Previous Session Recap

Trading volume at PSX floor increased by 12.44 million shares or 6.84% on DoD basis, whereas the Benchmark KSE100 index opened at 36,686.20, posted a day high of 37,484.64 and day low of 36,686.20 points while the session suspended at 37,484.64 with net change of 983.96 points and net trading volume of 101.31 million shares. Daily trading volume of KSE100 listed companies increased by 9.19 million shares or 9.97% on DoD basis.

Foreign Investors remained in net selling position of 7.41 million shares and net value of Foreign Inflow dropped by 4.35 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 6.02 and 1.38 million shares. While on the other side Local Individuals, Banks, NBFCs, Mutual Fund and Insurance Companies remained in net selling positions of 0.03, 2.71, 0.48 and 9.75 million shares but Local Companies and Brokers remained in net selling positions of 2.57 and 1.69 million shares respectively.

Analytical Review

Wall St. falls as investors eye a united hawkish Fed

Wall Street’s major indexes edged lower after a choppy session on Wednesday after the Federal Reserve showed broad agreement on the need to raise borrowing costs further, cementing investor concerns that had helped cause a major sell-off the week before. The S&P 500 .SPX zigzagged furiously between positive and negative territory after the 2 p.m. ET (1800 GMT) release of the Fed's September meeting minutes. In defiance of sharp criticism from U.S. President Donald Trump, policymakers showed agreement on the September hike and general anticipation that further gradual increases would be consistent with the economic expansion, labor market strength, and firm inflation that most forecast.

CDWP clears seven uplift projects worth Rs142bn

The Central Development Working Party (CDWP) on Wednesday cleared a total of seven development projects at an estimated cost of Rs142 billion. A meeting of the CDWP presided over by Minister for Planning and Development Makhdoom Khusro Bakhtyar deferred the Rs65bn mass transit project for Karachi. It was the first meeting of the CDWP after a gap of about six months. The gap is reported to have caused a significant loss to the nation on external account because it dried up fresh flows of project-related funds from multilateral lenders.

Punjab to contest case in National Finance Commission

The Punjab government will contest its case in National Finance Commission with full preparation, while in the past financial matters between in Punjab and Federal issues were completely ignored and province paid the cost of it. Provincial Finance Minister Jawan Bakhat Hashim, addressing post-budget conference here on Wednesday, said that surplus budget of Punjab would not be surrendered to anyone rather it would be judiciously utilized in the future budget and this budget surplus is created for fiscal space for the betterment of the country. He said the Punjab government will present its growth strategy in next month.

LSM growth declined by 3.33pc in Aug

Pakistan’s economic growth has currently slowed down that could be gauged from the decline in growth of large-scale manufacturing (LSM) during first couple of months (July and August) of the ongoing fiscal year. The LSM growth declined by 1.17 percent during July and August period of the FY2019, the data shared by the Pakistan Bureau of Statistics (PBS) revealed on Wednesday. Meanwhile, the LSM growth went down by 3.33 percent during August 2018 as against the corresponding period of previous year.

Inflation to go up, warns govt

The federal government on Wednesday warned that inflation would rise in the months to come due to increase in oil prices in international market, rupee depreciation and recent hike in gas rates. READ MORE: PPP crossed rivers of blood for democracy: Bilawal The National Price Monitoring Committee, which met under the chair of Special Secretary Finance, reviewed the inflationary trend in the country. The main reason for the rise is increase in international crude oil prices and the recent decisions of the government.

Wall Street’s major indexes edged lower after a choppy session on Wednesday after the Federal Reserve showed broad agreement on the need to raise borrowing costs further, cementing investor concerns that had helped cause a major sell-off the week before. The S&P 500 .SPX zigzagged furiously between positive and negative territory after the 2 p.m. ET (1800 GMT) release of the Fed's September meeting minutes. In defiance of sharp criticism from U.S. President Donald Trump, policymakers showed agreement on the September hike and general anticipation that further gradual increases would be consistent with the economic expansion, labor market strength, and firm inflation that most forecast.

The Central Development Working Party (CDWP) on Wednesday cleared a total of seven development projects at an estimated cost of Rs142 billion. A meeting of the CDWP presided over by Minister for Planning and Development Makhdoom Khusro Bakhtyar deferred the Rs65bn mass transit project for Karachi. It was the first meeting of the CDWP after a gap of about six months. The gap is reported to have caused a significant loss to the nation on external account because it dried up fresh flows of project-related funds from multilateral lenders.

The Punjab government will contest its case in National Finance Commission with full preparation, while in the past financial matters between in Punjab and Federal issues were completely ignored and province paid the cost of it. Provincial Finance Minister Jawan Bakhat Hashim, addressing post-budget conference here on Wednesday, said that surplus budget of Punjab would not be surrendered to anyone rather it would be judiciously utilized in the future budget and this budget surplus is created for fiscal space for the betterment of the country. He said the Punjab government will present its growth strategy in next month.

Pakistan’s economic growth has currently slowed down that could be gauged from the decline in growth of large-scale manufacturing (LSM) during first couple of months (July and August) of the ongoing fiscal year. The LSM growth declined by 1.17 percent during July and August period of the FY2019, the data shared by the Pakistan Bureau of Statistics (PBS) revealed on Wednesday. Meanwhile, the LSM growth went down by 3.33 percent during August 2018 as against the corresponding period of previous year.

The federal government on Wednesday warned that inflation would rise in the months to come due to increase in oil prices in international market, rupee depreciation and recent hike in gas rates. READ MORE: PPP crossed rivers of blood for democracy: Bilawal The National Price Monitoring Committee, which met under the chair of Special Secretary Finance, reviewed the inflationary trend in the country. The main reason for the rise is increase in international crude oil prices and the recent decisions of the government.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

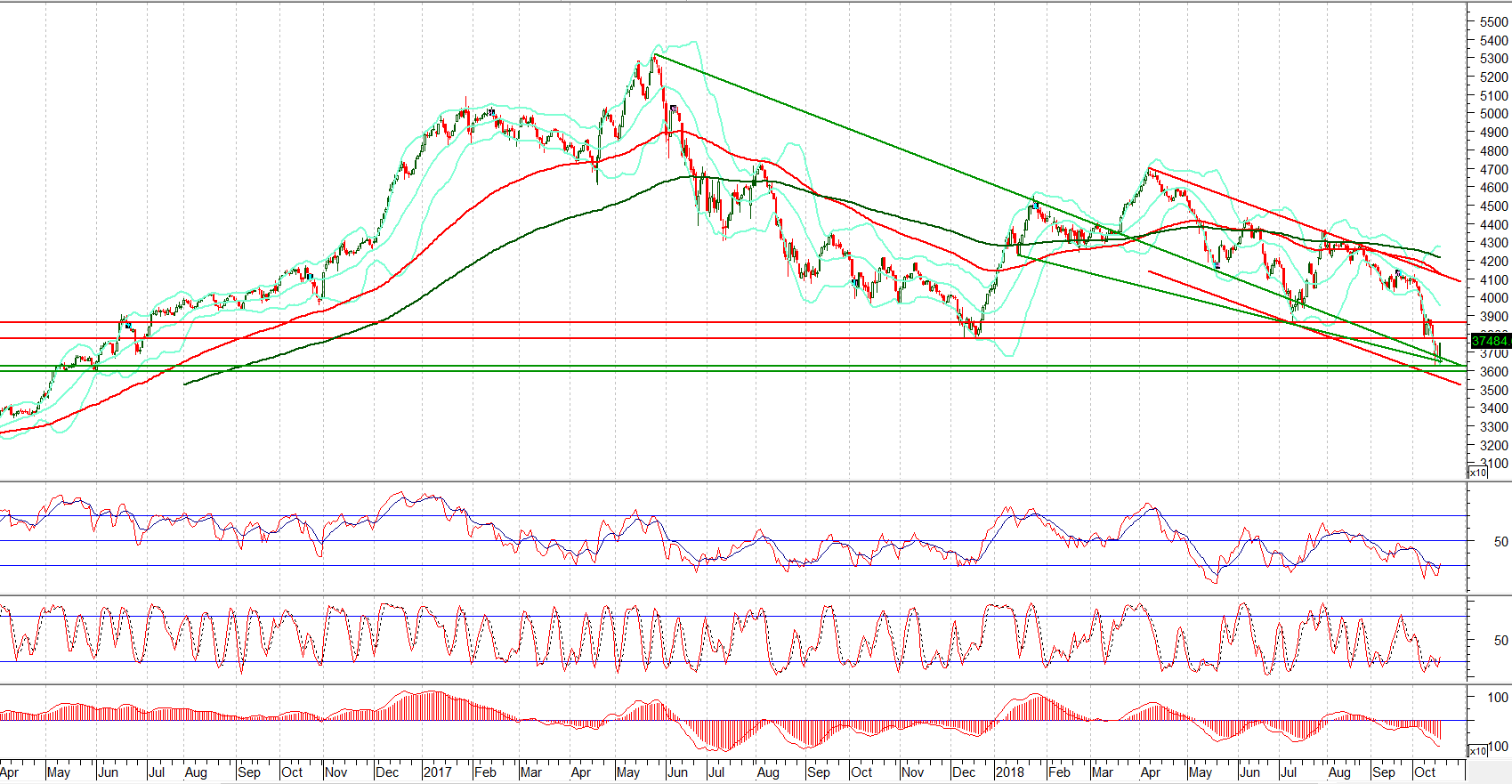

Technical Analysis

The Benchmark KSE100 Index have bounced back after getting support from horizontal supportive region along with two supportive trend lines during last two three trading sessions and a morning star have been formatted on daily chart which is a reversal sign in bullish direction, but this kind of evident formations usually don’t complete and react as a cheat patter in such huge volatile situations. Therefore it’s recommended to stay cautious and trade with strict stop loss until index close above 38,300 points during current trading session. It’s expected that index would initially face resistances at 37,780 points which falls on a previous supportive region and breakout of that region would call for 38,300 and 38,600 points. It’s recommended to start profit taking around 38,300 till 38,600 points, if a clear breakout of 37,780 points happens on hourly chart otherwise some pressure could be witnessed on index at this region.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.