Previous Session Recap

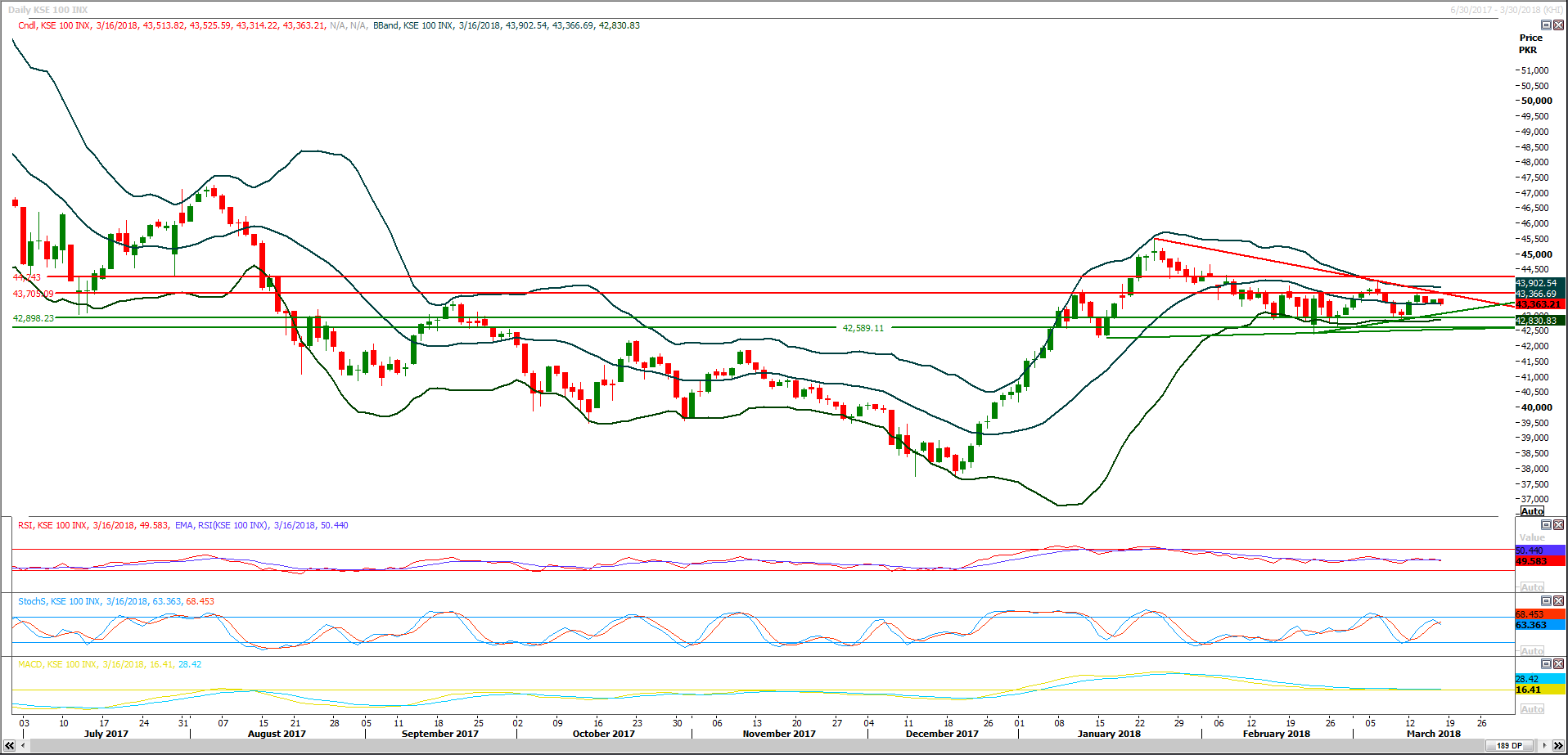

Trading volume at PSX floor dropped by 27.04 million shares or 12.27% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43513.82, posted a day high of 43525.59 and a day low of 43314.22 during last trading session. The session suspended at 43363.21 with net change of -131.86 and net trading volume of 54.22 million shares. Daily trading volume of KSE100 listed companies increased by 14.79 million shares or 37.5% on DoD basis.

Foreign Investors remained in net selling position of 10.02 million shares and net value of Foreign Inflow dropped by 10.18 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani Investors remained in net selling positions of 6.52 and 3.47 million shares. While on the other side LOcal Individuals, Banks and NBFCs remained in net selling positions of 10.79, 1.69 and 9.61 million shares respectively, but Local Companies, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 31.19, 0.45, 3.47 and 2.82 million shares respectively.

Analytical Review

Shares in the red as nervous markets await Fed

Asian share markets slipped into the red on Monday as caution gripped investors in a week in which the Federal Reserve is likely to hike U.S. interest rates and perhaps signal that as many as three more lie in store for the rest of the year. Japan’s Nikkei extended early losses to drop 1.3 percent as exporters were undermined by recent broad-based gains in the yen. MSCI’s broadest index of Asia-Pacific shares outside Japan eased 0.5 percent, while Australia’s main index lost 0.2 percent. The pain was not confined to Asia, with the June contract for E-Minis futures on the S&P 500 down 0.3 percent and FTSE futures off 0.4 percent. While Wall Street had bounced on Friday, the major indices still ended lower for the week. The Dow lost 1.57 percent, the S&P 1.04 percent and the Nasdaq 1.27 percent. The decline was surprising given figures from Bank of America Merrill Lynch showed a record $43.3 billion of inflows into equities last week, outpacing bond flows for the first time since 2013. For the year so far, $9.8 billion has gone into tech stocks and $7.3 billion into financials, while $41 billion has flowed into emerging markets and $31 billion into Japan.

Incentives for banking sector demanded

Former vice president, Federation of Pakistan Chamber of Commerce and Industry (FPCCI), M Adnan Jalil has called for adoption of banking-friendly policies in the annual budget for financial year 2018-19. Talking to journalists here on Sunday regarding the upcoming national budget, he demanded incentives for the banking sector to bring it out of the prevailing crisis-like situation. He proposed the exempting of the banking sector of the With Holding Tax and Federal Excise Duty, saying these levies are bearing highly negative impacts on the banking sector . He particularly demanded the abolition of the cash withdrawal limit of Rs50,000. Not only this, he also called for cutting of the ratio of General Sales Tax (GST) to single digit and its levy on all sectors except education across the country.

Local vehicles sales up by 15pc

The sales of locally assembled vehicles and Light Commercial Vehicles (LCVs) have witnessed 15 per cent increase in February this year as compared to same month last year. Local auto manufacturers have sold a total of 22,654 units in February this year as compared to the 19,686 units that were sold in February last year. This increase may be attributed to strict import policy that government implemented to decrease trade deficit and imports. The statistics issued by Pakistan Automotive Manufacturers Association (PAMA) on Sunday revealed that sales of LCVs increased by 41 per cent year-on-year for February 2018 as 3,627 units of LCVs were sold in February this year as compared to 2,467 units in February 2017. Hilux sales increased by 33 per cent as well to reach record sales numbers. Pak Suzuki saw most sales among top three automobile giants in Pakistan. This growth is mainly because of increased sales of Suzuki Mehran and recently upgraded Suzuki WagonR. Suzuki sold 1,000 more units of Mehran in February 2018 as compared to February 2017. The Company sold 447 more units of Wagon-R year-on-year for month of February. Suzuki posted a year-on-year overall increase of 25 per cent in its sales . Honda posted some decent profits as well due to increasing popularity of BR-V model and Honda City sedan. Honda sold 661 more units of its BR-V model in last month as compared to February 2017.

‘PakPlastics expo helps explore export potential’

Pakistan Plastic Manufactures Association President Zakria Usman commented that: "It was thrilling to see such enthusiastic participation from all key players of the industry and the general masses. The show also featured numerous informative sessions to highlight the productivity, capabilities, evolving trends and export potential of this essential sector of the economy." He said on Sunday as the Pakistan Plastic show 2018 reached its conclusion in Lahore, after featuring numerous insightful sessions, technologies and strategic discussions. This highly informative event received tremendous response from industry professionals, media and the general public. During the concluding ceremony, each exhibiting enterprise was presented with a commemorative shield. The exhibition was held at the Expo Centre in Lahore from the 16th to 18th of March 2018. It was orchestrated by the Pakistan Plastic Manufacturers Association (PPMA). It featured more than 100 local and international exhibitors, and was thronged by over 100,000 visitors in three days.

Ministry demands Rs204b for water sector projects

The Ministry Water Resources has demanded an allocation of about Rs203.7 billion, in the Public Sector Development Programme (PSDP) 2018-19, for water sector projects . In its proposal the ministry has submitted a total of 116 projects , according to official documents available with The Nation. According the documents, the total estimated cost of these projects is Rs2.29 trillion. An amount of Rs465 billion had already been spent on the ongoing projects while an amount of Rs1.8 trillion will be required to complete these projects . It merits a mention that in PSDP 2017-18 the allocation for water sector was only Rs36.7billion. However, for the fiscal 2018-19, the Water Resource Ministry demanded Rs203.7 billion for the progress of 116 projects . Similarly as per the projection of Water Resource Ministry for PSDP 2019-20 an amount of Rs201.4 billion would be required. For the water sector development project it has been projected that the ministry of water resource will require Rs239.5 billion for the fiscal year 2020-21.

Market is expected to remain volatile therefore it is advised to remain cautious while trading today.

Asian share markets slipped into the red on Monday as caution gripped investors in a week in which the Federal Reserve is likely to hike U.S. interest rates and perhaps signal that as many as three more lie in store for the rest of the year. Japan’s Nikkei extended early losses to drop 1.3 percent as exporters were undermined by recent broad-based gains in the yen. MSCI’s broadest index of Asia-Pacific shares outside Japan eased 0.5 percent, while Australia’s main index lost 0.2 percent. The pain was not confined to Asia, with the June contract for E-Minis futures on the S&P 500 down 0.3 percent and FTSE futures off 0.4 percent. While Wall Street had bounced on Friday, the major indices still ended lower for the week. The Dow lost 1.57 percent, the S&P 1.04 percent and the Nasdaq 1.27 percent. The decline was surprising given figures from Bank of America Merrill Lynch showed a record $43.3 billion of inflows into equities last week, outpacing bond flows for the first time since 2013. For the year so far, $9.8 billion has gone into tech stocks and $7.3 billion into financials, while $41 billion has flowed into emerging markets and $31 billion into Japan.

Former vice president, Federation of Pakistan Chamber of Commerce and Industry (FPCCI), M Adnan Jalil has called for adoption of banking-friendly policies in the annual budget for financial year 2018-19. Talking to journalists here on Sunday regarding the upcoming national budget, he demanded incentives for the banking sector to bring it out of the prevailing crisis-like situation. He proposed the exempting of the banking sector of the With Holding Tax and Federal Excise Duty, saying these levies are bearing highly negative impacts on the banking sector . He particularly demanded the abolition of the cash withdrawal limit of Rs50,000. Not only this, he also called for cutting of the ratio of General Sales Tax (GST) to single digit and its levy on all sectors except education across the country.

The sales of locally assembled vehicles and Light Commercial Vehicles (LCVs) have witnessed 15 per cent increase in February this year as compared to same month last year. Local auto manufacturers have sold a total of 22,654 units in February this year as compared to the 19,686 units that were sold in February last year. This increase may be attributed to strict import policy that government implemented to decrease trade deficit and imports. The statistics issued by Pakistan Automotive Manufacturers Association (PAMA) on Sunday revealed that sales of LCVs increased by 41 per cent year-on-year for February 2018 as 3,627 units of LCVs were sold in February this year as compared to 2,467 units in February 2017. Hilux sales increased by 33 per cent as well to reach record sales numbers. Pak Suzuki saw most sales among top three automobile giants in Pakistan. This growth is mainly because of increased sales of Suzuki Mehran and recently upgraded Suzuki WagonR. Suzuki sold 1,000 more units of Mehran in February 2018 as compared to February 2017. The Company sold 447 more units of Wagon-R year-on-year for month of February. Suzuki posted a year-on-year overall increase of 25 per cent in its sales . Honda posted some decent profits as well due to increasing popularity of BR-V model and Honda City sedan. Honda sold 661 more units of its BR-V model in last month as compared to February 2017.

Pakistan Plastic Manufactures Association President Zakria Usman commented that: "It was thrilling to see such enthusiastic participation from all key players of the industry and the general masses. The show also featured numerous informative sessions to highlight the productivity, capabilities, evolving trends and export potential of this essential sector of the economy." He said on Sunday as the Pakistan Plastic show 2018 reached its conclusion in Lahore, after featuring numerous insightful sessions, technologies and strategic discussions. This highly informative event received tremendous response from industry professionals, media and the general public. During the concluding ceremony, each exhibiting enterprise was presented with a commemorative shield. The exhibition was held at the Expo Centre in Lahore from the 16th to 18th of March 2018. It was orchestrated by the Pakistan Plastic Manufacturers Association (PPMA). It featured more than 100 local and international exhibitors, and was thronged by over 100,000 visitors in three days.

The Ministry Water Resources has demanded an allocation of about Rs203.7 billion, in the Public Sector Development Programme (PSDP) 2018-19, for water sector projects . In its proposal the ministry has submitted a total of 116 projects , according to official documents available with The Nation. According the documents, the total estimated cost of these projects is Rs2.29 trillion. An amount of Rs465 billion had already been spent on the ongoing projects while an amount of Rs1.8 trillion will be required to complete these projects . It merits a mention that in PSDP 2017-18 the allocation for water sector was only Rs36.7billion. However, for the fiscal 2018-19, the Water Resource Ministry demanded Rs203.7 billion for the progress of 116 projects . Similarly as per the projection of Water Resource Ministry for PSDP 2019-20 an amount of Rs201.4 billion would be required. For the water sector development project it has been projected that the ministry of water resource will require Rs239.5 billion for the fiscal year 2020-21.

Technical Analysis

The Benchmark KSE100 Index is caged in a triangle on daily chart while daily Stochastic and MAORSI both have generated bearish crossovers after completion of 61.8% correction of Index on daily chart. As of now index is capped by resistant trend line of said triangle along with a horizontal resistant region at 43630 and other major resistant regions are standing at 43747 and 43960 points. Market Momentum on daily and hourly charts is bearish therefore its recommended to book profits or sell on strength strategy would be beneficial for current trading session. On supportive side ins have supportive regions around 43130 and 42900 points on intra-day basis while major supportive region is at 42800 which would shift market trend for short and mid term basis if broken. New buying is not recommended on intra-day basis until index close above 43630 on hourly chart.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.