Previous Session Recap

Trading volume at PSX floor increased by 42.04 million shares or 33.68%, DoD basis, whereas, the benchmark KSE100 Index opened at 40892.36, posted a day high of 41353.23 and a day low of 40692.09 during the last trading session. The session suspended at 40724.96 with a net change of -66.43 and net trading volume of 81.06 million shares. Daily trading volume of KSE100 listed companies increased by 25.79 million shares or 46.65% on DoD basis.

Foreign Investors remained in a net selling position of 7.79 million shares and net value of Foreign Inflow dropped by 0.65 million US Dollars. Categorically, Foreign Coporate investors remained in a net selling position of 8.1 million shares but Overseas Pakistanis remained in a net buying position of 0.3 million shares.On the other side Local Individuals, Banks and NBFCs remained in net selling positions of 9.18, 0.05 and 1.04 million shares but Local Companies, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 4.98, 1.87, 6.0 and 5.18 million shares respectively.

Analytical Review

Byco Petroleum's Single Point Mooring (SPM) has imported 5 million tons of crude oil since its inception. It has been in continuous operation since 2012 including the severe monsoon season from June through September, which was previously considered impossible for the area. Byco's SPM is Pakistan's only floating terminal and revolutionizes the handling crude oil and refined petroleum products in the country. The SPM has been set up in the deep sea and is connected to a storage tank via 15km of both on-shore and sub-sea pipeline. Byco has a storage capacity of 140,000 metric tons. Amir Abbasi, CEO BPPL, remarked on the achievement: "Byco's SPM is a national asset for Pakistan. Its continuous safe operation is a testament to our promise of keeping safety our top priority. I want to congratulate the entire Byco team on this singular achievement and on having imported 5 million tons of crude oil since inception."

The Ministry of Law and Justice has appointed arbitrators to resolve the issue of $30 million penalty imposed on the Pakistan Gas Port Consortium Limited (PGPC) by Pakistan LNG Terminal Limited (PLTL) for allegedly delaying completion of the country’s second LNG terminal at Port Qasim. The law ministry appointed the two arbitrators — one each from PLTL and PGPC — after both the parties invoked the relevant clause of dispute resolution in the contract. The PGPC is constructing the country’s second LNG terminal in private sector after Engro. The project is close to completion. Though the project, under the timeline, was supposed to be commissioned in July this year but it could not happen. Following the delay, PLTL – a public sector company owned by the Ministry of Energy (Petroleum Division) – imposed $30m fine on PGPC which the latter declined to pay, claiming it was not responsible for the delay.

A spokesman for Agriculture Department has said that under Khadam-E- Punjab Kissan package, the government is providing subsidy on DAP fertilizer to 5.2 million farmers in the province in the form of vouchers which will be sealed in the bag of DAP fertilizer. He said the farmers/stakeholders will type voucher number along with their CNIC number and send it to 8070 through SMS. The farmer will get subsidy of Rs 150 per voucher through mobile cash agents. A farmer can get subsidy vouchers on up to 20 bags of DAP fertilizer this subsidy is being provided to all registered farmers of Kissan package. Unregistered farmers can contact Agriculture Helpline toll free numbers 0800-15000 & 0800-29000 to register themselves and get benefit of this subsidy scheme. The Spokesman said through this subsidy scheme the farmers cost of production will be reduced while use of DAP fertilizer will increase per acre yield of crops.

Borrowing by the government for budgetary support increased 27 per cent year-on-year in the first 98 days of 2017-18, the State Bank of Pakistan (SBP) reported on Tuesday. Borrowing during July 1 and Oct 6 amounted to Rs479 billion compared to Rs376bn in the same period a year ago. The government borrowed from both scheduled banks and the SBP. This reflects the government’s attempt to maximize growth in view of general elections due by the middle of 2018.During the period under review, the government borrowed Rs443bn from the SBP compared to Rs673bn a year ago. The government almost stopped borrowing from the central bank last fiscal year. Its total borrowing from the SBP was Rs710bn in 2016-17.

The revenue and expenditure imbalance of around Rs 17 billion that export incentive and import disincentive packages would create would be met by diverting funds from ''elsewhere'' in order to ensure that it does not have any impact on the budget deficit for the current fiscal year. This was stated by well-informed sources in the Ministry of Finance while adding the government has estimated Rs 30 billion enhanced revenue collection through imposing a regulatory duty on 295 items to reduce the impact of increasing import bill on balance of payment position. And the financial impact of export incentives is an estimated Rs 47 billion - a package upgraded to what it was till June 2017 (notably the 10 percent increase in exports to qualify for the incentives would no longer be applicable till 31 December 2017 when the implementation performance and export package impact on exports will be reviewed).

The market is expected to remain volatile today, we advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

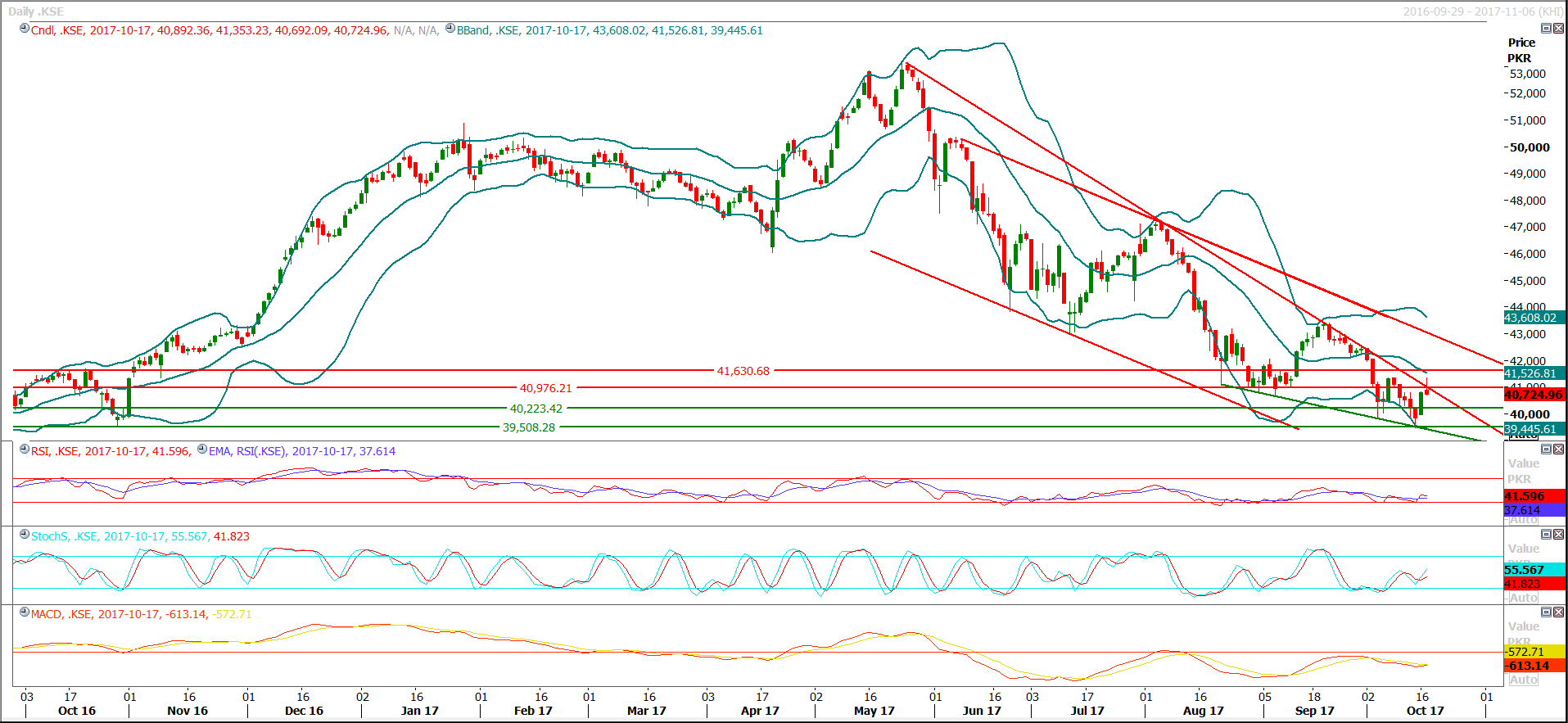

The Benchmark KSE100 Index pushed back from a double top on the daily chart and it did not succeed to confirm its bullish morning star, as it has closed below its resistant region of 40975. For the current trading session index has supportive regions around 40200 and 40036 while resistant regions are standing at 40975 and 41360. For the current trading session a cautious trading strategy is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.