Previous Session Recap

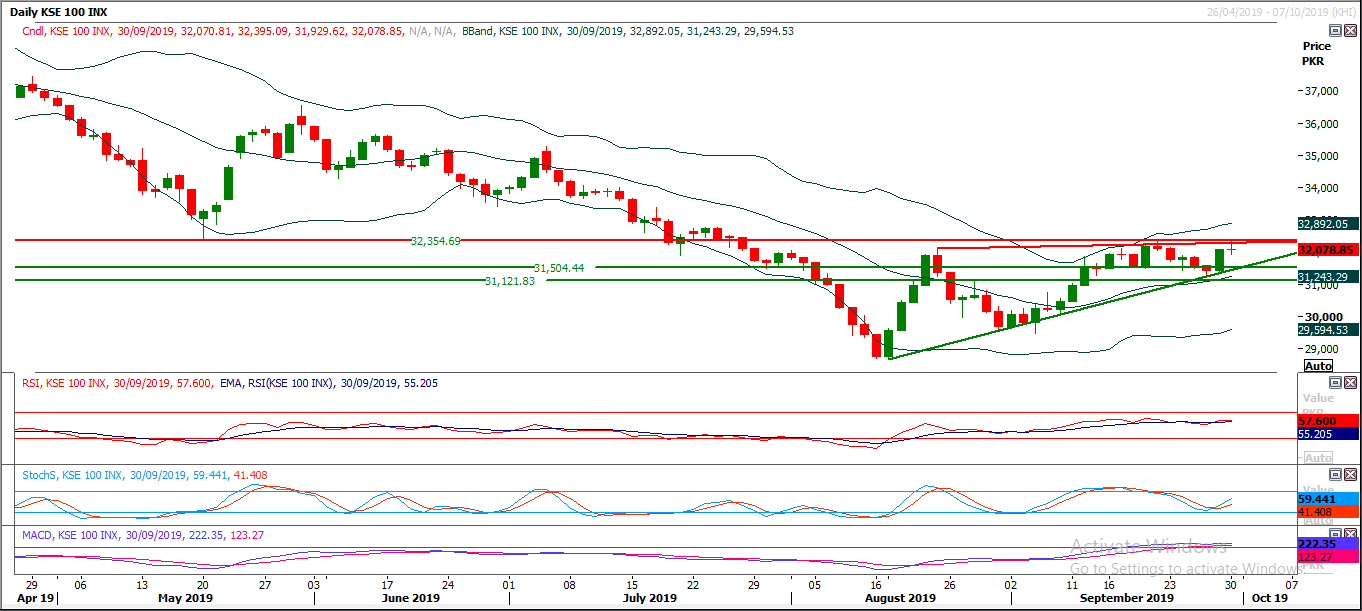

Trading volume at PSX floor increased by 30.89 million shares or 22.85% on DoD basis, whereas the benchmark KSE100 index opened at 32,131.37, posted a day high of 32,395.09 and a day low of 31,929.62 points during last trading session while session suspended at 32,078.85 points with net change of 8.04 points and net trading volume of 142.81 million shares. Daily trading volume of KSE100 listed companies increased by 35.49 million shares or 33.07% on DoD basis.

Foreign Investors remained in net buying positions of 3.00 million shares and net value of Foreign Inflow increased by 1.80 million US Dollars. Categorically, Foreign Individual remained in net selling positions of 0.01 million shares but Overseas Pakistanis and Foreign Corporate investors remained in net buying positions of 1.84 and 1.17 million shares. While on the other side Local Individuals, NBFCs and Brokers remained in net selling positions of 1.72, 0.20 and 6.43 million shares respectively but Local Companies, Banks, Mutual Fund and Insurance Companies remained in net buying positions of 0.07, 3.48, 1.34 and 0.12 million shares respectively.

Analytical Review

Global shares steady, investors pin hopes on U.S.-China talks

Global share prices ticked up on Tuesday as some investors clung to hopes that China and the United States could work towards reaching a deal on trade and other issues in the fourth quarter.Japan's Nikkei .N225 rose 0.6% while MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS inched up 0.11%. Chinese markets will be shut for a week from Tuesday to mark 70 years since the founding of the People’s Republic of China. U.S. stock futures ESc1 rose 0.16% in Asia, a day after the S&P 500 .SPX gained 0.50%. Technology sectors led the gains on Monday while U.S.-listed shares of Chinese firms bounced up a tad, after big balls on Friday, with Alibaba (BABA.N) up 0.75% and Baidu (BIDU.O) gaining 1.53%. During the July-September quarter, the S&P500 gained 1.21%.

Govt looks for local firms to invest in Reko Diq

The Balochistan government is trying to persuade large Pakistani investors to form a consortium to invest their money in the development of Reko Diq copper and gold mining project. “Our first priority is to convince Pakistani companies to invest in this project because neither the provincial nor the federal government has the finances for developing this resource that will prove a game changer for both Balochistan and the entire country,” provincial chief minister Jam Kamal Khan said during an interaction with senior journalists at the Punjab Governor’s House on Monday. “The development of the project [for commercial production] requires an initial investment of $3-4 billion, which is in addition to the $6bn awarded by the International Centre for Settlement of Investment Disputes (ICSID) in July against Pakistan for terminating agreement with the Tethyan Copper Company (TCC).

China warns US investment curbs to hurt global growth

China warned the US against trying to limit investment ties between the two countries, even as the Trump administration contradicted a report that Washington might be considering removing Chinese companies from American stock exchanges. The foreign ministry appealed to Washington to “meet us halfway” and resolve disputes amid a tariff war that threatens to depress global economic growth. China’s warning comes two days after a US official tweeted a Treasury Department statement saying the administration “is not contemplating blocking Chinese companies from listing shares on the US stock exchanges at this time.” Stock markets slid after Bloomberg News reported last week that US officials were considering restricting investment ties with China. It said other options including banning investments in Chinese companies by government pension funds.

Pakistan earns over $61m from export of transport services

Pakistan earned $61.850 million by providing different transport services in various countries during the first month of current financial year 2019-20 as compared to the corresponding month of last year. This shows decrease of 25.57 percent when compared to $83.103 million earned through provision of services during the corresponding period of fiscal year (2018-19), Pakistan Bureau of Statistics (PBS) reported. During the period under review, the exports of sea transport services declined by 50 percent, by going down from $1.970 million current year to $3.940 million during last year. Among the sea transport services, the exports of freight services, however witnessed increased by 5.74 percent, from $1.220 million last year to $1.290 million during current year, whereas the exports of other sea transport services decreased by 75 percent, from $0.680 million to $2.720 million, the data revealed.

Food group imports reduce by $255m in two months

Food group imports into the country during first two months of current financial year reduced by 28.81 percent as compared the corresponding period of last year. According the data released by the Pakistan Bureau of Statistics, food group imports came down from $952.717 million in first two months of last financial year to $697.340 million of the same period of current financial year. During the period from July-August, 2019, imports of milk, cream and milk food for infants reduced by 40.89 percent as 7,981 metric tons of the above mentioned commodity worth $21.014 million imported as compared the imports of 13,300 metric tons valuing $35,551 million of same period of last year, it added.

Global share prices ticked up on Tuesday as some investors clung to hopes that China and the United States could work towards reaching a deal on trade and other issues in the fourth quarter.Japan's Nikkei .N225 rose 0.6% while MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS inched up 0.11%. Chinese markets will be shut for a week from Tuesday to mark 70 years since the founding of the People’s Republic of China. U.S. stock futures ESc1 rose 0.16% in Asia, a day after the S&P 500 .SPX gained 0.50%. Technology sectors led the gains on Monday while U.S.-listed shares of Chinese firms bounced up a tad, after big balls on Friday, with Alibaba (BABA.N) up 0.75% and Baidu (BIDU.O) gaining 1.53%. During the July-September quarter, the S&P500 gained 1.21%.

The Balochistan government is trying to persuade large Pakistani investors to form a consortium to invest their money in the development of Reko Diq copper and gold mining project. “Our first priority is to convince Pakistani companies to invest in this project because neither the provincial nor the federal government has the finances for developing this resource that will prove a game changer for both Balochistan and the entire country,” provincial chief minister Jam Kamal Khan said during an interaction with senior journalists at the Punjab Governor’s House on Monday. “The development of the project [for commercial production] requires an initial investment of $3-4 billion, which is in addition to the $6bn awarded by the International Centre for Settlement of Investment Disputes (ICSID) in July against Pakistan for terminating agreement with the Tethyan Copper Company (TCC).

China warned the US against trying to limit investment ties between the two countries, even as the Trump administration contradicted a report that Washington might be considering removing Chinese companies from American stock exchanges. The foreign ministry appealed to Washington to “meet us halfway” and resolve disputes amid a tariff war that threatens to depress global economic growth. China’s warning comes two days after a US official tweeted a Treasury Department statement saying the administration “is not contemplating blocking Chinese companies from listing shares on the US stock exchanges at this time.” Stock markets slid after Bloomberg News reported last week that US officials were considering restricting investment ties with China. It said other options including banning investments in Chinese companies by government pension funds.

Pakistan earned $61.850 million by providing different transport services in various countries during the first month of current financial year 2019-20 as compared to the corresponding month of last year. This shows decrease of 25.57 percent when compared to $83.103 million earned through provision of services during the corresponding period of fiscal year (2018-19), Pakistan Bureau of Statistics (PBS) reported. During the period under review, the exports of sea transport services declined by 50 percent, by going down from $1.970 million current year to $3.940 million during last year. Among the sea transport services, the exports of freight services, however witnessed increased by 5.74 percent, from $1.220 million last year to $1.290 million during current year, whereas the exports of other sea transport services decreased by 75 percent, from $0.680 million to $2.720 million, the data revealed.

Food group imports into the country during first two months of current financial year reduced by 28.81 percent as compared the corresponding period of last year. According the data released by the Pakistan Bureau of Statistics, food group imports came down from $952.717 million in first two months of last financial year to $697.340 million of the same period of current financial year. During the period from July-August, 2019, imports of milk, cream and milk food for infants reduced by 40.89 percent as 7,981 metric tons of the above mentioned commodity worth $21.014 million imported as compared the imports of 13,300 metric tons valuing $35,551 million of same period of last year, it added.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 is caged in an ascending wedge on daily chart and right now it’s trying to bounce back after resistance from resistant trend line of this wedge and right now it’s expected that index would try to create an evening shooting star in response to previous morning star if it would not succeed in penetration of this wedge in upward direction and a cheat pattern would take place which would try to push index in downward direction. It’s expected that index would try to find some ground at 31,500 points which fall on crossover of a trend line with a horizontal supportive region. It’s recommended to adopt swing trading between 31,500 to 32,360 points until unless index succeeds in penetration of either side with strict stop loss on both sides. But it’s recommended to stay on selling side because if index would succeed in penetration below 31,500 points in coming days then it would try to target 30,700 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.