Previous Session Recap

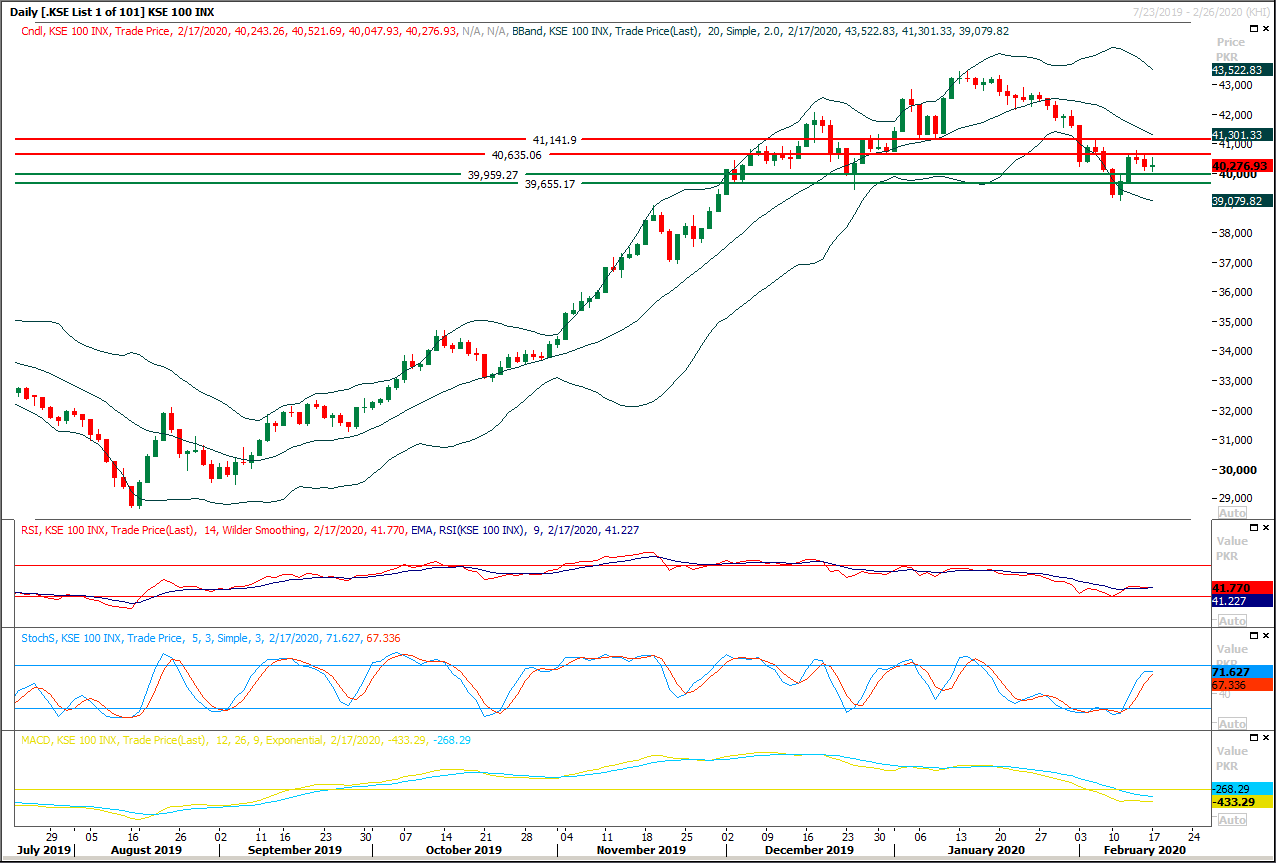

Trading volume at PSX floor dropped by 17.63 million shares or 14.99% on DoD basis, whereas the benchmark KSE100 index opened at 40,243.26, posted a day high of 40,521.69 and a day low of 40,047.93 points during last trading session while session suspended at 40,276.93 points with net change of 33.67 points and net trading volume of 77.58 million shares. Daily trading volume of KSE100 listed companies also dropped by 8.23 million shares or 9.59% on DoD basis.

Foreign Investors remained in net selling positions of 1.32 million shares and value of Foreign Inflow dropped by 1.32 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net long positions of 0.0025 and 0.51 million shares and Foreign Corporate Investors remained in net selling positions of 1.83 million shares respectively. While on the other side Local Individuals, Banks, NBFCs and Brokers remained in net long positions of 3.04, 1.73, 0.03 and 0.86 million shares but Local Companies, Mutual Fund and Insurance Companies remained in net selling positions of 2.85, 1.57 and 0.60 million shares respectively.

Analytical Review

Stocks fall after Apple warns on coronavirus impact

Asian shares fell and Wall Street retreated from record highs on Tuesday after Apple Inc (AAPL.O) said it will not meet its revenue guidance for the March quarter as the coronavirus outbreak slowed production and weakened demand in China.The warning from the most valuable company in the United States sobered investor optimism that economic stimulus by Beijing and other countries would protect the global economy from the effects of the epidemic. S&P500 e-mini futures ESc1 dipped as much as 0.3% in Asian trade. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.65% while Tokyo's Nikkei .N225 slid 1.0%. Shanghai shares .SSEC dipped 0.2%, having gained in nine of the past 10 sessions largely on hopes for policy support by Beijing. China’s central bank cut the interest rate on its medium-term lending on Monday, which is expected to pave the way for a reduction in the benchmark loan prime rate on Thursday.

Wheat smuggling probes’ outcome ‘inconclusive’

The departmental committees constituted to probe exports of wheat and wheat flour during ban period largely remains inconclusive while the Pakistan Bureau of Statistics (PBS) is standing by its export figures. The PBS reported figures received from the Pakistan Revenue Automation Limited (PRAL), a subsidiary of the Federal Board of Revenue (FBR), which showed exports of wheat and wheat flour at 3,947 and 26,206 metric tonnes, respectively between Aug-Oct 31, 2019. The FBR and its field formation are busy in announcing committees. However, the same have so far failed to produce the desired results and identify the Customs officers involved in the scam. As the scam was detected on the report of customs intelligence, seven officers of Peshawar and Quetta Collectorates were transferred.

GIDC collections come under scrutiny as court questions fate of funds

Despite collecting the Gas Infrastructure Development Cess (GIDC) for almost 10 years now, the government on Tuesday was left floundering for a response when a three-member bench of the Supreme Court began asking questions about what the money had been used for. The SC bench, led by Justice Mushir Alam, had taken up a case relating to the GIDC 2015 levy. The federal government was asked to explain the existing state of the three projects for which GIDC fee was originally levied as well as explain why it was being shown as “tax revenue” in government accounts or whether any of the funds had ever been used towards the purpose for which they were supposedly collected. In all cases, the answer was in the negative. Towards the end, the court was left frustrated because the finance ministry representative told the bench that dealing with the GIDC was not even his domain.

Academia urged to contribute for exports promotion

Advisor to Prime Minister for Finance and Revenue, Abdul Hafeez Shaikh on Monday said that since the economy was coming out of the crises, institutes of management sciences and graduates could contribute to promote export-led growth. He said this while addressing to the 7thDeans and Directors Conference 2020 organized by National Business Education Accreditation Council (NBEAC). During sharing his remarks regarding the current situation of economy, he said “We have to find a way to make business education more relevant”.

ICCI foresees huge opportunity after Pak-Turkey FTA

President Islamabad Chamber of Commerce and Industry (ICCI) Muhammad Ahmed Waheed on Sunday observed huge trade opportunities after signing of Free Trade Agreement (FTA) between Pakistan and Turkey would also help balancing the trade volume between the two sides. After finalising the FTA between the two countries, bilateral trade could increase from existing $800 million to $5 billion, which would also help decreasing the country’s trade and foreign account deficit, Muhammad Ahmed Waheed told APP here. After the recent official visit of Turkish President RecepTayyip Erdogan to Pakistan, he hoped that both of the countries evolved consensus for finalizing the FTA, which would start a new era of growing trade and economic relations between the two countries.

Asian shares fell and Wall Street retreated from record highs on Tuesday after Apple Inc (AAPL.O) said it will not meet its revenue guidance for the March quarter as the coronavirus outbreak slowed production and weakened demand in China.The warning from the most valuable company in the United States sobered investor optimism that economic stimulus by Beijing and other countries would protect the global economy from the effects of the epidemic. S&P500 e-mini futures ESc1 dipped as much as 0.3% in Asian trade. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.65% while Tokyo's Nikkei .N225 slid 1.0%. Shanghai shares .SSEC dipped 0.2%, having gained in nine of the past 10 sessions largely on hopes for policy support by Beijing. China’s central bank cut the interest rate on its medium-term lending on Monday, which is expected to pave the way for a reduction in the benchmark loan prime rate on Thursday.

The departmental committees constituted to probe exports of wheat and wheat flour during ban period largely remains inconclusive while the Pakistan Bureau of Statistics (PBS) is standing by its export figures. The PBS reported figures received from the Pakistan Revenue Automation Limited (PRAL), a subsidiary of the Federal Board of Revenue (FBR), which showed exports of wheat and wheat flour at 3,947 and 26,206 metric tonnes, respectively between Aug-Oct 31, 2019. The FBR and its field formation are busy in announcing committees. However, the same have so far failed to produce the desired results and identify the Customs officers involved in the scam. As the scam was detected on the report of customs intelligence, seven officers of Peshawar and Quetta Collectorates were transferred.

Despite collecting the Gas Infrastructure Development Cess (GIDC) for almost 10 years now, the government on Tuesday was left floundering for a response when a three-member bench of the Supreme Court began asking questions about what the money had been used for. The SC bench, led by Justice Mushir Alam, had taken up a case relating to the GIDC 2015 levy. The federal government was asked to explain the existing state of the three projects for which GIDC fee was originally levied as well as explain why it was being shown as “tax revenue” in government accounts or whether any of the funds had ever been used towards the purpose for which they were supposedly collected. In all cases, the answer was in the negative. Towards the end, the court was left frustrated because the finance ministry representative told the bench that dealing with the GIDC was not even his domain.

Advisor to Prime Minister for Finance and Revenue, Abdul Hafeez Shaikh on Monday said that since the economy was coming out of the crises, institutes of management sciences and graduates could contribute to promote export-led growth. He said this while addressing to the 7thDeans and Directors Conference 2020 organized by National Business Education Accreditation Council (NBEAC). During sharing his remarks regarding the current situation of economy, he said “We have to find a way to make business education more relevant”.

President Islamabad Chamber of Commerce and Industry (ICCI) Muhammad Ahmed Waheed on Sunday observed huge trade opportunities after signing of Free Trade Agreement (FTA) between Pakistan and Turkey would also help balancing the trade volume between the two sides. After finalising the FTA between the two countries, bilateral trade could increase from existing $800 million to $5 billion, which would also help decreasing the country’s trade and foreign account deficit, Muhammad Ahmed Waheed told APP here. After the recent official visit of Turkish President RecepTayyip Erdogan to Pakistan, he hoped that both of the countries evolved consensus for finalizing the FTA, which would start a new era of growing trade and economic relations between the two countries.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have faced a strong resistance at 40,800 points during last trading session and had bounced back after getting resistance from that level. It's expected that index would face intraday pressure again today from same region in case of bullish pull back but some kind of bearish volatility could be witnessed and chances of formation of an evening star would increased if index would slide below 40,000 points. It's recommended to adopt swing trading with strict stop loss on both sides. Index have initial supportive regions ahead at 40,000 points and breakout below said regions would call for 39,900 and 39,700 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.