Previous Session Recap

Trading volume at PSX floor dropped by 24.15 million shares or 21.64% on DoD basis, whereas the benchmark KSE100 index opened at 32,949.25, posted a day high of 33,014.74 and a day low of 32,223.54 points during last trading session while session suspended at 32,309.54 points with net change of -672.45 points and net trading volume of 71.67 million shares. Daily trading volume of KSE100 listed companies dropped by 22.17 million shares or 23.62% on DoD basis.

Foreign Investors remained in net buying positions of 3.17 million shares and net value of Foreign Inflow increased by 2.65 million US Dollars. Categorically, Foreign Individuals remained in net selling positions of 0.005 million shares respectively but Foreign Corporate and Overseas Pakistanis remained in net buying positions of 2.93 and 0.24 million shares respectively. While on the other side Local Companies, NBFCs, Brokers and Insurance Companies remained in net buying positions of 3.13, 0.03, 1.78 and 1.48 million shares respectively, but Local Individuals, Banks and Mutual Fund remained in net selling positions of 3.01, 0.21 and 5.35 million shares.

Analytical Review

Asia stocks gain, dollar sags as Fed reinforces rate cut expectations

Asian stocks gained and the dollar sagged on Friday after a top Federal Reserve official all but cemented expectations of a U.S. interest rate cut later this month. New York Fed President John Williams said on Thursday that policymakers need to add stimulus early to deal with too-low inflation when interest rates are near zero and cannot wait for economic disaster to unfold, in a speech read as a strong argument in favor of quick action. The comments by Williams made it a virtual certainty the Fed would opt to cut interest rates by 25 basis points (bps) at its July 30-31 policy meeting and also fueled expectations of an even deeper 50 bp reduction. Financial markets quickly reacted, with futures <FF#:> at one point pricing in almost 70 percent chance of a 50-basis-point cut at the month-end meeting. The odds eased to around 40 percent after the New York Fed clarified later that Williams’ speech was not about potential action at the upcoming policy meeting.

Govt not shared documents of CPEC with IMF: Senate panel told

The Senate Standing Committee on China Pakistan Economic Corridor (CPEC) was informed on Thursday that the government had not shared any document relating to CPEC with the International Monetary Fund (IMF). Briefing the meeting, Secretary Planning Zafar Hassan said “Neither ministry of Planning nor finance has shared any such document of CPEC with the Fund”. Chairperson of the committee, Senator Sherry Rehman said the government’s statement was in contradiction to some media reports which stated that the government had shared details of debt incurred on account of CPEC projects besides other sensitive information.

Govt allows urea price hike by only Rs10 per bag

Adviser to Prime Minister on Commerce, Industries and Production Abdul Razak Dawood on Thursday said that government has allowed to increase the urea price by Rs10 per bag. Addressing a press conference, he said that government would give one billion rupees subsidy on importing 100,000 tons of urea during ongoing fiscal year to overcome the shortage in the country. However, there was sufficient stock of Urea available in the country to cater the demands of Khareef season. The government would provide relief to farmers by ensuring availability of agriculture inputs including fertilizers on affordable prices in order to boost agriculture yield.

200mmcfd LNG contract likely to be awarded next week

To further enhance the LNG import the government is likely to award the contract for 200 mmcfd LNG next week. The government has planned to sign deal for the import of additional 400 mmcfd LNG by the end of this year, official sources said. The source said that to meet the gas demand the government is working on two pronged strategies which include the import of additional LNG and development of local gas reserves, said the source.

Inflation almost doubled in Pakistan: ADB

The Asian Development Bank (ADB) has said that Pakistan’s GDP growth had deteriorated to 3.3 percent in fiscal year 2018-2019, which was lowest rate in last 8 years. According to Asian Development Bank (ADB) report released. “Preliminary official estimates for Pakistan show growth in FY2019 (ended 30 June 2019) deteriorating to 3.3percent, the lowest rate in 8 years, pulled down by weak performance across the board. Rising twin deficits in the fiscal and current accounts weigh on Pakistan’s outlook,” It added that inflation in Pakistan almost doubled from 3.8 percent in the same period of FY2018 to 7.2 percent in FY2019. Pakistan’s GDP growth remained lower as compared to the other countries of South Asia. Whereas Indian GDP growth has projected at 7 percent during FY2019 and growth in Bangladesh accelerated from 7.9 percent in FY2018 to 8.1 percent in FY2019 with faster growth in industry and services. Similarly, GDP growth in Nepal accelerated from an upwardly revised 6.7 percent in FY2018 to 7.1 percent in FY2019. However, Pakistan’s GDP growth recorded at only 3.3 percent in FY2019.

Asian stocks gained and the dollar sagged on Friday after a top Federal Reserve official all but cemented expectations of a U.S. interest rate cut later this month. New York Fed President John Williams said on Thursday that policymakers need to add stimulus early to deal with too-low inflation when interest rates are near zero and cannot wait for economic disaster to unfold, in a speech read as a strong argument in favor of quick action. The comments by Williams made it a virtual certainty the Fed would opt to cut interest rates by 25 basis points (bps) at its July 30-31 policy meeting and also fueled expectations of an even deeper 50 bp reduction. Financial markets quickly reacted, with futures <FF#:> at one point pricing in almost 70 percent chance of a 50-basis-point cut at the month-end meeting. The odds eased to around 40 percent after the New York Fed clarified later that Williams’ speech was not about potential action at the upcoming policy meeting.

The Senate Standing Committee on China Pakistan Economic Corridor (CPEC) was informed on Thursday that the government had not shared any document relating to CPEC with the International Monetary Fund (IMF). Briefing the meeting, Secretary Planning Zafar Hassan said “Neither ministry of Planning nor finance has shared any such document of CPEC with the Fund”. Chairperson of the committee, Senator Sherry Rehman said the government’s statement was in contradiction to some media reports which stated that the government had shared details of debt incurred on account of CPEC projects besides other sensitive information.

Adviser to Prime Minister on Commerce, Industries and Production Abdul Razak Dawood on Thursday said that government has allowed to increase the urea price by Rs10 per bag. Addressing a press conference, he said that government would give one billion rupees subsidy on importing 100,000 tons of urea during ongoing fiscal year to overcome the shortage in the country. However, there was sufficient stock of Urea available in the country to cater the demands of Khareef season. The government would provide relief to farmers by ensuring availability of agriculture inputs including fertilizers on affordable prices in order to boost agriculture yield.

To further enhance the LNG import the government is likely to award the contract for 200 mmcfd LNG next week. The government has planned to sign deal for the import of additional 400 mmcfd LNG by the end of this year, official sources said. The source said that to meet the gas demand the government is working on two pronged strategies which include the import of additional LNG and development of local gas reserves, said the source.

The Asian Development Bank (ADB) has said that Pakistan’s GDP growth had deteriorated to 3.3 percent in fiscal year 2018-2019, which was lowest rate in last 8 years. According to Asian Development Bank (ADB) report released. “Preliminary official estimates for Pakistan show growth in FY2019 (ended 30 June 2019) deteriorating to 3.3percent, the lowest rate in 8 years, pulled down by weak performance across the board. Rising twin deficits in the fiscal and current accounts weigh on Pakistan’s outlook,” It added that inflation in Pakistan almost doubled from 3.8 percent in the same period of FY2018 to 7.2 percent in FY2019. Pakistan’s GDP growth remained lower as compared to the other countries of South Asia. Whereas Indian GDP growth has projected at 7 percent during FY2019 and growth in Bangladesh accelerated from 7.9 percent in FY2018 to 8.1 percent in FY2019 with faster growth in industry and services. Similarly, GDP growth in Nepal accelerated from an upwardly revised 6.7 percent in FY2018 to 7.1 percent in FY2019. However, Pakistan’s GDP growth recorded at only 3.3 percent in FY2019.

Market is expected to remain volatile during current trading session.

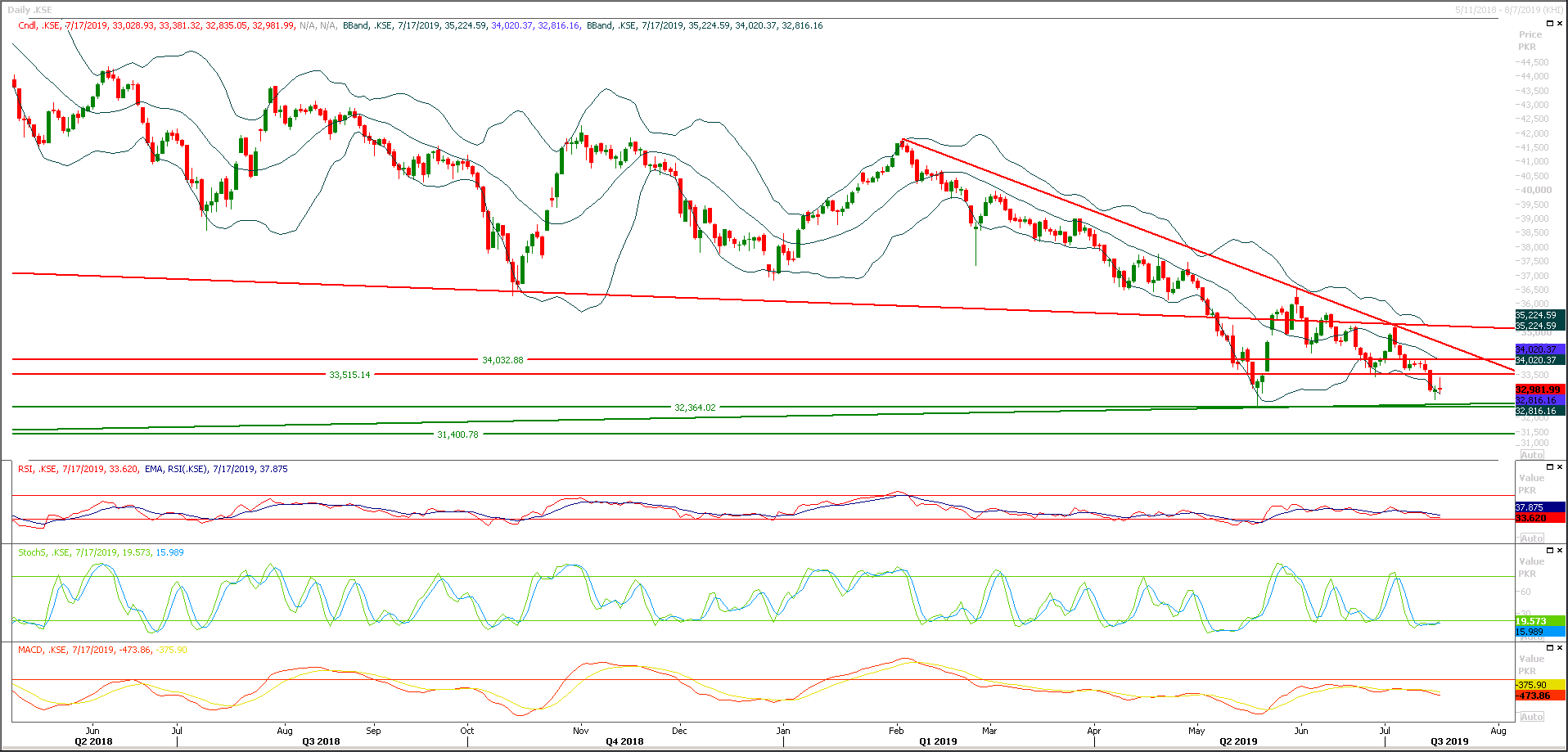

Technical Analysis

The Benchmark KSE100 index have not succeeded in penetration above its initial resistant region of 33,450 points and have formatted a hammer on daily chart after being pushed back by a horizontal resistant region. As of now index would try to find some ground at 32,360 and 31,700 points while on flip side resistant regions are still standing at 33,500 and 34,000 points. It's expected that index would remain bearish until it would succeed in penetration above 34,000 points on daily basis. Daily momentum indicators are still in bearish mode therefore it's recommended to practice caution until index close above its major regions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.