Previous Session Recap

Trading volume at PSX floor dropped by 89.72 million shares or 64.19% on DoD basis, whereas, the benchmark KSE100 Index opened at 38660.09, posted a day high of 38703.15 and a day low of 38337.37 during last trading session. The session suspended at 38383.97 with net change of -261.93 and net trading volume of 25.41 million shares. Daily trading volume of KSE100 listed companies dropped by 69.45 million shares or 73.22% on DoD basis.

Foreign Investors remained in net selling position of 3.15 million shares but net value of Foreign Inflow increased by 0.96 million US Dollars. Categorically, Foreign Individuals remained in net buying of 0.14 million shares but Foreign Corporate and Overseas Pakistan Investors remained in net selling positions of 1.35 and 1.94 million shares. While on the other side Local Individuals, Banks, NBFCs and Insurance Companies remained in net selling positions of 7.73, 1.31, 0.31 and 0.4 million shares respectively but Local Companies, Mutual Funds and Brokers remained in net buying positions of 0.37, 1.14 and 11.4 million shares respectively.

Analytical Review

Asian stocks advanced on Tuesday after a record-setting session on Wall Street on bets that U.S. lawmakers would pass sweeping tax legislation, while the dollar treaded water as traders were circumspect about the bill’s economic impact. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.3 percent. Australian shares added 0.6 percent, Hong Kong’s Hang Seng rose 0.7 percent and Shanghai climbed 0.4 percent. South Korea’s KOSPI lost 0.2 percent and Japan’s Nikkei trimmed earlier gains and was last 0.05 percent higher. Wall Street hit record highs on Monday on growing optimism about lower corporate tax rates as the Republican tax bill moved closer to passage. Global markets have been buffeted in recent weeks by shifting expectations about President Donald Trump’s ability to push through his signature policy.

Minister for Planning and Development Ahsan Iqbal said on Monday that the government was examining a proposal to replace the US dollar with the Chinese yuan for trade between China and Pakistan. He was talking to journalists after the formal launch of Long Term Plan (LTP) for the China-Pakistan Economic Corridor (CPEC) 2017-30 signed by the two sides on Nov 21. Newly-appointed Chinese Ambassador Yao Jing and officials of the provincial governments also attended the launching ceremony. Asked if the Chinese currency could be allowed for use in Pakistan, Mr Iqbal said the Pakistani currency would be used within the country, but China desired that bilateral trade should take place in its currency — known as Renminbi (RMB) or yuan — and “we are examining the use of RMB instead of the US dollar for trade between the two countries”. He said the use of RMB was not against the interest of Pakistan, rather it would benefit the country.

Fear of fuel shortage is looming over Azad Jammu & Kashmir, Gilgit Baltistan and Chitral as oil tankers have stopped supply of fuel to these areas. Since the government has delayed the increase in oil tankers fares the oil supply to these hilly areas has been completely choked and the fuel shortage on the petrol pumps is going to start within one week, said All Pakistan Oil Tankers and Contractors Association General Secretary Nauman Ali Butt while talking to media here. When asked for how many days do you think the oil shortage crises will start in those areas, Nauman Butt replied that currently these areas have 0.7 million litres of fuel supplies and it will take a week for drying the pumps. The daily consumption of fuel in these areas is 50000 to 60000 liters and the crisis is going to start by the end of current week, he said.

Pakistan and Asian Development Bank (ADB) have signed two loan agreements for provision of $180 million for CAREC Corridor Development Investment Programme and $200 million for Punjab Intermediate Cities Improvement Investment Project. The ADB has committed to provide $800 million for financing infrastructure projects under the Central Asia Regional Economic Cooperation (CAREC) Corridor Development Investment Programme. Under this programme, ADB will provide $180 million as first tranche to National Highway Authority for improving road network along N-55. NHA will construct additional 2-lane carriageway of 66kms along the existing 2-lane of Petaro – Sehwan Road and 43kms along the existing 2-lane of Ratodero – Shikarpur Road. It will also help in rehabilitation of the existing 34kms 4-lane carriageway of Dara Adamkhel –Peshawar Road. This would also provide due diligence advisory services to NHA for preparing projects under subsequent tranches.

An agreement for production of light commercial and passenger vehicles has been signed between the Ministry of Industries & Production and KIA Lucky Motors. According to the details, the company will invest $115 million for setting up an automobile assembly plant in Karachi that will produce wide range of commercial and passenger vehicles. The agreement has been signed for production of light commercial and passenger vehicles under Automotive Development Policy 2016-2021. This week Pakistani auto sector is taking a big leap with Hyundai plant inauguration in Faisalabad and KIA Lucky agreement signed already. The new auto policy announced last year is finally bringing fruits for Pakistani consumers, said the official. The Korean auto giant KIA Motors is a favorite brand in GCC, US and European markets. KIA website shows products range from low-cost hatchbacks to luxury sedans, from crossovers to SUVs, most of them with plug-in hybrid variants as well.

Market is expected to remain volatile today therefore its recommended to stay cautious during current trading session.

Technical Analysis

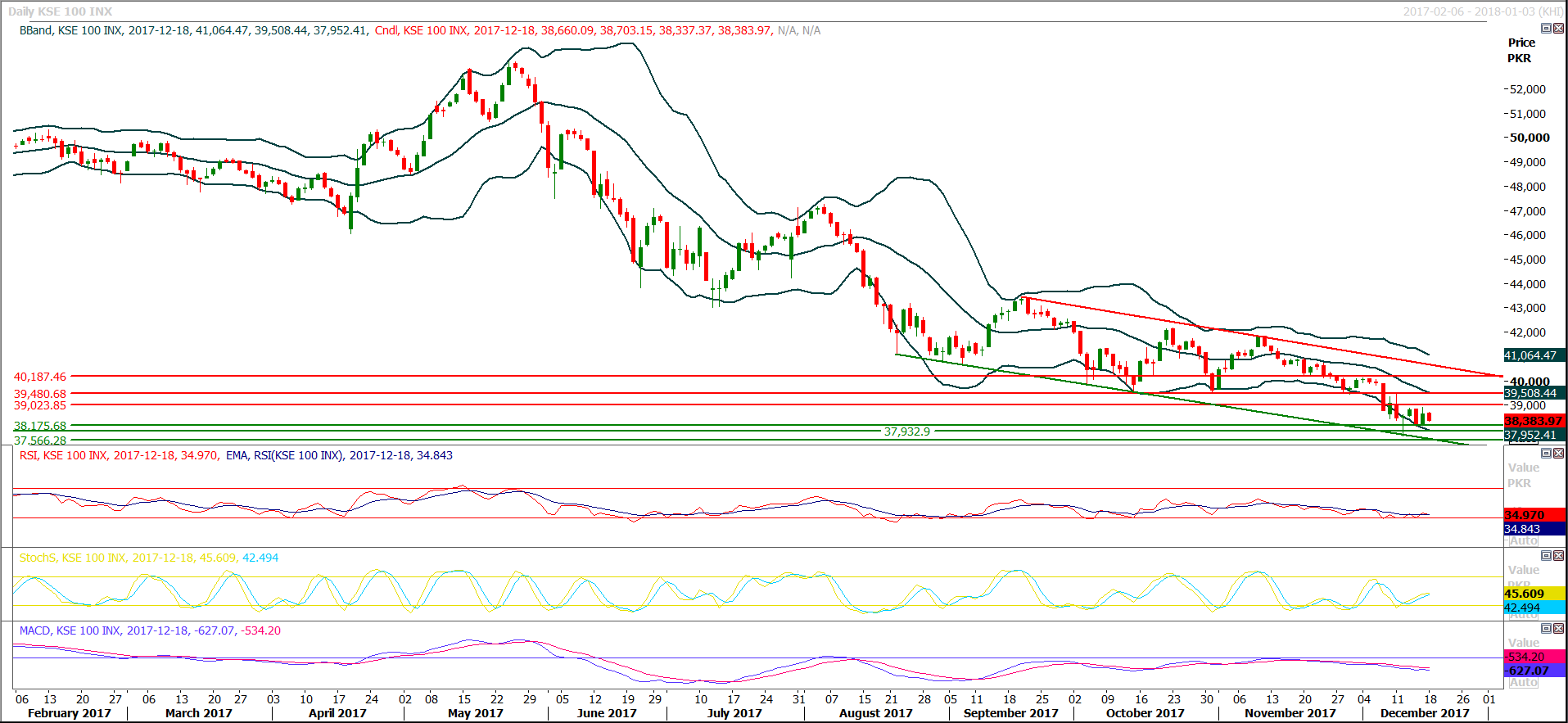

The Benchmark KSE100 Index is moving in a bearish trend channel on daily chart and have tried to bounce back after retesting its supportive trend line on daily chart and completing its 100% expansion on hourly chart during last week. As of right now index have a supportive region around 38100 which would try to support index but if index would close below that level then index would enter into a new bearish expansion which would lead index towards 37570 and 37087 points. Index have bounced back after completing its bullish correction as well therefore there is still a hope that if 38100 region would be maintained then index would try to retest 39023 points region and breakout of that region would open doors for a better monthly closing along with a yearly closing. Its recommended to stay cautious and buy on dips with strict stop loss and sell on stregths during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.