Previous Session Recap

Trading volume at PSX floor increased by 105.85 million shares or 74.56% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 39,658.99, posted a day high of 40,012.61 and a day low of 39,333.49 during last trading session. The session suspended at 40,897.90 with net change of 964.92 and net trading volume of 131.27 million shares. Daily trading volume of KSE100 listed companies increased by 44.87 million shares or 51.94% on DoD basis.

Foreign Investors remained in net selling position of 15.4 million shares and net value of Foreign Inflow dropped by 4.32 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling positions of 0.04, 12.81 and 2.56 million shares respectively. While on the other side Local Individuals, Companies, Brokers and Insurance Companies remained in net buying positions of 15.03, 6.08, 0.77 and 3.62 million shares respectively but Banks remained in net selling positions of 11.4 million shares.

Analytical Review

Asian shares higher on U.S. earnings but trade worries rattle offshore yuan

Asian shares made early gains on Thursday as upbeat Wall Street earnings supported global investor sentiment, although trade war jitters pushed China’s offshore yuan to a fresh one-year low. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.53 percent, while Japan’s Nikkei and the Australian benchmark advanced 0.42 percent and 0.38 percent, respectively. On Wall Street, the Dow Jones Industrial Average rose 0.32 percent and the S&P 500 gained 0.22 percent to hit a more than five-month high, while the Nasdaq Composite declined marginally by 0.01 percent.

IMF bailout only option for next govt

The new government would have no other option than to approach International Monetary Fund (IMF) for bailout package amid deteriorating economic situation of the country that is going from bad to worse. Pakistan's economic situation is deteriorating with the passage of time as rupee is depreciating sharply, foreign exchange reserves are tumbling, current account and budget deficits are widening more than projections. Trade deficit has recently touched all-time high $37.67 billion during previous fiscal year. Similarly, Pakistan's debt has increased to Rs24.5 trillion or 72percent of the GDP of the country.

Work on CASA-1000 power project in full swing: Tajik diplomat

The Central Asia-South Asia power project (CASA-1000) is in full swing and would ready to transmit surplus hydroelectricity from Tajikistan and Kyrgyzstan to Pakistan and Afghanistan by mid 2020, a diplomat from Tajikistan said. Afghanistan is responsible for providing security to the CASA-1000 transmission line in its area and the project will be ready to supply power to Afghanistan and Pakistan within next two years, said the first Secretary of the Embassy of Tajikistan, Bahodur Buriev, while talking to a selected group of journalists about International Conference on the International Decade for Action "Water for Sustainable Development, 2018-2028" held in Dushanbe, Tajikistan, on 20-21 June 2018. The Tajik diplomat said that according to the some information and media reports, Taliban have assured that they would not harm the CASA-1000 Transmission line.

Cost of steel, construction rises with falling rupee

The price of steel bars has hit a new peak further pushing up cost of construction. A steel dealer said the price of high quality rebar now hovers between Rs107,000-110,000 per tonne against Rs97,000 per tonne in April. Faizul Sultan at BMA Capital said Amreli Steel on Tuesday raised prices of rebar by Rs4,000 to Rs107,000 per tonne. This is the fourth straight increase since February, taking cumulative price increase to 20 per cent. He attributed price rise to latest rupee devaluation. The local currency lost its value by 21pc from December 2017 till to date against the dollar.

Power companies seek 70-paisa per unit increase

The electricity rates for distribution companies (Discos) of ex-Wapda are estimated to go up by 70 paisa per unit on account of monthly fuel price adjustment owing to currency devaluation, higher international oil prices and changes in benchmarks to consumers’ disadvantage. The National Electric Power Regulatory Authority (Nepra) will take up for usual public hearing on July 24 a petition by Discos seeking an increase in consumer tariff on account of fuel cost adjustment for electricity consumed in June. The higher electricity rates, on approval by the regulator, would be recovered from consumers in the upcoming billing month ie August.

Asian shares made early gains on Thursday as upbeat Wall Street earnings supported global investor sentiment, although trade war jitters pushed China’s offshore yuan to a fresh one-year low. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.53 percent, while Japan’s Nikkei and the Australian benchmark advanced 0.42 percent and 0.38 percent, respectively. On Wall Street, the Dow Jones Industrial Average rose 0.32 percent and the S&P 500 gained 0.22 percent to hit a more than five-month high, while the Nasdaq Composite declined marginally by 0.01 percent.

The new government would have no other option than to approach International Monetary Fund (IMF) for bailout package amid deteriorating economic situation of the country that is going from bad to worse. Pakistan's economic situation is deteriorating with the passage of time as rupee is depreciating sharply, foreign exchange reserves are tumbling, current account and budget deficits are widening more than projections. Trade deficit has recently touched all-time high $37.67 billion during previous fiscal year. Similarly, Pakistan's debt has increased to Rs24.5 trillion or 72percent of the GDP of the country.

The Central Asia-South Asia power project (CASA-1000) is in full swing and would ready to transmit surplus hydroelectricity from Tajikistan and Kyrgyzstan to Pakistan and Afghanistan by mid 2020, a diplomat from Tajikistan said. Afghanistan is responsible for providing security to the CASA-1000 transmission line in its area and the project will be ready to supply power to Afghanistan and Pakistan within next two years, said the first Secretary of the Embassy of Tajikistan, Bahodur Buriev, while talking to a selected group of journalists about International Conference on the International Decade for Action "Water for Sustainable Development, 2018-2028" held in Dushanbe, Tajikistan, on 20-21 June 2018. The Tajik diplomat said that according to the some information and media reports, Taliban have assured that they would not harm the CASA-1000 Transmission line.

The price of steel bars has hit a new peak further pushing up cost of construction. A steel dealer said the price of high quality rebar now hovers between Rs107,000-110,000 per tonne against Rs97,000 per tonne in April. Faizul Sultan at BMA Capital said Amreli Steel on Tuesday raised prices of rebar by Rs4,000 to Rs107,000 per tonne. This is the fourth straight increase since February, taking cumulative price increase to 20 per cent. He attributed price rise to latest rupee devaluation. The local currency lost its value by 21pc from December 2017 till to date against the dollar.

The electricity rates for distribution companies (Discos) of ex-Wapda are estimated to go up by 70 paisa per unit on account of monthly fuel price adjustment owing to currency devaluation, higher international oil prices and changes in benchmarks to consumers’ disadvantage. The National Electric Power Regulatory Authority (Nepra) will take up for usual public hearing on July 24 a petition by Discos seeking an increase in consumer tariff on account of fuel cost adjustment for electricity consumed in June. The higher electricity rates, on approval by the regulator, would be recovered from consumers in the upcoming billing month ie August.

Market is expected to remain volatile therefore its recommended to be cautious while trading during current trading session.

Technical Analysis

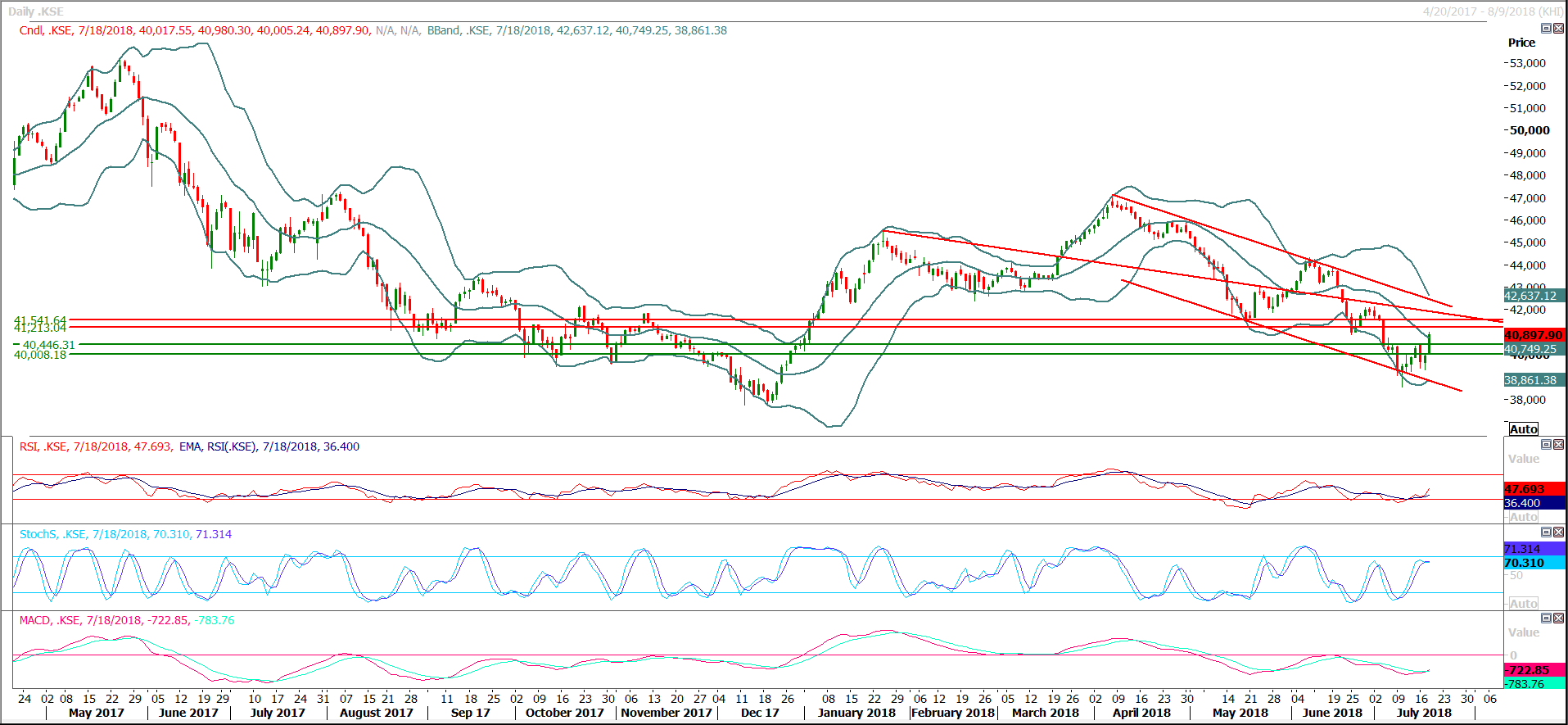

The Benchmark KSE100 Index is trying to strengthen chances of a morning star on weekly chart by expanding its 61.8% correction on daily chart. As of now index have supportive regions around 40,450 and 40,000 points while resistant regions are standing at 41,200 and 41,540 points. Expansion of last bullish correction would be completed at 41,130 points where index would face resistance against current bullish momentum but breakout of that region would call for a further advance move of initially 400 points and then 800 points.

It’s recommended to start profit taking around 41,130 points from previous buying positions because along with completion of 100% expansion of last bullish correction 50% correction of third bearish wave of current Elliot wave also would be completed at 40,210 points.

It’s recommended to start profit taking around 41,130 points from previous buying positions because along with completion of 100% expansion of last bullish correction 50% correction of third bearish wave of current Elliot wave also would be completed at 40,210 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.