Previous Session Recap

Trading volume at PSX floor increased by 62.39 million shares or 39.13% on DoD basis, whereas the benchmark KSE100 index opened at 28,023.39, posted a day high of 29,334.55 and a day low of 28,023.39 points during last trading session while session suspended at 29,231.63 points with net change of 1208.24 points and net trading volume of 186.15 million shares. Daily trading volume of KSE100 listed companies also increased by 58.51 million shares or 45.84% on DoD basis.

Foreign Investors remained in net selling positions of 20.72 million shares and value of Foreign Inflow dropped by 8.74 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani remained in net selling positions of 20.62 and 0.1 million shares respectively. While on the other side Local Individuals, Mutual Fund, Brokers and Insurance Companies remained in net long positions of 15.19, 9.08, 1.55 and 0.12 million shares but Local Companies, Banks and NBFCs remained in net selling positions of 1.89, 3.10 and 0.06 million shares respectively.

Analytical Review

Asian shares hold on to gains but virus keeps markets on edge

Asian stocks clung to gains on Wednesday, helped by a bounce in Australian shares, but risks for equities remain large as the coronavirus pandemic rattles the underpinnings of the global economy.

Drug regulator dysfunctional as fight against Covid-19 rages

Bootleg hand sanitisers have flooded the retail market as demand skyrockets and imports are unable to keep pace. Meanwhile, critical drugs needed for the fight against Covid-19 are running out. Pharmaceutical executives say the Drug Regulatory Authority of Pakistan (Drap) has been dysfunctional for over a month now because 10 key posts of directors have been vacant, bringing key decisions on pricing, distribution, testing or introducing drugs to a halt.

Demand for electricity, gas, oil drops dramatically

Demand in the country for electricity, natural gas and petroleum products has dropped dramatically as a result of the coronavirus epidemic, creating serious operational and financial challenges in the supply chain. Senior government officials told Dawn that electricity consumption had plummeted by almost 30 per cent and authorities had been compelled to provide uninterrupted power supply to even high-loss areas to maintain frequency. For example, the total power demand went down to about 8,500MW on Monday against 12,500-13,000MW projections based on actual consumption last year.

Govt considering restoring regular flight operations

The government has been considering restoring regular flight operations after April 4 and the Civil Aviation Authority (CAA) has issued the Airline Operational Standard Operating Procedure (SOP) for the April 4-11 period. Spokesman for the Aviation Division Abdul Sattar Khokhar, who is also a senior joint secretary, said that the restoration of regular flights was under consideration, but “a final decision has not been taken yet”. He, however, confirmed that the CAA has issued an advisory to ensure the safety of passengers and crew members to minimise the risks associated with Covid-19 and recommended some preventive measures in case a decision is taken regarding resuming regular flights.

Oil prices rebound, but languish near 18-year lows

Oil prices clawed back some ground in Asian trade Tuesday after falling to 18-year lows, as the coronavirus pandemic brings economies worldwide to a standstill and throttles demand. US benchmark West Texas Intermediate rose 2.9 percent to just over $20 a barrel while Brent crude, the international benchmark, was up 0.5 percent at nearly $23 a barrel. In New York on Monday, prices struck their lowest levels since 2002, with WTI briefly falling below $20. Oil markets have plunged as governments across the planet introduce lockdowns to stem the spread of the virus, hammering demand for the commodity. About two-fifths of the globe’s population have now been confined to their homes, while the death toll has soared over 37,000, with the US suffering a serious and escalating outbreak.

Asian stocks clung to gains on Wednesday, helped by a bounce in Australian shares, but risks for equities remain large as the coronavirus pandemic rattles the underpinnings of the global economy.

Bootleg hand sanitisers have flooded the retail market as demand skyrockets and imports are unable to keep pace. Meanwhile, critical drugs needed for the fight against Covid-19 are running out. Pharmaceutical executives say the Drug Regulatory Authority of Pakistan (Drap) has been dysfunctional for over a month now because 10 key posts of directors have been vacant, bringing key decisions on pricing, distribution, testing or introducing drugs to a halt.

Demand in the country for electricity, natural gas and petroleum products has dropped dramatically as a result of the coronavirus epidemic, creating serious operational and financial challenges in the supply chain. Senior government officials told Dawn that electricity consumption had plummeted by almost 30 per cent and authorities had been compelled to provide uninterrupted power supply to even high-loss areas to maintain frequency. For example, the total power demand went down to about 8,500MW on Monday against 12,500-13,000MW projections based on actual consumption last year.

The government has been considering restoring regular flight operations after April 4 and the Civil Aviation Authority (CAA) has issued the Airline Operational Standard Operating Procedure (SOP) for the April 4-11 period. Spokesman for the Aviation Division Abdul Sattar Khokhar, who is also a senior joint secretary, said that the restoration of regular flights was under consideration, but “a final decision has not been taken yet”. He, however, confirmed that the CAA has issued an advisory to ensure the safety of passengers and crew members to minimise the risks associated with Covid-19 and recommended some preventive measures in case a decision is taken regarding resuming regular flights.

Oil prices clawed back some ground in Asian trade Tuesday after falling to 18-year lows, as the coronavirus pandemic brings economies worldwide to a standstill and throttles demand. US benchmark West Texas Intermediate rose 2.9 percent to just over $20 a barrel while Brent crude, the international benchmark, was up 0.5 percent at nearly $23 a barrel. In New York on Monday, prices struck their lowest levels since 2002, with WTI briefly falling below $20. Oil markets have plunged as governments across the planet introduce lockdowns to stem the spread of the virus, hammering demand for the commodity. About two-fifths of the globe’s population have now been confined to their homes, while the death toll has soared over 37,000, with the US suffering a serious and escalating outbreak.

Market is expected to remain volatile during current trading session.

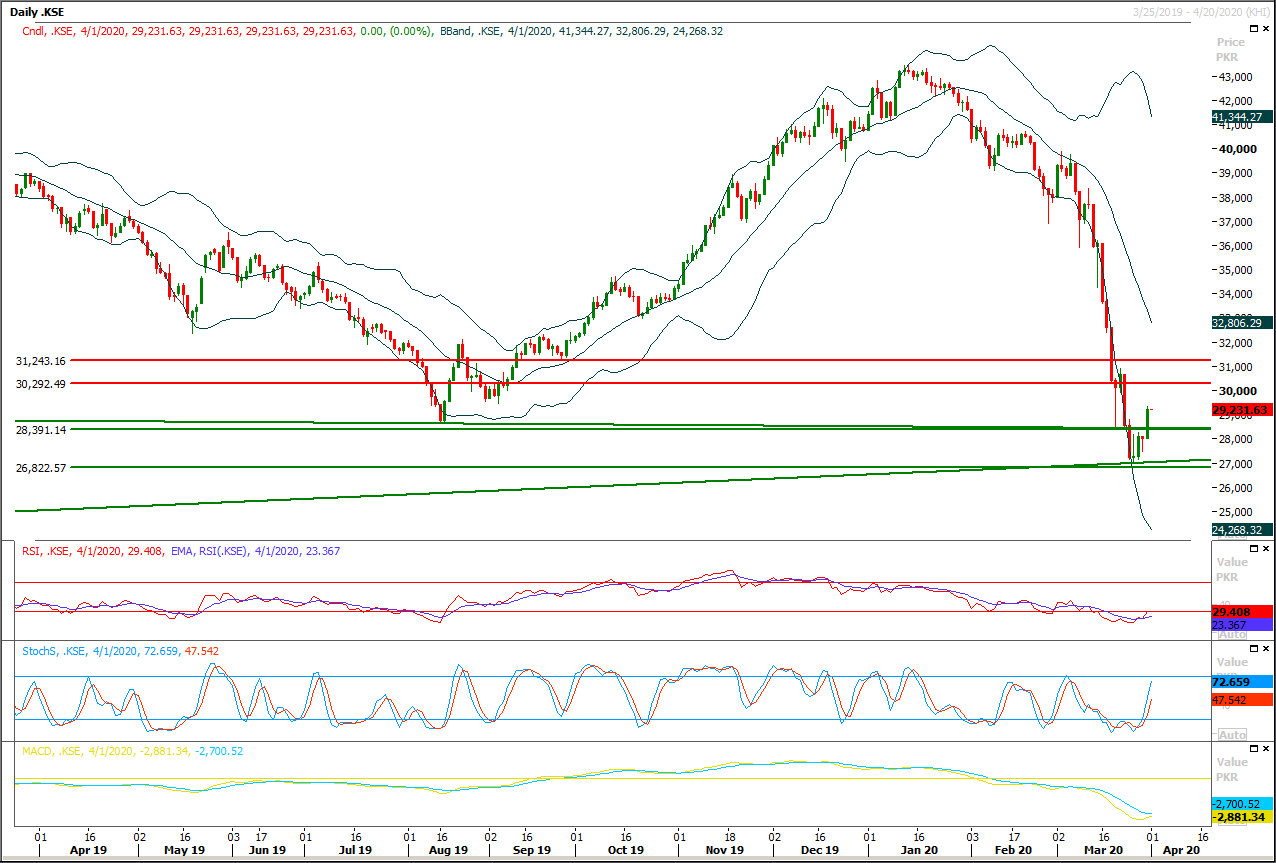

Technical Analysis

The Benchmark KSE100 index have pulled back after getting support from a rising trend line on weekly and monthly charts meanwhile index succeed in closing above its major supportive region of 28,500pts on monthly chart. As of now it's expected that index would try to extend its bullish sentiment towards 29,700pts initially and breakout above that region would call for 30,300pts and 30760pts in coming days. It's recommended to stay cautious and post trailing stop loss on long positions because if index would start sliding downward again then it would move very quickly.

Index would remain bearish until it would not succeed in closing above 32,500pts on weekly chart and in case of facing rejection from its resistant regions index could fall below its previous low to complete 100% expansion of its last weekly correction. Initially index would try to find some ground at 28,500pts in case of bearish pressure but closing below that region would call for 27,000pts.

Index would remain bearish until it would not succeed in closing above 32,500pts on weekly chart and in case of facing rejection from its resistant regions index could fall below its previous low to complete 100% expansion of its last weekly correction. Initially index would try to find some ground at 28,500pts in case of bearish pressure but closing below that region would call for 27,000pts.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.