Previous Session Recap

The Bench Mark KSE100 Index Opened at 46584.53, posted day high of 47070.56 and day low of 46584.53 during last trading session. The session suspended at 46938.59 points with net change of 354.06 points and trading volume of 187.25 million shares. Daily trading volume of KSE100 listed companies increased by 9.83 million shares or 5.54% on DOD bases.

Foreign Investors remained in net selling postion of 2.06 million shares and net value of Foreign inflow dropped by 14.38 million US Dollars. Categorically Foreign Corporate and Overseas Pakistani Investors remained in net selling position of 1.85 and 0.31 million share but Foreign Individuals remained in net buying position of 0.11 million shares. While on the other side Local Companies and Brokers remained in net buying positon of 9.85 and 0.39 million shares respectively. Local Individuals, Banks and Mutual Funds remained in net selling position of 2.83, 5.82 and 0.52 million shares respectively.

Analytical Review

The safe-haven Japanese yen held on to gains on Tuesday, with investors spooked after deadly incidents in Germany and Turkey, while regional stocks were mixed following upbeat comments from Federal Reserve Chair Janet Yellen. The Bank of Japan kept monetary policy steady as widely expected, maintaining its pledge to guide short-term rates at minus 0.1 percent and the 10-year government bond yield around zero percent. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS pared earlier gains to trade little changed. Japanese Nikkei .N225 was flat. Reduced volumes ahead of the Christmas holidays tempered buying in some Asian markets. Chinese CSI 300 index .CSI300 slid 0.4 percent, and Taiwan .TWII shares retreated 0.3 percent. Hong Kong .HSI shares reversed earlier losses to trade little changed.

Prime Minister Nawaz Sharif on Monday chaired a meeting to review progress on various energy related projects. The meeting was given a detailed briefing on the capacity and timeline for completion of various ongoing power projects in country. The meeting was informed that around 10,996MW of power will be added to the national grid by March 2018 against an expected generation shortfall of 7,000 to 8,000MW, estimated for 2017-18. The significant addition of power to the national grid will eliminate load shedding from the country.

The government is all set to award 600KV (4,000MW) HVDC (High Voltage Direct Current) 878-kilometres Matiari-Lahore Transmission Line Project of $2.1 billion to China Electric Power Equipment & Technology Co Ltd (CET) at wheeling tariff of 0.74 cents per unit without evaluation of its technical and financial evaluation, as the project is part of CPEC.

Annual growth in cotton output has slowed to 12.33 per cent as arrivals of phutti (seed cotton) dropped during the outgoing fortnight (Dec 1 to 15), dimming hopes of a better cotton harvest this year. The country harvested 10.147 million bales of cotton up to Dec 15, a year-on-year growth of over 12pc, according to figures released by the Pakistan Cotton Ginners Association on Monday. However, phutti arrivals during the outgoing fortnight fell 3pc to 389,490 bales.

The Federal Board of Revenue (FBR) has asked banks to improve their reporting system to bring it on a par with International Reporting Standards (IRS) for the exchange of financial information regarding bank accounts of non-residents with members of the Organisation for Economic Cooperation and Development (OECD). All banks have been advised to improve their reporting system in the next few months.

AKZO, NRL, FATIMA and ATRL, along with Banking Sector can lead market in positive direction.

Technical Analysis

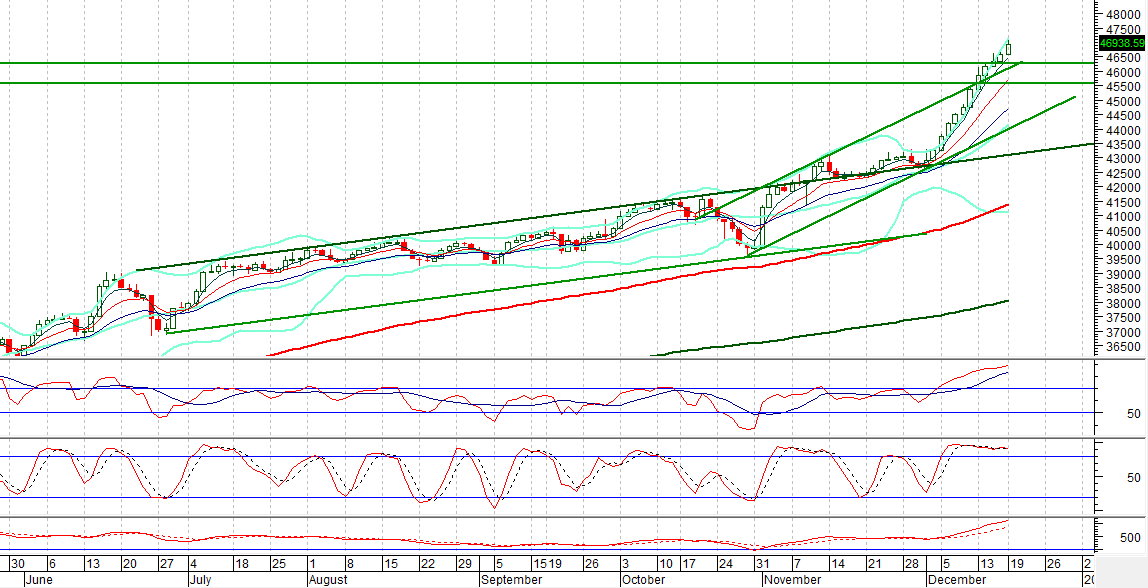

The Bench Mark KSE100 Index is moving in an upward price channel on Intraday chart and right now it has penetrated said channel in upward direction and right now its getting support from resistant trend line of said channel. It is also supported by a rising trend line inside that bullish channel which is supporting its bullish momentum at 46275 points. Today a slight pressure on intraday bases can be witnessed in KSE100 Index as it can try to fulfill its previous day gap. Market is trying to penetrate its ever high on daily bases so trading with strict stop losses is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.