Previous Session Recap

The Bench Mark KSE100 Index opened at 47125.12, posted a day high of 47182.86 and a day low of 46809.19 during the last trading session, where as it suspended at 46874.37 with net change of -250.75 points and net trading volume of 82.62 million shares. Daily trading volume of KSE100 listed companies increased by 17.29 million shares or 26.47% on DoD basis.

Foreign Investors remained in net selling position of 4.27 million shares and net value of Foreign Inflow dropped by 2.65 million US Dollars. Categorically Foreign Individual, Corporate and Overseas Pakistani investors remained in net selling position of 0.071, 4.06 and 0.14 million shares respectively. While on the other side Local Individuals and Brokers remained in net selling position of 9.98 and 6.43 million shares but Local Companies, Banks and Mutual Funds remained in net buying position of 11.03, 4.78 and 3.84 million shares respectively during last trading session.

Analytical Review

Sterling stole the show in Asia on Wednesday amid speculation Britain surprise decision to call a snap election could ultimately deliver a more market-friendly outcome in its divorce from the European Union. Safe-havens stayed in favor as gold and bonds climbed ahead of presidential elections in France and on escalating tensions between the United States and North Korea. Equities were largely sidelined with MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS off 0.1 percent to the lowest since mid-March. Japanese Nikkei .N225 eased 0.2 percent, in line with losses across the region. Sterling surged to a more than six-month top against the dollar after British Prime Minister Theresa May called an early general election for June 8, seeking to strengthen her party majority ahead of Brexit negotiations.

The government is set to increase the rates of 56 withholding taxes (WHTs) for non-filers of income tax returns in the next fiscal year. An official source privy to the budget-making process told Dawn on Tuesday that the existing WHT rates will be further increased while the scope of these taxes will be extended to a maximum number of sectors. “We have decided to raise WHT rates for non-filers by 100pc and (extend them to the) segments that were not covered previously,” the source said. The increase in the incidence of taxation will compel people to file tax returns and come under the tax net to avoid higher rates meant for non-filers.

The International Monetary Fund (IMF) projected on Tuesday that economy of Pakistan will continue to grow at a healthy pace in 2017 and 2018. The World Economic Outlook, which precedes this week annual spring meeting of the IMF and the World Bank, also predicted a noticeable growth in the global economy in 2017, linked to an upsurge in investment, manufacturing and trade activities. The report projects that the world growth is expected to rise to 3.5 per cent this year and 3.6pc in 2018, from 3.1pc last year.

The National Highway Authority (NHA) on Wednesday awarded a contract of over Rs9 billion for the fifth and last section of the China-Pakistan Economic Corridor’s (CPEC) western route. Under the contract, a road from Rehmani Khel to Kot Belian (package 2A of section five) will be constructed. The approved project forms an important section of the Hakla-D I Khan Motorway. The contract was awarded to the lowest evaluated bidder — a joint venture (JV) of construction firms SKB and KNK at their evaluated bid price of Rs9.2bn.

Sahiwal coal-fired power plant would start its generation in the third week of May 2017, the Punjab Power Development Board spokesman said here on Tuesday. The first unit of the plant would start generating 660 MW electricity next month while the plant would be fully operational with total capacity of 1320 MW in June 2017, he said while talking to APP. The spokesman said power would be evacuated through 500 kv grid stations each in Yousafwala and Lahore.

The Market is expected to remain volatile today. We advise Traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

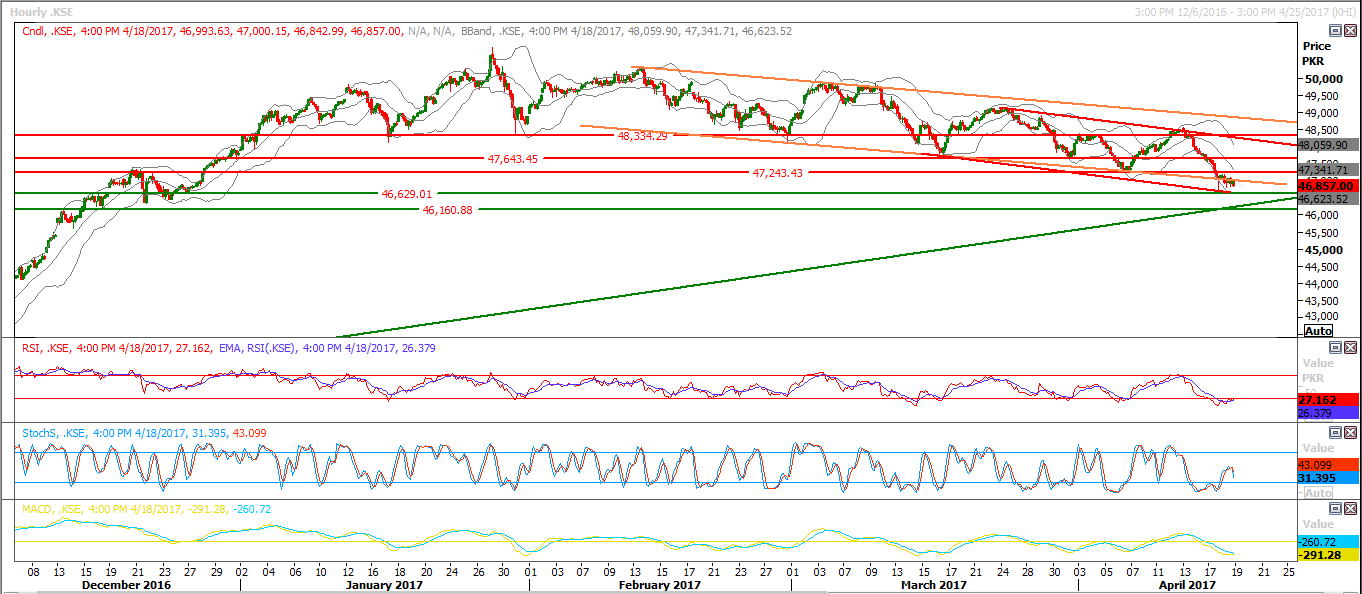

The Benchmark KSE100 index is attempting to form a double bottom on daily charts, by retesting its supportive trend line. We foresee further downside towards a support at 46160-46000, Incase 46630 is breached. However, the major supportive region for the index lies at 45460, for the sessions to come. For today’s session, buying above 46160 is recommended with a strict stop loss at 46000 in place.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.