Previous Session Recap

The Bench Mark KSE100 Index Opened at 46358.35, posted day high of 46661.74 and day low of 46229.89 during last trading session. The session suspended at 46584.35 points with net change of 226.18 points and net trading volume of 177.42 million shares. Daily trading volume of KSE100 listed companies increased by 5.61 million shares or 3.27% on DOD bases.

Foreign Investors remained in net buying position of 6.67 million shares but net value of Foreign Inflow dropped by 8.61 million US Dollars. Categorically Foreign Individual, Coportate and Overseas Pakistani Investors remained in net buying position of 0.29, 2.48 and 3.90 million shares respectively. While on the other side, Local Companies, Banks, Mutual Funds and Brokers remained in net selling position of 0.82, 0.16, 0.7 and 0.85 million shares respetively but Local Individuals remained in net buying position of 3.37 million shares.

Analytical Review

The dollar stood near a 14-year peak, bond yields were highly elevated and Asian stocks struggled for traction on Friday as global markets continued adjusting to the idea of higher U.S. interest rates. In a move that reverberated across the financial markets, the Fed on Wednesday raised rates for the first time in a year and projected three more increases in 2017, up from the two projected in September. The dollar index against other major currencies last stood at 103.10 after storming to 103.56 overnight, its highest since December 2002. The euro was steady at $1.0427 after hitting $1.0366 overnight, its lowest since January 2003. The dollar was little changed at 118.250 yen after surging to a 10-month high of 118.660 the previous day. The prospect of the Fed tightening monetary policy next year faster than earlier expected drove the benchmark U.S. Treasury 10-year yield to highs unseen in two years.

The Divestment Committee of the Pakistan Stock Exchange (PSX) started receiving bids for the sale of 40 per cent equity stake in the bourse from 4pm on December 15, a press release stated on Friday morning. It said the bids will be received until 4pm on December 22 and will be opened at 5pm on the same day at PSX. “The bids will be opened in the presence of authorised representatives of the respective bidders in line with prescribed procedures,” the statement by the PSX said.

Pakistan spent a total of $38.673 billion on import of different petroleum products during the last five years while a total of 291 new wells were drilled out in different parts of the country during the last three years for exploration of oil and gas to increase domestic output to meet the demand. Total import bill of the petroleum products during the financial year 2011-12 was $9.422 billion; $8.282 billion in 2012-13; $8.899 billion in 2013-14; $7.411 billion in 2014-15 and $4.659 billion in 2015-16.

Government Holding (Private) Limited (GHPL), an arm of the Petroleum Ministry, is expected to be tasked to fund all projects of Inter-State Gas Systems Limited (ISGSL) as a 100 percent subsidiary company, in addition to three years term loan to fund the projects Business Recorder.

The Sindh-based industry has objected to the reversal of the government’s earlier decision to cut the gas price for the industrial sector from Rs600 per million British thermal units (mmBtu) to Rs400 per mmBtu. It said the revised decision will increase the cost of production and render its products uncompetitive in the world market. Industry leaders said reduced prices of wellhead contracts will benefit provinces at the cost of the industry after the reversal of the November 25 decision by the Economic Coordination Committee (ECC).

SEARL, ATRL, SSGC, AKZO, and SMBL can lead market in positive direction.

Technical Analysis

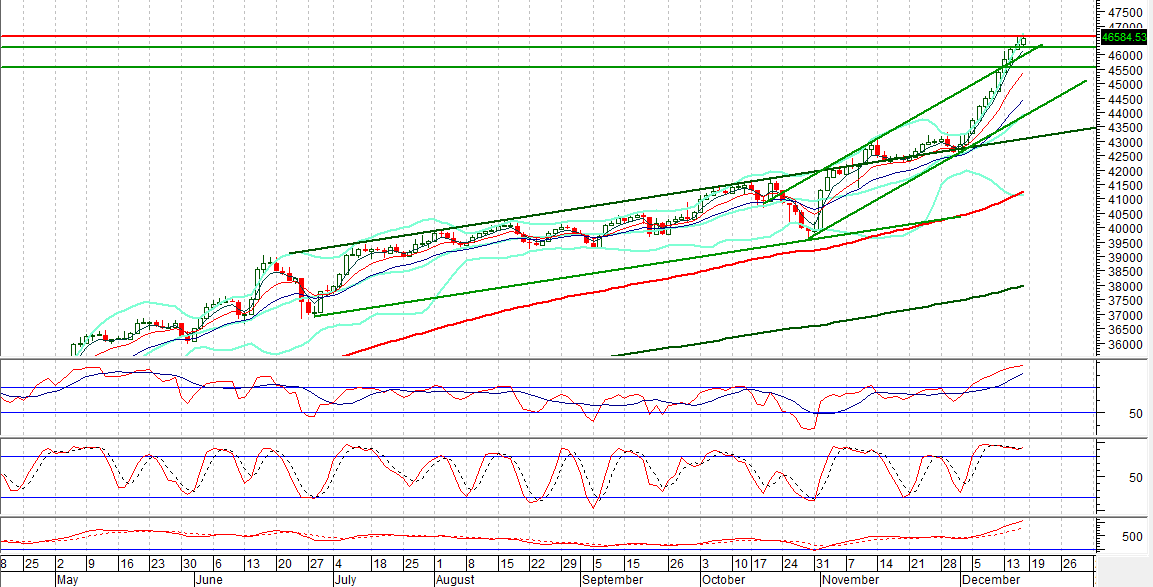

The Bench Mark KSE100 Index is moving in an upward price channel on Intraday chart and right now it has penetrated said channel in upward direction with a gap of around 408 points on Tuesday but has tried to cover that gap during last trading session. It is also supported by a rising trend line inside that bullish channel which is supporting its bullish momentum at 45700 points. Today a slight pressure on intraday bases can be witnessed in KSE100 Index as it can try to fulfill its Gap and a slight pressure can be witnessed on oil sector from international crude oil prices. Market is trying to penetrate its ever high on daily bases so trading with strict stop losses is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.