Previous Session Recap

Trading volume at PSX floor increased by 8.89 million shares or 6.65% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,574.60, posted a day high of 42,919.72 and a day low of 42,496.37 during last trading session. The session suspended at 42,846.64 with net change of 300.16 and net trading volume of 98.88 million shares. Daily trading volume of KSE100 listed companies increased by 14.86 million shares or 17.69% on DoD basis.

Foreign Investors remained in net selling position of 10.90 million shares and net value of Foreign Inflow dropped by 7.96 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 7.82 and 3.07 million shares. While on the other side Local Individuals, Local Companies, Banks, NBFCs and Brokers remained in net selling positions of 1.18, 18.89, 0.03, 0.16 and 0.49 million shares but Mutual Fund and Insurance Companies remained in net buying positions of 4.76 and 24.19 million shares respectively.

Analytical Review

Asia stocks sag as U.S. tariffs reignite trade war fears

Asian equities sagged on Friday as worries about U.S. trade policy hit global financial markets, which were already shaken this week by political turmoil in Italy. Wall Street shares posted deep losses overnight after the United States said it would impose tariffs on aluminum and steel imports from Canada, Mexico and the European Union. Fears of a global trade conflict, which had partially receded over the past few weeks, were rekindled as Washington’s allies took steps to retaliate against the U.S. measures. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dipped 0.08 percent. The index was down roughly 0.9 percent this week, during which it touched a six-week low on concerns that political developments in Italy could weaken its commitment to the euro and exacerbate the country’s debt burden.

LNG imports a major success: PM

After talking at length on his government’s performance in restoring economic growth and “eliminating loadshedding”, Prime Minister Shahid Khaqan Abbasi now turned his attention towards the oil and gas sector, touting increased consumption of primary fuels as a sign of economic health and growing industrial activity. In 2013, he said, the total primary energy supplies of the country were 65 million tonnes of oil equivalent which in 2017 has increased to 85m tonnes of oil equivalent depicting an increase of 23 per cent. It is expected that total primary energy supplies of the country for 2018 will be over 85mn tonnes of oil equivalent. He recalled that the gas price for first slab of residential consumers was Rs106 per million British thermal units (mmBtu) in 2013 which now stood at Rs110mmBtu, showing a minor increase of Rs3.7 during the five years.

ECC approves tax relief for former Fata, Pata

The Economic Coordination Committee (ECC) of the Cabinet on Thursday approved tax exemptions and other incentives for the next five years for the people of erstwhile FATA and PATA after the landmark 31st Constitutional Amendment. Prime Minister Shahid Khaqan Abbasi chaired a meeting of the ECC at PM Office. The ECC has approved tax exemption for erstwhile FATA and Provincially Administered Tribal Areas (PATA), which have become part of the Khyber Pakhtunkhwa after President Mamnoon Hussain signed the 31st Constitutional Amendment. Speaker of the Khyber-Pakhtunkhwa (KP) Assembly Asad Qaiser early this week voiced concerns over the issue of tax exemption enjoyed by the people of Malakand Division.

Cement prices up in retail market

The cement prices have increased by Rs15 per 50kg bag in retail market of the provincial capital on the plea of hike in Federal Excise Duty though it would be implemented from July 2018. In retail market of Lahore, different brands of cement bags are available in the range of Rs535 to Rs570 per 50kg bag against their rates of last week of Rs525 to Rs545, showing a jump of Rs15 per 50kg bag on average during the last couple of weeks. It is to be noted that the government in the federal budget has proposed rise in FED on cement sale by 20 percent to Rs1.5/kg. The industry had suggested in its budget proposal that the Federal Board of Revenue should phase out the Federal Excise Duty to encourage cement off take. It said the cement industry was subject to FED at the rate of 5 percent of retail price and General Sales Tax at the rate of 17 percent of maximum retail price. These taxes account for about Rs100 per bag before fiscal year 2016-17.

FBR struggling to meet revised target

The Federal Board of Revenue (FBR) is struggling to achieve the revised tax collection target during outgoing fiscal year despite it would generate additional revenue due to enforcement of new taxation measures of next year before June. The FBR during the first 11 months (July to May) of the current financial year has recorded a provisional net revenue collection of over Rs3274 billion as against Rs2854 billion collected during the same period of the previous fiscal year, excluding collection on account of book adjustments which depicts an increase of around 15 percent. The provisional collection for the month of May 2018 is Rs351 billion excluding collection on account of book adjustments. The figures of collection received in the treasuries of the remote areas may further swell the revenue.

Asian equities sagged on Friday as worries about U.S. trade policy hit global financial markets, which were already shaken this week by political turmoil in Italy. Wall Street shares posted deep losses overnight after the United States said it would impose tariffs on aluminum and steel imports from Canada, Mexico and the European Union. Fears of a global trade conflict, which had partially receded over the past few weeks, were rekindled as Washington’s allies took steps to retaliate against the U.S. measures. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dipped 0.08 percent. The index was down roughly 0.9 percent this week, during which it touched a six-week low on concerns that political developments in Italy could weaken its commitment to the euro and exacerbate the country’s debt burden.

After talking at length on his government’s performance in restoring economic growth and “eliminating loadshedding”, Prime Minister Shahid Khaqan Abbasi now turned his attention towards the oil and gas sector, touting increased consumption of primary fuels as a sign of economic health and growing industrial activity. In 2013, he said, the total primary energy supplies of the country were 65 million tonnes of oil equivalent which in 2017 has increased to 85m tonnes of oil equivalent depicting an increase of 23 per cent. It is expected that total primary energy supplies of the country for 2018 will be over 85mn tonnes of oil equivalent. He recalled that the gas price for first slab of residential consumers was Rs106 per million British thermal units (mmBtu) in 2013 which now stood at Rs110mmBtu, showing a minor increase of Rs3.7 during the five years.

The Economic Coordination Committee (ECC) of the Cabinet on Thursday approved tax exemptions and other incentives for the next five years for the people of erstwhile FATA and PATA after the landmark 31st Constitutional Amendment. Prime Minister Shahid Khaqan Abbasi chaired a meeting of the ECC at PM Office. The ECC has approved tax exemption for erstwhile FATA and Provincially Administered Tribal Areas (PATA), which have become part of the Khyber Pakhtunkhwa after President Mamnoon Hussain signed the 31st Constitutional Amendment. Speaker of the Khyber-Pakhtunkhwa (KP) Assembly Asad Qaiser early this week voiced concerns over the issue of tax exemption enjoyed by the people of Malakand Division.

The cement prices have increased by Rs15 per 50kg bag in retail market of the provincial capital on the plea of hike in Federal Excise Duty though it would be implemented from July 2018. In retail market of Lahore, different brands of cement bags are available in the range of Rs535 to Rs570 per 50kg bag against their rates of last week of Rs525 to Rs545, showing a jump of Rs15 per 50kg bag on average during the last couple of weeks. It is to be noted that the government in the federal budget has proposed rise in FED on cement sale by 20 percent to Rs1.5/kg. The industry had suggested in its budget proposal that the Federal Board of Revenue should phase out the Federal Excise Duty to encourage cement off take. It said the cement industry was subject to FED at the rate of 5 percent of retail price and General Sales Tax at the rate of 17 percent of maximum retail price. These taxes account for about Rs100 per bag before fiscal year 2016-17.

The Federal Board of Revenue (FBR) is struggling to achieve the revised tax collection target during outgoing fiscal year despite it would generate additional revenue due to enforcement of new taxation measures of next year before June. The FBR during the first 11 months (July to May) of the current financial year has recorded a provisional net revenue collection of over Rs3274 billion as against Rs2854 billion collected during the same period of the previous fiscal year, excluding collection on account of book adjustments which depicts an increase of around 15 percent. The provisional collection for the month of May 2018 is Rs351 billion excluding collection on account of book adjustments. The figures of collection received in the treasuries of the remote areas may further swell the revenue.

Market is expected to remain volatile therefore it'ss recommended to stay cautious while trading today.

Technical Analysis

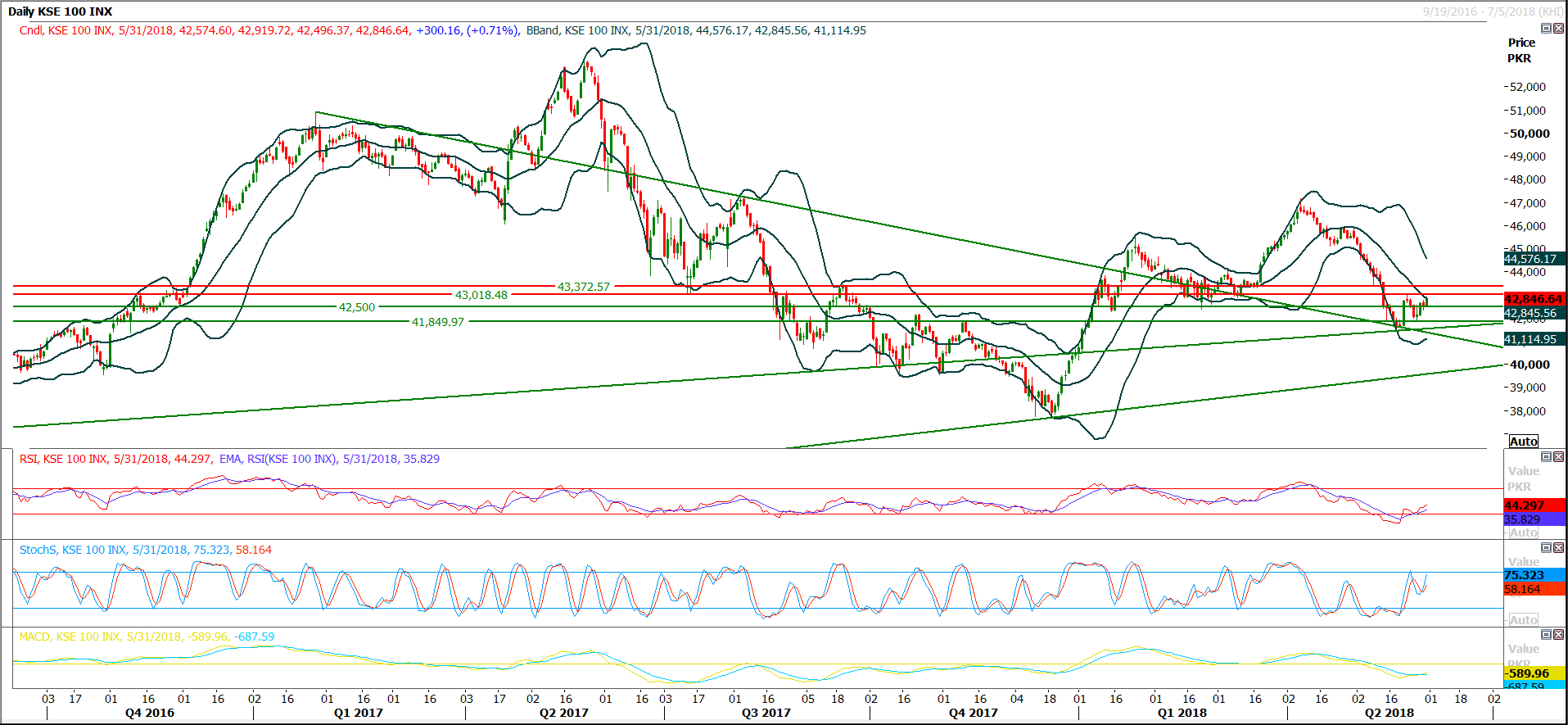

The Benchmark KSE100 Index is trying to penetrate its major resistant region of 42.860 since last three trading session after creating a morning shooting star on daily chart. Current trading session is very important being last trading day of weekly because today’s closing above 43,018 would create a morning star on weekly chart as well. But this weekly shooting star would not help bulls as much as it would be expected by bulls because index have created an evening star on monthly chart after completing its monthly 61.8% bearish correction. For current trading session index have supports around 42,560 and 41,850 points while resistant regions are standing at 43,018 and 43,330 points. It’s not recommended to initiate new buying until index close above 43,330 points on daily basis. On intraday basis it’s expected that after a spike index could start reversal therefore it’s recommended to trade with strict stop loss

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.