to privatize the loss-making PSEs including Pakistan International Airlines (PIA), Pakistan Steel Mills and power sector companies in last five years.

Asian shares held steady on Thursday, while the euro struggled near five-month lows set a day earlier following a report that Italian populist parties trying to form a coalition could ask the European Central Bank to forgive 250 billion euros of debt. In equity markets, MSCI’s broadest index of Asia-Pacific shares outside Japan was little changed, while Japan’s Nikkei gained 0.4 percent and South Korea’s KOSPI rose 0.4 percent. Worries about political risks had jolted Italian markets and pressured the euro following reports that Italy’s anti-establishment 5-Star Movement and anti-immigrant League may ask the European Central Bank to forgive 250 billion euros of debt as the parties worked to draft a coalition program. The two populist parties have held six days of talks aimed at putting together a coalition government and ending 10 weeks of stalemate following an inconclusive election on March 4. The common currency edged up 0.l percent to $1.1814 in early Asian trade, after having set a five-month low of $1.1763 on Wednesday. Italian stocks tumbled 2.3 percent while Italy’s10-year bond yield jumped nearly 19 basis points to 2.13 percent.

As Ramazan starts several outlets of the Utility Stores Cooperation are facing shortage of major eatables and other daily used items including sugar, flour and pulses, as the suppliers, including multinational companies, have halted supply due to non-payment by the government. Presently, there is no availability of sugar and different variety of pulses while flour supply is also short at outlets of Mozang Road, AG Office, Shadman, Multan Road and Gulshan-e-Ravi. The USC outlet branch manager Fayyaz Taj, situated in Mozang area of Lahore, stated that several items of different multinational companies like Colgate and Unilever are not available for sale in the branch including detergent powder, toothpaste, bath soap, dish washing soap, Lipton and Supreme teas and shampoos etc.

Federal Minister for Information Technology Anusha Rehman Khan said Pakistan has entered in the era of digitization through revolution and not through an evolution. Chairing the 39th meeting of the Board of Directors of Pakistan Software Export Board (PSEB) here Wednesday, she said that a lot more work needs to be done to keep up pace with technology including amendments in rules of business, framework and laws to take full benefits of what technology for development and growth. Anusha said that 'The Digital Pakistan' policy gives a framework and would be presented to the cabinet for its approval. Due to strenuous efforts of the incumbent government and particularly Ministry of IT and PSEB Board, Pakistan's IT sector has developed exponentially through the incentives and facilitation granted to the IT and ITeS sector and announced by the prime minister last week including cash reward on IT/ ITeS exports, extension of tax holiday on IT/ ITeS exports till 2025.

Pakistan has started implementing agreement to export 3000 metric tons rice to Nigeria while 5000 metric tons sugar will also be exported to Nigeria. According to Commerce Ministry, government has issued tenders for exporting 3000 metric tons irri-6 rice. These exports will prove wholesome for next crop and incentives will be given to farmers to cultivate next crop of rice in a better way. Pakistan has surplus rice. Government has also issued tenders for supply of 5000 metric tons sugar to Nigeria. These tenders have been issued by TCP authorities. The export of sugar to Nigeria will enable sugar mills owners to pay price of sugarcane to the cultivators forthwith besides clearing their outstanding dues.

The collective debt and liabilities of Public Sector Entities have swelled to Rs1.2 trillion at the end of March this year amid government's failure to bring reforms or privatizing these PSEs. The debt and liabilities of PSEs have gone up by over 24 percent on annual basis, as it recorded at Rs964 billion in March last year. Liabilities alone have swelled to Rs200 billion in March 2018, according to the data of State Bank of Pakistan. Debt of the PSEs has increased to Rs996.4 billion at the end of March 2018 as compared to Rs765 billion a year ago, showing an increase of 30.2 percent. The debt is increasing at rapid pace as ailing PSEs could not meet its expenses due to their heavy losses. The government has failed to privatize the loss-making PSEs including Pakistan International Airlines (PIA), Pakistan Steel Mills and power sector companies in last five years.

Market is expected to remain volatile therefore it'ss recommended to stay cautious while trading today.

Technical Analysis

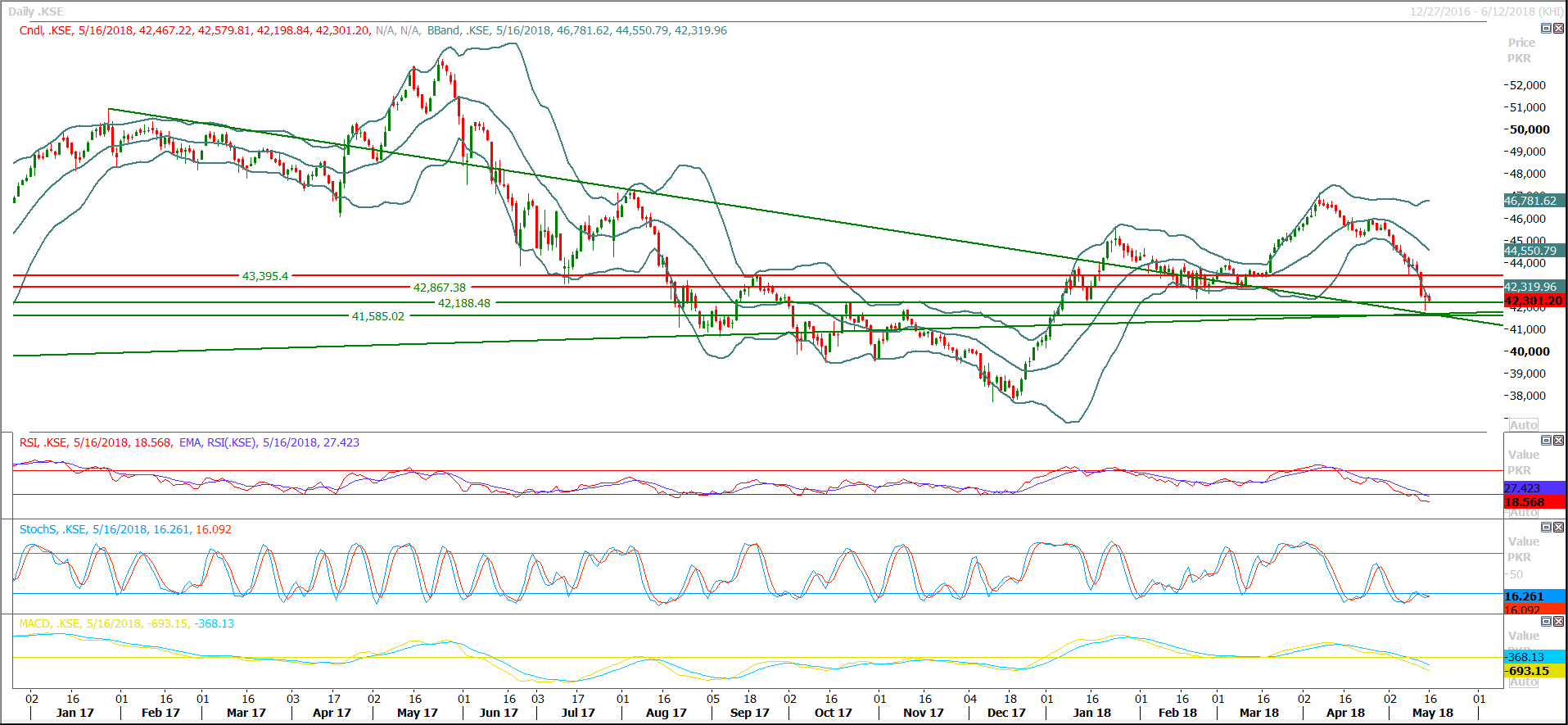

The Benchmark KSE100 Index had bounced back during last trading session after getting support from a horizontal support and a descending trend line but expected impact of an inverted hammer on daily chart has been vanished. It’s expected that index would start with a positive momentum and a spike is expected on intraday basis but daily and weekly momentum indicators are still in bearish direction and those would try to add pressure on index at day end. Index would face resistances at 42,860 and 43,390 points while supportive regions are standing at 42,180 and 41,580 points. Its recommended to sell on strength with strict stop loss during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.