Previous Session Recap

Trading volume at PSX floor increased by 21.32 million shares or 14.68% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 40,540.53, posted a day high of 41,270.43 and a day low of 40,439.29 during last trading session. The session suspended at 41,238.07 with net change of 717.60 and net trading volume of 83.32 million shares. Daily trading volume of KSE100 listed companies increased by 13.92 million shares or 20.06% on DoD basis.

Foreign Investors remain in net selling positions of 8.26 million shares and net value of Foreign Inflow dropped by 6.49 million US Dollars. Categorically Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 6.26 and 2.00 million shares. While on the other side Local Individuals, Local Companies, NBFCs, Mutual Fund, and Insurance Companies remained in net buying positions of 1.44, 4.07, 0.16, 5.14 and 1.57 million shares respectively but Banks and Brokers remained in net selling positions of 2.94 and 1.31 million shares.

Analytical Review

Global stocks, U.S. bond yields rise as trade row fails to dent confidence

Asian stocks rose and U.S. Treasury yields hovered near four-month highs on Wednesday, as investors looked past the latest escalation in the U.S.-China trade conflict, seen by some market participants as less severe than expected. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.15 percent. Australian stocks added 0.35 percent, South Korea’s KOSPI climbed 0.1 percent and Japan’s Nikkei rose 1.45 percent. Equity markets in Asia took their cues from Wall Street, which posted a broad-based rally on Tuesday amid emerging views that the U.S.-China trade dispute’s impact on world growth might not be as heavy as previously feared.

Traders fear gas tariff hike to hurt exports

The Lahore Chamber of Commerce and Industry feared that increase in gas tariff at this time would increase challenges of industrial sector. LCCI President Malik Tahir Javaid, Senior Vice President Khawaja Khawar Rasheed and Vice President Zeshan Khalil said that massive increase in the gas tariff would hurt the exports as it would increase the cost of doing business manifold and expel the Pakistani products from the international export market. They said that such anti-business measures would hamper the growth of manufacturing sector. They said that the raise in the gas tariff would create multiple problems for the industrialists as they have to bear heavy loss while fulfilling their export commitments.

APTMA welcomes uniform energy tariff

The All Pakistan Textile Mills Association has welcomed the historic announcement of providing regionally competitive energy tariff with a countrywide uniform price to the textile industry in the budget. APTMA former chairman and patron-in-chief Gohar Ejaz expressed his deep gratitude to Prime Minister Imran Khan for keeping his words of reviving the export-oriented textile industry by announcing equal power tariff across the country. He stated that during his visit to APTMA office in the month of February this year Imran Khan had promised to bring textile industry out of crisis soon after coming into power.

PR raises fares for dams fund

Pakistan Railways has decided to increase RE1, Rs2 and Rs10 on ticket fare for Economy and Business Class, on the directives of Federal Minister for Railways, Sheikh Rasheed Ahmed in order to play a vital role in Dam Fund Contribution. As per details regarding Dam Fund Contribution, an additional amount of RE1 shall be charged on the purchase of Economy Class Ticket worth Rs100 from each passenger and Rs2 for tickets worth more than Rs100.

Federal secretary for ensuring smooth, safe travelling on highways

Federal Secretary Communications Shoaib Ahmed Siddiqui has said, all possible measures will be undertaken to ensure uninterrupted flow of traffic and controlling accidents on national highways and motorways network. A comprehensive course of action will be adopted with cooperation and consultation of other relevant departments, Goods Transport Agencies and Truck Drivers Associations. He was presiding over a high level meeting at Ministry of Communications participated by Chairman NHA Jawwad Rafique Malik, Inspector General National Highways and Motorway Police Muhammad Aamir Zulfiqar Khan, Chief NTRC Sajjad Afzal Afridi and Senior officials from Ministry of Communications.

Asian stocks rose and U.S. Treasury yields hovered near four-month highs on Wednesday, as investors looked past the latest escalation in the U.S.-China trade conflict, seen by some market participants as less severe than expected. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.15 percent. Australian stocks added 0.35 percent, South Korea’s KOSPI climbed 0.1 percent and Japan’s Nikkei rose 1.45 percent. Equity markets in Asia took their cues from Wall Street, which posted a broad-based rally on Tuesday amid emerging views that the U.S.-China trade dispute’s impact on world growth might not be as heavy as previously feared.

The Lahore Chamber of Commerce and Industry feared that increase in gas tariff at this time would increase challenges of industrial sector. LCCI President Malik Tahir Javaid, Senior Vice President Khawaja Khawar Rasheed and Vice President Zeshan Khalil said that massive increase in the gas tariff would hurt the exports as it would increase the cost of doing business manifold and expel the Pakistani products from the international export market. They said that such anti-business measures would hamper the growth of manufacturing sector. They said that the raise in the gas tariff would create multiple problems for the industrialists as they have to bear heavy loss while fulfilling their export commitments.

The All Pakistan Textile Mills Association has welcomed the historic announcement of providing regionally competitive energy tariff with a countrywide uniform price to the textile industry in the budget. APTMA former chairman and patron-in-chief Gohar Ejaz expressed his deep gratitude to Prime Minister Imran Khan for keeping his words of reviving the export-oriented textile industry by announcing equal power tariff across the country. He stated that during his visit to APTMA office in the month of February this year Imran Khan had promised to bring textile industry out of crisis soon after coming into power.

Pakistan Railways has decided to increase RE1, Rs2 and Rs10 on ticket fare for Economy and Business Class, on the directives of Federal Minister for Railways, Sheikh Rasheed Ahmed in order to play a vital role in Dam Fund Contribution. As per details regarding Dam Fund Contribution, an additional amount of RE1 shall be charged on the purchase of Economy Class Ticket worth Rs100 from each passenger and Rs2 for tickets worth more than Rs100.

Federal Secretary Communications Shoaib Ahmed Siddiqui has said, all possible measures will be undertaken to ensure uninterrupted flow of traffic and controlling accidents on national highways and motorways network. A comprehensive course of action will be adopted with cooperation and consultation of other relevant departments, Goods Transport Agencies and Truck Drivers Associations. He was presiding over a high level meeting at Ministry of Communications participated by Chairman NHA Jawwad Rafique Malik, Inspector General National Highways and Motorway Police Muhammad Aamir Zulfiqar Khan, Chief NTRC Sajjad Afzal Afridi and Senior officials from Ministry of Communications.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

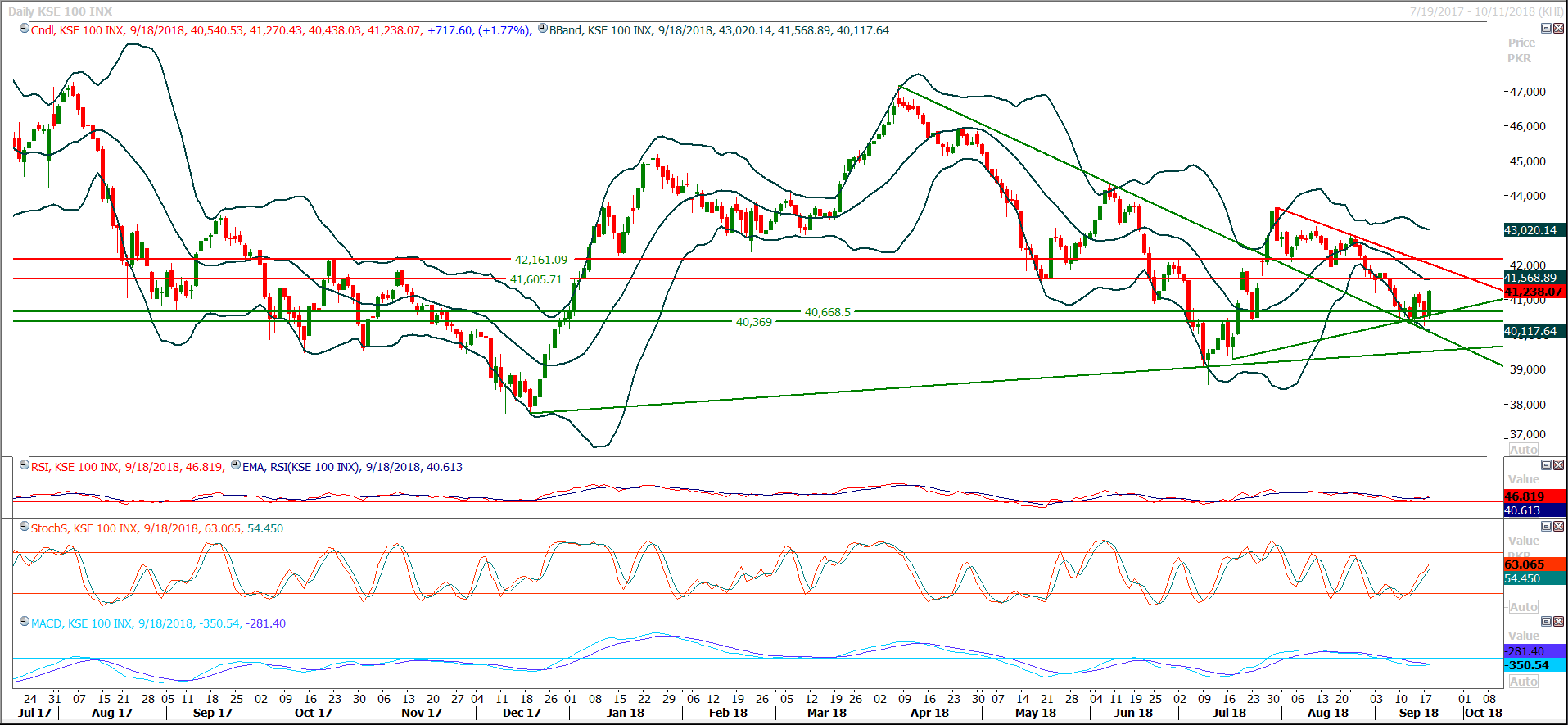

The Benchmark KSE100 Index have tried to create a bullish engulfing pattern on daily chart during last trading session after getting support from a rising trend line but could not succeed in closing above 41,300 points. As of now daily momentum indicators have converted to bullish side after a long struggle but hourly momentum indicators are once again ready for a bearish crossover and they would succeed if index would not become able to open with a positive gap above 41,300 points and succeed to maintain above that level till day end. Index has resistant regions ahead at 41,600 and 42,160 points in coming days while supportive regions are standing at 40,500 and 41,130 points. It’s expected that index would try to open with a positive gap above 41,300 points but it would face strong resistance before 41,600 points because 50% correction falls at 41,557 points which would react as a strong resistance and in case of penetration of that region 61.8% correction at 41,865 points would try to push index back in negative zone. If index would not become able to penetrate its resistant regions in bullish direction then a new bearish sentiment would be witnessed in coming days which would lead index towards 39,400 and further downward.

It’s expected that DGKC would start reversal in bearish direction before 112 Rs because before that region it have strong resistances. While SNGP would face strong resistances before 103 and it would try to bounce back before retesting that region. ISL also seems to start its bearish journey once again before 103.25. TRG have created a bullish engulfing pattern after getting support from a rising trend line and it may would continue its bullish journey towards 32.50 if it would succeed in closing above 30.80 otherwise it would also start a bearish rally.

It’s expected that DGKC would start reversal in bearish direction before 112 Rs because before that region it have strong resistances. While SNGP would face strong resistances before 103 and it would try to bounce back before retesting that region. ISL also seems to start its bearish journey once again before 103.25. TRG have created a bullish engulfing pattern after getting support from a rising trend line and it may would continue its bullish journey towards 32.50 if it would succeed in closing above 30.80 otherwise it would also start a bearish rally.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.