Previous Session Recap

Trading volume at PSX floor dropped by 27.17 million shares or 19.58% on DoD basis, whereas the benchmark KSE100 index opened at 33,028.93, posted a day high of 33,381.32 and a day low of 32,835.05 points during last trading session while session suspended at 32,981.99 points with net change of 9.97 points and net trading volume of 93.84 million shares. Daily trading volume of KSE100 listed companies dropped by 25.66 million shares or 21.47% on DoD basis.

Foreign Investors remained in net selling positions of 2.39 million shares and net value of Foreign Inflow dropped by 0.46 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistanis remained in net selling positions of 0.22, 0.62 and 1.55 million shares respectively. While on the other side Local Companies, NBFCs and Mutual Fund remained in net buying positions of 3.50, 0.05 and 2.49 million shares respectively, but Local Individuals, Banks, Brokers and Insurance Companies remained in net selling positions of 0.90, 1.03, 0.31 and 0.30 million shares.

Analytical Review

Asian stocks wobble, bond yields fall on earnings woes, trade worries

Asian shares wobbled in early Thursday trading as Wall Street stocks dropped on early signs that the U.S.-China trade war could hurt corporate earnings, helping to underpin solid demand for safe-haven U.S. Treasuries. MSCI’s broadest index of Asia-Pacific shares outside Japan was down a touch, while Japan’s benchmark Nikkei fell 1.3% and Australian shares dropped 0.4%. South Korea’s market was off 0.4%. Moments earlier, the Bank of Korea unexpectedly cut its policy interest rate for the first time in three years, as uncertainties from a trade dispute with Japan added to anxiety about the economy’s outlook. On Wall Street, all three major indexes fell on Wednesday as weak results from trade-related CSX Corp stoked concerns that the protracted trade standoff between the United States and China could hurt U.S. corporate earnings. Earlier in the week, U.S. President Donald Trump kept up the pressure on Beijing with a threat to put tariffs on another $325 billion of Chinese goods, amid market nervousness over when face-to-face talks will resume.

ECC imposes ban on export of wheat

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday has decided to impose ban on export of wheat/wheat flour due to 33 percent reduction in its stock. Adviser to Prime Minister on Finance and Revenue, Dr. Abdul Hafeez Shaikh, chaired the meeting of the ECC. The Ministry of National Food Security and Research (MoNFSR) had requested the ECC to ban the export of wheat due to 33 percent reduction in its stock. The ECC was informed that wheat reserves stood at 7.775 million tons as against 11.37 million tons at the same time last year, showing a significant reduction. The country has produced 24.12 million tons of wheat against the target of 25.5 million tons from an area of 8.833 million hectares during the Rabi season 2018-19. Heavy rains coupled with hailstorms affected wheat crop in the country.

Pak exports to EU up by 51pc in five years

Pakistan’s exports to European Union (EU) have increased by over 51 percent in last five years mainly due to the GSP Plus status. Pakistan’s exports to EU have increased from 4.54 billion euros in 2013 to 6.88 billion euros in 2018. This represents an increase of 51.62 percent. Pakistani products have duty free access in all 28-member states of the European Union (EU) since 1st January 2014. This duty-free access is available under EU’s “Special Incentive Arrangement for Good Governance and Sustainable Development”, which is also popularly known as GSP+. On the other hand, Pakistan has to ensure implementation of 27-UN to enjoy preferential market access under GSP+. These conventions pertain to human rights, labor rights, environment protection and good governance. As a result of this arrangement, Pakistan’s exports to EU have increased by 51.62 percent. This arrangement has helped Pakistani products to compete successfully with similar products originating from other competing countries such as China, India and Bangladesh.

Current account deficit down 32 percent in FY19

The country''s current account deficit narrowed substantially by 32 percent during the last fiscal year (FY19) supported by a significant decline in goods and services import bill. The State Bank of Pakistan (SBP) Wednesday reported that the country''s current account deficit fell to $ 13.587 billion in July-June FY19 compared to $ 19.897 billion in same period of FY18, depicting a decline of $ 6.31 billion. In terms of GDP ratio, the current account deficit stood at -4.8 percent of GDP at the end of FY19 as against -6.3 percent in FY18. Economists said that the country''s external account continues to perform well on the back of lower import bill that mainly shrank due to decline in machinery and energy related imports.

Agreement with IMF: Government to further increase power tariff by Rs 3.5 per unit

The government is committed to further increasing power tariff by Rs 3.5 per unit as per agreement with the International Monetary Fund (IMF) by clubbing impact of hike in gas prices from current fiscal year, well informed sources told Business Recorder. Power Division, as per IMF prior condition, has implemented a quarterly automatic tariff adjustment in the electricity sector by about 10 percent to generate Rs 150 billion in additional revenues to reduce the circular debt accumulated over the first half of FY 2019.

Asian shares wobbled in early Thursday trading as Wall Street stocks dropped on early signs that the U.S.-China trade war could hurt corporate earnings, helping to underpin solid demand for safe-haven U.S. Treasuries. MSCI’s broadest index of Asia-Pacific shares outside Japan was down a touch, while Japan’s benchmark Nikkei fell 1.3% and Australian shares dropped 0.4%. South Korea’s market was off 0.4%. Moments earlier, the Bank of Korea unexpectedly cut its policy interest rate for the first time in three years, as uncertainties from a trade dispute with Japan added to anxiety about the economy’s outlook. On Wall Street, all three major indexes fell on Wednesday as weak results from trade-related CSX Corp stoked concerns that the protracted trade standoff between the United States and China could hurt U.S. corporate earnings. Earlier in the week, U.S. President Donald Trump kept up the pressure on Beijing with a threat to put tariffs on another $325 billion of Chinese goods, amid market nervousness over when face-to-face talks will resume.

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday has decided to impose ban on export of wheat/wheat flour due to 33 percent reduction in its stock. Adviser to Prime Minister on Finance and Revenue, Dr. Abdul Hafeez Shaikh, chaired the meeting of the ECC. The Ministry of National Food Security and Research (MoNFSR) had requested the ECC to ban the export of wheat due to 33 percent reduction in its stock. The ECC was informed that wheat reserves stood at 7.775 million tons as against 11.37 million tons at the same time last year, showing a significant reduction. The country has produced 24.12 million tons of wheat against the target of 25.5 million tons from an area of 8.833 million hectares during the Rabi season 2018-19. Heavy rains coupled with hailstorms affected wheat crop in the country.

Pakistan’s exports to European Union (EU) have increased by over 51 percent in last five years mainly due to the GSP Plus status. Pakistan’s exports to EU have increased from 4.54 billion euros in 2013 to 6.88 billion euros in 2018. This represents an increase of 51.62 percent. Pakistani products have duty free access in all 28-member states of the European Union (EU) since 1st January 2014. This duty-free access is available under EU’s “Special Incentive Arrangement for Good Governance and Sustainable Development”, which is also popularly known as GSP+. On the other hand, Pakistan has to ensure implementation of 27-UN to enjoy preferential market access under GSP+. These conventions pertain to human rights, labor rights, environment protection and good governance. As a result of this arrangement, Pakistan’s exports to EU have increased by 51.62 percent. This arrangement has helped Pakistani products to compete successfully with similar products originating from other competing countries such as China, India and Bangladesh.

The country''s current account deficit narrowed substantially by 32 percent during the last fiscal year (FY19) supported by a significant decline in goods and services import bill. The State Bank of Pakistan (SBP) Wednesday reported that the country''s current account deficit fell to $ 13.587 billion in July-June FY19 compared to $ 19.897 billion in same period of FY18, depicting a decline of $ 6.31 billion. In terms of GDP ratio, the current account deficit stood at -4.8 percent of GDP at the end of FY19 as against -6.3 percent in FY18. Economists said that the country''s external account continues to perform well on the back of lower import bill that mainly shrank due to decline in machinery and energy related imports.

The government is committed to further increasing power tariff by Rs 3.5 per unit as per agreement with the International Monetary Fund (IMF) by clubbing impact of hike in gas prices from current fiscal year, well informed sources told Business Recorder. Power Division, as per IMF prior condition, has implemented a quarterly automatic tariff adjustment in the electricity sector by about 10 percent to generate Rs 150 billion in additional revenues to reduce the circular debt accumulated over the first half of FY 2019.

Market is expected to remain volatile during current trading session.

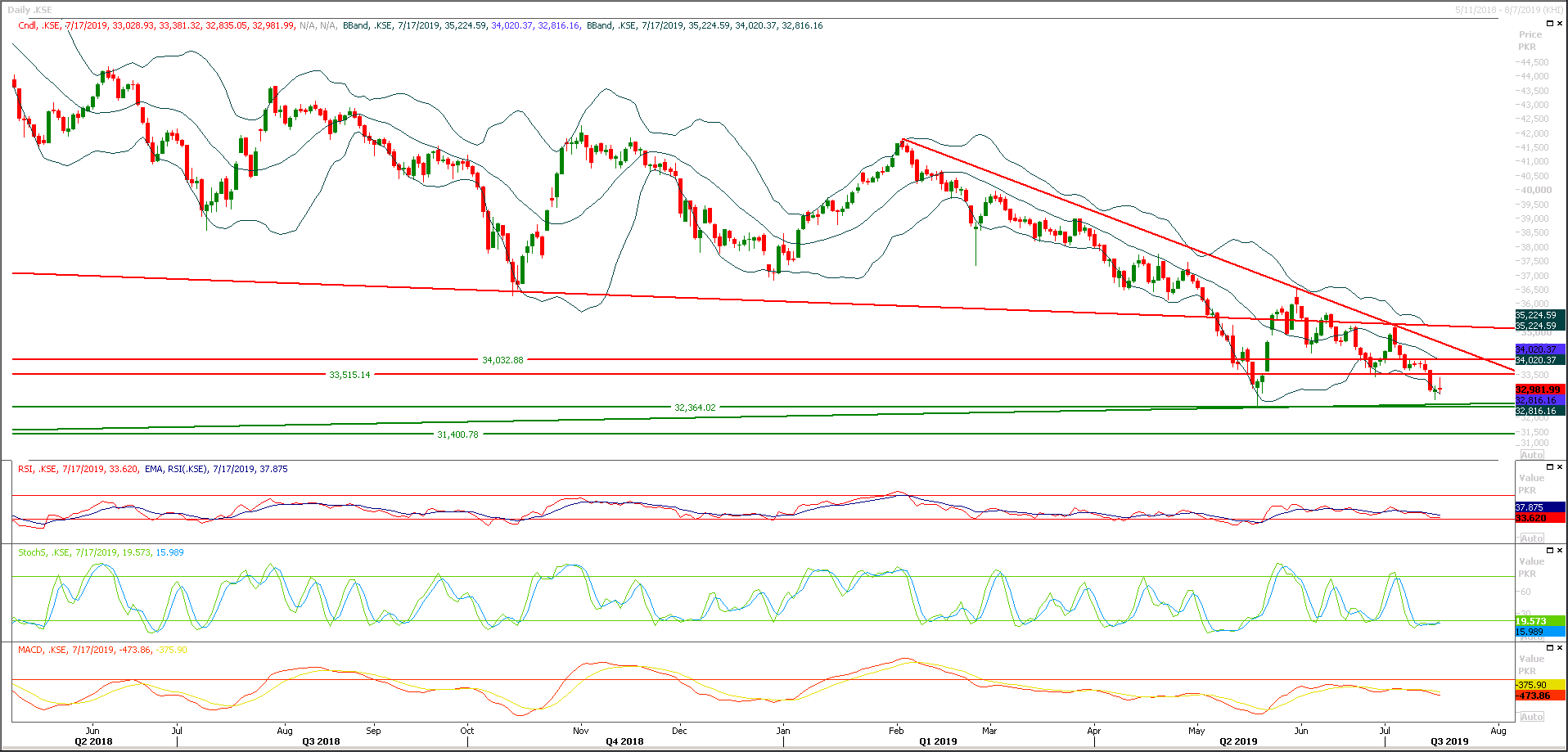

Technical Analysis

The Benchmark KSE100 index have not succeeded in penetration above its initial resistant region of 33,450 points and have formatted a hammer on daily chart after being pushed back by a horizontal resistant region. As of now index would try to find some ground at 32,360 and 31,700 points while on flip side resistant regions are still standing at 33,500 and 34,000 points. It's expected that index would remain bearish until it would succeed in penetration above 34,000 points on daily basis. Daily momentum indicators are still in bearish mode therefore it's recommended to practice caution until index close above its major regions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.