Previous Session Recap

Trading volume at PSX floor dropped by 53.37 million shares or 20.94% on DoD basis, whereas the Benchmark KSE100 index opened at 41,536.07, posted a day high of 41,804.81 and day low of 40,439.41 points during last trading session while session suspended at 41,660.75 with net change of 232.12 points and net trading volume of 107.56 million shares. Daily trading volume of KSE100 listed companies dropped by 37.60 million shares or 25.90% on DoD basis.

Foreign Investors remained in net selling position of 4.28 million shares and net value of Foreign Inflow dropped by 10.93 million US Dollars. Categorically, Foreign Individuals and Foreign Corporate remained in net selling positions of 0.05 and 5.57 million shares but Overseas Pakistani investors remained in net buying positions of 1.34 million shares respectively. While on the other side Local Companies, Banks and Mutual Fund remained in net buying positions of 3.59, 1.59 and 6.70 million shares respectively but Local Individuals, NBFCs, Brokers and Insurance Companies remained in net buying positions of 1.42, 0.89, 1.04 and 3.81 million shares respectively.

Analytical Review

Asia shares inch up, Fed caution curbs dollar

Asian shares crept cautiously higher on Monday amid conflicting signals on the chance of a truce in the Sino-U.S. trade dispute, while the Federal Reserve’s new-found concern on the global economy undermined the dollar. Asian shares crept cautiously higher on Monday amid conflicting signals on the chance of a truce in the Sino-U.S. trade dispute, while the Federal Reserve’s new-found concern on the global economy undermined the dollar.

ECC to allow wheat export tomorrow

The government has called a meeting of the Economic Coordination Committee (ECC) of the cabinet on Tuesday to allow export of wheat for earning some foreign exchange and disbursement of about Rs1.6bn to Pakistan Steel Mills (PSM) for settlement of minuscule gratuity and provident fund liabilities. To be presided over by Finance Minister Asad Umar, the meeting is also expected to grant exemption from re-lending policy of the government for funds to be provided as grant to the Pakistan Poverty Alleviation Fund (PPAF) and consider a report on sugarcane price and cost of production of sugar.

Increase in exports only way to avoid external debt: Asad

Federal Minister for Finance Asad Umar has said that enhancing the country exports was the only way to overcome the external debt or we have to seek more loans from IMF to run the affairs of the country. Talking to a private news channel, he said when PTI government came into power the country's economy was facing the deficit of Rs 800 billion.

IPC moot fails to resolve water issue among provinces

The first meeting of the inter-provincial committee, constituted by the CCI, to resolve the contentious issue of water distribution among the provinces under Water Accord 1991, remained inconclusive and now it will meet again during the first week of December, it is learnt reliably here Sunday. “Second meeting of the Inter-provincial committee (IPC) has been convened on 4th and 5th December to undertake the water distribution issue among the provinces,” official source told The Nation here.

Petroleum division gets Rs9.327m under PSDP 2018-19/strong>

He government has released Rs 9.327 million for various projects of petroleum division out of total allocation of Rs 463.17 million under Public Sector Development Programme 2018-19. According to latest data released by Ministry of Planning, Development and Reform, the government released an amount of Rs2.747 million for the project appraisal of newly discovered coal resources of Badin coal field and its adjoining areas of Southern Sindh for which an amount of Rs14.61 million was allocated under PSDP 2018-19.

Asian shares crept cautiously higher on Monday amid conflicting signals on the chance of a truce in the Sino-U.S. trade dispute, while the Federal Reserve’s new-found concern on the global economy undermined the dollar. Asian shares crept cautiously higher on Monday amid conflicting signals on the chance of a truce in the Sino-U.S. trade dispute, while the Federal Reserve’s new-found concern on the global economy undermined the dollar.

The government has called a meeting of the Economic Coordination Committee (ECC) of the cabinet on Tuesday to allow export of wheat for earning some foreign exchange and disbursement of about Rs1.6bn to Pakistan Steel Mills (PSM) for settlement of minuscule gratuity and provident fund liabilities. To be presided over by Finance Minister Asad Umar, the meeting is also expected to grant exemption from re-lending policy of the government for funds to be provided as grant to the Pakistan Poverty Alleviation Fund (PPAF) and consider a report on sugarcane price and cost of production of sugar.

Federal Minister for Finance Asad Umar has said that enhancing the country exports was the only way to overcome the external debt or we have to seek more loans from IMF to run the affairs of the country. Talking to a private news channel, he said when PTI government came into power the country's economy was facing the deficit of Rs 800 billion.

The first meeting of the inter-provincial committee, constituted by the CCI, to resolve the contentious issue of water distribution among the provinces under Water Accord 1991, remained inconclusive and now it will meet again during the first week of December, it is learnt reliably here Sunday. “Second meeting of the Inter-provincial committee (IPC) has been convened on 4th and 5th December to undertake the water distribution issue among the provinces,” official source told The Nation here.

He government has released Rs 9.327 million for various projects of petroleum division out of total allocation of Rs 463.17 million under Public Sector Development Programme 2018-19. According to latest data released by Ministry of Planning, Development and Reform, the government released an amount of Rs2.747 million for the project appraisal of newly discovered coal resources of Badin coal field and its adjoining areas of Southern Sindh for which an amount of Rs14.61 million was allocated under PSDP 2018-19.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

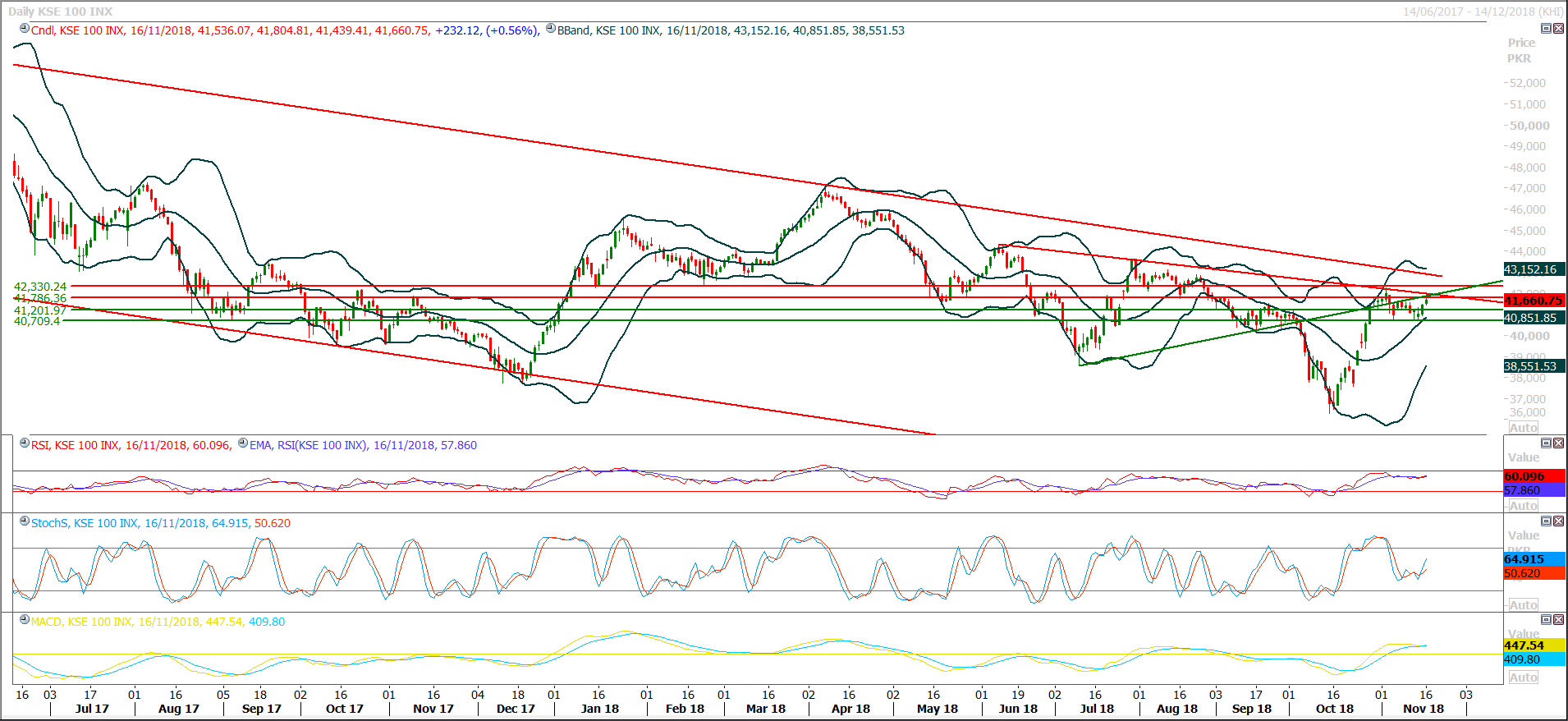

Technical Analysis

The Benchmark KSE100 Index is being capped by two strong resistant trend lines at 41,910 and 41,970 points during current trading session along with a horizontal resistant region which is trying to cap index move at 41,800 points. All these three elements have played a vital role at their respective regions previously and if index would not succeed in closing above 41,900 points during current trading session then tomorrow it would have to face a very strong resistance region at 41,950 points because tomorrow the said both trend lines would create a crossover with each other at 41,950 points and that region would become a strong resistance against any bullish trend if maintained during current trading session. Intraday bullish momentum is losing strength and it seems that index would try to take a dip in first half during current trading session and if this dip would occur after posting a high around 41,800 points then index would try to create an evening shooting star on daily chart. It’s recommended to stay cautious during current trading session as market is expected to remain volatile.

TRG have supportive regions ahead at 29.97-29.67 Rs and penetration of these regions in downward direction would call 29.20 but it’s recommended to adopt swing trading strategy around these region until clear breakout would happen. PSO is being capped by a strong resistant trend line along with a horizontal resistant region at 286 therefore it’s recommended to trade it cautiously because breakout of that region would call for 292 and 297 but if it would succeed in maintain that region then 267 could be witnessed in coming days. PAEL is moving downward after posting weekly double top therefore it is recommended to initiate selling on strength in it with strict stop of 34.40.

TRG have supportive regions ahead at 29.97-29.67 Rs and penetration of these regions in downward direction would call 29.20 but it’s recommended to adopt swing trading strategy around these region until clear breakout would happen. PSO is being capped by a strong resistant trend line along with a horizontal resistant region at 286 therefore it’s recommended to trade it cautiously because breakout of that region would call for 292 and 297 but if it would succeed in maintain that region then 267 could be witnessed in coming days. PAEL is moving downward after posting weekly double top therefore it is recommended to initiate selling on strength in it with strict stop of 34.40.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.