Previous Session Recap

Trading volume at PSX floor increased by 52.02 million shares or 36.59% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,006.53, posted a day high of 42,552.84 and a day low of 41,991.98 during last trading session. The session suspended at 42,446.62 with net change of -485.82 and net trading volume of 111.78 million shares. Daily trading volume of KSE100 listed companies increased by 28.16 million shares or 33.67% on DoD basis.

Foreign Investors remained in net selling position of 4.83 million shares and net value of Foreign Inflow dropped by 3.00 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 3.08 and 1.76 million shares. While on the other side Local Companies, Banks, NBFCs, Mutual Fund and Insurance Companies remained in net selling positions of 5.70, 0.86, 1.14, 2.23 and 1.98 million shares but Local Individuals and Brokers remained in net buying positions of 10.03 and 5.95 million shares respectively.

Analytical Review

Asia shares inch up, cautious on Sino-U.S. trade talks

Asian share markets crept cautiously higher on Monday as investors awaited developments on proposed Sino-U.S. trade talks, while keeping a wary eye on the Chinese yuan and Turkish lira for any new signs of strain. MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.3 percent in early trade, with South Korea leading the way with a rise of 0.6 percent. Japan’s Nikkei wavered either side of flat, much as did the yen on the dollar. EMini futures for the S&P 500 edged up 0.08 percent. Investors had been encouraged by news China and the United States will hold lower-level trade talks this month, offering hope that they might resolve an escalating tariff war.

SBP move slows down trading on open market

The State Bank of Pakistan’s (SBP) decision to bar exchange companies from ‘home delivery’ of dollars and other foreign currencies is inhibiting large investors from currency trading, forex traders said on Saturday. It is now compulsory to buy and sell dollars at the counters of exchange companies only — a move which has led to surplus dollars and other currencies. Currency dealers insist that the State Bank move has made the business risky for large investors. For making the open market business more transparent, the SBP on July 26 issued a circular with instructions not to move cash from one city to another, and advised companies to open bank accounts for transfer of money. The step was taken after Pakistan was included in the grey-list by the Financial Action Task Force (FATF).

Iran says no Opec member can take over its share

Iran told OPEC on Sunday no member country should be allowed to take over another member’s share of oil exports, expressing Tehran’s concern about Saudi Arabia’s offer to pump more oil in the face of US sanctions on Iranian oil sales. In a meeting with OPEC Secretary-General Mohammad Barkindo, a senior Iranian diplomat urged him to keep the group out of politics. “No country is allowed to take over the share of other members for production and exports of oil under any circumstance, and the OPEC Ministerial Conference has not issued any licence for such actions,” Iran’s oil ministry news agency SHANA quoted Kazem Gharibabadi, the permanent envoy to Vienna-based international organisations, as saying.

Manufacturers want urgent plan to boost exports

Pakistan Readymade Garments Manufacturers and Exporters Association (PRGMEA) Chief Coordinator Ijaz A. Khokhar on Sunday underscored the need for widening the tax net aimed at reducing the burden of existing taxpayers in the country. At present, the existing taxpayers were bearing extra burden which is unjust and under the prevailing situation there was a great need of hunting the new eligible taxpayers across the country he pointed out. Talking to reporters, he expressed confidence that the new government would surely focus special attention on resolving the longstanding issues of the business community. Ijaz suggested that the new government should formulate short and long term policies to cope with sharp decline in exports of the country and try to develop close liaison with stakeholders for making the policies.

Sanjrani for increasing Sino-Pak economic ties

Senate Chairman Muhammad Sadiq Sanjrani has said that Pakistan hoped to strengthen exchanges and cooperation with Liaoning, northeastern province of China, in fields of port construction, economic trade, high-tech and education. He made these remarks during his meeting with Xia Deren, chairman of the Provincial Political Consultative Conference in Dalian, the provincial capital. Xia Deren welcomed the distinguished guest and his delegation and briefly introduced the economic and social development of Liaoning. He said that Liaoning is an important industrial base of China and one of the earliest coastal provinces in China to implement the policy of opening up to the outside world. It has abundant port resources. At present, Liaoning is actively integrating into the construction of the "Belt and Road" to promote a higher level of opening up.

Asian share markets crept cautiously higher on Monday as investors awaited developments on proposed Sino-U.S. trade talks, while keeping a wary eye on the Chinese yuan and Turkish lira for any new signs of strain. MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.3 percent in early trade, with South Korea leading the way with a rise of 0.6 percent. Japan’s Nikkei wavered either side of flat, much as did the yen on the dollar. EMini futures for the S&P 500 edged up 0.08 percent. Investors had been encouraged by news China and the United States will hold lower-level trade talks this month, offering hope that they might resolve an escalating tariff war.

The State Bank of Pakistan’s (SBP) decision to bar exchange companies from ‘home delivery’ of dollars and other foreign currencies is inhibiting large investors from currency trading, forex traders said on Saturday. It is now compulsory to buy and sell dollars at the counters of exchange companies only — a move which has led to surplus dollars and other currencies. Currency dealers insist that the State Bank move has made the business risky for large investors. For making the open market business more transparent, the SBP on July 26 issued a circular with instructions not to move cash from one city to another, and advised companies to open bank accounts for transfer of money. The step was taken after Pakistan was included in the grey-list by the Financial Action Task Force (FATF).

Iran told OPEC on Sunday no member country should be allowed to take over another member’s share of oil exports, expressing Tehran’s concern about Saudi Arabia’s offer to pump more oil in the face of US sanctions on Iranian oil sales. In a meeting with OPEC Secretary-General Mohammad Barkindo, a senior Iranian diplomat urged him to keep the group out of politics. “No country is allowed to take over the share of other members for production and exports of oil under any circumstance, and the OPEC Ministerial Conference has not issued any licence for such actions,” Iran’s oil ministry news agency SHANA quoted Kazem Gharibabadi, the permanent envoy to Vienna-based international organisations, as saying.

Pakistan Readymade Garments Manufacturers and Exporters Association (PRGMEA) Chief Coordinator Ijaz A. Khokhar on Sunday underscored the need for widening the tax net aimed at reducing the burden of existing taxpayers in the country. At present, the existing taxpayers were bearing extra burden which is unjust and under the prevailing situation there was a great need of hunting the new eligible taxpayers across the country he pointed out. Talking to reporters, he expressed confidence that the new government would surely focus special attention on resolving the longstanding issues of the business community. Ijaz suggested that the new government should formulate short and long term policies to cope with sharp decline in exports of the country and try to develop close liaison with stakeholders for making the policies.

Senate Chairman Muhammad Sadiq Sanjrani has said that Pakistan hoped to strengthen exchanges and cooperation with Liaoning, northeastern province of China, in fields of port construction, economic trade, high-tech and education. He made these remarks during his meeting with Xia Deren, chairman of the Provincial Political Consultative Conference in Dalian, the provincial capital. Xia Deren welcomed the distinguished guest and his delegation and briefly introduced the economic and social development of Liaoning. He said that Liaoning is an important industrial base of China and one of the earliest coastal provinces in China to implement the policy of opening up to the outside world. It has abundant port resources. At present, Liaoning is actively integrating into the construction of the "Belt and Road" to promote a higher level of opening up.

SNGP, ATRL, PSO,DGKC, ISL and MLCF may lead the positive momentum during current trading session.

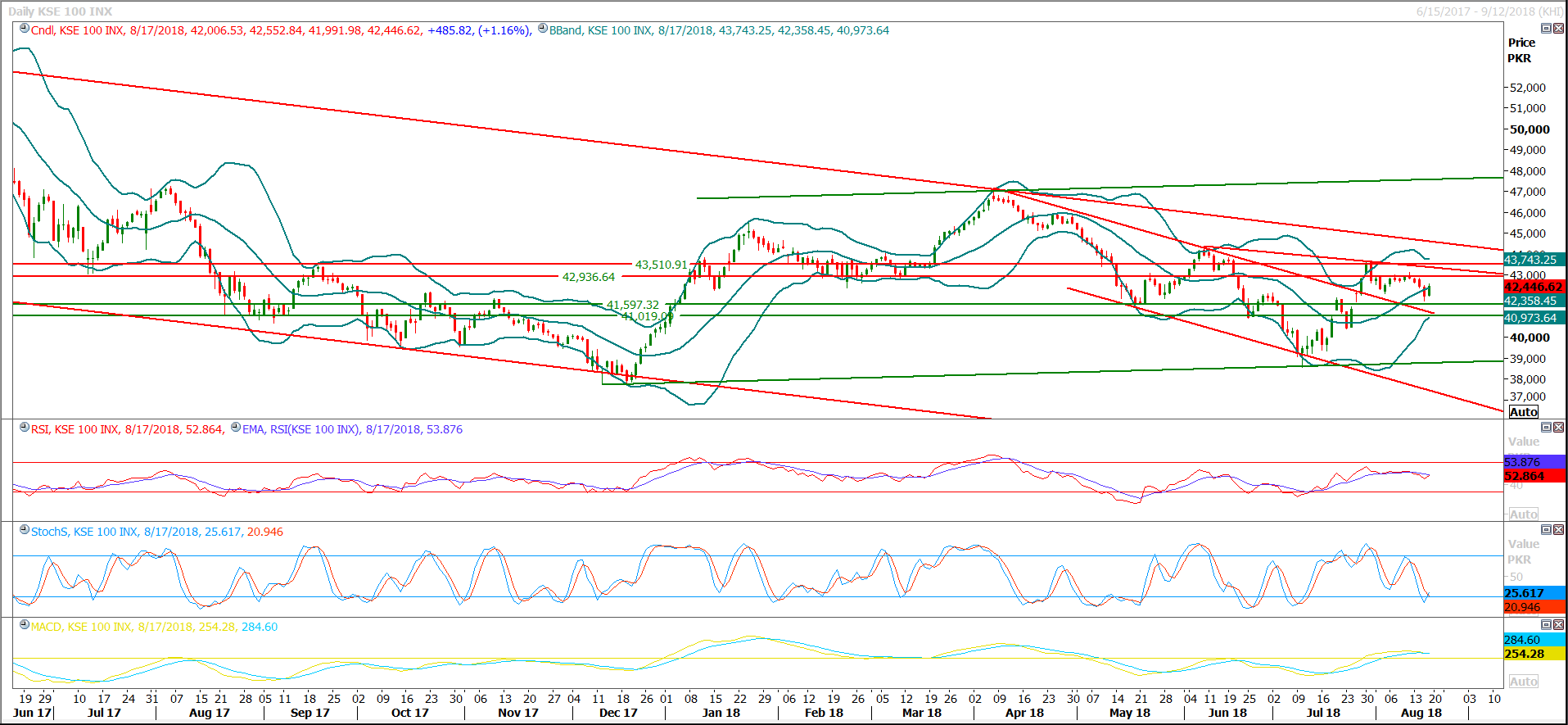

Technical Analysis

The Benchmark KSE100 Index have bounced back after testing its major supportive region of 41,800 points during last two trading sessions and now it’s trying to generate bullish crossovers on daily momentum indicators but weekly momentum is still in bearish mode which would try to cap any upcoming bullish rally on weekly basis. A spike may be witnessed on intraday basis but index would face strong resistances at 42,940 and 43,060 points during current trading session. It’s recommended to start profit taking before 42,940 points because if index would not become able to penetrate this region then a dip would be on cards in coming days and if it would succeed in closing above 43,060 points on daily chart then next targets would be 43,330 and 43,510 points. It’s recommended to stay cautious and trade in chunks with strict stop loss because if index would not succeed in penetration of its resistant regions then it would try to bounce back towards its supportive regions at 42,089 and 41,800 points again.

Current bullish rallies in DGKC, MLCF and ISL may be expired before 122, 61 and 113 Rs respectively if these scripts would not succeed to close above these regions on daily chart therefore profit taking before these levels is recommended. PSO and ATRL may advance further because initially PSO have bounced back after covering its gap on daily chart and now it would try to target 357 while ATRL have bounced back after completing its correction so it may advance towards 231 and closing above that region would call for 239. SNGP would try to open with a positive gap above 100 Rs and if would succeed in doing so then next targets would be 103 and 107, but its recommended to wait for confirmation of breakout of 100 Rs in first hour of current trading session, later on it would be joined by SSGC if it would succeed in closing above 31 Rs on hourly chart. TRG would face strong resistance at 32.50 and breakout of that region on hourly chart would call for a spike towards 33.60 but in case of failure 30.45 would be insight.

Current bullish rallies in DGKC, MLCF and ISL may be expired before 122, 61 and 113 Rs respectively if these scripts would not succeed to close above these regions on daily chart therefore profit taking before these levels is recommended. PSO and ATRL may advance further because initially PSO have bounced back after covering its gap on daily chart and now it would try to target 357 while ATRL have bounced back after completing its correction so it may advance towards 231 and closing above that region would call for 239. SNGP would try to open with a positive gap above 100 Rs and if would succeed in doing so then next targets would be 103 and 107, but its recommended to wait for confirmation of breakout of 100 Rs in first hour of current trading session, later on it would be joined by SSGC if it would succeed in closing above 31 Rs on hourly chart. TRG would face strong resistance at 32.50 and breakout of that region on hourly chart would call for a spike towards 33.60 but in case of failure 30.45 would be insight.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.