Previous Session Recap

Trading volume at PSX floor increased by 16.21 million shares or 9.80% on DoD basis, whereas the Benchmark KSE100 index opened at 36,784.07, posted a day high of 37336.40 and day low of 36,508.30 points while the session suspended at 36,663.38 with net change of -104.19 points and net trading volume of 92.12 million shares. Daily trading volume of KSE100 listed companies dropped by 13.40 million shares or 12.70% on DoD basis.

Foreign Investors remained in net selling position of 24.11 million shares and net value of Foreign Inflow dropped by 4.41 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 22.11 and 2.00 million shares. While on the other side Local Individuals, Banks, Mutual Fund, Brokers and Insurance Companies remained in net buying positions of 15.28, 1.17, 5.98, 0.42 and 5.46 million shares but Local Companies and NBFCs remained in net selling positions of 2.57 and 1.69 million shares respectively.

Analytical Review

Asia shares ride Wall Street bounce, China muted

Asian equities got some welcome relief on Wednesday after upbeat U.S. earnings reports drove a rebound on Wall Street and helped restore a little faith in emerging market stocks and currencies. Japan’s Nikkei galloped out of the gates with a rise of 1.7 percent, but still has a long way to go to recoup the past week’s losses. MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.7 percent and South Korea 1.2 percent. Chinese blue chips, however, lagged with a gain of only 0.2 percent. U.S. stocks had jumped more than 2 percent on Tuesday in reaction to upbeat earnings reports from major companies including UnitedHealth and Goldman Sachs.

Five export sectors to get priority in gas supply during winter

TThe Economic Coordination Committee (ECC) of the Cabinet on Tuesday amended the natural gas load management policy for winter shortages to upgrade five zero-rated export sectors on the priority list after domestic and commercial consumers. Under the decision, zero-rated export sectors – textile including jute, carpets, leather, sports and surgical goods – would be treated on a par with the power sector in gas supplies instead of the third position under load management policy of 2013. They would be given a blend of domestic gas and imported LNG on a 50:50 basis at an weighted average cost of about Rs870 ($6.5) per unit.

CDWP meets today to consider 10 projects

The revised PC-I of the Peshawar Metro, Peshawar Sustainable Bus Rapid Transit Corridor Project (BRT), with the increased cost of 38 percent from Rs49.3 billion to Rs67.9 billion is once again coming to the CDWP for approval today (Wednesday). The first CDWP meeting after the coming of PTI into power will discuss 10 projects including Peshawar Sustainable Bus Rapid Transit Corridor Project (BRT) and Karachi Metro, Construction of BRT Red Line Project in Karachi. In information technology, the revised PC-I of Punjab Police Integrated Command, Control, and Communication (PPIC3) Center Lahore with the cost Rs 17.5 billion will be coming to CDWP for approval. In science and technology, the certification incentive Program for SMEs under PQ initiative 2025 worth Rs 745.81 million is coming to CDWP.

Punjab budget: Rs112.5b proposed for agri, irrigation sectors

The Punjab government has proposed allocation of Rs93 billion for agriculture sector as against the last year’s outlay of Rs81.3 billion. The government has planned to spend Rs19.50 billion on irrigation sector for fiscal year 2018-19. Rs six billion will be spent on construction of Dadhocha Dam to provide clean water to Rawalpindi and Islamabad. The government said it will start rehabilitation work on Panjnad Barrage and construction work on Jalalpur Irrigation Canal System in the year 2018-019. Provincial Water Policy and Punjab Ground Water Act will also be completed in the year.

Oil import bill swells 19pc

The country’s oil import bill surged by 19.44 per cent year-on-year to $3.78 billion during the first quarter of this fiscal year, according to data released by the Pakistan Bureau of Statistics (PBS).

Asian equities got some welcome relief on Wednesday after upbeat U.S. earnings reports drove a rebound on Wall Street and helped restore a little faith in emerging market stocks and currencies. Japan’s Nikkei galloped out of the gates with a rise of 1.7 percent, but still has a long way to go to recoup the past week’s losses. MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.7 percent and South Korea 1.2 percent. Chinese blue chips, however, lagged with a gain of only 0.2 percent. U.S. stocks had jumped more than 2 percent on Tuesday in reaction to upbeat earnings reports from major companies including UnitedHealth and Goldman Sachs.

TThe Economic Coordination Committee (ECC) of the Cabinet on Tuesday amended the natural gas load management policy for winter shortages to upgrade five zero-rated export sectors on the priority list after domestic and commercial consumers. Under the decision, zero-rated export sectors – textile including jute, carpets, leather, sports and surgical goods – would be treated on a par with the power sector in gas supplies instead of the third position under load management policy of 2013. They would be given a blend of domestic gas and imported LNG on a 50:50 basis at an weighted average cost of about Rs870 ($6.5) per unit.

The revised PC-I of the Peshawar Metro, Peshawar Sustainable Bus Rapid Transit Corridor Project (BRT), with the increased cost of 38 percent from Rs49.3 billion to Rs67.9 billion is once again coming to the CDWP for approval today (Wednesday). The first CDWP meeting after the coming of PTI into power will discuss 10 projects including Peshawar Sustainable Bus Rapid Transit Corridor Project (BRT) and Karachi Metro, Construction of BRT Red Line Project in Karachi. In information technology, the revised PC-I of Punjab Police Integrated Command, Control, and Communication (PPIC3) Center Lahore with the cost Rs 17.5 billion will be coming to CDWP for approval. In science and technology, the certification incentive Program for SMEs under PQ initiative 2025 worth Rs 745.81 million is coming to CDWP.

The Punjab government has proposed allocation of Rs93 billion for agriculture sector as against the last year’s outlay of Rs81.3 billion. The government has planned to spend Rs19.50 billion on irrigation sector for fiscal year 2018-19. Rs six billion will be spent on construction of Dadhocha Dam to provide clean water to Rawalpindi and Islamabad. The government said it will start rehabilitation work on Panjnad Barrage and construction work on Jalalpur Irrigation Canal System in the year 2018-019. Provincial Water Policy and Punjab Ground Water Act will also be completed in the year.

The country’s oil import bill surged by 19.44 per cent year-on-year to $3.78 billion during the first quarter of this fiscal year, according to data released by the Pakistan Bureau of Statistics (PBS).

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

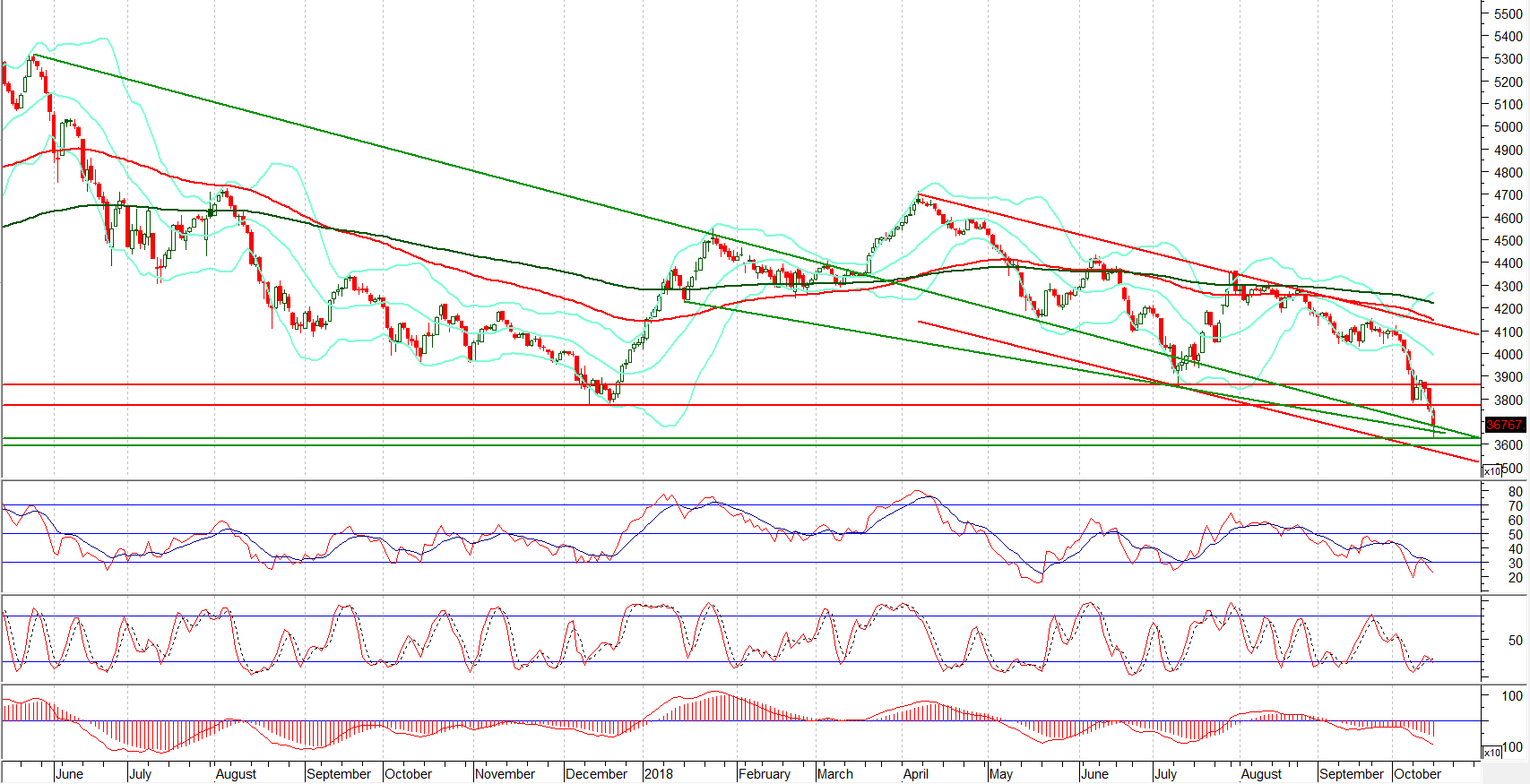

The Benchmark KSE100 index have tried a false breakout of its major supportive region of 36,500 points but did not closed below that region and an intraday pullback was witnessed before session end. As of now it’s expected that index would continue its pullback during current trading session because it’s bouncing back after testing its second supportive region of 36,300 points and it would try to create a positive sentiment on daily chart which may lead index towards 37,700 and then 38,300 points in coming days. If index would not succeed in closing above 37,700 points then a new bearish rally toward 34,500 points would be witnessed in coming days. It’s recommended to stay cautious until index close above 37,700 points which would now react as a major resistance. For current trading session it’s recommended to initiate buying with strict stop loss.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.