Previous Session Recap

Trading volume at PSX floor dropped by 136.09 million shares or 33.01% on DoD basis, whereas the benchmark KSE100 index opened at 41,768.66, posted a day high of 41,920.62 and a day low of 41,389.60 points during last trading session while session suspended at 41,603.71 points with net change of -164.95 points and net trading volume of 182.86 million shares. Daily trading volume of KSE100 listed companies dropped by 71.03 million shares or 27.98% on DoD basis.

Foreign Investors remained in net buying positions of 5.99 million shares and value of Foreign Inflow increased by 1.64 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.01 and 6.61 million shares but Foreign Corporate remained in net selling positions of 0.63 million shares. While on the other side Local Individuals, Brokers and Insurance Companies remained in net buying positions of 11.40, 0.07 and 3.92 million shares but Local Companies, Banks, NBFCs and Mutual Fund remained in net selling positions of 4.72, 1.78, 0.007 and 11.52 million shares respectively.

Analytical Review

Asian shares ease from highs, reaction to impeachment muted

Asian shares pulled back from a one-and-a-half year peak on Thursday as investors booked profits ahead of holiday trade and awaited further data on the state of the global economy. Investors were also watching proceedings in Washington where the Democrat-led U.S. House of Representatives voted to impeach Republican U.S. President Donald Trump for abuse of power and obstruction of Congress. Market reaction, however, has so far been limited as the Republican-controlled Senate is widely expected not to vote to remove Trump from office. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS briefly touched the highest since June 2018 but then fell 0.2%. Australian shares erased early gains to trade 0.14% lower due to declines in the mining sector, while Chinese shares .CSI300 drifted 0.06% lower.

Large-scale manufacturing contracts shrink for seventh month in row

The country’s large-scale manufacturing (LSM) shrank for seventh month in row raising fears of massive layoffs across the industrial sector. The LSM Index contracted by 7.97 per cent year-on-year in October, the Pakistan Bureau of Statistics (PBS) reported on Wednesday. The data further showed that between July to October, big industry output declined by 6.48pc on a year-on-year basis. The latest monthly decrease was mainly led by 41.77pc plunge in automobile sector, 39.28pc in electronic products, followed by 11.73pc in petroleum products and 8.25pc in food products. In 2018-19, the large manufacturing sectors recorded a decline of 3.64pc against the target growth of 8.1pc. The government has set LSM target of 3.1pc for the ongoing fiscal year.

Cotton output set to hit record low

Continuing its consistent fall for the sixth year in row, the country’s cotton output in the ongoing season is set to hit record low at 8.5 million bales. Production data released by the Pakistan Cotton Ginners Association (PCGA) on Wednesday revealed that the country is likely to face a shortfall of around 2.1m bales. Cotton analysts firmly believe that the total production to remain below the 9m mark. PCGA Chairman Jawed Sohail Rehmani feared the current season would be the worst as initial estimates suggest that only 8.5m bales of cotton may be produced. He added that cotton is a cash crop and backbone of the economy because around 65 per cent of the country’s exports depend on this crop but lamented the government’s lack of attention to the changing trend.

Slight increase in textile exports

The exports of textile and clothing grew by 4.68 per cent year-on-year to $5.76 billion during the first five months of 2019-20, showed data released by the Pakistan Bureau of Statistics on Tuesday. The overall improvement in current account after a gap of five years was mainly contributed by increase in exports of textile and clothing and decline in import of oil and food products. In November, textile and clothing export proceeds were recorded at $1.17bn, higher by 7.03pc, from $1.09bn over the corresponding month last year.

Pakistan ranks 151 out of 153 on global gender parity index: World Economic Forum report

Pakistan ranked 151 out of 153 countries on the Global Gender Gap Index Report 2020 index, published by the World Economic Forum (WEF) on Tuesday, only managing to surpass Iraq and Yemen. The scorecard for the country places Pakistan at 150 in economic participation and opportunity, 143 in educational attainment, 149 in health and survival and 93 in political empowerment. A comparison of previous rankings shows that the overall ranking for Pakistan has drastically slipped from 112 in 2006 to 151 in 2020. Likewise, the country slipped from 112 to 150 in economic participation and opportunity, from 110 to 143 in educational attainment, from 112 to 149 in health and survival and from 37 to 93 in political empowerment during the same period.

Asian shares pulled back from a one-and-a-half year peak on Thursday as investors booked profits ahead of holiday trade and awaited further data on the state of the global economy. Investors were also watching proceedings in Washington where the Democrat-led U.S. House of Representatives voted to impeach Republican U.S. President Donald Trump for abuse of power and obstruction of Congress. Market reaction, however, has so far been limited as the Republican-controlled Senate is widely expected not to vote to remove Trump from office. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS briefly touched the highest since June 2018 but then fell 0.2%. Australian shares erased early gains to trade 0.14% lower due to declines in the mining sector, while Chinese shares .CSI300 drifted 0.06% lower.

The country’s large-scale manufacturing (LSM) shrank for seventh month in row raising fears of massive layoffs across the industrial sector. The LSM Index contracted by 7.97 per cent year-on-year in October, the Pakistan Bureau of Statistics (PBS) reported on Wednesday. The data further showed that between July to October, big industry output declined by 6.48pc on a year-on-year basis. The latest monthly decrease was mainly led by 41.77pc plunge in automobile sector, 39.28pc in electronic products, followed by 11.73pc in petroleum products and 8.25pc in food products. In 2018-19, the large manufacturing sectors recorded a decline of 3.64pc against the target growth of 8.1pc. The government has set LSM target of 3.1pc for the ongoing fiscal year.

Continuing its consistent fall for the sixth year in row, the country’s cotton output in the ongoing season is set to hit record low at 8.5 million bales. Production data released by the Pakistan Cotton Ginners Association (PCGA) on Wednesday revealed that the country is likely to face a shortfall of around 2.1m bales. Cotton analysts firmly believe that the total production to remain below the 9m mark. PCGA Chairman Jawed Sohail Rehmani feared the current season would be the worst as initial estimates suggest that only 8.5m bales of cotton may be produced. He added that cotton is a cash crop and backbone of the economy because around 65 per cent of the country’s exports depend on this crop but lamented the government’s lack of attention to the changing trend.

The exports of textile and clothing grew by 4.68 per cent year-on-year to $5.76 billion during the first five months of 2019-20, showed data released by the Pakistan Bureau of Statistics on Tuesday. The overall improvement in current account after a gap of five years was mainly contributed by increase in exports of textile and clothing and decline in import of oil and food products. In November, textile and clothing export proceeds were recorded at $1.17bn, higher by 7.03pc, from $1.09bn over the corresponding month last year.

Pakistan ranked 151 out of 153 countries on the Global Gender Gap Index Report 2020 index, published by the World Economic Forum (WEF) on Tuesday, only managing to surpass Iraq and Yemen. The scorecard for the country places Pakistan at 150 in economic participation and opportunity, 143 in educational attainment, 149 in health and survival and 93 in political empowerment. A comparison of previous rankings shows that the overall ranking for Pakistan has drastically slipped from 112 in 2006 to 151 in 2020. Likewise, the country slipped from 112 to 150 in economic participation and opportunity, from 110 to 143 in educational attainment, from 112 to 149 in health and survival and from 37 to 93 in political empowerment during the same period.

Market is expected to remain volatile during current trading session.

Technical Analysis

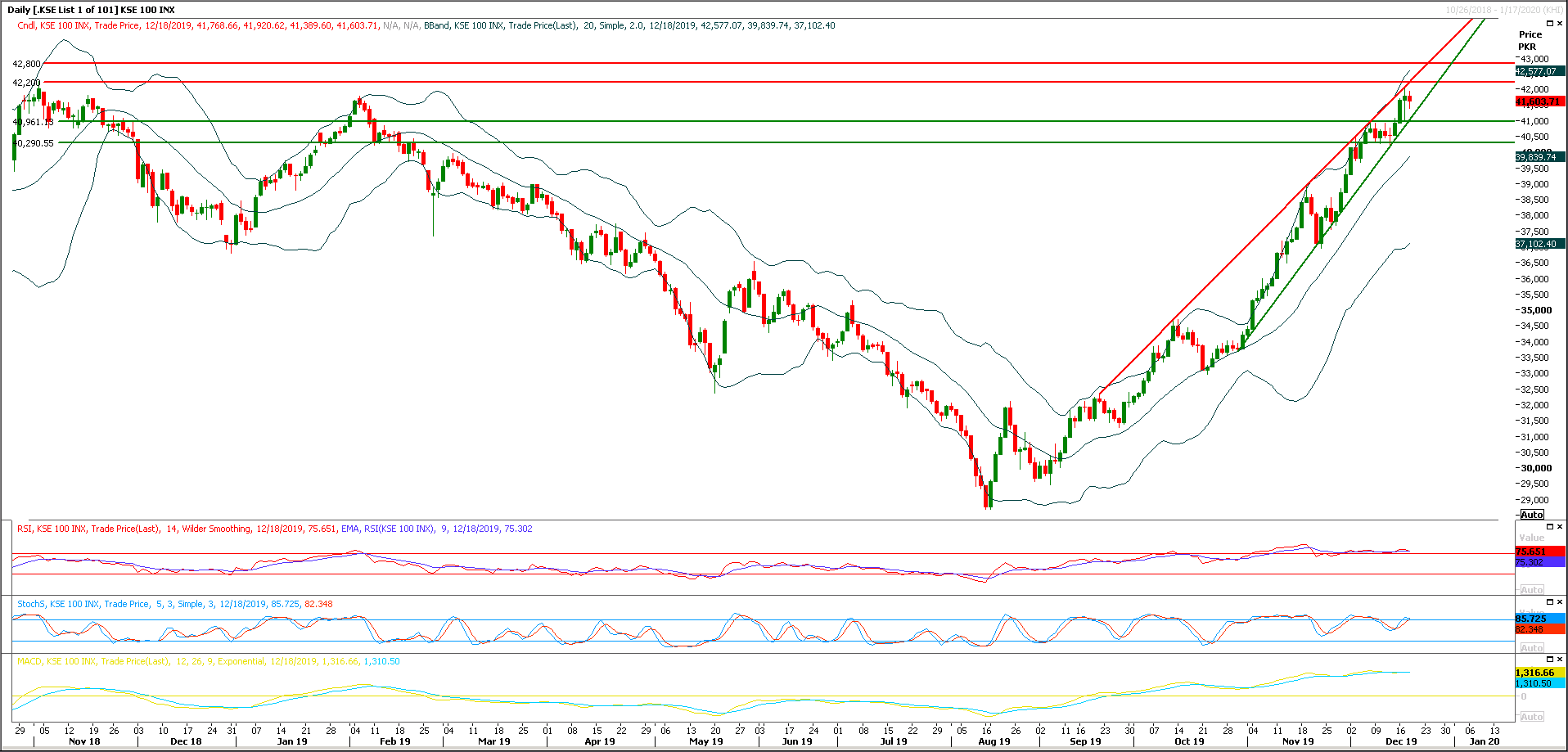

The Benchmark KSE100 index is caged in a rising wedge on daily chart and have retested its supportive regions during last trading session after getting resistance from resistant trend line of said formation. As of now it's expected that index would continue its bullish momentum if it would succeed in penetration above 42,200 points on daily chart because on that region resistant trend line of said wedge would break. It's recommended to post trailing stop loss on existing long positions and stay cautious because in case of rejection index would try to move downward to retest its supportive trend line which fall at 40,200 points while rejection from resistance on intraday basis could confirm formation of an evening shooting star on daily chart. Breakout of this wedge in either direction would call for a further 800-1500pts.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.