Previous Session Recap

Trading volume at PSX floor dropped by 5.04 million shares or 3.22% on DoD basis, whereas the benchmark KSE100 index opened at 34,186.27, posted a day high of 34,484.06 and a day low of 34,083.53 points during last trading session while session suspended at 34,281.09 points with net change of 197.56 points and net trading volume of 94.32 million shares. Daily trading volume of KSE100 listed companies dropped by 5.49 million shares or 5.50% on DoD basis.

Foreign Investors remained in net selling positions of 5.66 million shares and net value of Foreign Inflow dropped by 1.83 million US Dollars. Categorically, Foreign Individual and Overseas Pakistanis remained in net buying positions of 0.17 and 11.57 million shares but Foreign Corporate investors remained in net selling positions of 17.40 million shares. While on the other side Local Individuals, Banks, NBFCs and Brokers remained in net buying positions of 5.59, 1.47, 0.02 and 2.01 million shares but Local Companies, Mutual Fund and Increased Companies remained in net selling positions of 0.48, 1.68 and 0.88 million shares respectively.

Analytical Review

Asian shares pause after five-day rally, Brexit in focus

Asian stocks barely moved on Thursday as soft U.S. retail sales data raised fears about the health of the world’s largest economy, sucking the steam out of a five-session rally, while hopes of a Brexit deal kept sterling volatile. South Korean, Australian and New Zealand indexes were all in negative territory. Chinese shares were mostly flat while Japan's Nikkei .N225 ticked up and U.S. stock futures ESc1 were barely changed. That left MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS slightly higher with gains largely led by Hong Kong's Hang Seng index .HSI. The S&P 500 .SPX shed 0.20% on Wednesday after data showed U.S. retail sales contracted in September for the first time in seven months, in a potential sign that manufacturing-led weakness could be spreading to the broader economy. “It looks like the trade war has claimed yet another victim, in addition to diminished business confidence and reduced investment spending, as consumers are starting to chicken out,” said Chris Rupkey, chief financial economist at MUFG Union Bank.

‘US-China tensions fuel downturn risks for emerging markets’

Trade tensions between the United States and China – the world’s two largest economies – are a significant source of risk for the global economy, with “real spillover effects” for emerging markets, top IMF officials said on Wednesday. Tobias Adrian, director of the monetary and capital markets department of the International Monetary Fund, told reporters the tit-for-tat trade war between Washington and Beijing had a significant impact on financial markets over the past two years. The fight could set up a “domino effect” for smaller economies, according to a second IMF official. “We urge policymakers around the world to continue to work together in order to resolve those trade tensions as that is significant source of uncertainty and a significant source of creation of downturn risks,” he said. “There are real spillover effects for emerging markets.”

High debt levels to persist until FY24, says IMF

The International Monetary Fund (IMF) on Wednesday projected Pakistan’s primary deficit to turn positive one per cent of GDP in the FY21 from a negative 0.5pc in FY20 but said the country’s debt levels are likely to remain elevated at above 65.4pc until FY24 despite continuous decline. In one of its flagship publications released by IMF Director Fiscal Affairs Department Vitor Gaspar on the eve of annual meetings of the World Bank and the IMF, the fund noted that the government expenditure would generally remain stubborn above 22pc. The Fiscal Monitor 2019 put the budget deficit at 8.8pc of the GDP in 2019 with projection for FY20 at 7.4pc as IMF-supported programme comes into force. The fiscal deficit is likely to go down to 5.4pc of GDP in FY21, followed by 3.9pc in FY22 and 2.8pc in FY23. It will then stay at 2.6pc of GDP in FY24, adds the report.

Pakistan hopes to leap up list of ease-of-doing business

Pakistan is set to take the next stage of development with hopes to leap up the list of ease-of-doing business by 20 to 30 notches, Ambassador to the US Asad Majeed Khan has said. In an interview with David Bloom of The Forbes magazine, he said Pakistan is pushing its IT sector to the US companies and investors, hoping international deals will translate to a bottom-line boost for the country’s struggling economy. The interview under headline “A more peaceful Pakistan puts on an IT charm offensive in Silicon Valley” says that the most visible part of this fact came earlier this month with a daylong Silicon Valley conference in San Jose, California, backed by the Pakistani government.

Pakistan, Egypt agree to promote trade

Pakistan and Egypt on Wednesday agreed to work out measures for capturing untapped economic potential and promoting bilateral trade. The decision took place at the first meeting of the Pakistan-Egypt Joint Working Group (JWG) on Trade held in the capital. The JWG was established at the sidelines of Pakistan-Egypt trade conference held in Islamabad on Wednesday. On the occasion, the Ministry of Commerce and Egyptian Commercial Service signed a Memorandum of Understanding (MoU) for the establishment of the JWG on trade. The Pakistan delegation was led by Secretary Commerce Ahmed Sukhera while Egypt was represented by First Undersecretary of Egyptian Commercial Service Ahmed Anter. The two sides emphasised on the relative importance of Pakistani-Egyptian trade and economic relations as well as enhancing the current trade volume.

Asian stocks barely moved on Thursday as soft U.S. retail sales data raised fears about the health of the world’s largest economy, sucking the steam out of a five-session rally, while hopes of a Brexit deal kept sterling volatile. South Korean, Australian and New Zealand indexes were all in negative territory. Chinese shares were mostly flat while Japan's Nikkei .N225 ticked up and U.S. stock futures ESc1 were barely changed. That left MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS slightly higher with gains largely led by Hong Kong's Hang Seng index .HSI. The S&P 500 .SPX shed 0.20% on Wednesday after data showed U.S. retail sales contracted in September for the first time in seven months, in a potential sign that manufacturing-led weakness could be spreading to the broader economy. “It looks like the trade war has claimed yet another victim, in addition to diminished business confidence and reduced investment spending, as consumers are starting to chicken out,” said Chris Rupkey, chief financial economist at MUFG Union Bank.

Trade tensions between the United States and China – the world’s two largest economies – are a significant source of risk for the global economy, with “real spillover effects” for emerging markets, top IMF officials said on Wednesday. Tobias Adrian, director of the monetary and capital markets department of the International Monetary Fund, told reporters the tit-for-tat trade war between Washington and Beijing had a significant impact on financial markets over the past two years. The fight could set up a “domino effect” for smaller economies, according to a second IMF official. “We urge policymakers around the world to continue to work together in order to resolve those trade tensions as that is significant source of uncertainty and a significant source of creation of downturn risks,” he said. “There are real spillover effects for emerging markets.”

The International Monetary Fund (IMF) on Wednesday projected Pakistan’s primary deficit to turn positive one per cent of GDP in the FY21 from a negative 0.5pc in FY20 but said the country’s debt levels are likely to remain elevated at above 65.4pc until FY24 despite continuous decline. In one of its flagship publications released by IMF Director Fiscal Affairs Department Vitor Gaspar on the eve of annual meetings of the World Bank and the IMF, the fund noted that the government expenditure would generally remain stubborn above 22pc. The Fiscal Monitor 2019 put the budget deficit at 8.8pc of the GDP in 2019 with projection for FY20 at 7.4pc as IMF-supported programme comes into force. The fiscal deficit is likely to go down to 5.4pc of GDP in FY21, followed by 3.9pc in FY22 and 2.8pc in FY23. It will then stay at 2.6pc of GDP in FY24, adds the report.

Pakistan is set to take the next stage of development with hopes to leap up the list of ease-of-doing business by 20 to 30 notches, Ambassador to the US Asad Majeed Khan has said. In an interview with David Bloom of The Forbes magazine, he said Pakistan is pushing its IT sector to the US companies and investors, hoping international deals will translate to a bottom-line boost for the country’s struggling economy. The interview under headline “A more peaceful Pakistan puts on an IT charm offensive in Silicon Valley” says that the most visible part of this fact came earlier this month with a daylong Silicon Valley conference in San Jose, California, backed by the Pakistani government.

Pakistan and Egypt on Wednesday agreed to work out measures for capturing untapped economic potential and promoting bilateral trade. The decision took place at the first meeting of the Pakistan-Egypt Joint Working Group (JWG) on Trade held in the capital. The JWG was established at the sidelines of Pakistan-Egypt trade conference held in Islamabad on Wednesday. On the occasion, the Ministry of Commerce and Egyptian Commercial Service signed a Memorandum of Understanding (MoU) for the establishment of the JWG on trade. The Pakistan delegation was led by Secretary Commerce Ahmed Sukhera while Egypt was represented by First Undersecretary of Egyptian Commercial Service Ahmed Anter. The two sides emphasised on the relative importance of Pakistani-Egyptian trade and economic relations as well as enhancing the current trade volume.

Market is expected to remain volatile during current trading session.

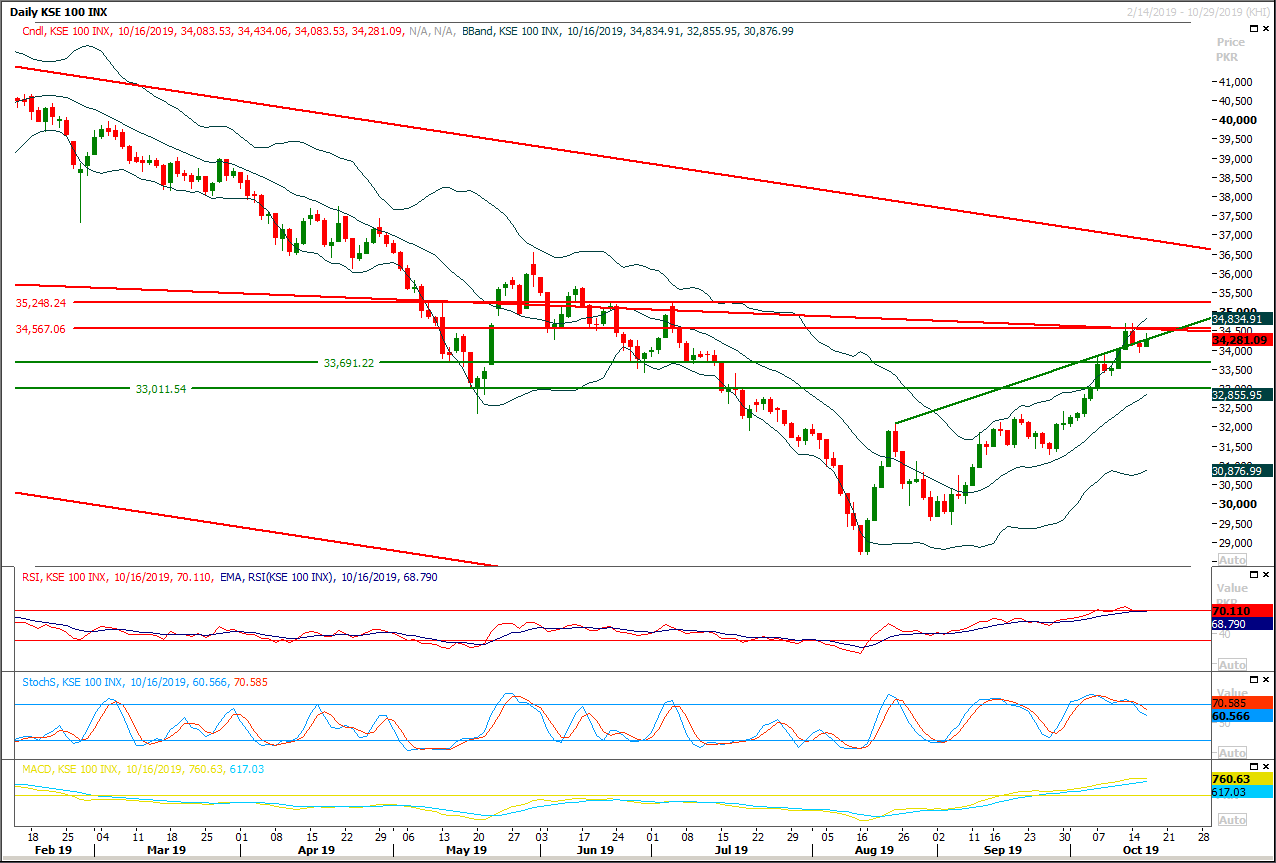

Technical Analysis

The Benchmark KSE100 index is being capped by a strong resistant trend line on daily and weekly chart while daily momentum indicators have changed their direction to bearish side and if index would not succeed in closing above said trend line till this weekend then pressure would start increasing from bears and index would face rejection from 34,500 points. As of now it's expected that index would face strong resistance at 34,560 and 34,800 points while supportive regions are standing at 34,000 and 33,760 points. It's recommended to stay on selling side until index succeeds in closing above its previous top of 34,800 points because if index would not succeed in penetration above 34,560 points then it would try to take a serious dip to extend its bearish correction on intraday basis.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.