Previous Session Recap

Trading volume at PSX floor increased by 117.12 million shares or 77.39% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43626.06 with a positive gap of 267.09 points, posted a day high of 44004.13 and a day low of 43192.75 during last trading session. The session suspended at 43580.88 with net change of 221.91 and net trading volume of 124.53 million shares. Daily trading volume of KSE100 listed companies increased by 60.51 million shares or 94.51% on DoD basis.

Foreign Investors remained in net buying postion of 1.28 million shares and net value of Foreign Inflow increased by 4.97 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani investors remained in net buying positions of 0.11, 0.11 and 1.06 million shares respectively. While on the other side Local Individuals, NBFCs and Mutual Funds remained in net buying positions of 11.61, 0.64 and 3.81 million shares but Local Companies, Banks, Brokers and Insurance Companies remained in net selling positions of 0.88, 3.14, 11.25 and 3.43 million shares respectively.

Analytical Review

Asia stocks edged higher on Friday and were within reach of record highs, although losses on Wall Street slowed the advance, while worries over a possible U.S. government shutdown weighed on the dollar. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS added 0.1 percent. The index was poised for a 1 percent gain on the week, during which it rode a surge in global equities and climbed to a record high on Thursday. Optimism over the global economic growth outlook and improved corporate earnings have helped share markets rally at the start of 2018. Supporting economic confidence was data on Thursday that showed China’s growth in 2017 accelerated for the first time in seven years. Australian stocks were mostly flat, South Korea's KOSPI .KS11 climbed 0.1 percent and Japan's Nikkei .N225 rose 0.2 percent.

The total liquid foreign reserves held by the country stood at $19,771.5m on January 12, 2018. The weekly break-up of the foreign reserves position released on Thursday showed that foreign reserves held by the State Bank of Pakistan stood at $13,699m and net foreign reserves held by commercial banks are $6,072.5 million. During the week ending 12th January, SBP’s reserves decreased by $284 million to $13,699 million, due to external debt servicing and other official payments.

Pakistan Electric Power Company (PEPCO) has established special monitoring cell headed by GM/chief engineer to execute the constraints removal by the DISCOs at the end of March 2018 enabling to enforce zero loadshedding on 0-10% losses feeders across the country. On the directions of the federal minister for power division all distribution companies have established special constraint removal war rooms (CRWR). The directions were passed in a special meeting with all the CEOs, technical staff associated with distribution network, PEPCO and other concerned officials at the power division here today. The DISCOs are further directed to equip the constraint removal war rooms with CCTV cameras connected with centralised monitoring system via communication link of Power information Technology Company (PITC) for continued monitoring by the federal minister for power division himself. The CCTV cameras will have direct access through smart mobile of the federal minister for power division.

The Standing Committee of the cabinet on legislative business has recommended the inclusion of the cement industry in schedule-C of the industrial location policy 2002. Punjab Chief Minister Shehbaz Sharif has already approved the summary for the imposition of ban on installation of new cement plants in the entire province. It is pertinent to mention here that, the law secretary Syed Abul Hasan Najmi, a couple of days back, had proposed to forward the matter to the chief minister. The CM may kindly approve the proposal of enfolding the cement industries within the regulatory framework under the ordinance, he wrote. Moreover, the matter may be placed before the cabinet sub-committee on legislation for appropriate recommendations to the cabinet , the law secretary had written.

French Ambassador to Pakistan Dr Mark Barety has said that his first goal is to promote trade between the two countries, saying that he has evolved an action plan in this regard. He was talking to LCCI President Malik Tahir Javaid, Vice President Zeshan Khalil and Executive Committee members here at the Lahore Chamber of Commerce & Industry. Ijaz A. Mumtaz, Sohail Lashari, Amjad Ali Jawa, Awais Saeed Piracha, Shahid Nazir, Tahir Manzoor Chaudhry, Nabila Intesar and others were also present on the occasion. French Ambassador said that help to French and Pakistani businessmen to visit each other’s country, exchange of valuable trade, business & investment related information and ease of visa processing are his action plan for boosting mutual trade relations. He said that new French president is taking various initiatives for economic stability of the country. He said that regulations are being simplified to make doing business in France easy.

Its recommended to practice caution as market is expected to remain volatile.

Technical Analysis

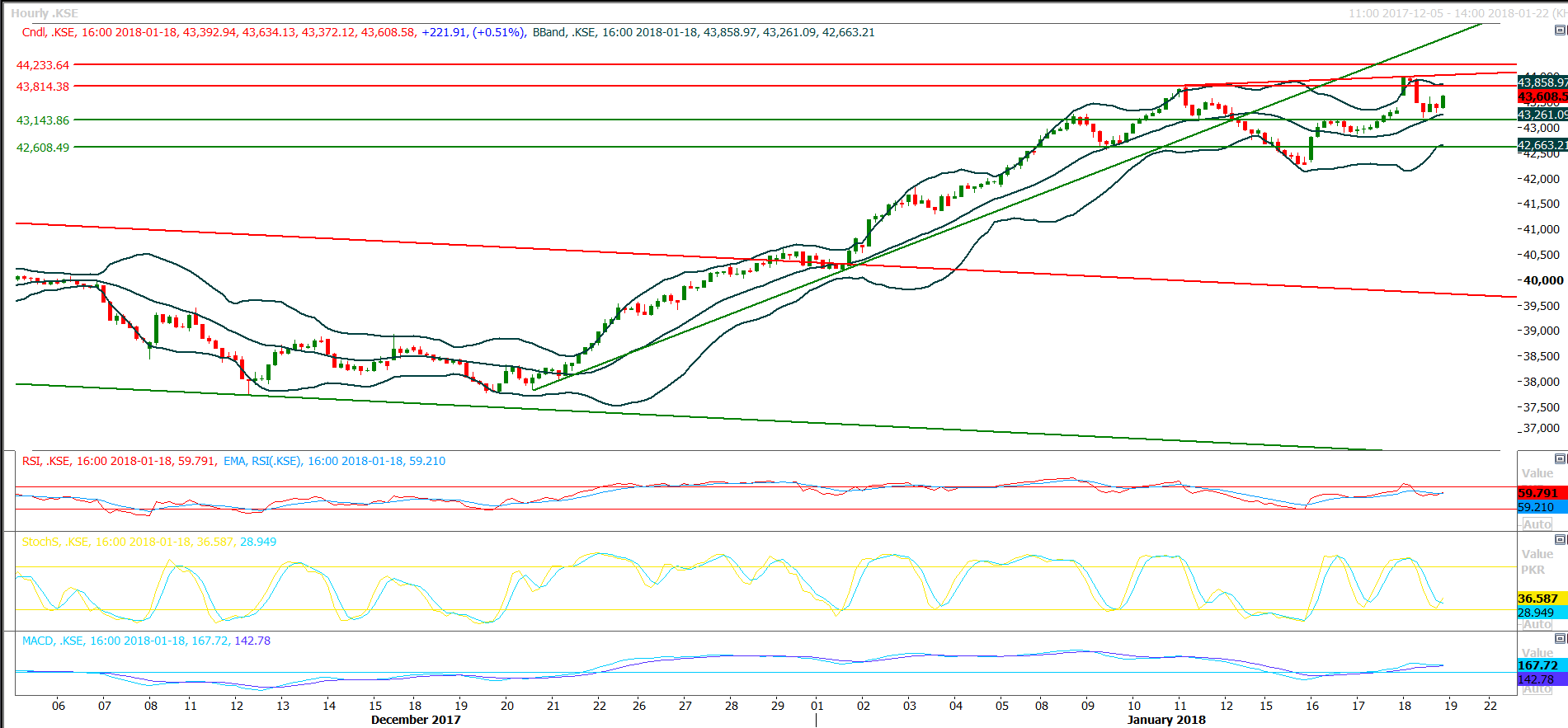

The Benchmark KSE00 Index is capped by two horizontal resistances at 43814 and 44233 points along with a resistant trend line at 44032 and these regions would try to push index back in negative zone during current trading session. Index have created a doji on daily chart during last trading session and if index would not become able to close above its resistant regions and slipped below 43140 then an evening star would be formatted which would push index in negative zone for a correction therefore daily closing of current trading session matters a lot for short term trend of index.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.