Previous Session Recap

Trading volume at PSX floor increased by 54.01 million shares or 41.56% on DoD basis, whereas the benchmark KSE100 index opened at 33,761.41, posted a day high of 34,306.00 and a day low of 33,761.41 points during last trading session while session suspended at 34,203.68 points with net change of 442.27 points and net trading volume of 103.76 million shares. Daily trading volume of KSE100 listed companies increased by 25.06 million shares or 31.84% on DoD basis.

Foreign Investors remained in net selling positions of 5.13 million shares and net value of Foreign Inflow dropped by 2.05 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistanis investors remained in net selling positions of 0.07, 5.00 and 0.06 million shares. While on the other side Local Individuals, Banks and Mutual Fund remained in net selling positions of 2.00, 1.13 and 0.19 million shares respectively but Local Companies, NBFCs, Brokers and Insurance Companies remained in net buying positions of 0.73, 0.04, 0.28 and 2.04 million shares respectively.

Analytical Review

Asian shares turn higher after positive China data

Asian shares reversed early losses on Friday as an unexpected bounce in Chinese manufacturing activity offset some negativity cast by a Bloomberg news report that raised doubts over whether the United States and China can reach a long-term trade deal. Factory activity in China expanded at its fastest pace in more than two years in October as export orders and production rose, a private business survey showed on Friday. The expansion, which beat expectations and contrasted with the dour results of an official survey Thursday, helped to boost Chinese blue chips .CSI300, which rose 0.7%. Hong Kong's Hang Seng .HSI added 0.3% and Seoul's Kospi .KS11 rose 0.42%. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS reversed early losses to add 0.16%, having hit three-month highs on Thursday. The index’s performance reflected a results season that has shown companies to be more resilient than expected, said Jim McCafferty, head of Equity Research, Asia ex-Japan at Nomura.

WB president urges focus on reforms for jobs, growth

World Bank Group President David R. Malpass on Thursday said the reforms carried out by Pakistan for ease of doing business would help create jobs, attract investment and generate more tax revenue. Malpass acknowledged the efforts taken by the government to improve its ranking on the Ease of Doing Business index. “Your country jumped to 108th place from 136th last year. Your reforms made it easier for the entrepreneurs to start business, get electricity and construction permits, register property, pay taxes and trade across border”, he remarked at the exhibition held to celebrate the country’s 28-point jump in ease of doing business ranking.

Mansha proposes bond swap for circular debt

With total circular debt close to Rs1.7 trillion, the government is considering to introduce swap bonds to re-profile short- and medium-term payables into long-term coupons having up to 25 years of maturity. The proposal has come from leading businessman Mian Mohammad Mansha who had a meeting with Finance Adviser Dr Abdul Hafeez Shaikh here on Thursday. Another power sector player Muhamamd Saleem Shahzad was also part of the meeting attended by Secretary Finance Naveed Kamran Baloch, State Bank of Pakistan Governor Dr Reza Baqir, Federal Board of Revenue Chairman Shabbar Zaidi and Special Secretary Finance Omar Hamid Khan.

RCCI welcomes Chinese statement on FATF

The Rawalpindi Chamber of Commerce and Industry (RCCI) Thursday has welcomed the Chinese statement on Financial Action Task Force (FATF) where China has categorically announced that they did not want the forum to be politicised as some countries were pursuing their political agenda in a bid to blacklist Pakistan. Referring to the statement of Chinese Ministry of Foreign Affair Department of Asian Affair, Deputy Director General for Policy Planning Yao Wen, RCCI President Saboor Malik said that business community appreciated Chinese support and stand for Pakistan at different platforms, including FATF. He said that China always stood with Pakistan and expressed hope that it will block any attempt to include Pakistan in the blacklist. RCCI president said that Pakistan was effectively pursuing its National Action Plan, and China would also help Pakistan in capacity building to handle issues related to terror financing. He said that the FATF member countries should assist Pakistan to improve its system rather pressurizing it to meet the goals.

Pak-China JWG on Agriculture Cooperation visits PARC

A delegation of Pak-China Joint Working Group (JWG) on Agriculture Cooperation here on Thursday visited Pakistan Agricultural Research Council (PARC). The delegation met PARC Chairman Dr Muhammad Azeem Khan and discussed ways and means to enhance bilateral cooperation in agriculture sectors between both the countries, a press release said. On the occasion, Dr Muhammad Azeem acknowledged the support of China in various projects of PARC and gave a detailed presentation about the council, its mission and vision to achieve sustainable food security and poverty alleviation through knowledge and innovation.

Asian shares reversed early losses on Friday as an unexpected bounce in Chinese manufacturing activity offset some negativity cast by a Bloomberg news report that raised doubts over whether the United States and China can reach a long-term trade deal. Factory activity in China expanded at its fastest pace in more than two years in October as export orders and production rose, a private business survey showed on Friday. The expansion, which beat expectations and contrasted with the dour results of an official survey Thursday, helped to boost Chinese blue chips .CSI300, which rose 0.7%. Hong Kong's Hang Seng .HSI added 0.3% and Seoul's Kospi .KS11 rose 0.42%. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS reversed early losses to add 0.16%, having hit three-month highs on Thursday. The index’s performance reflected a results season that has shown companies to be more resilient than expected, said Jim McCafferty, head of Equity Research, Asia ex-Japan at Nomura.

World Bank Group President David R. Malpass on Thursday said the reforms carried out by Pakistan for ease of doing business would help create jobs, attract investment and generate more tax revenue. Malpass acknowledged the efforts taken by the government to improve its ranking on the Ease of Doing Business index. “Your country jumped to 108th place from 136th last year. Your reforms made it easier for the entrepreneurs to start business, get electricity and construction permits, register property, pay taxes and trade across border”, he remarked at the exhibition held to celebrate the country’s 28-point jump in ease of doing business ranking.

With total circular debt close to Rs1.7 trillion, the government is considering to introduce swap bonds to re-profile short- and medium-term payables into long-term coupons having up to 25 years of maturity. The proposal has come from leading businessman Mian Mohammad Mansha who had a meeting with Finance Adviser Dr Abdul Hafeez Shaikh here on Thursday. Another power sector player Muhamamd Saleem Shahzad was also part of the meeting attended by Secretary Finance Naveed Kamran Baloch, State Bank of Pakistan Governor Dr Reza Baqir, Federal Board of Revenue Chairman Shabbar Zaidi and Special Secretary Finance Omar Hamid Khan.

The Rawalpindi Chamber of Commerce and Industry (RCCI) Thursday has welcomed the Chinese statement on Financial Action Task Force (FATF) where China has categorically announced that they did not want the forum to be politicised as some countries were pursuing their political agenda in a bid to blacklist Pakistan. Referring to the statement of Chinese Ministry of Foreign Affair Department of Asian Affair, Deputy Director General for Policy Planning Yao Wen, RCCI President Saboor Malik said that business community appreciated Chinese support and stand for Pakistan at different platforms, including FATF. He said that China always stood with Pakistan and expressed hope that it will block any attempt to include Pakistan in the blacklist. RCCI president said that Pakistan was effectively pursuing its National Action Plan, and China would also help Pakistan in capacity building to handle issues related to terror financing. He said that the FATF member countries should assist Pakistan to improve its system rather pressurizing it to meet the goals.

A delegation of Pak-China Joint Working Group (JWG) on Agriculture Cooperation here on Thursday visited Pakistan Agricultural Research Council (PARC). The delegation met PARC Chairman Dr Muhammad Azeem Khan and discussed ways and means to enhance bilateral cooperation in agriculture sectors between both the countries, a press release said. On the occasion, Dr Muhammad Azeem acknowledged the support of China in various projects of PARC and gave a detailed presentation about the council, its mission and vision to achieve sustainable food security and poverty alleviation through knowledge and innovation.

Market is expected to remain volatile during current trading session.

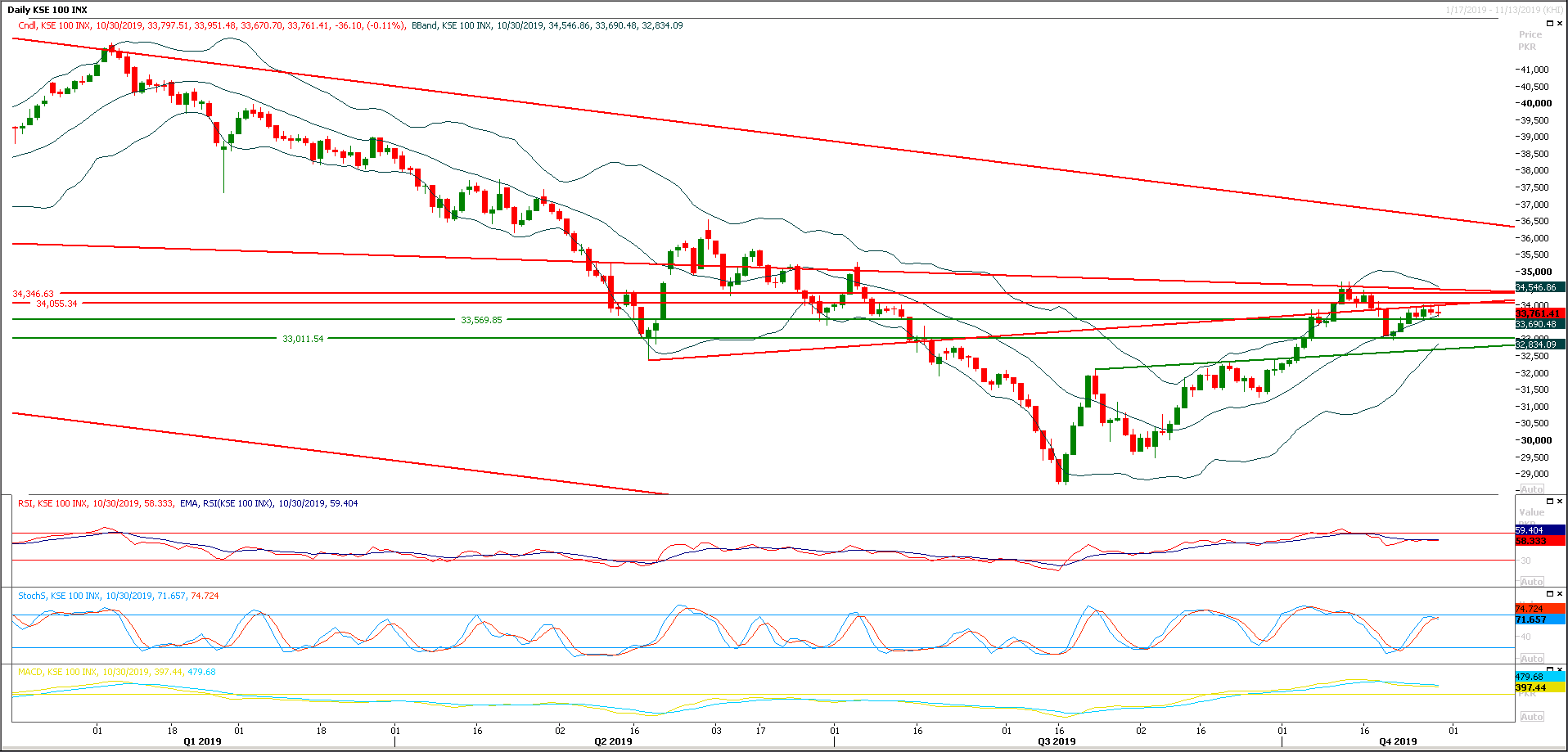

Technical Analysis

Daily momentum indicators are trying to change their direction towards bearish side and it's expected that the Benchmark KSE100 index would remain under pressure until index would not succeed in penetration above 34,200 points. As of now index is being capped by a strong resistant trend line along with a horizontal resistant region therefore it's recommended to start selling on strength with strict stop loss of 34,200 points. Index would try to target 33,500 and then 33,330 points if it would succeed in maintain below its major resistant trend line on daily chart.

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.