Previous Session Recap

The Bench Mark KSE100 Index Opened at 49612.89 and posted day high of 49893.38 points till Jumma Break but after break Market Opened with a gap of around -300 points at 49594.24 points and dropped towards day low of 49320.48 points while session suspended at 49375.71 points with net change of -212.59 points and net trading volume of 153.83 million shares during last trading session. Daily trading volume of KSE100 listed companies increased by 64.96 million shares or 73.09% on DOD bases.

Foreign Investors remain in net selling of 15.03 million shares and net value of Foreign Inflow dropped by 3.5 million US Dollars. Categorically Foreign Corporate and Overseas Pakistani Investors remain in net selling of 15.08 and 0.11 million shares respectively but Foreign Individuals remain in net buying of 0.16 million shares. While on the other side Local Individuals, NBFCs and Brokers remain in net selling of 10.08, 0.082 and 7.21 million shares respectively but Local Companies, Banks and Mutual Funds remain in net buying of 21.39, 3.71 and 3.41 million shares respectively.

Analytical Review

Asian share markets were mixed on Monday as political uncertainty globally kept the mood cautious, while the U.S. dollar recouped early losses ahead of a busy week for Federal Reserve speakers. Turnover was light with U.S. markets closed for the Presidents Day holiday. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS edged up 0.1 percent and back toward a 19-month peak set last week. Japanese Nikkei .N225 slipped 0.2 percent as domestic data showed exports disappointed in January even as imports outpaced forecasts. Shanghai stocks .SSEC added 0.6 percent and expectations of solid economic growth in China kept commodities such as copper and iron ore well bid. Wall Street had ended last week on a roll, with all three major indexes making historic highs and the Dow Jones Industrial Average reaching a seventh straight record close.

Independent consultants appointed on the instructions of the government have recommended limiting the expansion of piped-natural gas to uneconomical consumer categories and replacing it with cylindered-gas to contain huge energy losses amid scarce domestic resources. Bottled (cylinder) LPG is the perfect option for homes that do not have access to a piped network, said KPMG Taseer Hadi & Co appointed by the Oil and Gas Regulatory Authority (Ogra) under a decision of the Economic Coordination Committee (ECC) of the cabinet. This apparently is in contrast to a recent decision taken by the ECC at the request of Petroleum Minister Shahid Khaqan Abbasi to provide liquefied petroleum gas to consumers through pipeline network linked with LPG air-mix plants starting with three such plants in his constituency — areas around Murree.

In the local currency market, the rupee’s stability against the dollar persisted last week in the absence of leading currency players who remained in the sidelines amid lacklustre trading activity. The central bank provided a major incentive to exchange companies by exempting them from surrendering 10pc of dollars to the banking system against their exports of other foreign currencies in order to reduce the gap between the interbank and open market rates in the range of 50-70paisa from the Rs3.60 that prevailed in mid-January.

The government raised Rs630.87bn from the auction of Pakistan Market Treasury Bills of various tenors held last Thursday, smaller against the received bids of Rs731.32bn. It however, exceeded the auction target of Rs550bn. Of the total raised amount, three month T-bills fetched the highest Rs283.06bn at a cut off yield of 5.94pc, followed by six month T-bill Rs204.56bn at 5.98pc, and 12 month T-bill Rs143.25bn at 5.99pc. Three month T-bill attracted the highest amount of Rs369.02bn: six month T-bill Rs216.21bn, and 12 month T-bill Rs146.08bn. According to the weekly statement of position of all scheduled banks for the week ended February 03, deposits and other accounts of all scheduled banks stood at Rs10,688.88bn after a 0.14pc decrease over the preceding week’s figure of Rs10,703.99bn.

Roshan Packages Limited (RPL) has grabbed the spotlight as it took the lead as the first — from among the probable seven private companies — to enter the Pakistan Stock Exchange in 2017. RPL stock may begin trading after the usual gong ceremony on Feb 28. In mid-January, RPL set out to raise Rs1.14bn through the offer of 32.5m shares at the floor price of Rs35 per share. Three-quarters or 24.375m shares were for the book building portion while the remaining 25pc of the issue (8.125m shares) was offered to the general public in an Initial Public Offering (IPO). In the book building process, the company received a subscription of Rs5.8bn, against a requirement of Rs853m, representing oversubscription by 6.8 times, says Shahid Ali Habib, CEO Arif Habib Ltd, the Lead Manager and Book Runner to the issue. He also claims that it was the first ever Book Building with participation from more than 1,246 High Net worth Individuals.

STCL, BYCO, NBP, SSGC and SNGP can lead market in positive direction.

Technical Analysis

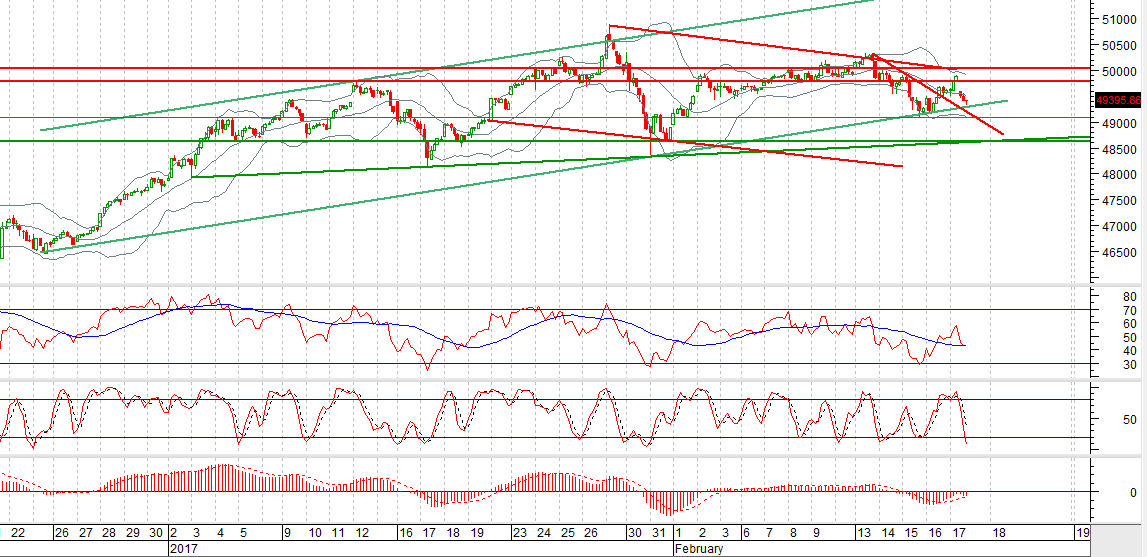

The Bench Mark KSE100 Index have been pushed back from its double top on hourly chart and it have came back to retest its supportive regions of 49320 and 49200 points after penetration of its resistances. Index is not being able to close above its 61.8% correction level since last two weeks which is becoming an alarming element now as closing below 49100 can push index into negative zone on short term bases as after retesting its supportive regions today Index will try to penetrate its resistnce and if it will not become able to close above thoses resistances then it will try to break its supports which will be very dangerous for bulls. Trading with strict stop loss of 49100 points is recommended as during current session market will try to take a spike towards 49700 points to cover its previous gap but its not attractive for buyers untill unless it close above its weekly correction levels, untill that occures swing trading could be beneficial.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.