Previous Session Recap

Trading volume at PSX floor increased by 51.32 million shares or 56.00% on DoD basis, whereas the benchmark KSE100 index opened at 40,175.35, posted a day high of 40,644.06 and a day low of 40,175.06 points during last trading session while session suspended at 40,574.52 points with net change of 399.17 points and net trading volume of 109.56 million shares. Daily trading volume of KSE100 listed companies also increased by 39.16 million shares or 55.63% on DoD basis.

Foreign Investors remained in net selling positions of 8.47 million shares and value of Foreign Inflow dropped by 5.00 million US Dollars. Categorically, Foreign Individuals and Corporate remained in net selling positions of 0.08 and 8.76 million shares and Overseas Pakistani remained in net long positions of 0.37 million shares respectively. While on the other side Local Companies, Banks, NBFCs, Brokers and Insurance Companies remained in net long positions of 4.02, 0.29, 1.46, 1.35 and 3.63 million shares but Local Individuals and Mutual Fund remained in net selling positions of 2.29 and 0.88 million shares respectively.

Analytical Review

Slowing virus, China stimulus hopes support stocks, yen nurses losses

Asian stocks edged up on Thursday, supported by a fall in coronavirus cases and expectations of more Chinese stimulus to offset the economic impact of the epidemic, while the Japanese yen nursed heavy losses after suffering its steepest drop in six months. The epicenter of the outbreak in China’s Hubei reported just 349 new cases on Thursday, the lowest since Jan. 25, although it was accompanied by a change in diagnosis rules. China is widely expected to cut its benchmark lending rate on Thursday, adding to a slew of fiscal and monetary measures in recent weeks aimed at cushioning the virus’ impact on the economy. China also plans to take over HNA Group and sell off its airline assets, Bloomberg reported on Wednesday, citing people familiar with the matter. MSCI’s broadest index of Asia-Pacific shares outside Japan ticked up 0.1%.

Ogra rejects gas companies demand for additional UFG allowance

Oil and Gas Regulatory Authority (OGRA) has categorically rejected the gas companies demand for additional Unaccounted for Gas (UFG) allowance over and above the Ogra’s approved limit saying that the regulator cannot allow the transfer of additional burden of theft and losses to the gas consumers. Ogra has set the maximum limit for the UFG and will not allow the transfer of burden of over and above the permitted UFG to the gas consumers, OGRA Chairman, Uzma Adil said to the National Assembly standing Committee on Petroleum. Why the gas consumers should bear the burden of gas theft and losses, she questioned? The standing committee meeting which was chaired by Imran Khattak has discussed the SNGPL gas schemes and the improvement of SSGCL gas supply to the consumers. Khwaja Sheeraz Mahmood questioned that why SNGPL has stopped working on the gas schemes initiated by the previous government.

Pakistan needs to focus on agriculture to overcome poverty: Expert

Pakistan is needed to move from traditional to modern agriculture to overcome its trade deficit and meet its socio-economic targets. Pakistan’s trade deficit decreased from $5.8 billion to $31.8 billion in the financial year 2019. The reduction in the trade deficit was primarily driven by the fall in imports. In the financial year of 2020, exports face severe challenges, reports Gwadar Pro App quoting it’s commentator Prof. Cheng Xizhong.

Ministry to table proposals for controlling deficiency of essential items

Ministry of National Food Security and Research (NFS&R) is preparing proposals for controlling the deficiency of essential items, which would be presented in Economic Coordination Committee (ECC) for approval. The National Price Monitoring Committee (NPMC), which was held under the chairmanship of the Secretary Finance Naveed Kamran Baloch, has discussed the inflation rate and measures taken by the government to control the prices. The NPMC meeting was held after a gap of almost six months.

IMF’s full cost recovery formula to devastate economy

The Ministry of Water Resources is likely to propose an allocation of Rs140 billion for 15 Hydropower Projects of WAPDA with the total cost of Rs1363 billion in the Public Sector Development Programme (2020-21). The power division will make a demand of Rs140 billion for the next PSDP 2020-21 which is Rs19 billion higher than the current fiscal, according the documents available with The Nation. Of the total demand of Rs140 billion, Rs 38 billion is Foreign Exchange Component (FEC) while Rs 102 billion is local component, said the document. For three hydropower projects in initial stage with the generation capacity of 3698 MW and total estimated cost of Rs620 billion, allocation of Rs100 billion in next PSDP has been proposed. For the refurbishment of four Hydro Power stations of 580 MW, the demand for allocation in coming fiscal is Rs14.67 billion. The total cost of the project is Rs80.72 billion.

Asian stocks edged up on Thursday, supported by a fall in coronavirus cases and expectations of more Chinese stimulus to offset the economic impact of the epidemic, while the Japanese yen nursed heavy losses after suffering its steepest drop in six months. The epicenter of the outbreak in China’s Hubei reported just 349 new cases on Thursday, the lowest since Jan. 25, although it was accompanied by a change in diagnosis rules. China is widely expected to cut its benchmark lending rate on Thursday, adding to a slew of fiscal and monetary measures in recent weeks aimed at cushioning the virus’ impact on the economy. China also plans to take over HNA Group and sell off its airline assets, Bloomberg reported on Wednesday, citing people familiar with the matter. MSCI’s broadest index of Asia-Pacific shares outside Japan ticked up 0.1%.

Oil and Gas Regulatory Authority (OGRA) has categorically rejected the gas companies demand for additional Unaccounted for Gas (UFG) allowance over and above the Ogra’s approved limit saying that the regulator cannot allow the transfer of additional burden of theft and losses to the gas consumers. Ogra has set the maximum limit for the UFG and will not allow the transfer of burden of over and above the permitted UFG to the gas consumers, OGRA Chairman, Uzma Adil said to the National Assembly standing Committee on Petroleum. Why the gas consumers should bear the burden of gas theft and losses, she questioned? The standing committee meeting which was chaired by Imran Khattak has discussed the SNGPL gas schemes and the improvement of SSGCL gas supply to the consumers. Khwaja Sheeraz Mahmood questioned that why SNGPL has stopped working on the gas schemes initiated by the previous government.

Pakistan is needed to move from traditional to modern agriculture to overcome its trade deficit and meet its socio-economic targets. Pakistan’s trade deficit decreased from $5.8 billion to $31.8 billion in the financial year 2019. The reduction in the trade deficit was primarily driven by the fall in imports. In the financial year of 2020, exports face severe challenges, reports Gwadar Pro App quoting it’s commentator Prof. Cheng Xizhong.

Ministry of National Food Security and Research (NFS&R) is preparing proposals for controlling the deficiency of essential items, which would be presented in Economic Coordination Committee (ECC) for approval. The National Price Monitoring Committee (NPMC), which was held under the chairmanship of the Secretary Finance Naveed Kamran Baloch, has discussed the inflation rate and measures taken by the government to control the prices. The NPMC meeting was held after a gap of almost six months.

The Ministry of Water Resources is likely to propose an allocation of Rs140 billion for 15 Hydropower Projects of WAPDA with the total cost of Rs1363 billion in the Public Sector Development Programme (2020-21). The power division will make a demand of Rs140 billion for the next PSDP 2020-21 which is Rs19 billion higher than the current fiscal, according the documents available with The Nation. Of the total demand of Rs140 billion, Rs 38 billion is Foreign Exchange Component (FEC) while Rs 102 billion is local component, said the document. For three hydropower projects in initial stage with the generation capacity of 3698 MW and total estimated cost of Rs620 billion, allocation of Rs100 billion in next PSDP has been proposed. For the refurbishment of four Hydro Power stations of 580 MW, the demand for allocation in coming fiscal is Rs14.67 billion. The total cost of the project is Rs80.72 billion.

Market is expected to remain volatile during current trading session.

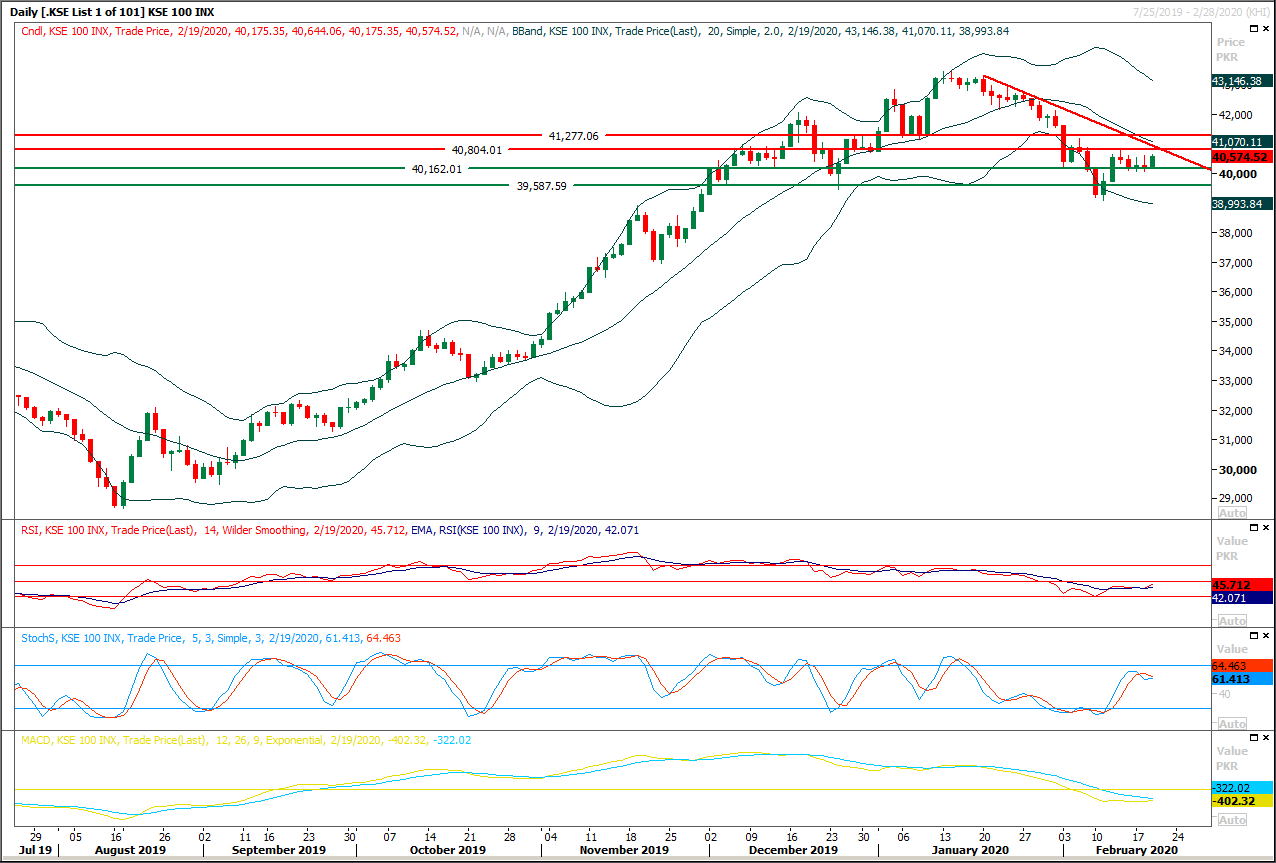

Technical Analysis

The Benchmark KSE100 index have succeeded in closing above its initial resistant region of 40,500 points during last trading session and now its heading towards its correction of its last bearish rally and during this rally it would face strong resistances at 40,800 and 41,200 points. While 50% correction of its last bearish rally on daily chart would complete at 41,200 points therefore it's recommended to stay cautious and selling on strength between 40,800-41,000 points with strict stop loss of 41,300 points could be beneficial because if index would not succeed in breakout above its corrective regions then a sharp bearish rally would be witnessed from those regions which would expand current correction below 39,000 points. While on flip side if index would face rejection from its resistant regions then it would slide towards 40,160 points on intraday basis and breakout below this region would call for 40,000 and 39,800 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.