Previous Session Recap

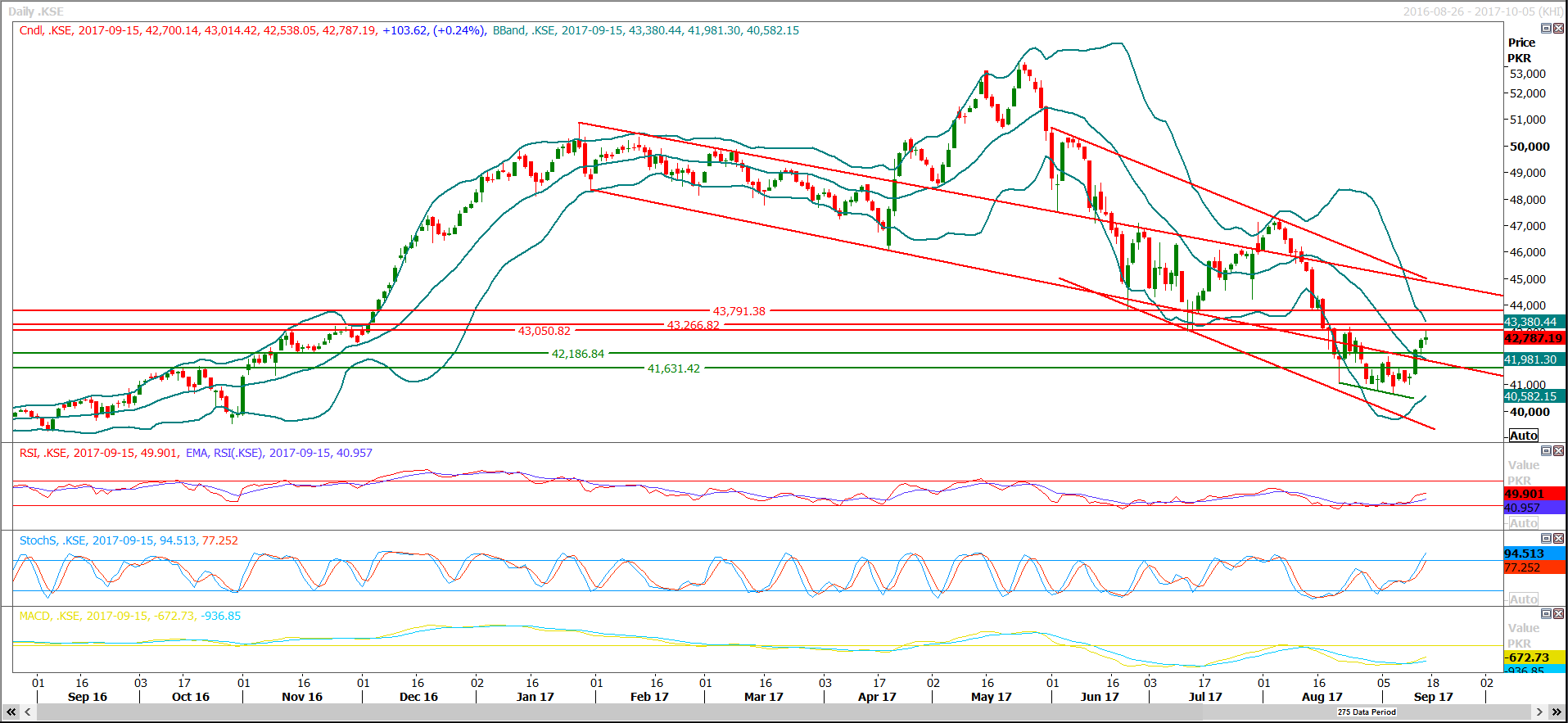

Trading volume at PSX floor dropped by 17.04 million shares or 7.85%, DoD basis. Whereas, the benchmark KSE100 Index opened at 42700.14, posted a day high of 43014.42 and a day low of 42538.05 during the last trading session. The session suspended at 42787.19 with a net change of 103.62(0.24%) points and a net trading volume of 97.95 million shares. Daily trading volume of KSE100 listed companies increased by 17.54 million shares or 21.82%,DoD basis.

Foreign Investors turned back to buying again and they remained in a net buying position of 6.16 million shares and net value of Foreign Inflow increased by 14.25 million shares, DoD basis. Categorically, Foreign Corporate Investors remained in net buying of 6.25 million shares but Foreign Individual and Overseas Pakistanis remained in net selling positions of 0.01 and 0.08 million shares.On the other side Local Individuals, Companies, Banks, NBFCs, Mutual Funds and Insurance Companies remained in net selling positions of 1.16, 1.15, 6.3, 0.3, 0.52 and 3.95 million shares respectively but Brokers remained in net buying position of 7.51 million shares. Foreign Investors month till date net volume have reached 8.85 million shares in buying.

Analytical Review

Asian shares hit decade highs on Monday and the dollar held firm early in a week in which the U.S. Federal Reserve is likely to wrestle with its bloated balance sheet as part of a long reversal of super-cheap money worldwide. There was relief the weekend passed with no new provocation by North Korea, though Pyongyang’s nuclear ambitions will be centre stage when U.S. President Donald Trump addresses world leaders at the United Nations on Tuesday. Some details of Trump’s tax plans may also emerge this week, while elections in Germany and New Zealand will add extra political uncertainty to the mix. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.9 percent to reach heights not visited since late 2007. Samsung Electronics (005930.KS) led the gains, along with healthcare and financial stocks. Australia's main index added 0.6 percent while Japan's Nikkei .N225 was closed for a holiday. E-Mini futures for the S&P 500 ESc1 rose 0.2 percent.

The proposed, second multi-million dollars terminal being set up at the Port Qasim to handle liquefied natural gas (LNG) imports will give tremendous boost to LNG trade. Sources in the Ministry of Ports and Shipping said that the new terminal would be ready for operations early next year. The development comes after the government had abandoned proposed $2 billion Gwadar-Nawabshah gas pipeline project and opted for The Pakistan LNG Terminal Limited, second terminal facility at Qasim Port. The Pakistan LNG Terminal Limited was to become operational by June 2017 but got delayed for some time. At present, Pakistan is importing around 600 million cubic feet per day (mmcfd) LNG from Qatargas through Engro LNG terminal. LNG imports are set to double in the next five to six months when the second LNG import terminal becomes operational in Pakistan.

The palm oil imports into the country surged by 68.56 percent during the month of July 2017 compared to the same month of the last year. Pakistan imported palm oil worth $176.600 million in July 2017 compared to the imports of $104.771 million in July 2016, according to latest trade data of Pakistan Bureau of Statistics (PBS). On month-on-month basis, the palm imports increased by 11.05 percent in July 2017 when compared to the imports of $159.034 million in June 2017. In terms of quantity, the palm oil imports soared by 62.33 percent by growing from 150,728 metric tons in July 2016 to 244,671 metric tons in July 2017. While on month-on-month basis, the imports of the commodity increased by 11.71 percent in July when compared to the imports of 219,032 metric tons in June 2017, the data revealed.

According to the weekly statement of position of all scheduled banks for the week ended Sept 1, 2017, deposits and other accounts of all scheduled banks stood at Rs11,661.904bn after a 0.09pc increase over the preceding week’s figure of Rs11,651.413bn. Compared with last year’s corresponding figure of Rs10,223.484bn, the current week’s figure was higher by 14.07pc. Deposits and other accounts of all commercial banks stood at Rs11,588.601bn against preceding week’s deposits of Rs11,575.717bn, showing a rise of 0.11pc. Deposits and other accounts of specialised banks stood at Rs73.304bn, lower by 3.16pc against previous week’s figure of Rs75.696bn.

Today ENGRO, ISL and TRG may lead the market in the positive direction.

Technical Analysis

The Benchmark KSE100 Index formatted a morning star on the weekly chart which indicates the start of a bullish phase but it is capped by two major resistances at 43200 and 43800 which might try to ruin the impact of this bullish momentum, 50% correction of the last bearish rally might be fulfilled at 43900 and it might add some pressure to expire current bullish trend. Breakout of 43266 might call for 43700, whereas profit taking is recommended in coming days. For the current trading session index will face resistances around 43050 and 43266 while supportive regions are standing around 42186 and 41700.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.