Previous Session Recap

Trading volume at PSX floor dropped by 28.72 million shares or 17.22%,DoD basis, whereas, the benchmark KSE100 index opened at 40760.07, posted a day high of 40872.48 and a day low of40224.20 during the last trading session. The session suspended at 40733.45 with a net change of 8.49 and net trading volume of 49.26 million shares. Daily trading volume of KSE100 listed companies dropped by 31.8 million shares or 39.23%, DoD basis.

Foreign Investors remained in a net selling position of 4.1 million shares and net value of Foreign Inflow dropped by 0.09 million shares. Categorically, Foreign Corporate and Overseas Pakistanis remained in net selling position of 6.48 and 0.65 million shares.On the other side Local Individuals, Companies, Banks, Mutual Funds and Insurance Companies remained in net buying position of 2.46, 0.89, 0.61, 0.45 and 2.88 milion shares respectively but NBFCs and Brokers remained in net selling position of 0.19 and 2.34 million shares.

Analytical Review

Minister of State for Commerce and Textile Industry Haji Akram Ansari stated that electricity and gas prices must be reduced to enable industry to compete in the international market. This was stated by Haji Akram Ansari while talking exclusively to this correspondent on Wednesday. "Gas and electricity prices would be reduced and need to be reduced to lower input costs of export oriented sectors and make them competitive internationally which would increase exports", he added. Akram Ansari said that implementation of the prime minister's incentive package for exporters was suspended due to the prevailing situation, but now Prime Minister Shahid Khaqan Abbasi is taking a keen interest and the relief package is being implemented. The government is now focusing on power generation from coal, gas, water and wind instead of only relying on expensive imported oil due to which the generation cost will decline and be passed on to the consumers. The minister further said that government has directed the Federal Board of Revenue (FBR) to clear all the Refund Payment Orders (RPOs) pending till September 30, 2017 to improve exporters' liquidity position.

TThe Punjab Food Authority (PFA) on Wednesday discarded 117,000 liters of adulterated/substandard milk by erecting screening check posts on entry & exit points of various cities across the province. The PFA teams held pickets at eight points including Gajju Matta, Thokar Niaz Baig, Bhobtiyaa Chowk, Sagian and other entry points of the city. During action, 21,216 liters adulterated milk was wasted. In Rawalpindi division, 29,000 liters of milk recovered from dozens of vehicles was discarded on the spot. While taking action in Multan, 24,000 liters milk recovered from 11 vehicles was also spilt on the spot. In addition, 9000 liters milk captured from 14 vehicles in Gujranwala and 16,000 liters milk seized from Faisalabad division was wasted.

The country is likely to achieve the cotton production target of 13 million bales this season, latest figures released by the Pakistan Cotton Ginners Association (PCGA) show. The country produced 5.984m cotton bales by Oct 15, up 36.79 per cent from the output recorded in the corresponding period of last year. Following a crop failure in the last two consecutive seasons, the cotton production is likely to be 3m bales higher this year. Both Sindh and Punjab recorded higher year-on-year cotton production with the former producing 534,687 more bales. The output of Punjab was 1.07m more bales up to Oct 15.

Foreign Direct Investment (FDI) maintained an upward momentum and posted 56 percent growth in the first quarter (July-Sept) of this fiscal year (FY18). Economists said that since the beginning of this fiscal year, overall FDI is presenting an improved picture supported by rising Chinese investment on the back of ongoing CPEC-related projects. The high FDI inflows will support the depleting foreign exchange reserves, which are presently, stand at less than $ 20 billion, they added. They said that as the most of the investment is arriving under the umbrella of CPEC, there is need for developing fresh investment-friendly and long-term economic policies to attract more foreign investment in other sectors and from other destinations. According to State Bank of Pakistan (SBP), FDI posted an increase of 56.3 percent during July-Sept of this fiscal year compared to the same period of last fiscal year. Pakistan fetched FDI amounting to $ 662 million in first quarter of FY18 compared to $ 423.4 million in the same period of FY17.

United States Secretary of State Rex Tillerson is likely to make a stopover in Islamabad for holding crucial talks with Pakistani leadership before proceeding to India next week. No official confirmation was available as to whether Secretary Tillerson will also be visiting Pakistan or not, following his announcement to visit India next week. However, reportedly he may make a stopover in Islamabad for holding discussions with Pakistani authorities, particularly with respect to Trump's administration South Asia and Afghan strategy, besides holding talks on the war against terrorism and Afghan conflict. Foreign Office Spokesperson Nafees Zakaira expressed his inability to confirm the visit at this stage. Earlier, responding a Business Recorder query in his weekly media briefing last week regarding the expected visit of US Secretary of State and Secretary of Defence, he stated: "I cannot say when and who will be coming, but it was agreed [in the recent meetings between US and Pakistani authorities] that both sides will remain engaged at all levels."

The market is expected to remain volatile today, we advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

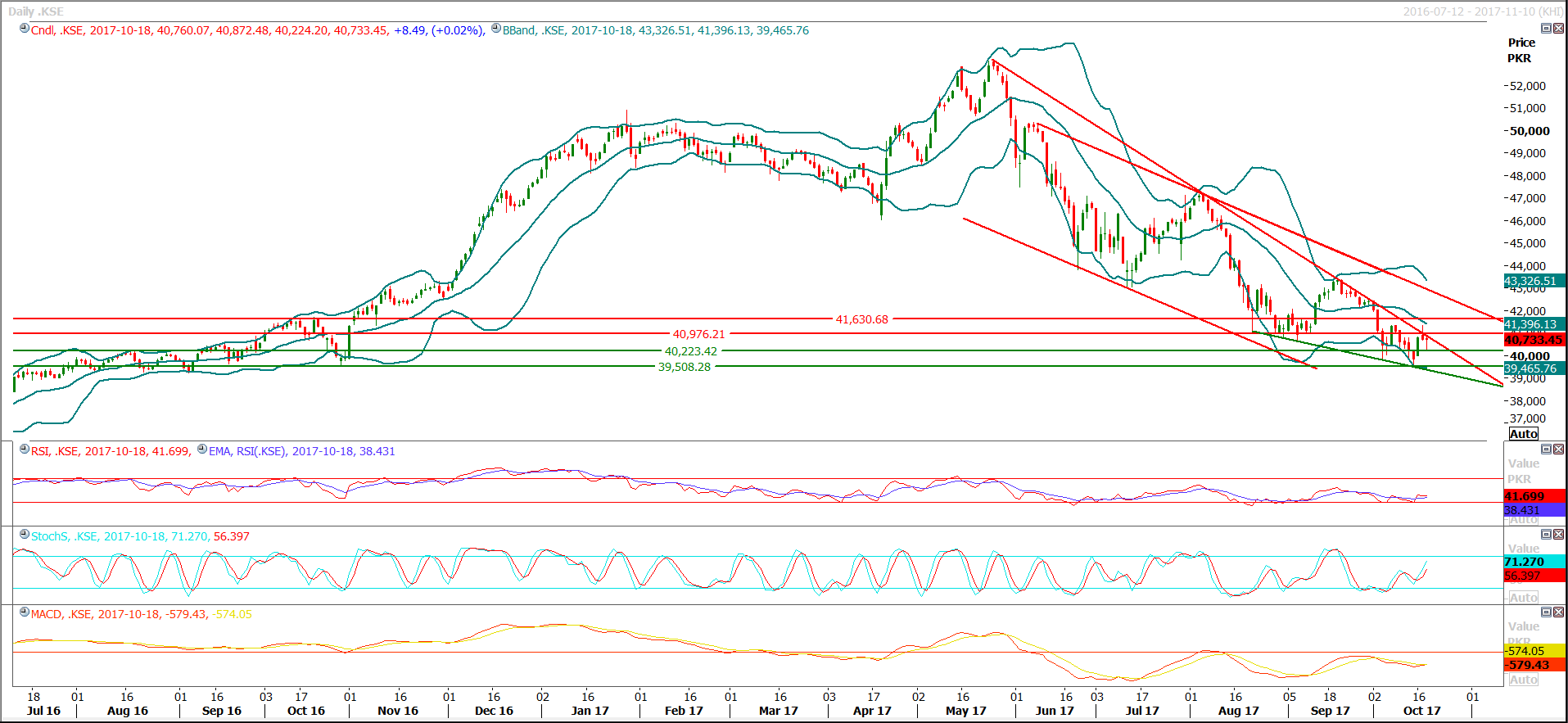

The Benchmark KSE100 Index has bounced back after getting support from a horizontal support at 40223 after completing its 61.8% bullish correction on hourly chart. Stochastic and MAORSI has generated bullish crossovers on hourly chart which creates a positive impact for the bulls on intraday basis. Daily trend is already bullish therefore it is expected that index might try to touch 40975 and then 41353 from where it has reversed during this week after posting a double top on the daily chart. As index is coming back after a correction so it is expected that if it may touch 40353 today then it might try to give a breakout of that level and breakout of that level might call for 41700. If daily closing above 40353 could not be witnessed in coming days then a sersious downward trend might be started. For the current trading session buying with strict stop loss of 40200 could be initiated.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.