Previous Session Recap

Trading volume at PSX floor dropped by 16.05 million shares or 5.81% on DoD basis, whereas the benchmark KSE100 index opened at 41,603.71, posted a day high of 41,796.33 and a day low of 41,414.36 points during last trading session while session suspended at 41,655.37 points with net change of -948.34 points and net trading volume of 169.92 million shares. Daily trading volume of KSE100 listed companies dropped by 12.94 million shares or 7.08% on DoD basis.

Foreign Investors remained in net buying positions of 8.22 million shares and value of Foreign Inflow increased by 1.57 million US Dollars. Categorically, Foreign Individuals remained in net selling positions of 0.21 million shares but Foreign Corporate and Overseas Pakistanis remained in net buying positions of 6.37 and 2.06 million shares. While on the other side Local Individuals, Companies, NBFCs, Mutual Fund and Insurance Companies remained in net selling positions of 4.40, 0.89, 0.38, 7.99 and 0.82 million shares but Banks and Brokers remained in net buying positions of 4.82 and 4.33 million shares respectively.

Analytical Review

Asia stocks digest meaty gains, sterling starved for love

Asian shares snoozed near 18-month highs on Friday as trade thinned in the run-up to Christmas and investors seemed content to digest the chunky gains already made so far this month. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was a fraction firmer in early trade, having gained 1.2% for the week so far and almost 5% for the month. Japan's Nikkei .N225 inched up 0.1% after reaching a 14-month top earlier in the week. It was ahead by 2.5% for the month so far. South Korea's market .KS11 added 0.25% on the day and 5.5% for December. Graphic: Asian stock markets - here E-Mini futures for the S&P 500 ESc1 held at all-time highs having put on 1.2% for the week. Sentiment had been bolstered after U.S. Treasury Secretary Steven Mnuchin said the United States and China would sign their Phase One trade pact in early January.

World Bank calls for a more unified sales tax regime

In what appears to be a major reform initiative, the World Bank is pushing for more harmonisation of general sales tax on services and goods among federating units of Pakistan, arguing that this will help tap 87 per cent potential revenue, which remains largely uncollected. The World Bank Country Director Patchamuthu Illangovan and one of his senior economists Muhammad Waheed spoke at length for almost an hour with a select group of journalists in Islamabad in support or a single GST regime, among other economic issues where the bank is playing a role.

Current account deficit returns in November

The current account turned negative in November after posting a surplus in October, indicating the deficit is still here to haunt the economy. However, the current account deficit (CAD) plunged by 73 per cent to $319 million in November, as compared to $1,166m in same period last year, reported the State Bank of Pakistan on Thursday. The country witnessed a surprise current account surplus of $70m (revised down from $99m) in October — a feat achieved after four years of deficit. During July-November, CAD clocked in at $1.821bn, declining by a massive 73pc over $6.733bn in same period last year. This consistent sharp decrease has helped the government improve its foreign currency reserves and stabilise the exchange rate.

Gas supply to Punjab industry halted

The Sui Northern Gas Pipelines Ltd (SNGPL) on Thursday halted gas supply to general industry — fertiliser, manufacturing and compressed natural gas sectors — to meet energy needs of around six million domestic consumers in Punjab. “In the wake of increasing gas consumption of domestic sector due to the current cold wave in the country, SNGPL has decided to temporarily discontinue gas supply to general industry and CNG sector. “However, gas supply to zero-rated industry (textile, sports, surgical goods, carpets and leather) will not be affected by the decision,” said a spokesman for the SNGPL. The utility is responsible for meeting the gas needs of Punjab and Khyber Pakhtunkhwa.

Govt to table draft Alternative & Renewable Energy Policy in CCI meeting

The government has decided to table the draft Alternative & Renewable Energy Policy 2019 to the next CCI meeting after Sindh objected the non-inclusion of the policy in the agenda of the council’s meeting. “It is feared that any unilateral or hasty attempt to introduce the draft ARE Policy 2019 directly in the CCI without prior consultation with the Government of Sindh and incorporation of its views in the summary and the draft policy may ruin the very purpose of the new ARE Policy 2019,” said Chief Minister of the Sindh in a letter to the PM of Pakistan.

Asian shares snoozed near 18-month highs on Friday as trade thinned in the run-up to Christmas and investors seemed content to digest the chunky gains already made so far this month. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was a fraction firmer in early trade, having gained 1.2% for the week so far and almost 5% for the month. Japan's Nikkei .N225 inched up 0.1% after reaching a 14-month top earlier in the week. It was ahead by 2.5% for the month so far. South Korea's market .KS11 added 0.25% on the day and 5.5% for December. Graphic: Asian stock markets - here E-Mini futures for the S&P 500 ESc1 held at all-time highs having put on 1.2% for the week. Sentiment had been bolstered after U.S. Treasury Secretary Steven Mnuchin said the United States and China would sign their Phase One trade pact in early January.

In what appears to be a major reform initiative, the World Bank is pushing for more harmonisation of general sales tax on services and goods among federating units of Pakistan, arguing that this will help tap 87 per cent potential revenue, which remains largely uncollected. The World Bank Country Director Patchamuthu Illangovan and one of his senior economists Muhammad Waheed spoke at length for almost an hour with a select group of journalists in Islamabad in support or a single GST regime, among other economic issues where the bank is playing a role.

The current account turned negative in November after posting a surplus in October, indicating the deficit is still here to haunt the economy. However, the current account deficit (CAD) plunged by 73 per cent to $319 million in November, as compared to $1,166m in same period last year, reported the State Bank of Pakistan on Thursday. The country witnessed a surprise current account surplus of $70m (revised down from $99m) in October — a feat achieved after four years of deficit. During July-November, CAD clocked in at $1.821bn, declining by a massive 73pc over $6.733bn in same period last year. This consistent sharp decrease has helped the government improve its foreign currency reserves and stabilise the exchange rate.

The Sui Northern Gas Pipelines Ltd (SNGPL) on Thursday halted gas supply to general industry — fertiliser, manufacturing and compressed natural gas sectors — to meet energy needs of around six million domestic consumers in Punjab. “In the wake of increasing gas consumption of domestic sector due to the current cold wave in the country, SNGPL has decided to temporarily discontinue gas supply to general industry and CNG sector. “However, gas supply to zero-rated industry (textile, sports, surgical goods, carpets and leather) will not be affected by the decision,” said a spokesman for the SNGPL. The utility is responsible for meeting the gas needs of Punjab and Khyber Pakhtunkhwa.

The government has decided to table the draft Alternative & Renewable Energy Policy 2019 to the next CCI meeting after Sindh objected the non-inclusion of the policy in the agenda of the council’s meeting. “It is feared that any unilateral or hasty attempt to introduce the draft ARE Policy 2019 directly in the CCI without prior consultation with the Government of Sindh and incorporation of its views in the summary and the draft policy may ruin the very purpose of the new ARE Policy 2019,” said Chief Minister of the Sindh in a letter to the PM of Pakistan.

Market is expected to remain volatile during current trading session.

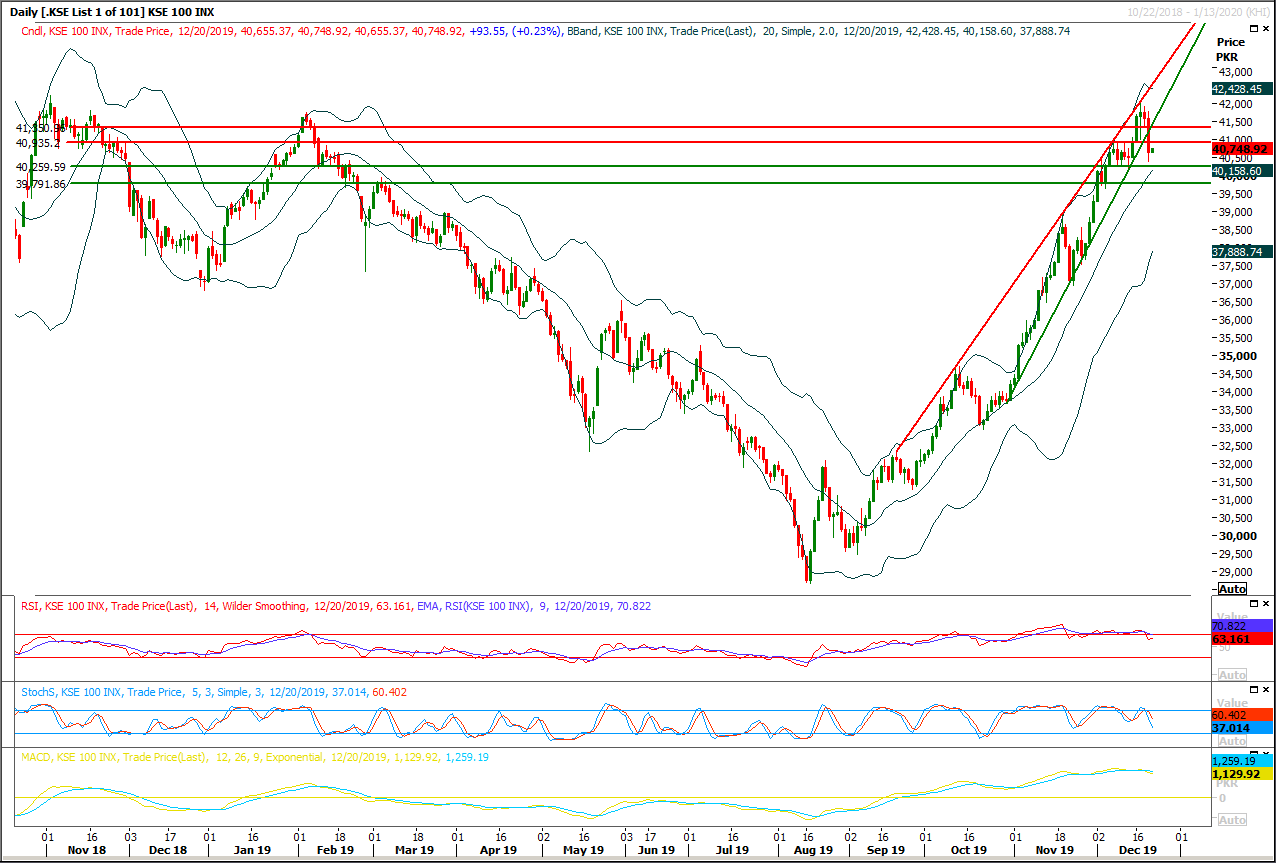

Technical Analysis

The Benchmark KSE100 index have succeed in giving a bearish breakout of its bullish wedge on daily chart during last trading session and also have created an evening shooting star on daily chart. As of now it's expected that index would try to retest its resistant regions on intraday basis and would face strong resistances at 41,000 and 41,350 points initially from a strong horizontal resistant region and formerly from supportive trend line its bullish wedge. It's recommended to stay cautious and post strict stop loss of 41,350 or 41,500 points for short positions because if index would not succeed in closing below 40,200 points today then next week would be very volatile. In case of rejection from its resistant regions index would try to bounce back towards its supportive region at 40,200 and 39,960 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.