Previous Session Recap

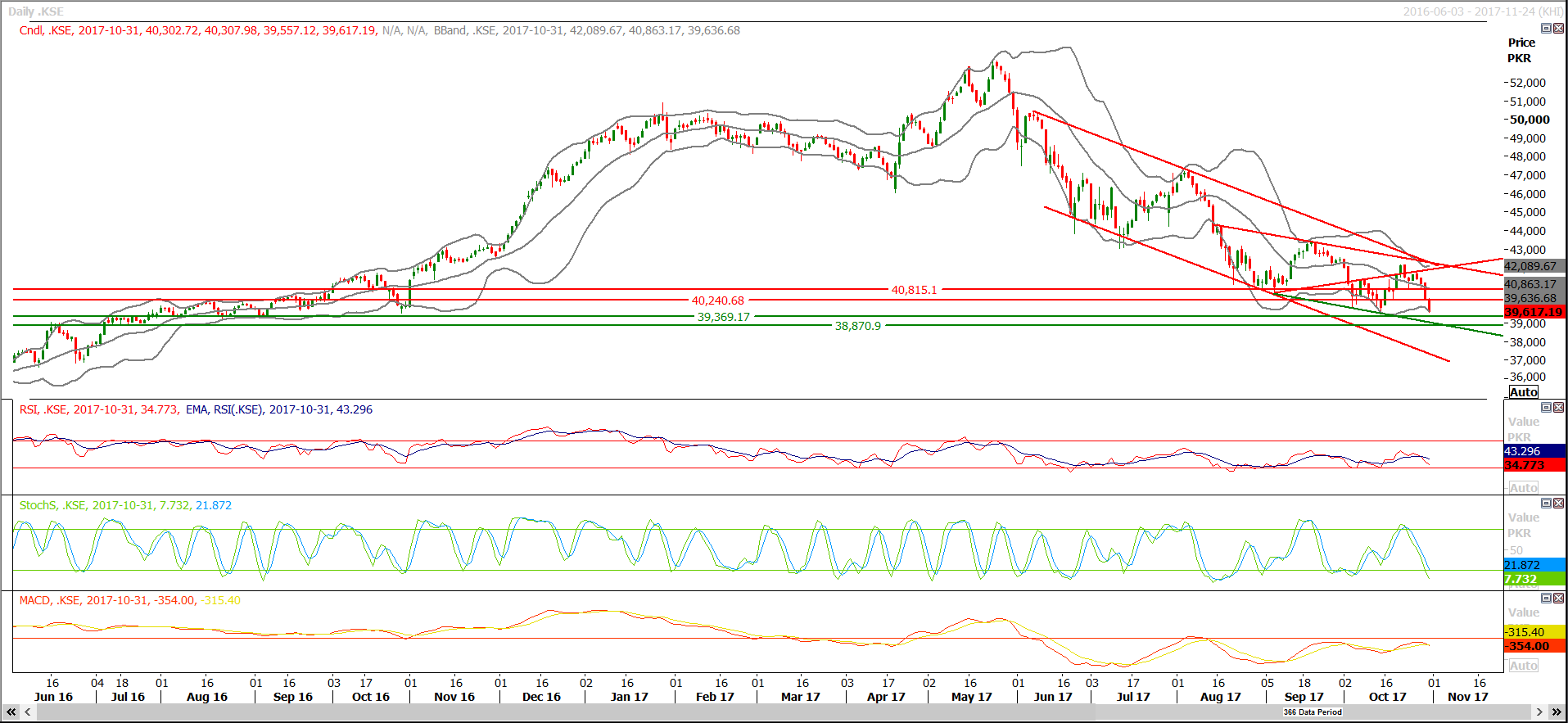

Trading volume at PSX floor increased by 40.72 million shares or 41.26%, DoD basis, whereas, the benchmark KSE100 Index opened at 40302.72, posted a day high of 40307.98 and a day low of 39557.12 during the last trading session. The session suspended at 39617.19 with a net change of -707.13 points and net trading volume of 93.5 million shares. Daily trading volume of KSE100 listed companies increased by 40.31 million shares or 75.78%,DoD basis.

Foreign Investors remained in a net selling position of 20.82 million shares and net value of Foreign Inflow dropped by 19.31 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.06 and 1.21 million shares but Foreign Corporate Investors remained in a net selling position of 22.09 million shares. While on the other side Local Individuals, Companies, Banks, Mutual Funds and Insurance companies remained in net buying positions of 24.54, 4.13, 1.89, 3.42 and 5.14 million shares respectively but Brokers remained in a net selling position of 19.98 million shares. Foreing Investors remained in net selling position of 19.66 million shares during the month of Oct. 2017 and net value of Foreign Inflow for the month dropped by 8.91 million US Dollars. Foreign Corporate Investors remained in net selling position of 30.86 million shares and net value of their net selling positions was 17.75 million US Dollars during the month, Overseas Pakistanis have tried to cover massive selling of Foreign Corporate investors by buying 11.56 million shares net with net value of 8.76 million US Dollars.

Analytical Review

Asian shares hit a 10-year high on Wednesday on the back of solid economic growth globally, while oil prices extended a bull run on hopes that major oil producers will maintain their output cuts. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.6 percent, led by 1.1 percent gains in South Korea while Japan’s Nikkei gained 1.4 percent. “Hopes of U.S. tax cuts, a slight easing in U.S. long-term bond yields since late last month and a rise in oil prices are all positive for Asian shares,” said Yukino Yamada, senior strategist at Daiwa Securities. “Last month, there were major inflows to high-tech shares in Korea and Taiwan. And GDP of these countries were also strong, showing the strength is spreading to the entire economy, not just within the high-tech sector,” she added.

In another arbitration setback, the London Court of International Arbitration (LCIA) has in its final award asked Pakistan to pay more than Rs14 billion to nine independent power producers (IPPs). A senior government official told Dawn that the final award was not binding because its very basis was under litigation in sovereign Pakistani courts under the law of the land. “The government is thoroughly examining the award and will exhaust all available options to defend the case,” said a spokesman for the ministry of energy’s power division.

The profit of the State Bank of Pakistan (SBP) registered a modest year-on-year growth of four per cent in 2016-17, according to the annual performance review issued on Tuesday. It amounted to Rs238 billion in the last fiscal year against Rs229bn in 2015-16. Its income on foreign currency assets registered an increase of almost 50pc. The central bank paid Rs227bn profit to the federal government. The SBP said the banking sector constitutes around 74pc of the country’s financial sector with an asset base equivalent to almost 55pc of the country’s GDP. It said lending to the federal government and commercial banks remained major sources of its profit followed by earnings on foreign exchange reserves.

The World Bank on Tuesday ranked Pakistan at 147th out of 190 countries in its ‘Doing Business 2018’ report. The report noted that Pakistan implemented four business reforms in 2017 — making it easier to register a new business, transfer commercial property and facilitate cross border trade. Pakistan is among the South Asian economies that carried out a record 20 business reforms in the past year, bringing to a total of 127 the number of reforms enacted in the region over the past 15 years, says the report which monitors the ease of doing business for small and medium-enterprises around the world.

The Federal Board of Revenue (FBR) has faced tax collection shortfall of Rs47 billion during first four months (July-October) of the current financial year. The FBR has provisionally collected Rs1,024 billion during July-October period of the year 2017-18 as against the target of Rs1,071 billion, said an official of the FBR . He further said that tax collection would enhance in the days to come. Meanwhile, the FBR has collected Rs259 billion during October . The federal government had set the revenue target of Rs4,013 billion for fiscal year 2017-18. The FBR would require collecting Rs650 billion additional revenue to achieve ambitious target of Rs4,013 billion in the current fiscal year. Around 19 percent growth would be required in the current fiscal year over provisional collection of Rs3,362.1 billion in the just concluded fiscal year.

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

The Benchmark KSE100 Index has given breakout of its two supportive regions during the last trading session and right now it has a supportive region and a last hope for bulls at its double bottom and a strong horizontal supportive region at 39400. If Index gives a breakout of this region then the next target might be 38640 which fall on 100% expansion of its last correction. At 38640, expansion of its bearish triangle will also complete therefore it needs to be very cautious while trading today.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.