Previous Session Recap

Trading volume at PSX floor dropped by 103.39 million shares or 27.36% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43,638.77, posted a day high of 43,638.77 and a day low of 42,610.64 during last trading session. The session suspended at 42,712.43 with net change of -844.20 and net trading volume of 158.01 million shares. Daily trading volume of KSE100 listed companies dropped by 18.40 million shares or 10.43% on DoD basis.

Foreign Investors remained in net selling position of 11.26 million shares and net value of Foreign Inflow dropped by 2.82 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.07 million shares but Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 6.65 and 4.69 million shares. While on the other side Local Individuals, Mutual Fund and Insurance Companies remained in net buying positions of 19.10, 0.74 and 3.11 million shares but Local Companies, Banks, NBFCs and Brokers remained in net selling positions of 0.84, 0.22, 2.57 and 8.21 million shares respectively.

Analytical Review

Asian shares rise, but U.S. tariff plan puts focus back on trade war

Asian shares were higher on Wednesday, tracking the firmer Wall Street finish though reports that Washington plans to raise tariffs on $200 billion of Chinese goods have put the focus back on volatile Sino-U.S. trade relations. Global markets inched higher on Tuesday, helped by a Bloomberg report that the U.S. and China were seeking to resume trade talks to defuse the battle over import tariffs. However, later reports that the U.S. plans tariffs of 25 percent on $200 billion in Chinese imports have injected some uncertainty back into financial markets, with the offshore yuan and the Australian dollar lower. A source told Reuters that an announcement on Washington’s tariff plans for China could come as early as Wednesday. In Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.2 percent, while Japan’s Nikkei stock index gained 0.6 percent. S&P E-mini futures were flat at 2816.5 after earlier edging higher.

Rs441.645m received for dams

As many as Rs441.645 million donation has been received in fund, set up for construction of Diamer Bhasha and Mohmand dams under the landmark decision of the Apex Court. According to data compiled by State Bank of Pakistan, Rs.59,438,771.22 were collected on July 30, Rs.11,390,307 on July 27, Rs.36,66,418.19 on July 26, Rs 31,850,931.56 on July 24, Rs 25,549,929.59 on July 23, Rs17,526,149.31 on July 20 and Rs.33,263,354.15 on July 19. Similarly, a sum of of Rs 40,096,370.19 was deposited on July 18, Rs.60,432,101.02 on July 17, Rs34,295,141.07 on July 16, Rs 26,143,838.44 on July 13, Rs. 30,204,440.89 on July 12, Rs26,865,970 on July 11, Rs 5,374,636 on July 10, Rs 1,346,261 on July 9 and Rs 1,201,150 on July 6.

Cement industry to expand capacity

The expansion in economic activity and investment in infrastructure projects under PSDP and CPEC have encouraged the cement industry to invest over Rs250 billion for expansion of their production capacity to around 73 million tonnes from present capacity of almost 50 million tonnes. According to a report of the central bank, the cement sector production capacity will register a growth of about 50 percent in next few years, adding about 24 million tonnes towards the production facility to reach around 73 million tonnes. The report said that the expansion may be even higher if other firms with 8 million tonnes in pipeline also join this campaign. The SBP has estimated that additional capacity would result in the imports of machinery of around $1.5 billion in next couple of years. In the cement industry, cost of machinery imports comes around 70 percent of total cost of the project. This means, the overall estimated cost of expansion would be around Rs 254 billion.

SECP directs PSCs to comply with governance rules

The Securities and Exchange Commission of Pakistan (SECP)'s chairman has directed the relevant department to ensure full compliance of public sector companies (PSCs) with Public Sector Companies (Corporate Governance) Rules, 2013, for better corporate governance and transparency. He appreciated the fact that the SECP's intensive efforts have improved the PSCs' compliance with rules from 36 percent in 2015 to 60 percent in 2018. He said that all enforcement measures should be taken to achieve full compliance by all PSCs. "No complacency shall be tolerated in this respect as public interest is associated with the efficient governance of PSCs and the SECP will play its due role within its regulatory framework."

IMF urges Greece to pursue 'realistic' economic targets

The International Monetary Fund on Tuesday urged Greece to be "realistic" about its economic goals, and reiterated the longstanding concern the country may yet need additional debt relief. The IMF board welcomed the agreement Athens reached with the European Union in June to reduce the country's debt burden over the next five to 10 years, but said it may be insufficient given the potential for political opposition to further reforms. Eurozone ministers agreed to extend maturities by 10 years on major parts of Greece's total debt, a mountain that is more than double the country's annual economic output. In turn, Greece committed to a primary budget surplus -- not counting debt repayments -- of 3.5 percent of GDP through 2022, and 2.2 percent through 2060, with average economic growth of three percent a year.

Asian shares were higher on Wednesday, tracking the firmer Wall Street finish though reports that Washington plans to raise tariffs on $200 billion of Chinese goods have put the focus back on volatile Sino-U.S. trade relations. Global markets inched higher on Tuesday, helped by a Bloomberg report that the U.S. and China were seeking to resume trade talks to defuse the battle over import tariffs. However, later reports that the U.S. plans tariffs of 25 percent on $200 billion in Chinese imports have injected some uncertainty back into financial markets, with the offshore yuan and the Australian dollar lower. A source told Reuters that an announcement on Washington’s tariff plans for China could come as early as Wednesday. In Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.2 percent, while Japan’s Nikkei stock index gained 0.6 percent. S&P E-mini futures were flat at 2816.5 after earlier edging higher.

As many as Rs441.645 million donation has been received in fund, set up for construction of Diamer Bhasha and Mohmand dams under the landmark decision of the Apex Court. According to data compiled by State Bank of Pakistan, Rs.59,438,771.22 were collected on July 30, Rs.11,390,307 on July 27, Rs.36,66,418.19 on July 26, Rs 31,850,931.56 on July 24, Rs 25,549,929.59 on July 23, Rs17,526,149.31 on July 20 and Rs.33,263,354.15 on July 19. Similarly, a sum of of Rs 40,096,370.19 was deposited on July 18, Rs.60,432,101.02 on July 17, Rs34,295,141.07 on July 16, Rs 26,143,838.44 on July 13, Rs. 30,204,440.89 on July 12, Rs26,865,970 on July 11, Rs 5,374,636 on July 10, Rs 1,346,261 on July 9 and Rs 1,201,150 on July 6.

The expansion in economic activity and investment in infrastructure projects under PSDP and CPEC have encouraged the cement industry to invest over Rs250 billion for expansion of their production capacity to around 73 million tonnes from present capacity of almost 50 million tonnes. According to a report of the central bank, the cement sector production capacity will register a growth of about 50 percent in next few years, adding about 24 million tonnes towards the production facility to reach around 73 million tonnes. The report said that the expansion may be even higher if other firms with 8 million tonnes in pipeline also join this campaign. The SBP has estimated that additional capacity would result in the imports of machinery of around $1.5 billion in next couple of years. In the cement industry, cost of machinery imports comes around 70 percent of total cost of the project. This means, the overall estimated cost of expansion would be around Rs 254 billion.

The Securities and Exchange Commission of Pakistan (SECP)'s chairman has directed the relevant department to ensure full compliance of public sector companies (PSCs) with Public Sector Companies (Corporate Governance) Rules, 2013, for better corporate governance and transparency. He appreciated the fact that the SECP's intensive efforts have improved the PSCs' compliance with rules from 36 percent in 2015 to 60 percent in 2018. He said that all enforcement measures should be taken to achieve full compliance by all PSCs. "No complacency shall be tolerated in this respect as public interest is associated with the efficient governance of PSCs and the SECP will play its due role within its regulatory framework."

The International Monetary Fund on Tuesday urged Greece to be "realistic" about its economic goals, and reiterated the longstanding concern the country may yet need additional debt relief. The IMF board welcomed the agreement Athens reached with the European Union in June to reduce the country's debt burden over the next five to 10 years, but said it may be insufficient given the potential for political opposition to further reforms. Eurozone ministers agreed to extend maturities by 10 years on major parts of Greece's total debt, a mountain that is more than double the country's annual economic output. In turn, Greece committed to a primary budget surplus -- not counting debt repayments -- of 3.5 percent of GDP through 2022, and 2.2 percent through 2060, with average economic growth of three percent a year.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

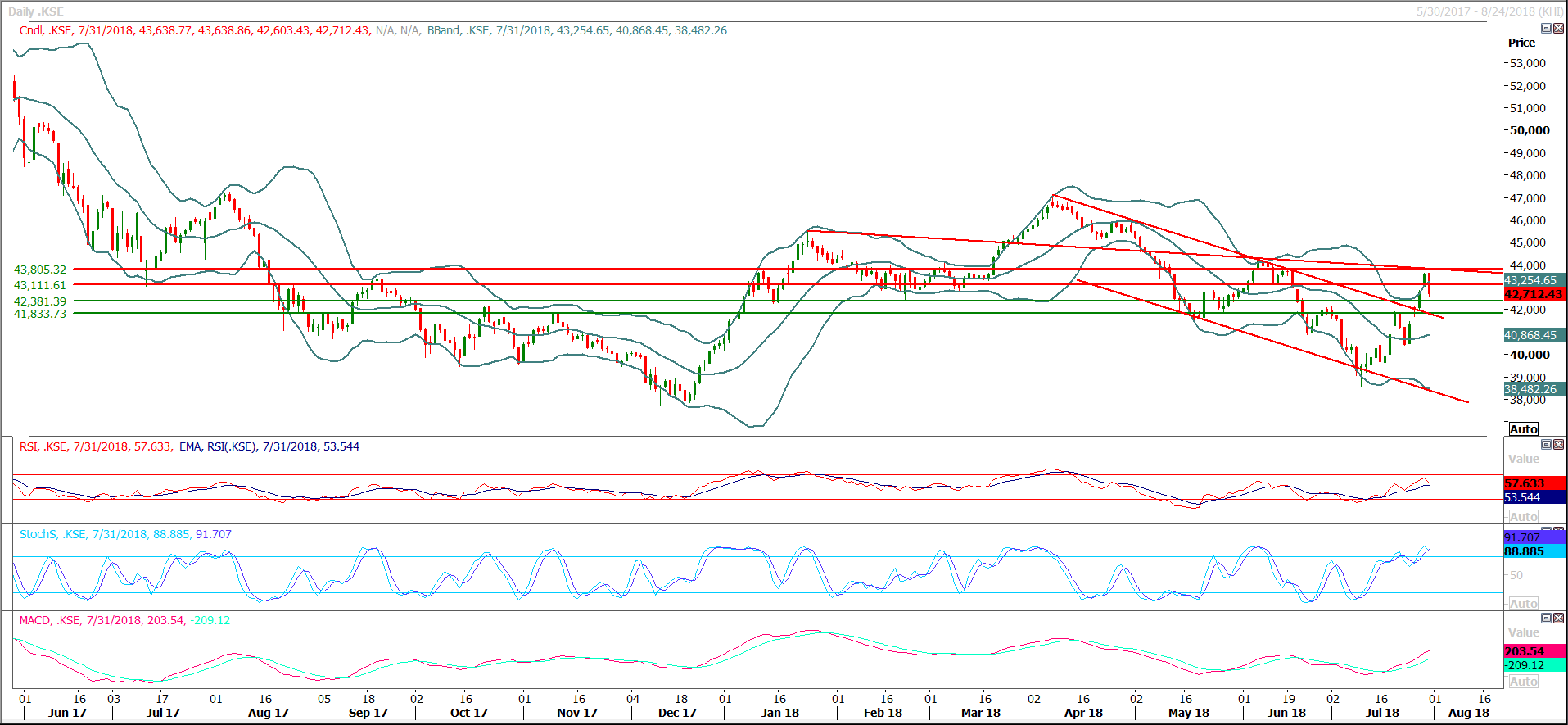

Technical Analysis

The Benchmark KSE100 Index have formatted a bearish engulfing pattern on daily chart after getting resistance from a horizontal resistant region during last trading session and have completed a gap which was occurred on daily chart. As of now daily momentum indicators are trying to convert to bearish side and if index would close with a negative change during current trading session then they would succeed in creating a clear indication of start of a correction. For current trading session it’s expected that index would start with a negative trend but would try to recover before day end and 42,300 and 42,089 would try to push index back in positive direction. Major supportive region would be 41,830 points against current bearish sentiment. Its recommended to wait for a dip before initiating long positions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.