Previous Session Recap

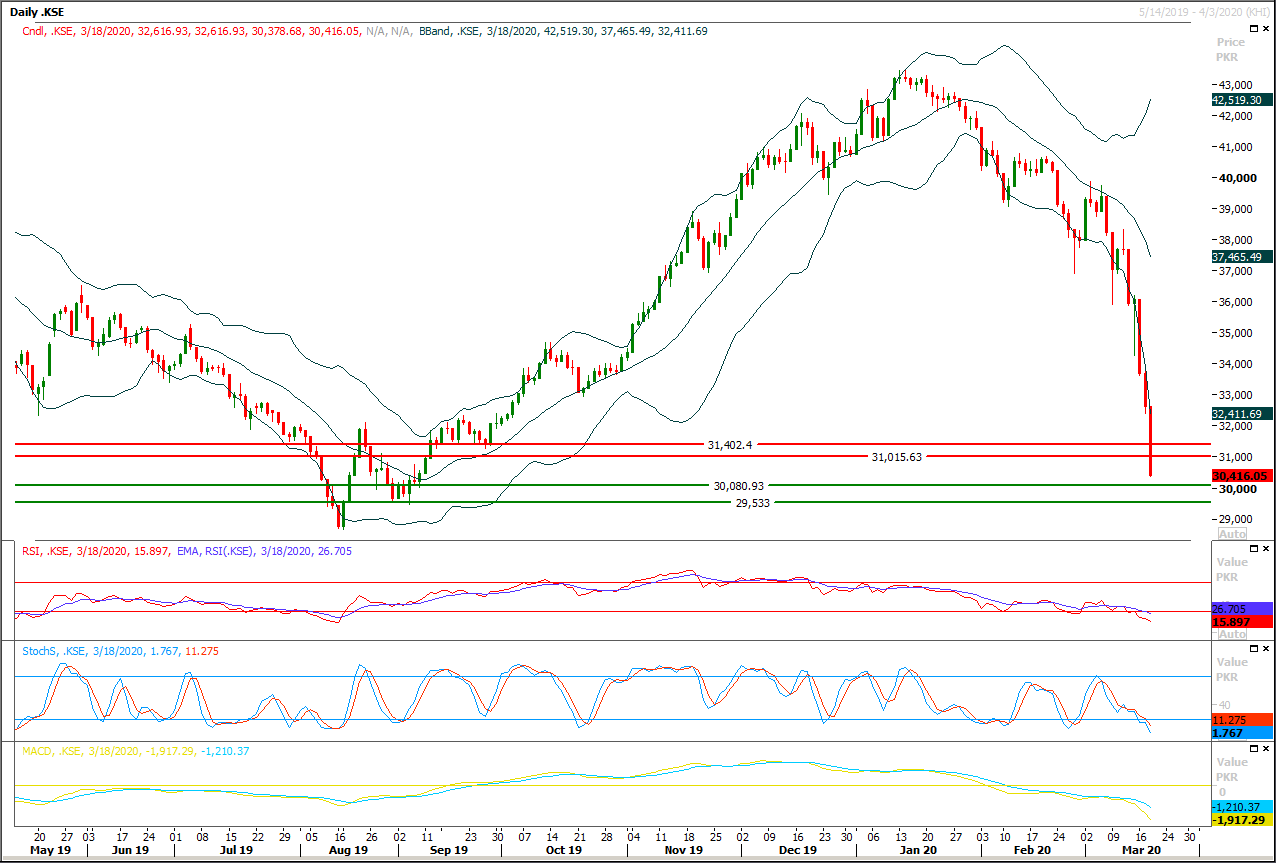

Trading volume at PSX floor dropped by 53.72 million shares or 22.35% on DoD basis, whereas the benchmark KSE100 index opened at 32,206.47, posted a day high of 32,206.47 and a day low of 30,378.68 points during last trading session while session suspended at 30,416.05 points with net change of -2200.88 points and net trading volume of 133.60 million shares. Daily trading volume of KSE100 listed companies also dropped by 62.99 million shares or 32.04% on DoD basis.

Foreign Investors remained in net selling positions of 7.70 million shares and value of Foreign Inflow dropped by 1.06 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net long positions of 0.02 and 3.85 million shares Foreign Corporate remained in net selling positions of 11.57 million shares respectively. While on the other side Local Individuals, Banks, NBFCs, Brokers and Insurance Companies remained in net long positions of 21.19, 9.08, 0.31, 1.58 and 9.57 million shares but Local Companies and Mutual Fund remained in net selling positions of 6.50 and 28.54 million shares respectively.

Analytical Review

Oil rockets nearly 20% as investors hail coronavirus stimulus spending - for now

Oil prices surged as much as nearly 20% on Thursday, bouncing back from days of heavy losses in a relief rally that may yet be short-lived, analysts warned, but which was stoked by economic stimulus efforts to ward off a global coronavirus recession. Brent crude LCOc1 was up $2.10, or 8%, at $26.98 a barrel by 0028 GMT after tumbling 13% on Wednesday in a third day of relentless selling. U.S. oil CLc1 gained $3.44, or 17%, to $23.81 a barrel after slumping nearly 25% in the previous session. “After a 24% crash, oil prices are firming up on some selling exhaustion and as U.S. and European leaders unleash ... aid and stimulus,” said Edward Moya, senior market analyst at OANDA in New York.

IMF suggests intervention to calm markets

The International Monetary Fund (IMF) has reminded governments that foreign exchange intervention may be necessary if the corona crisis causes markets to behave disorderly. On Tuesday afternoon, the IMF suggested a number of policy measures that governments across the globe could take to protect their economies from the adverse effects of the coronavirus, which has already infected more than 200,000 people and caused over 8,000 deaths. The crisis has also stirred the fears of an economic meltdown. “Exchange rate flexibility can offset external shocks, but foreign exchange intervention may be necessary if market conditions become disorderly,” the IMF suggests. “In crisis or near-crisis situations, capital flow measures may need to be deployed for a temporary period.”

Asian Development Bank, World Bank to give $588m for fight against virus

The Asian Development Bank (ADB) and the World Bank on Wednesday committed to providing $588 million to Pakistan for its emergency response to fight coronavirus and cater to the socioeconomic impact of the pandemic. This was announced by the Planning Commission after a meeting with country representatives of the two lending agencies on Pakistan’s preparedness and response to fight COVID-19. The meeting, presided over by Deputy Chairman of the Planning Commission Mohammad Jehanzeb Khan, was attended by World Bank Country Director Illango Patchamuthu, ADB Country Director Xiaohong Yang, besides Member Social Sector Dr Shabnum Sarfraz, Member Private Sector Asim Saeed, Director General Health Dr Safi and representatives of the ministries of economic affairs, finance and national health services.

Outstanding wharfage of Rs1.696b to be paid in 10 equal installments: ECC

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday has approved that outstanding wharfage of Rs1.696 billion on import of LNG by Pakistan State Oil (PSO) will be paid in 10 equal installments without interest over a period of next ten years. The ECC under the chair of Adviser to Prime Minister on Finance and Revenue Abdul Hafeez Shaikh has considered the summary of Ministry of Maritime Affairs regarding recovery of outstanding wharfage of Rs1.696 billion on import of LNG by PSO. The ECC has also decided that in January 2023, a committee will review the circumstances and suggest any possibility for early repayment of the remaining sum. The decision was taken on the recommendations of the committee constituted under the chairmanship of Minister for Economic Affairs.

Govt asks SSGCL, SNGPL to reduce allowable UFG benchmarks

To reduce the gas tariff, the government has asked the gas utilities companies that instead of increasing gas prices, reduce allowable UFG benchmarks and return on assets. The government has also asked the Sui Southern Gas Company Limited (SSGCL) and Sui Northern Gas Pipeline Limited (SNGPL) to rationalise transmission and distribution costs to create some fiscal space for the Companies instead of simply resorting to increase in tariffs. Both companies are incurring gas losses (UFG) in double digit which exceeds the best international practices, said a spokesman of the Petroleum Division here. According the spokesman one percent UFG loss of both Sui Companies in monetary terms exceeds 4 billion rupees. According the official sources, the total UFG losses of both the gas companies are around 12 to 13 percent against the allowed 7.3 UFG losses by OGRA.

Oil prices surged as much as nearly 20% on Thursday, bouncing back from days of heavy losses in a relief rally that may yet be short-lived, analysts warned, but which was stoked by economic stimulus efforts to ward off a global coronavirus recession. Brent crude LCOc1 was up $2.10, or 8%, at $26.98 a barrel by 0028 GMT after tumbling 13% on Wednesday in a third day of relentless selling. U.S. oil CLc1 gained $3.44, or 17%, to $23.81 a barrel after slumping nearly 25% in the previous session. “After a 24% crash, oil prices are firming up on some selling exhaustion and as U.S. and European leaders unleash ... aid and stimulus,” said Edward Moya, senior market analyst at OANDA in New York.

The International Monetary Fund (IMF) has reminded governments that foreign exchange intervention may be necessary if the corona crisis causes markets to behave disorderly. On Tuesday afternoon, the IMF suggested a number of policy measures that governments across the globe could take to protect their economies from the adverse effects of the coronavirus, which has already infected more than 200,000 people and caused over 8,000 deaths. The crisis has also stirred the fears of an economic meltdown. “Exchange rate flexibility can offset external shocks, but foreign exchange intervention may be necessary if market conditions become disorderly,” the IMF suggests. “In crisis or near-crisis situations, capital flow measures may need to be deployed for a temporary period.”

The Asian Development Bank (ADB) and the World Bank on Wednesday committed to providing $588 million to Pakistan for its emergency response to fight coronavirus and cater to the socioeconomic impact of the pandemic. This was announced by the Planning Commission after a meeting with country representatives of the two lending agencies on Pakistan’s preparedness and response to fight COVID-19. The meeting, presided over by Deputy Chairman of the Planning Commission Mohammad Jehanzeb Khan, was attended by World Bank Country Director Illango Patchamuthu, ADB Country Director Xiaohong Yang, besides Member Social Sector Dr Shabnum Sarfraz, Member Private Sector Asim Saeed, Director General Health Dr Safi and representatives of the ministries of economic affairs, finance and national health services.

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday has approved that outstanding wharfage of Rs1.696 billion on import of LNG by Pakistan State Oil (PSO) will be paid in 10 equal installments without interest over a period of next ten years. The ECC under the chair of Adviser to Prime Minister on Finance and Revenue Abdul Hafeez Shaikh has considered the summary of Ministry of Maritime Affairs regarding recovery of outstanding wharfage of Rs1.696 billion on import of LNG by PSO. The ECC has also decided that in January 2023, a committee will review the circumstances and suggest any possibility for early repayment of the remaining sum. The decision was taken on the recommendations of the committee constituted under the chairmanship of Minister for Economic Affairs.

To reduce the gas tariff, the government has asked the gas utilities companies that instead of increasing gas prices, reduce allowable UFG benchmarks and return on assets. The government has also asked the Sui Southern Gas Company Limited (SSGCL) and Sui Northern Gas Pipeline Limited (SNGPL) to rationalise transmission and distribution costs to create some fiscal space for the Companies instead of simply resorting to increase in tariffs. Both companies are incurring gas losses (UFG) in double digit which exceeds the best international practices, said a spokesman of the Petroleum Division here. According the spokesman one percent UFG loss of both Sui Companies in monetary terms exceeds 4 billion rupees. According the official sources, the total UFG losses of both the gas companies are around 12 to 13 percent against the allowed 7.3 UFG losses by OGRA.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have supportive regions ahead at 30,000 points and 29,500 points where two strong horizontal supportive regions would try to resist against current bearish pressure but if index would succeed in sliding below 29500 points then its next target would be 28,500pts where a rising trend line on monthly chart would try to support market against current bearish pressure. It's recommended to stay cautious and adopt swing trading strategy until index either close below 29,500 points or above 32,500 points. Index would remain bearish until it would not succeed in closing above 32,500 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.