Previous Session Recap

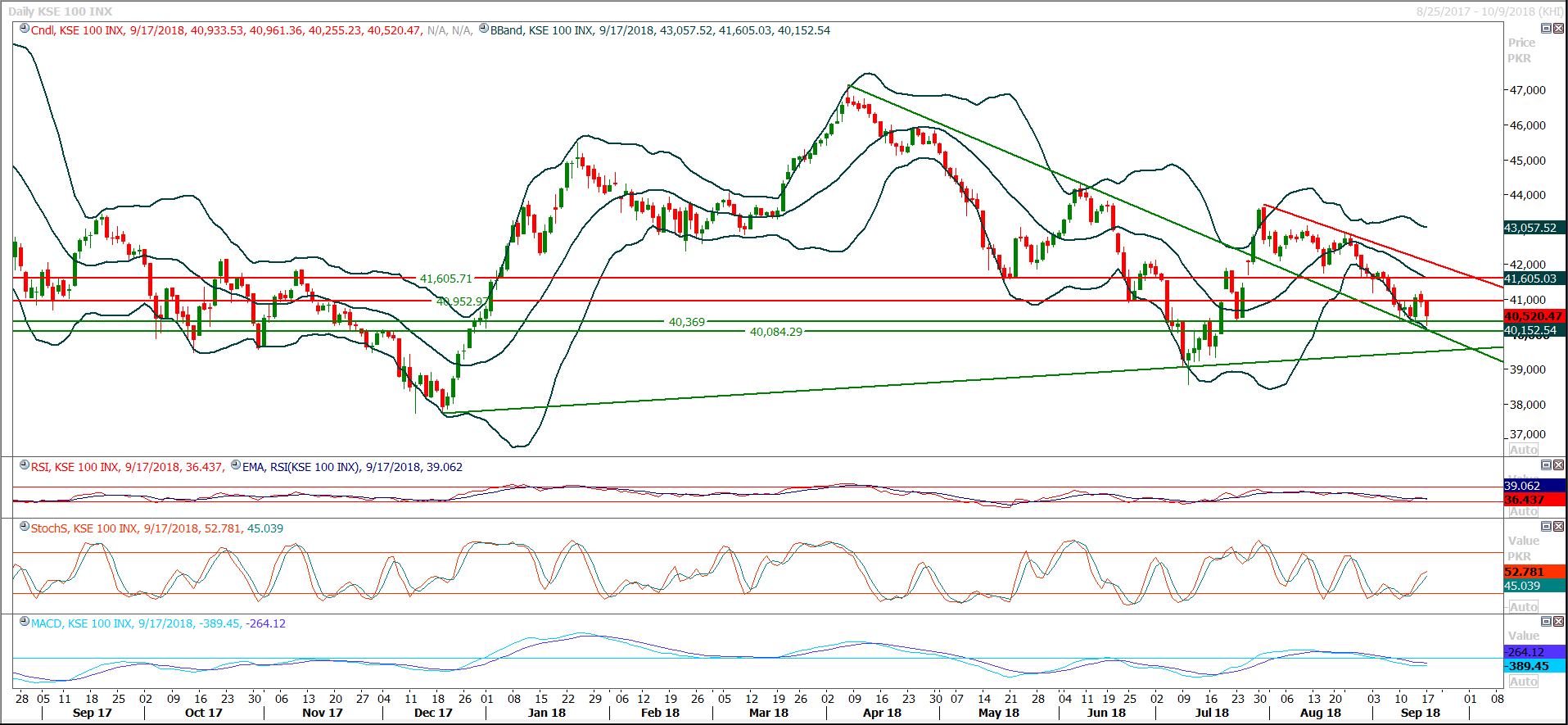

Trading volume at PSX floor dropped by 11.56 million shares or 7.38% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 40,933.53, posted a day high of 40,961.36 and a day low of 40,255.71 during last trading session. The session suspended at 40,520.47 with net change of -399.84 and net trading volume of 69.40 million shares. Daily trading volume of KSE100 listed companies dropped by 11.23 million shares or 13.93% on DoD basis.

Foreign Investors remain in net selling positions of 2.60 million shares and net value of Foreign Inflow dropped by 1.90 million US Dollars. Categorically Foreign Individuals remained in net buying positions of 0.01 million shares but Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 2.27 and 0.33 million shares. While on the other side Local Individuals, Local Companies, Banks, Mutual Fund, and Insurance Companies remained in net buying positions of 7.98, 0.21, 1.12, 2.47 and 1.85 million shares respectively but NBFCs and Brokers remained in net selling positions of 0.25 and 11.35 million shares.

Analytical Review

Oracle first-quarter revenue misses estimates, shares fall

Oracle Corp (ORCL.N) on Monday reported first-quarter revenue that narrowly missed analysts’ estimates, suggesting that the business software maker was struggling to make inroads in the highly competitive cloud computing market. Shares of Oracle fell 4 percent to $47.30 in extended trading as the company’s biggest unit, which houses its cloud services business, also reported disappointing sales. Revenue in its cloud services and license support business rose 3.2 percent to $6.61 billion, falling short of the average analyst estimate of $6.71 billion, with the co-Chief Executive Officer Safra Katz attributing the miss to a strong dollar.

TCP initiates import of 0.1 million tonnes of urea

Following the directives of the federal government, the Trading Corporation of Pakistan (TCP) has initiated import of 0.1 million metric tons of urea for domestic consumption. In the second week of this month, the Economic Coordination Committee of the Cabinet had allowed import of some 100,000 metric tons urea to avoid shortage in the domestic market.

Norinco Group to invest $20m in Punjab

China’s state-owned Norinco Group will invest US$ 20 million for the establishment of state of the art manufacturing unit in Punjab. Norinco Group has signed an MoU with Punjab Board of Investment & Trade in connection with establishment of the production facility near Faisalabad Industrial Estate. Chief Executive Officer (PBIT) Jahanzeb Burana received Won John of Norinco Auxin, while COO FIEDMC Aamer Saleemi was also present on the occasion. Jahanzeb Burana assured that PBIT will provide absolute facilitation to Norinco Group to promote valuable communication and coordination as well as utilize their full resources and energies for the expansion of Group’s investment and commercial engagement in Punjab.

Foreign company stops 13,000 towers acquisition from PMCL

A foreign company, Edotco Group Sdn Bhd, which is the subsidiary of Axiata Group Berhad, has announced that it will not be moving forward with the acquisition of 13,000 towers from Pakistan Mobile Communications Limited (PMCL) in Pakistan. The transaction was subject to a number of conditions and terminated due to the non-fulfillment of the conditions precedent to the SPA within the stipulated timeframe, in particular regulatory approval for the resulting change of control contemplated under the SPA. The Edotco remains committed to Pakistan and will continue to grow its existing business under Edotco Pakistan, comprising of the towers acquired by Tanzanite Towers carried out earlier this year.

Gas prices increased

The Economic Coordination Committee (ECC) of the Cabinet has decided to increase gas prices for all the sectors, including domestic, from 10 to 143 percent to bridge deficit of two gas companies by Rs 94 billion. The ECC also decided to increase gas price for other sectors from 30 percent to 57 percent with 40 percent in the price of per MMBTU for commercial Rs 700 to Rs 980 per MMBTU, 50 percent increase for fertilizer (feed) old from Rs 123 to Rs 185 MMBTU. 40 percent increase for fertilizer Industrial & captive Rs 600 to Rs 780 per MMBTU, 57 percent for power Rs 400 to Rs 629 per MMBTU, 30 percent for cement from Rs 750 to Rs 975 per MMBTU, and 40 percent for CNG from Rs 700 to Rs 980 per MMBTU. The increase is likely to reduce the revenue shortfall of companies from Rs 152 billion to Rs 58 billion.

Oracle Corp (ORCL.N) on Monday reported first-quarter revenue that narrowly missed analysts’ estimates, suggesting that the business software maker was struggling to make inroads in the highly competitive cloud computing market. Shares of Oracle fell 4 percent to $47.30 in extended trading as the company’s biggest unit, which houses its cloud services business, also reported disappointing sales. Revenue in its cloud services and license support business rose 3.2 percent to $6.61 billion, falling short of the average analyst estimate of $6.71 billion, with the co-Chief Executive Officer Safra Katz attributing the miss to a strong dollar.

Following the directives of the federal government, the Trading Corporation of Pakistan (TCP) has initiated import of 0.1 million metric tons of urea for domestic consumption. In the second week of this month, the Economic Coordination Committee of the Cabinet had allowed import of some 100,000 metric tons urea to avoid shortage in the domestic market.

China’s state-owned Norinco Group will invest US$ 20 million for the establishment of state of the art manufacturing unit in Punjab. Norinco Group has signed an MoU with Punjab Board of Investment & Trade in connection with establishment of the production facility near Faisalabad Industrial Estate. Chief Executive Officer (PBIT) Jahanzeb Burana received Won John of Norinco Auxin, while COO FIEDMC Aamer Saleemi was also present on the occasion. Jahanzeb Burana assured that PBIT will provide absolute facilitation to Norinco Group to promote valuable communication and coordination as well as utilize their full resources and energies for the expansion of Group’s investment and commercial engagement in Punjab.

A foreign company, Edotco Group Sdn Bhd, which is the subsidiary of Axiata Group Berhad, has announced that it will not be moving forward with the acquisition of 13,000 towers from Pakistan Mobile Communications Limited (PMCL) in Pakistan. The transaction was subject to a number of conditions and terminated due to the non-fulfillment of the conditions precedent to the SPA within the stipulated timeframe, in particular regulatory approval for the resulting change of control contemplated under the SPA. The Edotco remains committed to Pakistan and will continue to grow its existing business under Edotco Pakistan, comprising of the towers acquired by Tanzanite Towers carried out earlier this year.

The Economic Coordination Committee (ECC) of the Cabinet has decided to increase gas prices for all the sectors, including domestic, from 10 to 143 percent to bridge deficit of two gas companies by Rs 94 billion. The ECC also decided to increase gas price for other sectors from 30 percent to 57 percent with 40 percent in the price of per MMBTU for commercial Rs 700 to Rs 980 per MMBTU, 50 percent increase for fertilizer (feed) old from Rs 123 to Rs 185 MMBTU. 40 percent increase for fertilizer Industrial & captive Rs 600 to Rs 780 per MMBTU, 57 percent for power Rs 400 to Rs 629 per MMBTU, 30 percent for cement from Rs 750 to Rs 975 per MMBTU, and 40 percent for CNG from Rs 700 to Rs 980 per MMBTU. The increase is likely to reduce the revenue shortfall of companies from Rs 152 billion to Rs 58 billion.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

The benchmark KSE100 Index have once again bounced back after retesting a descending trend line which is supporting index very aggressively since last two weeks, this time index was coming back to penetrate that line after a breath but could not succeed in closing below that line therefore now it would react much aggressively against any bearish pressure during this week. If index would succeed in closing below that line then next target would be 39,500 points. As of now index would face strong resistances ahead at 40,960 and 41,300 points and it’s recommended to avoid any kind of long positions until index would succeed in closing above these regions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.