Previous Session Recap

Trading volume at PSX floor dropped by 8.32 million shares or 8.32% on DoD basis, whereas the benchmark KSE100 index opened at 40,276.93, posted a day high of 40,600.80 and a day low of 40,065.86 points during last trading session while session suspended at 40,175.35 points with net change of -101.58 points and net trading volume of 70.40 million shares. Daily trading volume of KSE100 listed companies also dropped by 7.18 million shares or 9.26% on DoD basis.

Foreign Investors remained in net selling positions of 3.90 million shares and value of Foreign Inflow increased by 0.67 million US Dollars. Categorically, Foreign Individuals remained in net long positions of 0.0025 million shares and Foreign Corporate and Overseas Pakistani remained in net selling positions of 0.54 and 3.36 million shares respectively. While on the other side Local Individuals, Banks, NBFCs, Brokers and Insurance Companies remained in net long positions of 0.086, 1.65, 0.32, 4.12 and 1.99 million shares but Local Companies and Mutual Fund remained in net selling positions of 0.47 and 3.73 million shares respectively.

Analytical Review

Asian shares nudge up as virus spread slows, euro fragile

Asian shares and U.S. stock futures edged cautiously higher on Wednesday, as investors tried to shake off worries about the coronavirus epidemic after a slight decline in the number of new cases. MSCI’s broadest index of Asia-Pacific shares outside Japan eked out a minor 0.03% gain but spent much of the morning session bouncing between gains and losses. Chinese shares erased early declines to trade 0.15% higher. Australian shares were up 0.02%, while Japan’s Nikkei stock index rose 0.5%. The euro languished at a three-year low versus the dollar as disappointing data from Germany, Europe’s largest economy, has stoked fears that the euro zone is more vulnerable to external shocks than previously thought. The Treasury curve remained inverted on Wednesday as yields on three-month bills traded above yields on 10-year notes in a sign that some investors remain cautious about the outlook.

Cotton production falls to 8.6m bales

Cotton production fell by 20.12 per cent to 8.6 million bales till January 15 this season against 10.7m bales in the same period last year, the Pakistan Cotton Ginners Association (PCGA) said on Tuesday. In its fortnightly report, the PCGA noted that the production of cotton bales went down by 2.153m in the current season. The country is likely to miss the target of 9.5m bales. According to the PCGA figures till Feb 15, Punjab suffered cotton production losses by up to 22.7pc, followed by Sindh with 16.3.

SECP agrees to amend brokers’ regime

The Securities and Exchange Commission of Pakistan (SECP) on Tuesday agreed to amend the new brokers regime regulations to accommodate the demands of PSX Stockbrokers Association (PSA). The decision came after negotiations with brokers from Lahore and Karachi via electronic links. The SECP had notified the new regime on Feb 3 but was faced with serious reservations from the PSA, which even threatened to approach the court of law against certain clauses of the Securities Brokers (Licensing and Operations) Regulations, 2016. However, after detailed discussions between the PSA and SECP, led by Chairman Amir Khan, the financial requirements for category II - Trading and Self-Clearing (TSC) brokers has been decreased.

China to help fight locusts as major crops face danger

China is sending a team of technical experts to Pakistan to deliberate on the aerial management of locust swarms in the country. The locust swarm invaded the country last year and has devastated the cotton crop in the last planting season and is already threatening the country’s wheat crop. The swarm arrived last summer, but has grown to threatening proportions since November 2019 when the Food and Agriculture Organisation (FAO) issued a warning that the swarm has started to leave its reproducing grounds in the deserts from Cholistan to Tharparkar. The federal government has declared an emergency this month but is struggling to figure out a robust response.

Ministry to propose Rs140b allocation for 15 hydropower projects in PSDP 2020-21

The Ministry of Water Resources is likely to propose an allocation of Rs140 billion for 15 Hydropower Projects of WAPDA with the total cost of Rs1363 billion in the Public Sector Development Programme (2020-21). The power division will make a demand of Rs140 billion for the next PSDP 2020-21 which is Rs19 billion higher than the current fiscal, according the documents available with The Nation. Of the total demand of Rs140 billion, Rs 38 billion is Foreign Exchange Component (FEC) while Rs 102 billion is local component, said the document. For three hydropower projects in initial stage with the generation capacity of 3698 MW and total estimated cost of Rs620 billion, allocation of Rs100 billion in next PSDP has been proposed. For the refurbishment of four Hydro Power stations of 580 MW, the demand for allocation in coming fiscal is Rs14.67 billion. The total cost of the project is Rs80.72 billion.

Asian shares and U.S. stock futures edged cautiously higher on Wednesday, as investors tried to shake off worries about the coronavirus epidemic after a slight decline in the number of new cases. MSCI’s broadest index of Asia-Pacific shares outside Japan eked out a minor 0.03% gain but spent much of the morning session bouncing between gains and losses. Chinese shares erased early declines to trade 0.15% higher. Australian shares were up 0.02%, while Japan’s Nikkei stock index rose 0.5%. The euro languished at a three-year low versus the dollar as disappointing data from Germany, Europe’s largest economy, has stoked fears that the euro zone is more vulnerable to external shocks than previously thought. The Treasury curve remained inverted on Wednesday as yields on three-month bills traded above yields on 10-year notes in a sign that some investors remain cautious about the outlook.

Cotton production fell by 20.12 per cent to 8.6 million bales till January 15 this season against 10.7m bales in the same period last year, the Pakistan Cotton Ginners Association (PCGA) said on Tuesday. In its fortnightly report, the PCGA noted that the production of cotton bales went down by 2.153m in the current season. The country is likely to miss the target of 9.5m bales. According to the PCGA figures till Feb 15, Punjab suffered cotton production losses by up to 22.7pc, followed by Sindh with 16.3.

The Securities and Exchange Commission of Pakistan (SECP) on Tuesday agreed to amend the new brokers regime regulations to accommodate the demands of PSX Stockbrokers Association (PSA). The decision came after negotiations with brokers from Lahore and Karachi via electronic links. The SECP had notified the new regime on Feb 3 but was faced with serious reservations from the PSA, which even threatened to approach the court of law against certain clauses of the Securities Brokers (Licensing and Operations) Regulations, 2016. However, after detailed discussions between the PSA and SECP, led by Chairman Amir Khan, the financial requirements for category II - Trading and Self-Clearing (TSC) brokers has been decreased.

China is sending a team of technical experts to Pakistan to deliberate on the aerial management of locust swarms in the country. The locust swarm invaded the country last year and has devastated the cotton crop in the last planting season and is already threatening the country’s wheat crop. The swarm arrived last summer, but has grown to threatening proportions since November 2019 when the Food and Agriculture Organisation (FAO) issued a warning that the swarm has started to leave its reproducing grounds in the deserts from Cholistan to Tharparkar. The federal government has declared an emergency this month but is struggling to figure out a robust response.

The Ministry of Water Resources is likely to propose an allocation of Rs140 billion for 15 Hydropower Projects of WAPDA with the total cost of Rs1363 billion in the Public Sector Development Programme (2020-21). The power division will make a demand of Rs140 billion for the next PSDP 2020-21 which is Rs19 billion higher than the current fiscal, according the documents available with The Nation. Of the total demand of Rs140 billion, Rs 38 billion is Foreign Exchange Component (FEC) while Rs 102 billion is local component, said the document. For three hydropower projects in initial stage with the generation capacity of 3698 MW and total estimated cost of Rs620 billion, allocation of Rs100 billion in next PSDP has been proposed. For the refurbishment of four Hydro Power stations of 580 MW, the demand for allocation in coming fiscal is Rs14.67 billion. The total cost of the project is Rs80.72 billion.

Market is expected to remain volatile during current trading session.

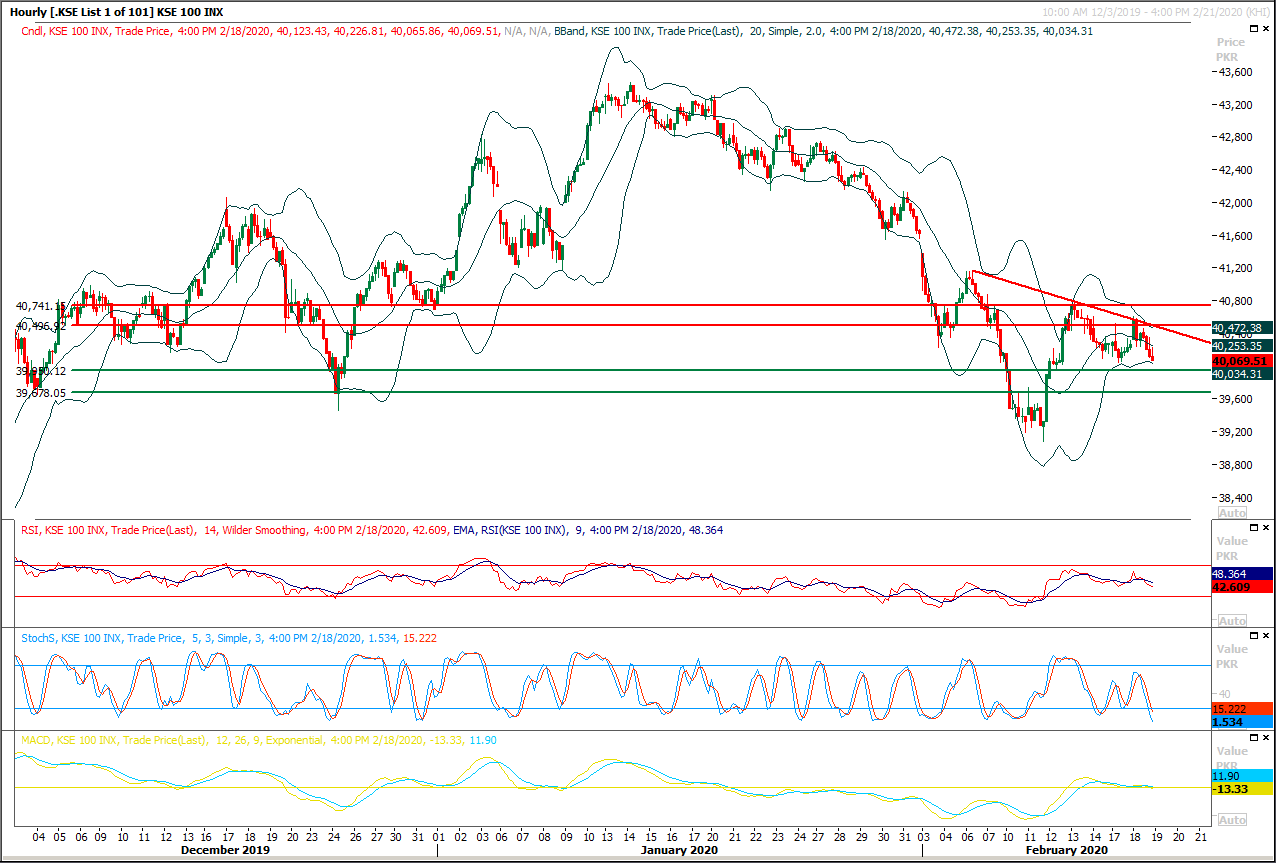

Technical Analysis

The Benchmark KSE100 index is trying to format a double bottom on daily chart since last two trading session and if index would succeed in starting a pull back before 40,000 points today then this bottom would be considered as a strong supportive region in coming days. Daily momentum indicators are in bearish mode and these would try to push index further downward on breakout below 40,000pts, therefore it's recommended to stay cautious and post strict stop loss on both sides. If index would succeed in closing above 40,500 points then it next targets would be 40,900 and 41,000 points. While on flip side in case of breakout below 40,000 points index would target 39,500 points and breakout below that region would try to call for a new monthly low in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.