Previous Session Recap

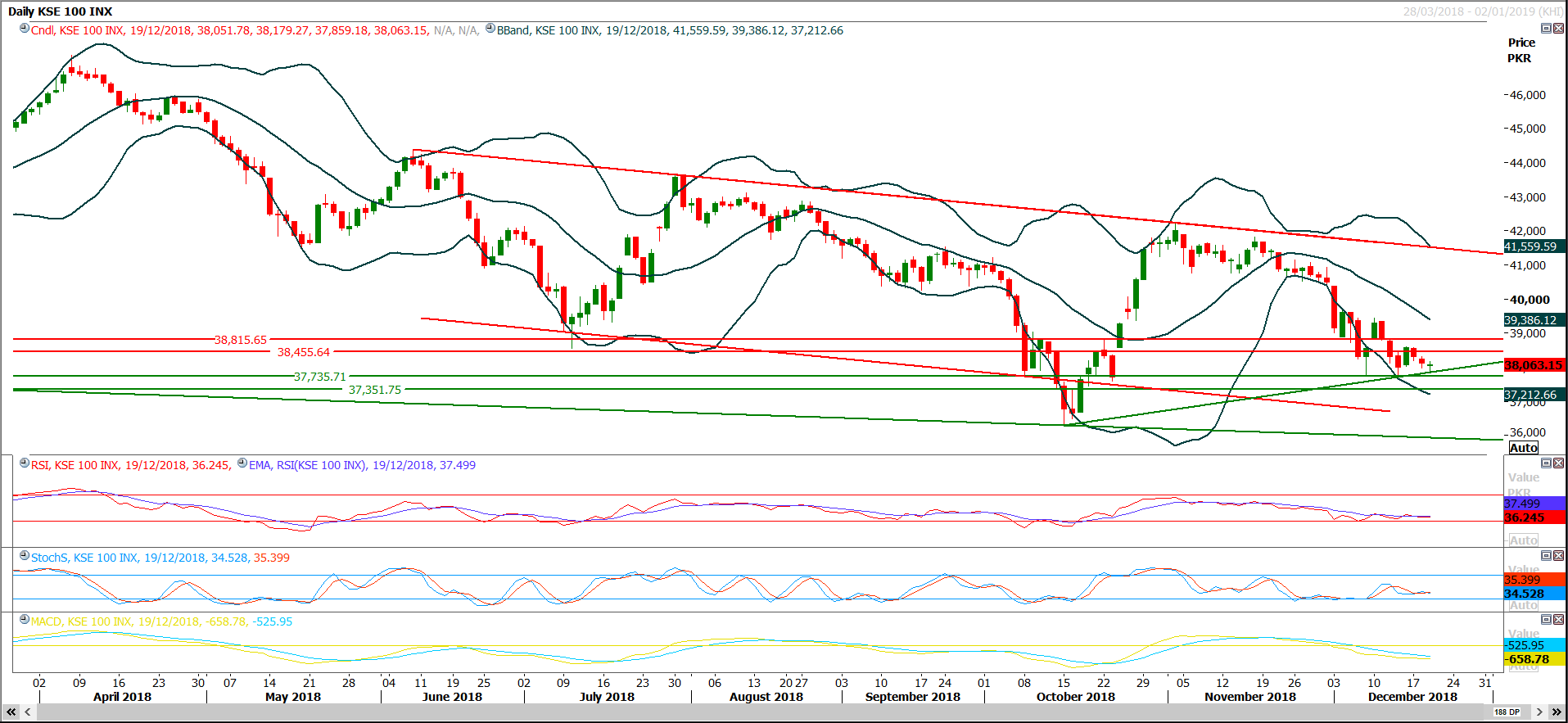

Trading volume at PSX floor increased by 10.42 million shares or 11.49% on DOD basis whereas the Benchmark KSE100 index opened at 38,115.80, posted a day high of 38,179.27 and day low of 37.859.18 during last trading session while session suspended at 38,063.15 points with net change of -52.66 points and net trading volume of 70.42 million shares. Daily trading volume of KSE100 listed companies increased by 2.28 million shares or 3.34% on DOD basis.

Foreign Investors remained in net selling positions of 14.82 million shares and net value of Foreign Inflow dropped by 8.42 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.56 and 1.48 million shares but Foreign Corporate investors remained in net selling positions of 16.85 million shares. While on the other side Local Individuals, Local Companies and Mutual Fund remained in net buying positions of 1.97, 4.10 and 16.22 million shares respectively but Banks, NBFCs, Brokers and Insurance Companies remained in net selling positions of 0.22, 1.90, 2.28 and 3.61 million shares.

Analytical Review

Stocks slide as Fed's 2019 rates guidance disappoints

Asian shares retreated on Thursday after the U.S. Federal Reserve raised rates, as expected, and kept most of its guidance for additional hikes next year, dashing investor hopes for a more dovish policy outlook. MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 1.3 percent, with Australian shares slipping as much as 0.7 percent to two-year lows. Japan’s Nikkei shed 1.7 percent to fresh nine-month lows. China’s benchmark Shanghai Composite and the blue-chip CSI 300 fell 0.8 percent and 0.9 percent, respectively, while Hong Kong’s Hang Seng was off 0.7 percent.

Govt lauds ADB's country operations business plan

Pakistan on Wednesday welcomed the Asian Development Bank's recently approved country operations business plan 2019-2021 with an indicative assistance of $7.5 billion. The ADB had recently proposed a $7.5-billion lending programme for Pakistan for next three years, allocating one-third of the total for budgetary support to the government. Finance Minister Asad Umar has appreciated the ADB's recently approved country operations business plan. He made these remarks in a meeting with Tomoyuki Kimura, Director General Strategy, Policy & Review Deptt ADB.

AIIB, Chinese firms urged to build sustainable partnership

Minister for Planning, Development and Reforms Makhdum Khusro Bakhtyar Wednesday invited Asian Infrastructure Investment Bank (AIIB) and Chinese corporate leaders to build a sustainable long-term partnership with Pakistan aimed at financing projects that contribute to overall economic growth of the country. The minister, in another meeting, invited Chinese enterprises to heavily invest in Pakistan’s industrial, socioeconomic, agriculture and transport infrastructure sectors.

‘Mini-budget’ planned as IMF, govt still differ

Preparations are on for introducing the third money bill of this fiscal year, while discussions between the government and the International Monetary Fund have been ramped up. Reports following a late evening hour-long video conference between the government and the IMF suggest that differences persist between both sides over a broad spectrum of issues.

Nepra allows govt to regularise hike of Rs1.27/unit in tariff

NEPRA has allowed the government to regularize the increase of Rs 1.27 per unit in power tariff for the end consumers. The Authority has considered the tariff proposed by the federal government to be charged from the consumers including the impact of targeted subsidy and inter disco tariff rationalization and the same is approved as final tariff in terms of section 31 (7) of the Act, said NEPRA determination released here. The Authority has determined the Uniform Tariff as required under Section 31(4) of the Act.Here it is pertinent to mention that the Uniform Tariff determined by the Authority includes impact of PYA of Rs.226 billion, to be recovered in a period of twelve months from the date of notification of the instant decision.

Asian shares retreated on Thursday after the U.S. Federal Reserve raised rates, as expected, and kept most of its guidance for additional hikes next year, dashing investor hopes for a more dovish policy outlook. MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 1.3 percent, with Australian shares slipping as much as 0.7 percent to two-year lows. Japan’s Nikkei shed 1.7 percent to fresh nine-month lows. China’s benchmark Shanghai Composite and the blue-chip CSI 300 fell 0.8 percent and 0.9 percent, respectively, while Hong Kong’s Hang Seng was off 0.7 percent.

Pakistan on Wednesday welcomed the Asian Development Bank's recently approved country operations business plan 2019-2021 with an indicative assistance of $7.5 billion. The ADB had recently proposed a $7.5-billion lending programme for Pakistan for next three years, allocating one-third of the total for budgetary support to the government. Finance Minister Asad Umar has appreciated the ADB's recently approved country operations business plan. He made these remarks in a meeting with Tomoyuki Kimura, Director General Strategy, Policy & Review Deptt ADB.

Minister for Planning, Development and Reforms Makhdum Khusro Bakhtyar Wednesday invited Asian Infrastructure Investment Bank (AIIB) and Chinese corporate leaders to build a sustainable long-term partnership with Pakistan aimed at financing projects that contribute to overall economic growth of the country. The minister, in another meeting, invited Chinese enterprises to heavily invest in Pakistan’s industrial, socioeconomic, agriculture and transport infrastructure sectors.

Preparations are on for introducing the third money bill of this fiscal year, while discussions between the government and the International Monetary Fund have been ramped up. Reports following a late evening hour-long video conference between the government and the IMF suggest that differences persist between both sides over a broad spectrum of issues.

NEPRA has allowed the government to regularize the increase of Rs 1.27 per unit in power tariff for the end consumers. The Authority has considered the tariff proposed by the federal government to be charged from the consumers including the impact of targeted subsidy and inter disco tariff rationalization and the same is approved as final tariff in terms of section 31 (7) of the Act, said NEPRA determination released here. The Authority has determined the Uniform Tariff as required under Section 31(4) of the Act.Here it is pertinent to mention that the Uniform Tariff determined by the Authority includes impact of PYA of Rs.226 billion, to be recovered in a period of twelve months from the date of notification of the instant decision.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

Technical Analysis

The Benchmark KSE100 index is trying to sustain above 38,000 points since last five trading session and on daily closing basis it have been succeeded in doing so but shrinked volumes have created an alarming situation and volatility is increasing due to these circumstances. Index is caged between 37,700 and 38,500 points and breakout of downward side would create a roam for a rally of 2,500-3,000 points while breakout in upward direction would push index towards 39,200 or 39,500 points. It’s recommended to trade very cautiously until index outside this region of 800 points because in this region index would try to remain volatile.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.