Previous Session Recap

Trading volume at PSX floor dropped by 29.03 million shares or 18.87%, DoD basis, whereas, the benchmark KSE100 Index opened at 39978.40 with a positive gap of 131.62, posted a day high of 40813.53 and a day low of 39978.40 during the last trading session. The session suspended at 40791.39 with a net change of 944.61 and net trading volume of 124.8 million shares. Daily trading volume of KSE100 listed companies dropped by 23.67 million shares or 29.98%, DoD basis.

Foreign Investors remained in a net buying position of 1.05 million shares and net value of Foreign Inflow increased by 3.03 million US Dollars. Categorically, Foreign Corporate investors remained in a net buying of 1.85 million shares but Overseas Pakistanis remained in a net selling position of 0.78 million shares.On the other side Local Individuals, Banks and Brokers remained in net buying positions of 0.09, 0.81 and 0.12 million shares but Local Companies, NBFCs, Mutual Funds and Insurance Companies remained in selling position of 0.95, 0.65, 0.12 and 1.02 million shares respectively.

Analytical Review

Oil prices held firm on Tuesday after Iraqi forces seized the oil-rich city of Kirkuk from largely autonomous Kurdish fighters while Asian shares look set to extend their bull run on optimism about upcoming earnings. Short-term U.S. bond yields and interest rates jumped after a report U.S. President Donald Trump favoured Stanford economist John Taylor to head the Federal Reserve. Japan's Nikkei .N225 gained 0.6 percent, extending its 10-day winning streak until Monday while MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.04 percent having gained 10 of the past 12 sessions.

Oil prices held firm on Tuesday after Iraqi forces seized the oil-rich city of Kirkuk from largely autonomous Kurdish fighters while Asian shares look set to extend their bull run on optimism about upcoming earnings. Short-term U.S. bond yields and interest rates jumped after a report U.S. President Donald Trump favored Stanford economist John Taylor to head the Federal Reserve. Japan's Nikkei .N225 gained 0.6 percent, extending its 10-day winning streak until Monday while MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.04 percent having gained 10 of the past 12 sessions.

Five suspected militants were killed in a US drone strike at a remote location along the Pak-Afghan border near Kurram Agency on Monday. Eyewitnesses said the drone strike was followed by heavy bombardment by jet fighters on suspected hideouts of militants in the border region. While it is yet to establish whether the area falls within the territorial jurisdiction of Pakistan or Afghanistan, locals claimed that the missile fired from the drone targeted a suspected militant hideout in Karar Tangi near Ghuzgarhi — 15 kilometers southwest of Parachinar, the headquarters of Kurram Agency.”.

The Managing Director of Sui Northern Gas Pipelines Limited (SNGPL) claimed Monday that the company’s overall losses, including technical losses and theft, are around 8 percent. While briefing a meeting of the Senate Standing Committee on Energy, chaired by Senator Nisar Muhammad, SNGPL MD Amjad Latif maintained that there are 4 percent technical losses while 4 percent losses are on account of theft. However, he evaded questions as to how much it would be in terms of amount if calculated. He sought time from the committee till next meeting to provide details as to how these losses would be in real terms. The GM SNGPL Peshawar informed the committee that work on supply of gas to Anar Cheena would be initiated in a few days, as required funds for the project, Rs 490 million, have been released by the Khyber Pakhtunkhwa government. He said that survey will be completed in a few days and supply of gas to Anar Cheena, Mirak Banda and Ketch, district Hangu, will be provided soon.

Leading battery manufacturers are hiding sensitive information from consumers, as some of them are even printing self-generated numbers to show fake capacity and charging higher prices. Sources said that an inquiry has also been carried out by the Competition Commission of Pakistan (CCP) against battery manufacturers for misleading consumers and engaging in deceptive marketing practices. The consumers buy dry and acid-led batteries for their vehicles and running home-based UPS systems and the choice of a battery is made on the basis of individual need and suitability. Therefore, the battery capacity is the crucial information for purchasing these products. Market sources said that excessive load-shedding in various parts of the country in summer trigger a higher demand for UPS batteries thus inciting manufactures to earn undue profits. The rising number of vehicles being sold in Pakistan has also increased the demand for batteries. An increased sale and higher prices against lower capacity incentivises manufactures to make undue profits at the cost of consumer rights.

Today ATRL, ENGRO,PPL, PSO and TRG may lead the market in the positive direction.

Technical Analysis

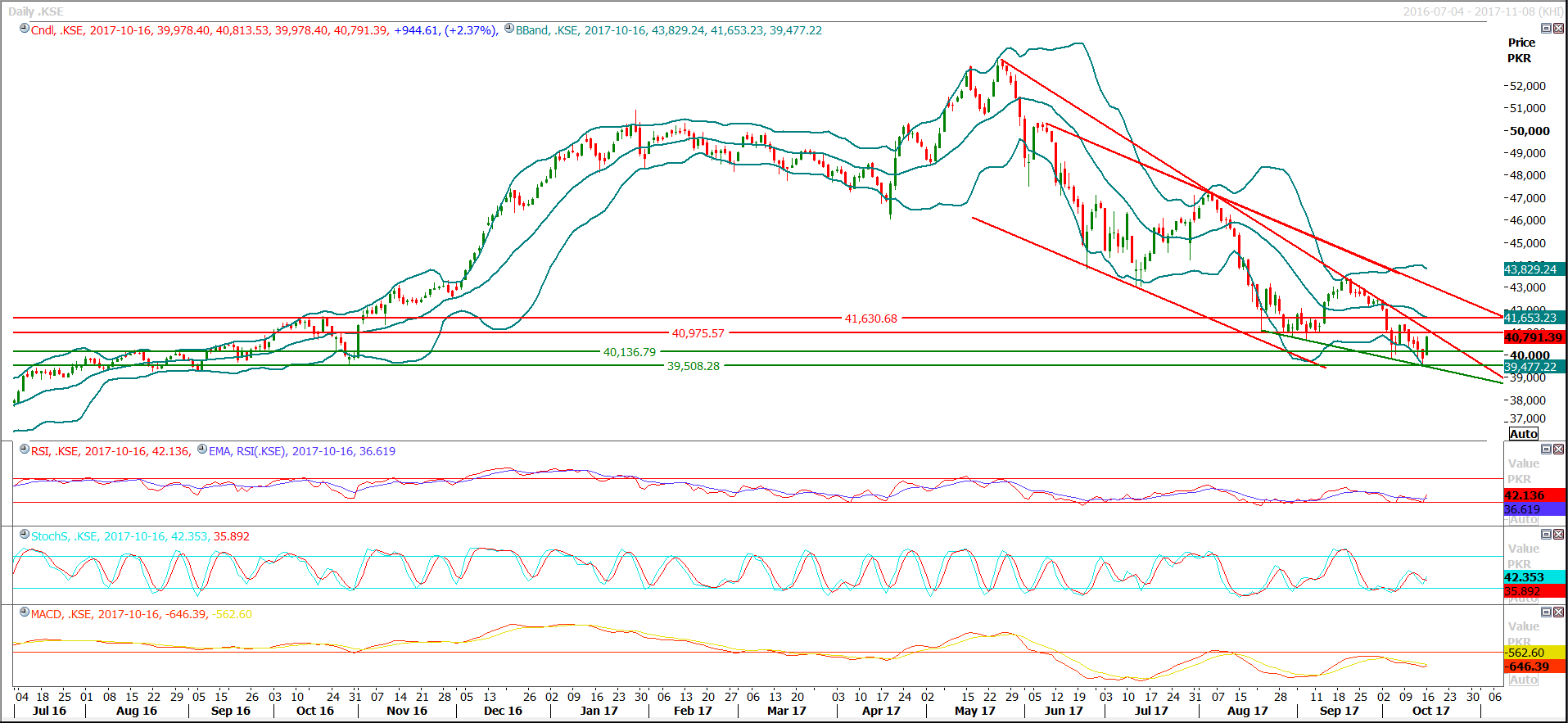

The Benchmark KSE100 Index has generated a morning shooting star on the daily chart after getting support from a crossover of two supportive lines and right now Stochastic and MAORSI have generated a bullish crossover on the daily chart which might try to push the index in the bullish direction but Index is capped by a trend line along with a horizontal resistance at 40975. For a straight bullish rally index need to be open above 40975 with a gap and then it can continue its current rally towards 41700 but as of right now it seems difficult for the current trading session as hourly stochastic has indicated expiry of current rally on intraday basis, therefore a cautious trading strategy is recommended for the current trading session as long as index gives a clear breakout of 40975.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.