Previous Session Recap

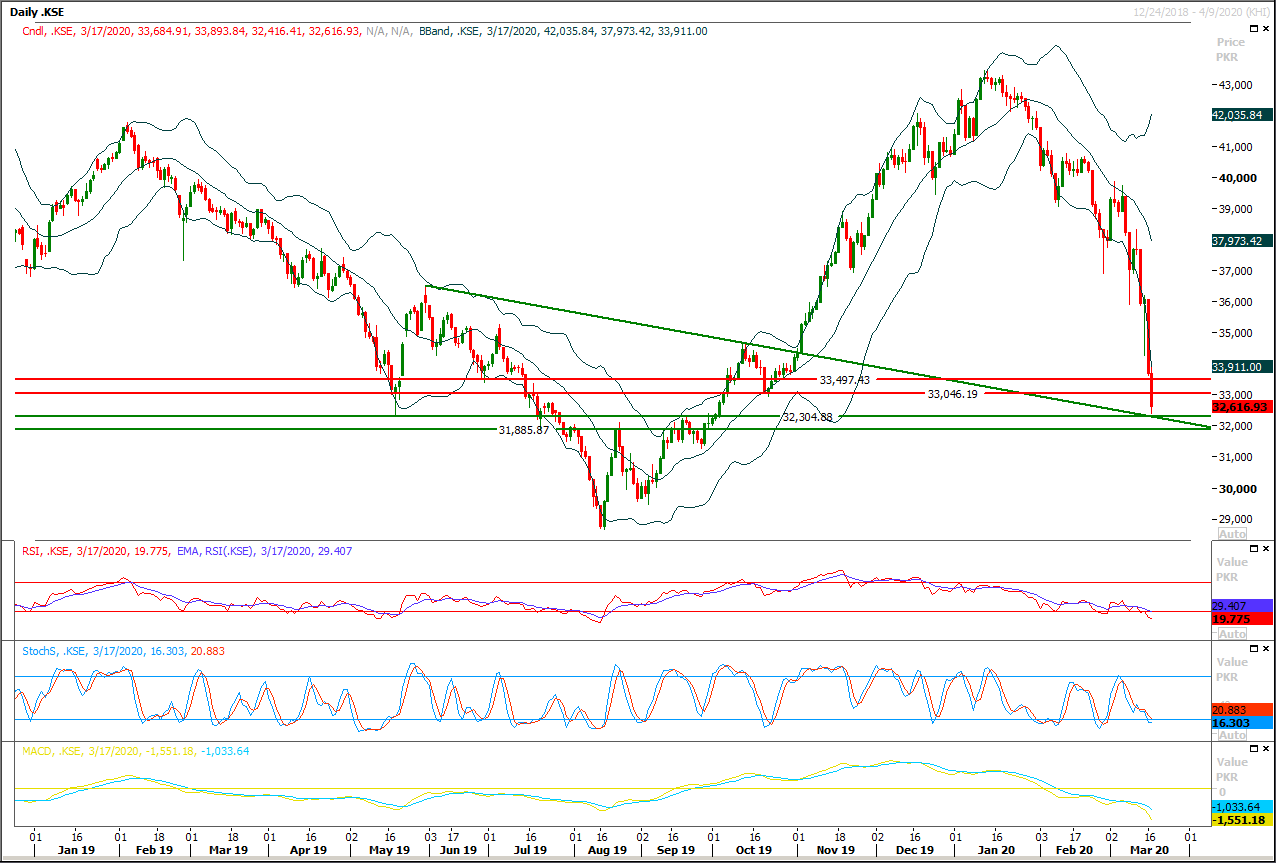

Trading volume at PSX floor increased by 24.94 million shares or 11.58% on DoD basis, whereas the benchmark KSE100 index opened at 33,365.99, posted a day high of 33,893.84 and a day low of 32,416.41 points during last trading session while session suspended at 32,616.93 points with net change of -1067.98 points and net trading volume of 196.59 million shares. Daily trading volume of KSE100 listed companies also increased by 26.34 million shares or 15.47% on DoD basis.

Foreign Investors remained in net long positions of 13.33 million shares and value of Foreign Inflow dropped by 5.60 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani remained in net selling positions of 11.97 and 1.36 million shares respectively. While on the other side Local Individuals, Banks, NBFCs, Mutual Fund and Insurance Companies remained in net long positions of 32.07, 8.12, 0.09, 0.86 and 9.59 million shares but Local Companies and Brokers remained in net selling positions of 27.20 and 9.59 million shares respectively.

Analytical Review

U.S. stock futures dip as coronavirus spread overshadows stimulus

U.S. stock futures stepped back in choppy early Asian trade on Wednesday as concerns about the widening coronavirus epidemic weighed against hopes policy support would combat its economic fallout. U.S. stock futures fell 2.0% after the S&P 500 gained 6.00% on Tuesday, paring a little under half of its huge losses on Monday. Tuesday’s lift in the S&P 500 came as policymakers around the world cobbled together packages to counter the severe restrictions on various economy-boosting activities aiming at slowing the spread of the virus. “While markets react to positive news on stimulus, that doesn’t last long. I think there are a lot of banks and investors whose balance sheet was badly hit and they will have lots of positions to sell,” said Shin-ichiro Kadota, senior currency and rates strategist at Barclays.

Government decides to revise energy sector accords

Due to the adverse impact of the coronavirus pandemic on the economy, the government on Tuesday decided to revise all international and local agreements in the energy sector, including those related to Independent Power Projects (IPPs) and Liquefied Natural Gas (LNG), to provide relief to the common man. The decision was taken in a meeting of the federal cabinet chaired by Prime Minister Imran Khan. During the meeting Adviser to the Prime Minister on Finance Dr Hafeez Shaikh presented a ‘budget strategy paper’ aimed at reviewing the federal fiscal budget in the backdrop of the global virus outbreak currently affecting over 150 states.

Moody’s lowers growth forecast to 2.5pc

Moody’s Investor Service on Tuesday lowered its forecast for Pakistan growth rate at 2.5 per cent for the current fiscal year owing to Covid-19 even though it said risks for the entire Asia-Pacific (APAC) region were generally on the downside. In December 2019, the New York-based rating agency had projected Pakistan’s growth rate at 2.9pc for the current year. This coincided with the State Bank of Pakistan (SBP) estimating the GDP growth rate for the current year at 3pc, down from its earlier projection of 3.5pc. “Risks for the APAC firmly tilted to the downside, including from much weaker European and American economies than currently assumed”, said Moody’s in its latest “Regional Credit Outlook Update on Evolving Coronavirus Impact”.

Textile exports surge 17pc

Pakistan’s textile and clothing exports jumped nearly 17 per cent year-on-year in February, reported the Pakistan Bureau of Statistics on Tuesday. Trade analysts and commerce ministry believe the growth is due to diversion of orders from China owing to the spread of coronavirus in the country. The proceeds from textile and clothing exports reached $1.27bn during February, from $1.09bn in the same month last year. The robust growth in the sector is seen after a long time as the past few years had been marred by single-digit increases.

Govt asks SSGCL, SNGPL to reduce allowable UFG benchmarks

To reduce the gas tariff, the government has asked the gas utilities companies that instead of increasing gas prices, reduce allowable UFG benchmarks and return on assets. The government has also asked the Sui Southern Gas Company Limited (SSGCL) and Sui Northern Gas Pipeline Limited (SNGPL) to rationalise transmission and distribution costs to create some fiscal space for the Companies instead of simply resorting to increase in tariffs. Both companies are incurring gas losses (UFG) in double digit which exceeds the best international practices, said a spokesman of the Petroleum Division here. According the spokesman one percent UFG loss of both Sui Companies in monetary terms exceeds 4 billion rupees. According the official sources, the total UFG losses of both the gas companies are around 12 to 13 percent against the allowed 7.3 UFG losses by OGRA.

U.S. stock futures stepped back in choppy early Asian trade on Wednesday as concerns about the widening coronavirus epidemic weighed against hopes policy support would combat its economic fallout. U.S. stock futures fell 2.0% after the S&P 500 gained 6.00% on Tuesday, paring a little under half of its huge losses on Monday. Tuesday’s lift in the S&P 500 came as policymakers around the world cobbled together packages to counter the severe restrictions on various economy-boosting activities aiming at slowing the spread of the virus. “While markets react to positive news on stimulus, that doesn’t last long. I think there are a lot of banks and investors whose balance sheet was badly hit and they will have lots of positions to sell,” said Shin-ichiro Kadota, senior currency and rates strategist at Barclays.

Due to the adverse impact of the coronavirus pandemic on the economy, the government on Tuesday decided to revise all international and local agreements in the energy sector, including those related to Independent Power Projects (IPPs) and Liquefied Natural Gas (LNG), to provide relief to the common man. The decision was taken in a meeting of the federal cabinet chaired by Prime Minister Imran Khan. During the meeting Adviser to the Prime Minister on Finance Dr Hafeez Shaikh presented a ‘budget strategy paper’ aimed at reviewing the federal fiscal budget in the backdrop of the global virus outbreak currently affecting over 150 states.

Moody’s Investor Service on Tuesday lowered its forecast for Pakistan growth rate at 2.5 per cent for the current fiscal year owing to Covid-19 even though it said risks for the entire Asia-Pacific (APAC) region were generally on the downside. In December 2019, the New York-based rating agency had projected Pakistan’s growth rate at 2.9pc for the current year. This coincided with the State Bank of Pakistan (SBP) estimating the GDP growth rate for the current year at 3pc, down from its earlier projection of 3.5pc. “Risks for the APAC firmly tilted to the downside, including from much weaker European and American economies than currently assumed”, said Moody’s in its latest “Regional Credit Outlook Update on Evolving Coronavirus Impact”.

Pakistan’s textile and clothing exports jumped nearly 17 per cent year-on-year in February, reported the Pakistan Bureau of Statistics on Tuesday. Trade analysts and commerce ministry believe the growth is due to diversion of orders from China owing to the spread of coronavirus in the country. The proceeds from textile and clothing exports reached $1.27bn during February, from $1.09bn in the same month last year. The robust growth in the sector is seen after a long time as the past few years had been marred by single-digit increases.

To reduce the gas tariff, the government has asked the gas utilities companies that instead of increasing gas prices, reduce allowable UFG benchmarks and return on assets. The government has also asked the Sui Southern Gas Company Limited (SSGCL) and Sui Northern Gas Pipeline Limited (SNGPL) to rationalise transmission and distribution costs to create some fiscal space for the Companies instead of simply resorting to increase in tariffs. Both companies are incurring gas losses (UFG) in double digit which exceeds the best international practices, said a spokesman of the Petroleum Division here. According the spokesman one percent UFG loss of both Sui Companies in monetary terms exceeds 4 billion rupees. According the official sources, the total UFG losses of both the gas companies are around 12 to 13 percent against the allowed 7.3 UFG losses by OGRA.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have a strong supportive region ahead at 32,300 points where a descending trend line is generating crossover with a horizontal supportive line, It's expected that index would try to take an intraday spike form this region to retest its resistant region but breakout below that region would call for 32,000 and 31,880 points. Mean while if index would succeed in bouncing back from its supportive regions than it would face strong resistances at 33,050 33,500 points. It's recommended to stay cautious and post strict stop loss on existing long positions because if index would succeed in sliding below 32,000 points on daily chart then some serious pressure could be witness in coming days again.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.