Previous Session Recap

Trading volume at PSX floor increased by 6.11 million shares or 2.16% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 44252.94, posted a day high of 44533.76 and a day low of 43996.42 during last trading session. The session suspended at 44049.05 with net change of -184.06 and net trading volume of 80.16 million shares. Daily trading volume of KSE100 listed companies increased by 8.26 million shares or 11.49% on DoD basis.

Foreign Investors remained in net buying position of 39.72 million shares but net value of Foreign Inflow dropped by 5.11 million US Dollars. Categorically, Foreign Individual and Corporate investors remained in net selling postions of 0.35 and 7.39 million shares but Overeas Pakistanis remained in net buying of 47.45 million shares. While on the other side Local Individuals, NBFCs, Mutual Funds and Insurance Companies remained in net buying postions of 6.73, 0.34, 7.07 and 2.62 million shares but Local Companies, Banks and Brokers remained in net selling positions of 0.2, 5.31 and 52.15 million shares respectively.

Analytical Review

Asian shares eked out modest gains on Thursday, clawing back sharp losses from earlier this week, however, rising U.S. bond yields and interest rates could dampen investors’ optimism toward the global economic outlook.The U.S. Federal Reserve kept interest rates on hold as expected at its first policy meeting in 2018 on Wednesday but flagged interest policy tightening later this year. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.1 percent in early trade, slowly recovering after Tuesday's 1.4 percent fall. Japan's Nikkei .N225 also gained, rising 0.5 percent from a four-week low hit the previous day. “The U.S. is cutting tax and spending $1.5 trillion in infrastructure when the economy is really strong. There would be little wonder if the economy overheats,” said Norihiro Fujito, senior investment strategist at Mitsubishi UFJ Morgan Stanley Securities.

The cement industry has urged the government to increase custom duty on import of clinker to support the local manufacturers, as exports continue to decline amidst buoyancy in domestic market. Moreover, the industry recommended that the imports of cement should not be allowed until the importers register themselves with Pakistan Standards and Quality Control Authority (PSQCA) to certify the quality of their cement in line with the Indian government as well as all other importing countries’ authorities, the industry representatives demanded. The industry stakeholders said that Pakistan has already lost a major chunk of its market in Afghanistan to Iranian cement . The high energy cost has made the cement more expensive as cement is an energy intensive sector.

A parliamentary committee was informed Wednesday that Federal Board of Revenue (FBR) had issued 33,000 notices to high value unregistered taxpayers. "We are doing mapping of 450 plazas, constructed during past 10 years, in the federal capital," the FBR officials told the Senate Committee on Finance here. The committee which met here with Saleem Mandviwalla in chair was also informed that in Islamabad Heights, so far, 97 units were sold and 40 of the buyers are unregistered taxpayers, the FBR official informed. FBR 's Director General for Broadening of Tax Base (BTB) Tanvir Malik informed the committee that so far 33,000 notices had been issued to high value unregistered taxpayers by targeting investors in real estate, mapping of plazas and housing schemes. Around 20,000 unregistered individuals have been identified from FBR 's withholding portal for bulk registration.

Punjab Board of Investment and Trade has inked an agreement with Jereh group, a global player in oil & gas, power, and environmental management. As a leading energy company, Jereh Group aims to make full use of strengths in equipment manufacturing, technical services, engineering and financing, contributing more to the construction of Pakistan as well as Punjab. The memorandum of understanding was signed by CEO PBIT , Jahanzeb Burana and Zhiyong Yao, Director Sales, Jereh Group intending to invest in energy sector in captive power mode. During visit to Punjab Board of Investment and Trade, the representatives from the company were briefed about special economic zones (SEZs) and the energy investment opportunities in these SEZs, being developed in Punjab, in order to invest and collaborate. Moreover, the delegation interacted with Bismillah Energy Group and JDW group, as the said groups are working in energy sector. Jereh Group showed keen interest in having joint venture with them and investing in Punjab for fruitful results. .

The Senate Sub Committee on PIA, probing the sale of air bus 310 to a German firm in violation of rules, was informed on Tuesday that the name of former CEO , a German national, was removed from Exit Control List (ECL) on the order of the then interior minister on a letter from the Foreign Office. The committee with Senator Farhatullah Babar in the chair met at the office of Secretary Civil Aviation Division in the PIA complex and attended by and senators Nauman Wazir, Tahir Hussain Mashhadi, secretary Civil Aviation besides officials of PIA, interior , defence, FIA and others. The meeting was also informed that under directions of the Public Accounts Committee of the National Assembly the case has since been referred to the NAB for inquiry. Besides the FIA has also taken notice and started its own investigations.

Its recommended to practice caution as market is expected to remain volatile.

Technical Analysis

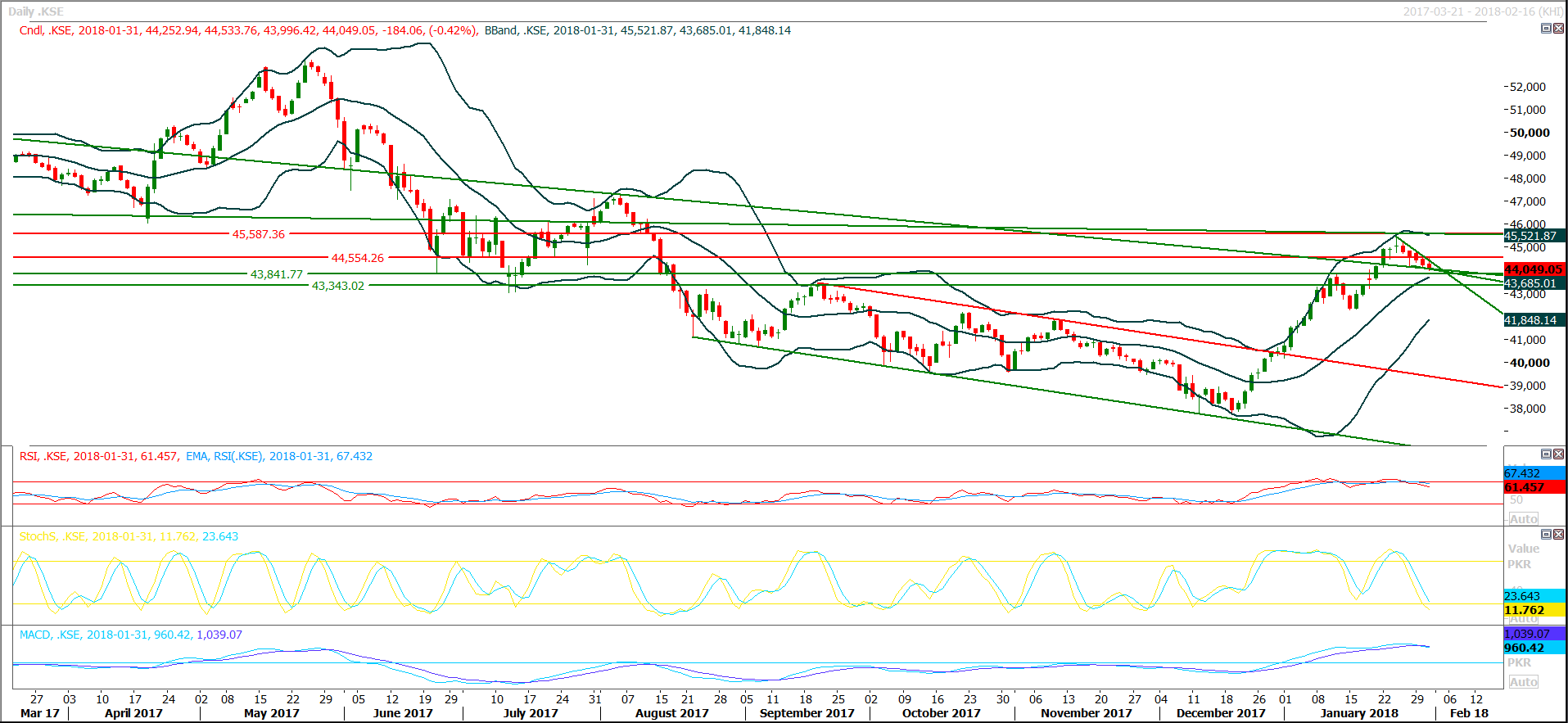

The Benchmark KSE100 Index have penetrated its supportive trend line on daily chart but did not closed belwo that region while hourly chart have gone far from its decending supportive trend line which was reacting as a strong supportive region since last four trading session in result of daily supportive region. As of right now index have supportive region at 43840 and breakout of that region would change market trend for a short term and after this region nearist support for the index would be 43330 points. As index is capped by a resistant trend line therefore its not recommended to initiate new buying with out strict stop loss untill index close above 44465 points on daily chart. Its expected that index would start a positive momentum in start of day during current trading session but chances of reversal are stronger therefore its recommended to sell on strength.ended to stay side line until breakout of that region or breakout of 44960 in upward direction.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.