Previous Session Recap

The Bench Mark KSE100 Index Opened at 48731.50, posted day high of 48971.01 and day low of 48501.42 during last trading session. The session suspended at 48642.21 with net change of -36.64 points and net trading volume of 151.90 million shares. Daily trading volume of KSE100 listed companies dropped by 27.57 million shares or 15.36% on DOD bases.

Foreign Investors remained in net selling position of 8.34 million shares and net value of Foreign Inflow dropped by 10.35 million US Dollars. Categorically Foreign Corporate and Overseas Pakistani Investors remained in net selling position of 8.33 and 0.02 million shares respectively but Foreign Individuals remained in net buying position of 9700 shares. While on the other hand Local Individuals, Companies, Banks and Brokers remained in net buying position of 4.28, 12.63, 2.9 and 1.68 million shares respectively. But Mutual Funds remained in net selling position of 17.27 million shares.

Analytical Review

The dollar kept broad gains against its major rivals on Thursday, after rebounding sharply overnight on comments by Federal Reserve Chair Janet Yellen suggesting U.S interest rates could be raised quickly this year. The dollar rise, however, was tempered as traders were cautious ahead of U.S. President-elect Donald Trump inauguration on Friday. The greenback was little changed at 114.670 yen. The U.S. currency rallied nearly 2 percent the previous day, when it pulled ahead from a seven-week low of 112.570 and snapped a seven-day losing streak. The pound, which had jumped 3 percent on Tuesday to vault above $1.2400 following British Prime Minister Theresa May Brexit speech, lost more than 1 percent overnight. It last traded at $1.2277 , up a fraction on the day.

Ministry of Petroleum asked the CNG sector to retire its outstanding dues of Rs 40 billion collected under the head of Gas Infrastructure Development Cess (GIDC) here on Wednesday. A meeting of the special committee was held to discuss the implementation on report of committee on Infrastructure Development Cess Bill 2015. Senator llyas Ahmed Bilour convened the committee.

The government will complete transactions of three major public sector entities by June this year, Chairman of Privatisation Commission, Muhammad Zubair said on Wednesday. Talking to Dawn, he described 2017 as a strong year for privatisation. In addition to Pakistan Steel Mills (PSM), the government has decided to complete the transactions of Pakistan International Airlines (PIA) and the Oil and Gas Development Company Limited (OGDCL) by June this year, Mr Zubair said.

Prime Minister Nawaz Sharif and Switzerland’s President Doris Leuthard on Wednesday stressed the need for exploring new avenues of cooperation and strengthening bilateral relations. The two leaders made these observations during a meeting on the sidelines of the World Economic Forum’s annual meeting here. The prime minister informed the Swiss president that Pakistan deeply valued its relations with Switzerland and looked forward to enhancing bilateral partnership in diverse areas.

Prices tended higher on the cotton market on Wednesday just after the release of the Pakistan Cotton Ginners Association (PCGA) report, depicting an increase of 11 percent against the last year, dealers said. The official spot rate after maintaining a stable trend for a long time, managed to gain Rs 75 to Rs 6450, dealers said.

SMBL, CHCC, MLCF, PKGS and GTYR can lead market in positive direction.

Technical Analysis

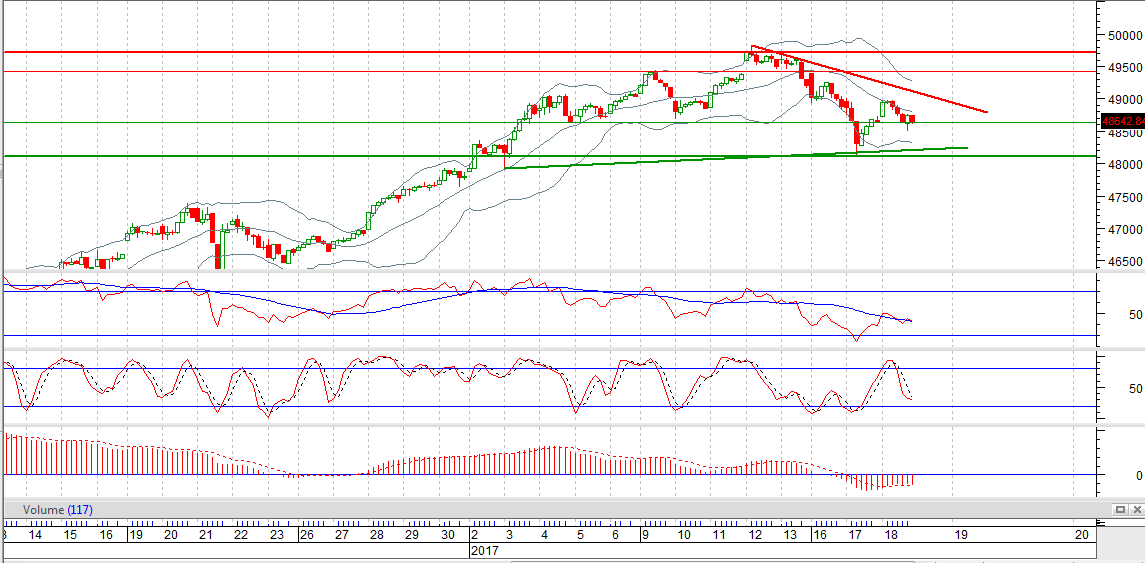

The Bench Mark KSE100 index is capped by a resistant trend line on hourly chart and it has bounced back from its 61.8% bearish correction during last trading session towards negative zone, while it is getting support from its 50% bullish correction during last two trading sessions. Hourly Stochastic and MAORSI is trying to generate bullish crossover so buying with strict stop loss of previous low is recommended because if it would not be able to penetrate it then an upward spike is expected towards 49068 where it will face resistance from resistant trend line.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.