Previous Session Recap

Trading volume at PSX floor increased by 6.34 million shares or 7.01, DoD basis, whereas, the benchmark KSE100 Index opened at 40705.44, posted a day high of 40886.03 and a day low of 40686.62 during the last trading session. The session suspended at 40813.31 with a net change of 150.52 and net trading volume of 51.54 million shares. Daily trading volume of KSE100 listed companies increased by 3.67 million shares or 7.67%, DoD basis.

Foreign Investors remained in a net selling position of 3.16 million shares and net value of Foreign Inflow dropped by 1.53 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling positions of 2.02, 0.91 and 0.23 million shares respectively. While on the other side Local Individuals, Companies, Banks and Insurance Companies remained in net buying positions of 3.18, 3.96, 0.65 and 1.33 million shares respectively but Mutual Funds and Brokers remained in net selling positions of 2.28 and 3.96 million shares.

Analytical Review

Asian shares rose on Friday as strong U.S. earnings and a step forward in the U.S. Congress on tax reform brightened the mood, even though investors noted that many more hurdles must be passed to reach a final deal on tax cuts. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.1 percent while Japan's Nikkei .N225 gained 0.9 percent, extending its recovery from a near three-week intraday low hit the previous day. Wall Street’s main indexes rose sharply on Thursday, boosted by strong gains in Wal-Mart (WMT.N) and Cisco (CSCO.O) following their earnings. The S&P 500 .SPX advanced 0.82 percent to turn positive for the week, a day after hitting a three-week low, while the Nasdaq Composite .IXIC added 1.3 percent to a closing record high of 6,793.29.

Pakistan can capture India’s $260 million rice business with the European Union following the EU’s zero tolerance on Tricyclazole chemical found in Indian grains. Rice Exporters Association of Pakistan Chairman Chaudhry Samee Ullah said that Pakistan can target India’s basmati rice share in the EU market, following the stringent policies placed by the European Union on the presence of hazardous pesticides in the commodity. From January 1, 2018, all countries that export basmati rice to the EU must bring down the maximum residue limit (MRL) level for Tricyclazole to 0.01 mg per kg. Up till now, the EU was accepting 1mg per kg from different countries, including India .

The government of Balochistan has refused to grant blanket tax exemption to Chinese companies working in Pakistan under China-Pakistan Economic Corridor (CPEC), negating the concept of standardized tax policy for Chinese investors. Sources told Business Recorder here on Thursday that the refusal has been made by Balochistan government during the follow-up meeting held at the Ministry of Planning to review the progress of CPEC projects under the chairmanship of the secretary ministry of planning and development. The meeting also decided that no attachment were of any Chinese company’s bank accounts, engaged in CPEC projects, would be carried out by the Federal Board of Revenue (FBR) unless approval has been taken at senior level in the board (FBR).

The country’s liquid foreign exchange reserves maintained downward trend during last week due to external debt servicing. According to the State Bank of Pakistan (SBP), Pakistan’s total liquid foreign exchange reserves posted a decline of $217 million during last week. The total liquid foreign exchange reserves held by the country stood at $19.695 billion as on November 10, 2017 compared to $19.912 billion on November 3, 2017. During the week under review, the SBP and banks'' reserves witnessed a downward trend, however the major fall was registered in the SBP''s reserves. During the week ending November 10, the SBP''s reserves decreased by some $184 million to $13.678 billion down from $13.861 billion due to external debt and other official payments.

Today ATRL, ENGRO and NCL may lead the market in the positive direction.

Technical Analysis

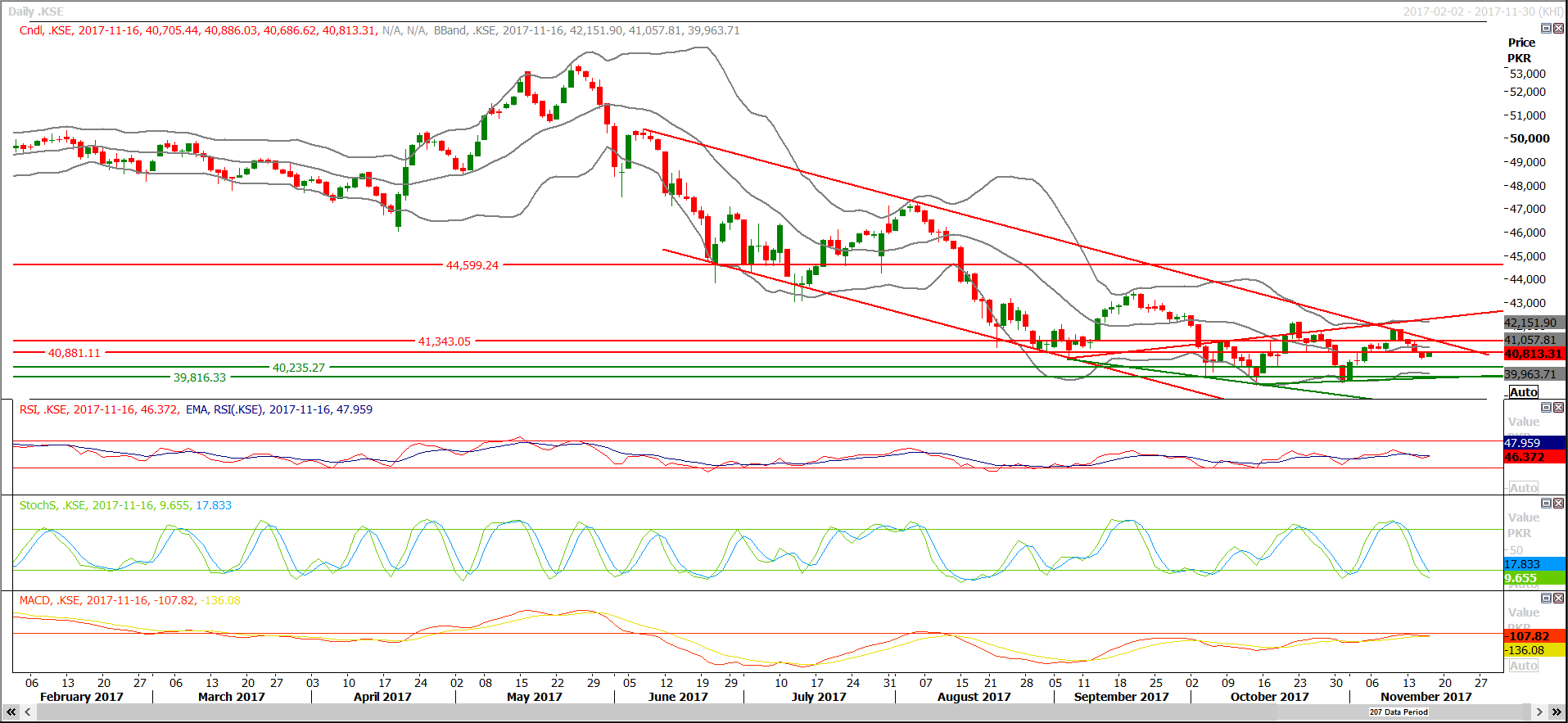

The Benchmark KSE100 Index is about to complete 61.8% correction of its last bullish rally at 40400 where it may find support but major supportive regions are standing at 40200 and 39800 if index penetrates its correction in bearish direction. During the last trading session index have tried to bounce back for a bullish rally but 40860 have capped its momentum and index closed at 40813. For the current trading session buying on dips with strict stop loss could be initiated as reversal started from its correction levels or supportive regions might try to push index towards 40860 which was supportive region while index was moving downward and now it may try to react as a resistance. Crossover of a supportive trend line and horizontal support is taking place at 39800 which might be a strong support for index in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.