Previous Session Recap

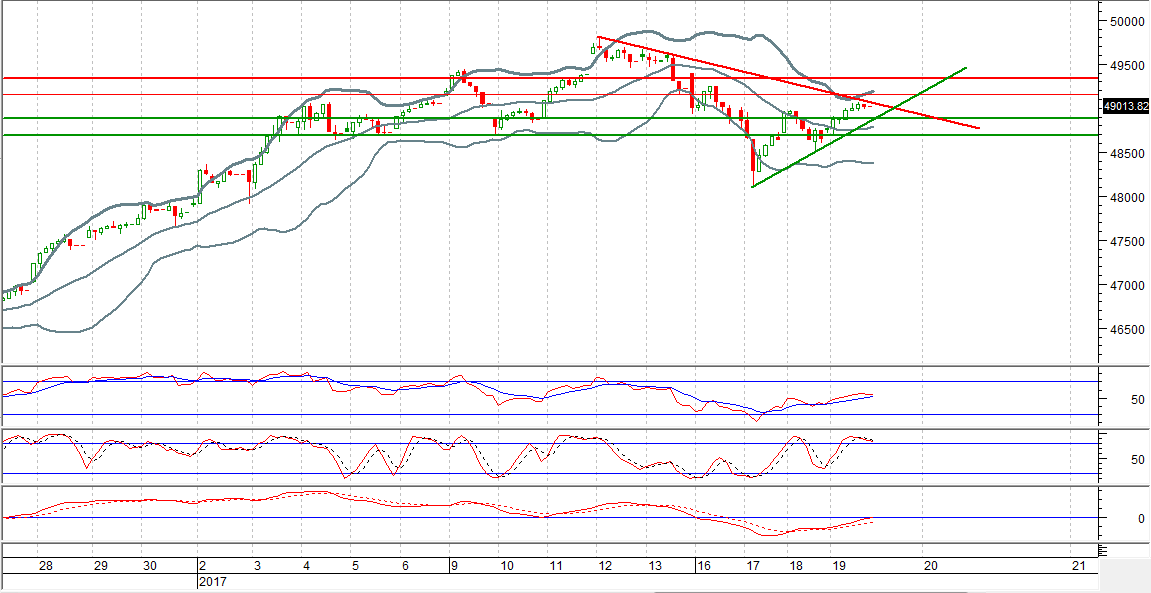

The Bench Mark KSE100 Index Opened at 48754.08, posted day high of 49065.33 and day low of 48693.89 during last trading session. The session suspended at 49013.82 with net change of 371.61 points and net trading volume of 208.55 million shares. Daily trading volume of KSE100 listed companies increased by 56.65 million shares or 37.29% on DOD bases.

Analytical Review

Caution prevailed in financial markets on Friday ahead of U.S. President-elect Donald Trump inauguration, even as Chinese fourth-quarter economic growth beat expectations and Federal Reserve Chair Janet Yellen took a less hawkish policy stance. Chinese fourth-quarter gross domestic product growth came in at 6.8 percent, versus forecasts of 6.7 percent, supported by higher government spending and record bank lending. The data helped China shares but did not move regional markets. The world second-largest economy expanded 6.7 percent in 2016, the National Bureau of Statistics said, in line with forecasts. While the robust headline growth may soothe investors, concerns are growing about whether Beijing can contain the financial risks from an explosive expansion in debt fueled by years of government stimulus.

Largest oil marketing company Pakistan State Oil (PSO) and Allied Bank Limited (ABL) have signed an agreement to facilitate deployment of ABL ATMs at PSO stations nationwide. The agreement was signed by Ghulam Murtaza Sheikh, Deputy General Manager, New Initiatives, PSO and Faisal Nadeem Siddiqui, Group Head e-Banking - DBG, ABL, at Allied Bank Head office, Lahore.

Commodity trader Gunvor has won a major tender to supply about 60 liquefied natural gas (LNG) shipments to Pakistan over a five year period while Italian Eni will supply the country with LNG over a 15-year period, a Pakistani energy official told Reuters. Pakistan LNG launched a five-year supply tender and a 15-year tender last year to purchase 240 shipments of LNG, drawing a lot of interest from suppliers eager to sell gas in an oversupplied market.

Consumers representatives and business community on Thursday voiced their serious concern over K-Electric demand for 40 paisa/kWh hike in power tariff under Fuel Charges Adjustment (FCA) for December 2016 on provisional basis. They said the FCA was part of KE Multi Year Tariff (MYT) which expired on June 30 last year. A KE petition for determination of its new MYT has been pending with the National Electric Power Regulatory Authority (NEPRA) for the last few months. NEPRS is yet to make decision in this regard.

The share of used imported cars and light commercial vehicles (LCVs) in the auto market was 19 per cent in 2016, up from 14pc in 2013. Last year saw the arrival of 46,500 used cars and commercial vehicles while the local industry rolled out 203,500 vehicles.

The State Bank of Pakistan (SBP) on Thursday declared the documents detailing massive amounts transacted from the purported accounts of top parliamentarians “fake”, saying that no actual transaction had taken place. National Assembly Speaker Ayaz Sadiq, Senate Chairman Raza Rabbani and Leader of the Opposition in the National Assembly Syed Khurshid Shah brought the matter to the attention of the authorities after receiving Term Deposit Reports (TDRs) from banks where they did not operate any accounts.

TOWL, CHCC, ANL, SMBL and SYS can lead market in positive direction.

Technical Analysis

The Bench Mark KSE100 index is capped by a resistant trend line on hourly chart and it has bounced back from its 61.8% bearish correction during last trading session towards negative zone, while it is getting support from its 50% bullish correction during last two trading sessions. Hourly Stochastic and MAORSI is trying to generate bullish crossover so buying with strict stop loss of previous low is recommended because if it would not be able to penetrate it then an upward spike is expected towards 49068 where it will face resistance from resistant trend line.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.