Previous Session Recap

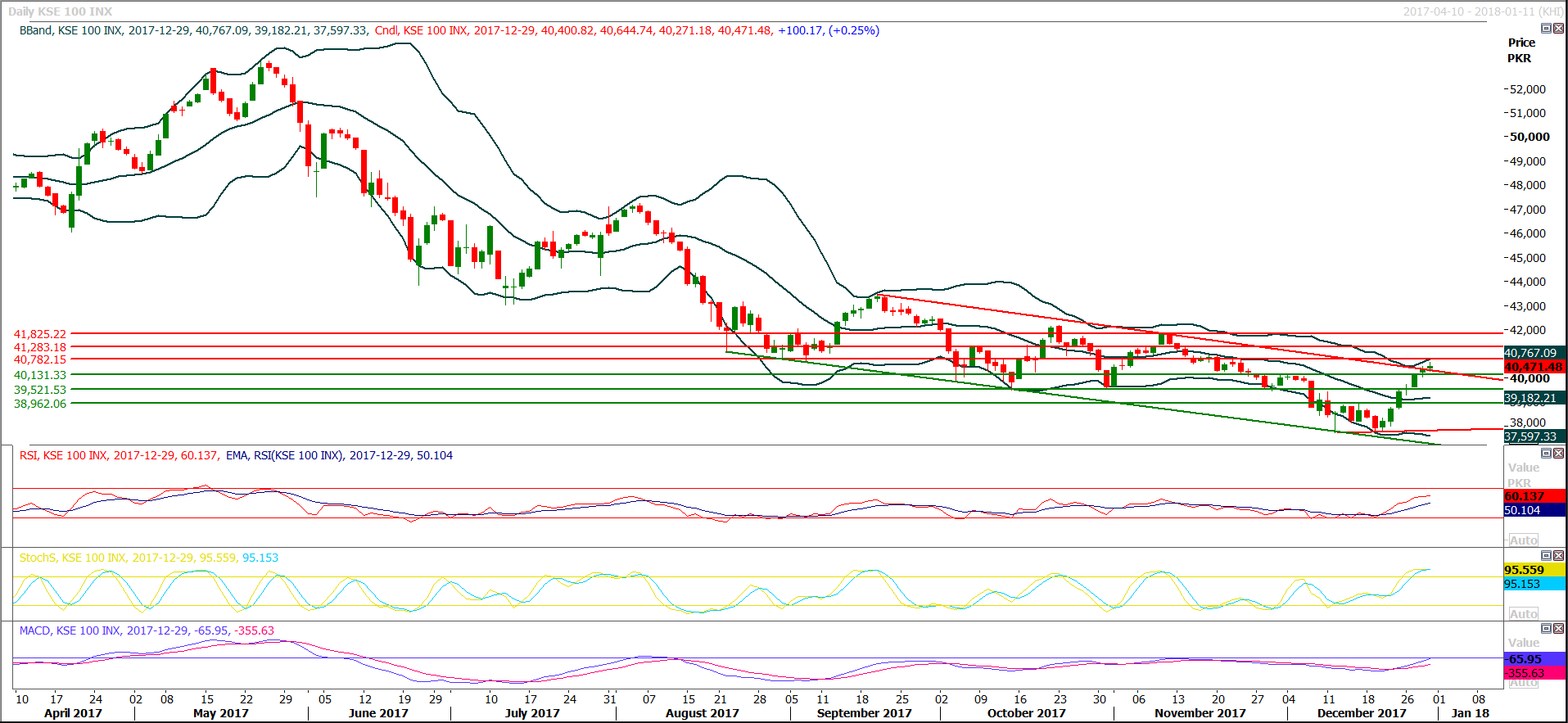

Trading volume at PSX floor increased by 1.38 million shares or 0.58% on DoD basis during last trading session of 2017, whereas the benchmark KSE100 Index opened at 40400.82, posted a day high of 40644.74 and a day low of 40271.18 during last trading session. The session suspended at 40471.48 with net change of 100.17 and net trading volume of 126.85 million shares. Daily trading volume of KSE100 listed companies increased by 32.66 million shares or 34.67% on DoD basis.

Foreign Investors remained in net buying position of 6.59 million shares and net value of Foreign Inflow increased by 8.66 million US Dollars. Categorically, Foreign Individual and Corporate Investors remained in net buying positions of 0.2 and 8.3 million shares but Overseas Pakistanis remained in net selling position of 1.91 million shares. While on the other side Local Individuals, Companies and Mutual Funds remained in net buying positions of 2.49, 22.77 and 10.45 million shares but Local Banks, Brokers and Insurance Companies remained in net selling postions of 23.9, 11.19 and 11.25 million shares respectively.

Analytical Review

Asian markets were ending 2017 in a party mood on Friday after a year in which a concerted pick-up in global growth boosted corporate profits and commodity prices, while benign inflation kept central banks from taking away the monetary punch bowl. MSCI’s broadest index of Asia-Pacific shares outside Japan inched up 0.2 percent as three straight weeks of gains left it within a whisker of decade peaks. The index has been on an upward trajectory for pretty much all of 2017, putting it 33 percent higher for the year so far. Hong Kong led the charge with gains of 36 percent for the year, while South Korea notched up 22 percent and India 27 percent. Japan’s Nikkei and the S&P 500 are both ahead by almost 20 percent, while the Dow has risen by a quarter. In Europe, the German DAX has gained nearly 14 percent, though the UK FTSE has lagged a little with a rise of 7 percent.

The federal government on Sunday increased the prices of petroleum products by up to 11.75 per cent for the month of January 2018, DawnNews reported. The announcement in this regard was made by Miftah Ismail, the newly appointed adviser to Prime Minister on Finance, while addressing a press conference in Islamabad. Petrol and high-speed diesel — the two most widely used products — will now sell for Rs81.53 and Rs89.91 a litre, respectively, after an increase of around Rs4 each. Ex-depot price of high-speed diesel increased by Rs3.96 per litre and that of petrol by Rs4.06 per litre. Moreover, the price of light-diesel oil (LDO) has been increased by Rs6.25 per litre while the price of kerosene oil will see a hike of Rs6.79 per litre.

After identifying “dodgy corporates and habitual investors”, Indus Motor Company (IMC) has cancelled advance car booking orders worth Rs600 million. IMC initiated a public-interest campaign at the end of November to discourage the practice of premium. Auto dealers charge their customers a premium for quick delivery of vehicles. To improve the booking process for genuine customers of Toyota vehicles, IMC conducted an examination of the pending provisional booking orders (PBO) to verify the accuracy of customer information, identification and other details.

Sindh Governor Mohammad Zubair said on Friday that Pakistan for the first time is going to use Thar coal for power generation, as a single unit of 660 megawatts (2x330MW), expected to start supplying power to the national grid from 2018. Speaking at an interactive session held by the Sindh Engro Coal Mining Company (SECMC) at the Governor House, he said there is going to be a combined investment of $4.5 billion, which is not restricted to only coal mining, but about transforming the entire landscape of the area. He said that Thar, being amongst the poorest and most neglected parts of the country, will hopefully be transformed through this economic activity.

The Federal Board of Revenue (FBR) collected Rs1722 billion during first half (July to December) of the current fiscal year, missing the target by a wide margin. The FBR has missed the first half’s target by Rs50 billion. However, despite missing the target , the FBR’s tax collection has shown healthy growth during first six months of the year 2017-18. The FBR remains on track to achieve annual collection target of Rs4013 billion. During first half of the current financial year, the FBR has received provisional net revenue of over Rs1722 billion as against Rs1466 billion collected during the same period in the previous year, registering an increase of around 17.5 percent over the revenue collected during the corresponding period in the last fiscal year. These figures have been arrived at by taking reconciled figures of net revenue collected up till November, 2017 at Rs1305 and provisional figures of Rs417 billion for December, 2017.

PSO, POL, OGDC, ISL and SNGP may lead the market in positive direction during current trading session.

Technical Analysis

The Benchmark KSE100 Index have closed above its 61.8% bearish correction on daily chart and it also has closed above resistant trend line of a bearish trend channel. As of right now index have a resistance at 40780 and breakout of that region would push index in positive direction towards 41280 and 41800 points in coming days. Its recommended to initiate new buying on dips with strict stop loss of 40131 during current trading session. While on the supportive side index have supportive regions around 40131 and 39500 points where two horizontal supportive regions are supporting index to maintain its bullish trend. Its recommended to post strict stop loss while buying as index have not been corrected since last 3000 points and have moved in a straight rally therefore it can take a correction of 800 to 1000 points if it would not become able to close above 40780.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.