Previous Session Recap

Trading volume at PSX floor increased by 46.82 million shares or 50.37% on DoD basis, whereas, the benchmark KSE100 Index opened at 38223.55, posted a day high of 38924.25 and a day low of 38192.70 during last trading session. The session suspended at 38645.90 with net change of 422.35 and net trading volume of 94.86 million shares. Daily trading volume of KSE100 listed companies increased by 40.70 million shares or 75.15% on DoD basis.

Foriegn Investors remained in net selling position of 7.78 million shares but net value of Foreign Inflow increased by 0.12 million US Dollars. Categorically, Foriegn Individual, Corporate and Overseas Pakistani Investors remained in net selling positions of 0.24, 2.18 and 5.37 million shares respectively. While on the other side Local Individuals remained in net selling position of 6.25 million shares but Local Companies, Banks, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 1.11, 1.68, 4.29, 5.49 and 1.29 million shares respectively.

Analytical Review

Asian shares inched up on Monday, tracking Wall Street, which hit record highs on expectations U.S. lawmakers will pass a long-awaited tax bill, while the British pound hovered near 3-week lows amid Brexit talks. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS gained 0.1 percent, after rising 0.8 percent last week. Meanwhile, the launch of bitcoin futures on the CME exchange on Monday has supported expectations the cryptocurrency’s red-hot rally in the cash market could continue. Australian shares were up 0.6 percent, edging closer to a level not seen since early 2008. Japan's Nikkei .N225 rose 1 percent to 22,795, not far from a 25-year peak of 23,382 set last month.

The top executive of a public sector firm — Pakistan LNG Terminal Limited (PLTL) — has been sacked for imposing penalties on a second terminal, which has delayed the processing of imported LNG since June this year. A senior government official confirmed that Azam Soofi, managing director of PLTL, was sacked on Dec 15 by the company’s board of directors. He is said to have posted a second round of $300,000 per day penalties on Pakistan GasPort Limited (PGPL) for the continuous delay in commissioning of its LNG terminal beyond even a revised deadline. The official said Mr Soofi had been replaced on a temporary basis by Adnan Gilani, the chief operating officer of another government entity, Pakistan LNG Limited. PLTL — a company under the petroleum division — had earlier imposed a $30 million penalty on PGPL when its terminal did not come online in June, as originally committed.

The Securities and Exchange Commission of Pakistan (SECP) has failed to respond to queries forwarded to it by the Senate Standing Committee on Finance over the alleged role of its former chairman, Zafar Hijazi, in the Multan metro bus money laundering case. The Senate committee forwarded a letter to the SECP on Oct 27, seeking a detailed reply from it by Dec 15 as to why the commission concealed certain facts regarding alleged corruption and money laundering in the Multan metro bus case. However, despite the passage of more than 40 working days the SECP has failed to submit a detailed reply of the queries to the Senate committee.

The private sector seems to have increased its activities despite persistent political uncertainty in recent months, latest data released by the State Bank of Pakistan (SBP) shows. The trend is reflected by the fact that the private sector doubled its credit off-take in the first five months of the current fiscal year. The private sector borrowed Rs112 billion between July 1 and Dec 1, which is 100 per cent higher than a year ago when its borrowing amounted to Rs54bn. Higher borrowing by the private sector reflects increased economic activities. In its last monetary policy announced in November, the SBP expressed confidence that the economy would achieve a 6pc growth rate in 2017-18.

The World Bank has approved $300 million loan to modernise agriculture in Punjab, create better prospects for farmers and ensure better quality and safer food at lower prices to consumers. The World Bank-supported ‘Strengthening Markets for Agriculture and Rural Transformation’ (Smart) project will support the much-needed reforms for agriculture and livestock productivity, improve agriculture’s resilience to climate change, and foster agribusiness in Punjab over the next five years. It will also reduce inequality and expand opportunities for women and youth. The project, approved on Friday, is expected to shift Rs55 billion a year towards ‘Smart’ input subsidies for small farmers, agricultural research, farmers’ training, support for high-value and climate-smart agriculture.

DGKC, ENGRO, NML and PSO may lead the market in positive direction

Technical Analysis

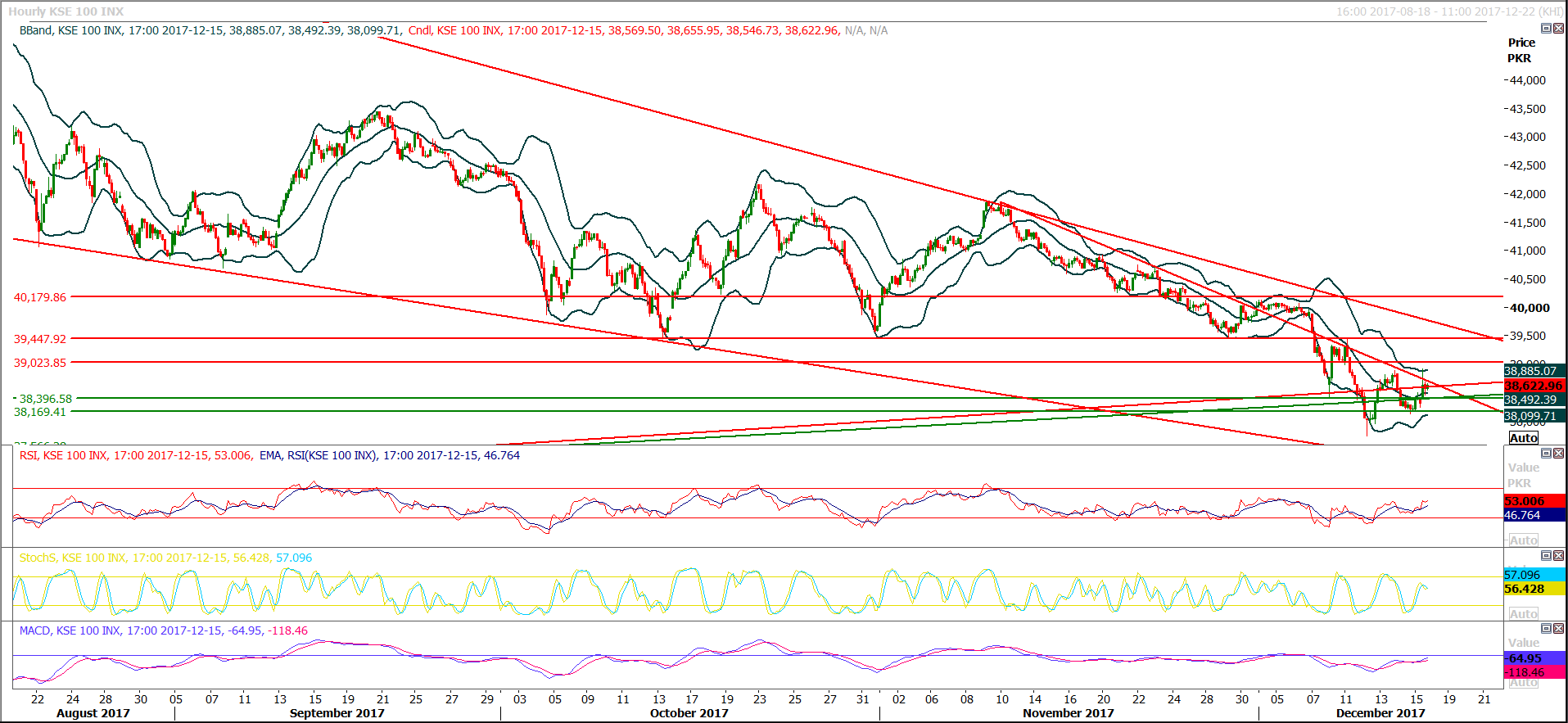

The Benchmark KSE100 Index have bounced back after posting its low at 61.8% correction of its last bullish rally and for current trading session its expected that index would open above 38680 which would lead index towards 38900 and then 39023 where it would face a resistance. If index would become able to close above 39023 and 39300 then next tragets would be 40150 in coming days. Closing above 40150 would change short term trend of index in bullish direction. While supportive regions are standing at 38360 and 38100 points which would try to resist against any bearish rally. For bullish momentum index needs to close above 38900 during current trading session otherwise this rally would start expiring.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.