Previous Session Recap

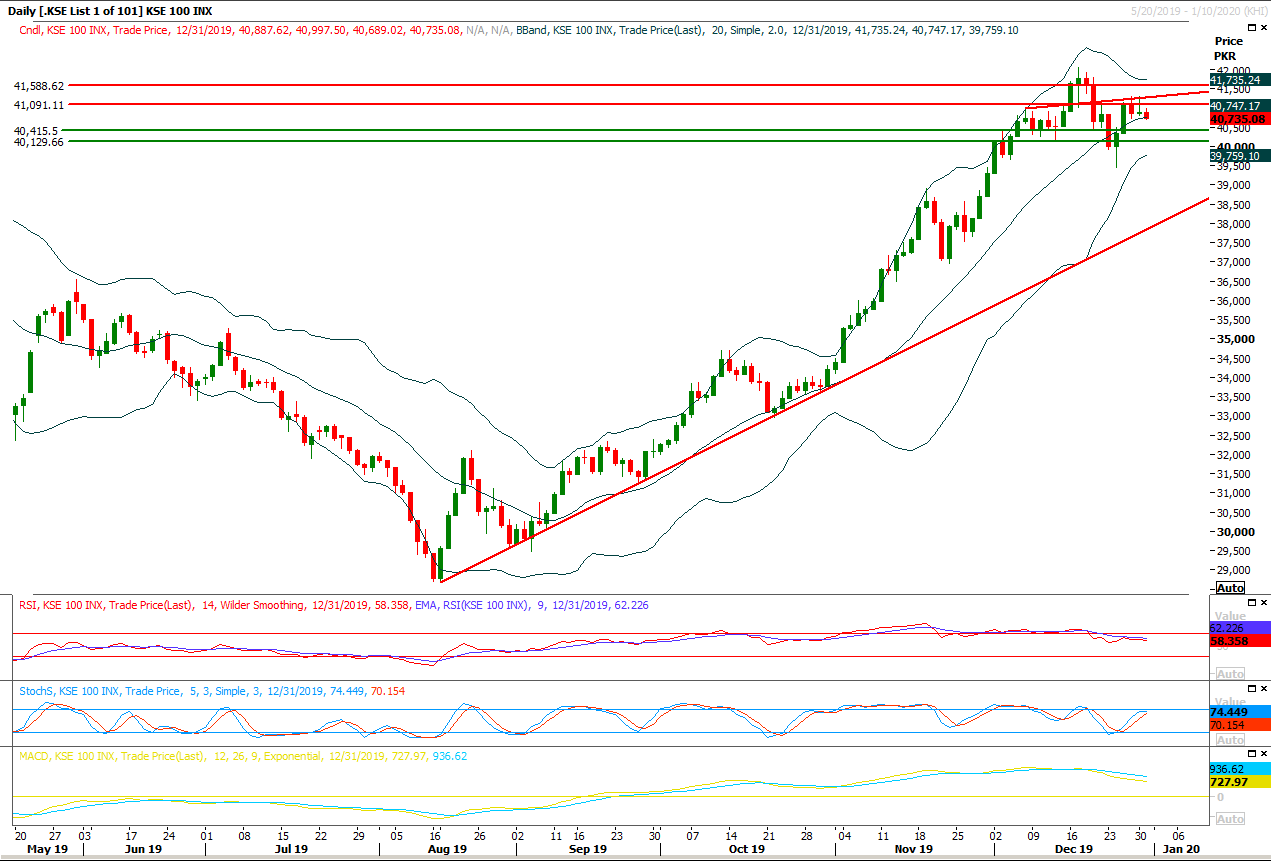

Trading volume at PSX floor increased by 11.29 million shares or 6.81% on DoD basis, whereas the benchmark KSE100 index opened at 40,887.62, posted a day high of 40,997.50 and a day low of 40,689.02 points during last trading session while session suspended at 40,735.08 points with net change of -152.54 points and net trading volume of 117.21 million shares. Daily trading volume of KSE100 listed companies increased by 6.53 million shares or 5.90% on DoD basis.

Foreign Investors remained in net selling positions of 5.64 million shares and value of Foreign Inflow dropped by 2.51 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.08 million shares but Overseas Pakistanis and Foreign Corporate remained in net selling positions of 2.20 and 3.53 million shares. While on the other side Local Companies, Banks, Mutual Fund, Brokers and Insurance Companies remained in net selling positions of 0.57, 0.32, 2.39, 60.10 and 2.58 million shares but Local Individuals and NBFCs remained in net buying positions of 68.66 and 0.01 million shares respectively.

Analytical Review

Wall Street edges higher; S&P closes decade with nearly 190% gain

Wall Street’s major indexes edged higher on Tuesday on a renewed rally fueled by trade optimism, capping off a decade of handsome returns in which the benchmark S&P 500 rose nearly 190% Both the S&P 500 and the Nasdaq notched their biggest annual percentage gains since 2013, while the Dow closed 2019 with its biggest yearly percentage gain since 2017. In 2019, the current bull run in U.S. stocks became the longest one on record as trade optimism, dovish monetary policy and an improving economic outlook fueled sharp gains. On Tuesday, President Donald Trump said on Twitter that the Phase 1 U.S.-China trade deal would be signed on Jan. 15 at the White House, bolstering widespread expectations of a finalized preliminary agreement in early 2020. That development was offset, however, by news of violent protests outside the U.S. embassy in Baghdad. The session’s modest gains marked a turnaround from Monday, when the S&P 500 and the Nasdaq posted their biggest daily percentage losses in nearly four weeks. U.S. stocks had become overbought, and Monday’s declines helped make room for future gains, said Alec Young, managing director of global markets research at FTSE Russell in New York.

Six-month revenue collection shortfall rises to Rs287bn

The Federal Board of Revenue (FBR) missed revised revenue collection target for the first half year of current fiscal year by a wide margin of Rs287 billion against the target of Rs2.367 trillion despite several measures and double-digit consumer inflation. The FBR has collected Rs2.080tr during the first half year as against the target of Rs2.367tr projected for the same period, leaving behind a shortfall of Rs287bn. The tax authority estimates to collect another Rs2-4bn in book adjustments. However, the collection during the first half of current fiscal year is 16.95 per cent higher than the Rs1.784tr collected in the corresponding period last year.

Price of petrol raised by Rs2.61 per litre, kerosene by Rs3.10

The government on Tuesday increased fuel prices for January, raising the petrol price to Rs116.60 per litre with the increase of Rs2.61, while approving the recommendations made by the Oil and Gas Regulatory Authority (Ogra). A notification issued by the finance ministry says that the new rate for the most widely used fuel consumed in large vehicle engines and generators — High Speed Diesel (HSD) — has been raised by Rs2.25 to Rs127.26 per litre. An official of the state-owned oil company PSO said that January was not the month of heavy consumption of diesel and petrol in the country as there was limited activity in the farm sector while the movement of trucks too was restricted in the wake of occasional fog at highways.

CPEC Phase-II to get additional stimulus in 2020: Asad Umar

Minister for Planning and Development Asad Umar on Monday said the benefits of China-Pakistan Economic Corridor (CPEC) will start to trickle into the productive sectors of the economy including industry and agriculture during the year 2020. The first phase of CPEC (early harvest projects) addressed key infrastructure gaps in the economy with focus on energy and transport bottlenecks, he said in an article. He said the big projects under CPEC targeted to be completed in 2020 include the trade and transport connectivity projects of KKH Phase-II Havelian-Thakot (118km) road and the Sukkur-Multan (392km) highway.

Rupee suffers hard against all major currencies

Almost all of the international currencies gained against the rupee in 2019 but the biggest appreciation was seen in the British pound which gained over 15 per cent. The Forex Association Pakistan on Tuesday issued a compiled report showing the devaluation trend of the rupee against major international currencies in interbank market. The US dollar dominates the country’s trade appreciated by 11.5pc during the year. The dollar traded at Rs139 in the interbank on Dec 31, 2018. However, it traded at Rs154.94 on Dec 31, 2019 showing a devaluation of almost Rs16 per dollar or 11.5pc. The open market rate is almost same with slight fluctuations. The dollar was traded as high as Rs164 in the open market during the year but it settled around Rs155 for more than two months.

Wall Street’s major indexes edged higher on Tuesday on a renewed rally fueled by trade optimism, capping off a decade of handsome returns in which the benchmark S&P 500 rose nearly 190% Both the S&P 500 and the Nasdaq notched their biggest annual percentage gains since 2013, while the Dow closed 2019 with its biggest yearly percentage gain since 2017. In 2019, the current bull run in U.S. stocks became the longest one on record as trade optimism, dovish monetary policy and an improving economic outlook fueled sharp gains. On Tuesday, President Donald Trump said on Twitter that the Phase 1 U.S.-China trade deal would be signed on Jan. 15 at the White House, bolstering widespread expectations of a finalized preliminary agreement in early 2020. That development was offset, however, by news of violent protests outside the U.S. embassy in Baghdad. The session’s modest gains marked a turnaround from Monday, when the S&P 500 and the Nasdaq posted their biggest daily percentage losses in nearly four weeks. U.S. stocks had become overbought, and Monday’s declines helped make room for future gains, said Alec Young, managing director of global markets research at FTSE Russell in New York.

The Federal Board of Revenue (FBR) missed revised revenue collection target for the first half year of current fiscal year by a wide margin of Rs287 billion against the target of Rs2.367 trillion despite several measures and double-digit consumer inflation. The FBR has collected Rs2.080tr during the first half year as against the target of Rs2.367tr projected for the same period, leaving behind a shortfall of Rs287bn. The tax authority estimates to collect another Rs2-4bn in book adjustments. However, the collection during the first half of current fiscal year is 16.95 per cent higher than the Rs1.784tr collected in the corresponding period last year.

The government on Tuesday increased fuel prices for January, raising the petrol price to Rs116.60 per litre with the increase of Rs2.61, while approving the recommendations made by the Oil and Gas Regulatory Authority (Ogra). A notification issued by the finance ministry says that the new rate for the most widely used fuel consumed in large vehicle engines and generators — High Speed Diesel (HSD) — has been raised by Rs2.25 to Rs127.26 per litre. An official of the state-owned oil company PSO said that January was not the month of heavy consumption of diesel and petrol in the country as there was limited activity in the farm sector while the movement of trucks too was restricted in the wake of occasional fog at highways.

Minister for Planning and Development Asad Umar on Monday said the benefits of China-Pakistan Economic Corridor (CPEC) will start to trickle into the productive sectors of the economy including industry and agriculture during the year 2020. The first phase of CPEC (early harvest projects) addressed key infrastructure gaps in the economy with focus on energy and transport bottlenecks, he said in an article. He said the big projects under CPEC targeted to be completed in 2020 include the trade and transport connectivity projects of KKH Phase-II Havelian-Thakot (118km) road and the Sukkur-Multan (392km) highway.

Almost all of the international currencies gained against the rupee in 2019 but the biggest appreciation was seen in the British pound which gained over 15 per cent. The Forex Association Pakistan on Tuesday issued a compiled report showing the devaluation trend of the rupee against major international currencies in interbank market. The US dollar dominates the country’s trade appreciated by 11.5pc during the year. The dollar traded at Rs139 in the interbank on Dec 31, 2018. However, it traded at Rs154.94 on Dec 31, 2019 showing a devaluation of almost Rs16 per dollar or 11.5pc. The open market rate is almost same with slight fluctuations. The dollar was traded as high as Rs164 in the open market during the year but it settled around Rs155 for more than two months.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index is being capped by a strong resistant trend line on daily chart and it's not being able to close above said trend line since last week. As of now it's expected that index would face some serious pressure during current trading session and may extend its bearish rally towards 40,400 or 40,130 points on intraday basis. Daily and hourly momentum indicators are facing serious pressure and these would try to push index downward if some fresh volumes would not popup today. It's recommended to stay on selling side with strict stop loss. While on flip side if index would try to take an intraday spike then it would face major resistances at 41,100 points where its being capped by a horizontal resistant region. While penetration above that region would call for 41,300 points where same trend line would try to push index downward again.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.